TSOH Investment Research

My name is Alex Morris. I’m the founder of TSOH Investment Research and the author of “Buffett And Munger Unscripted” (winner of one of Amazon’s “Best Books of 2025”). Prior to starting TSOH Investment Research in April 2021, I spent a decade working in the finance industry as a buyside equities analyst.

I stated TSOH with a clear objective: to provide professional investors (CIO’s, analysts, etc.) and serious DIY investors with high-quality, long-term focused equity research and 100% transparency. Subscribers have full access to timely equity research (published every Monday and every other Thursday), prior disclosure before all portfolio changes, and ongoing performance tracking / quarterly updates. (The portfolio disclosed to subscribers accounts for 100% of my family’s investable assets, outside of cash in checking for living expenses).

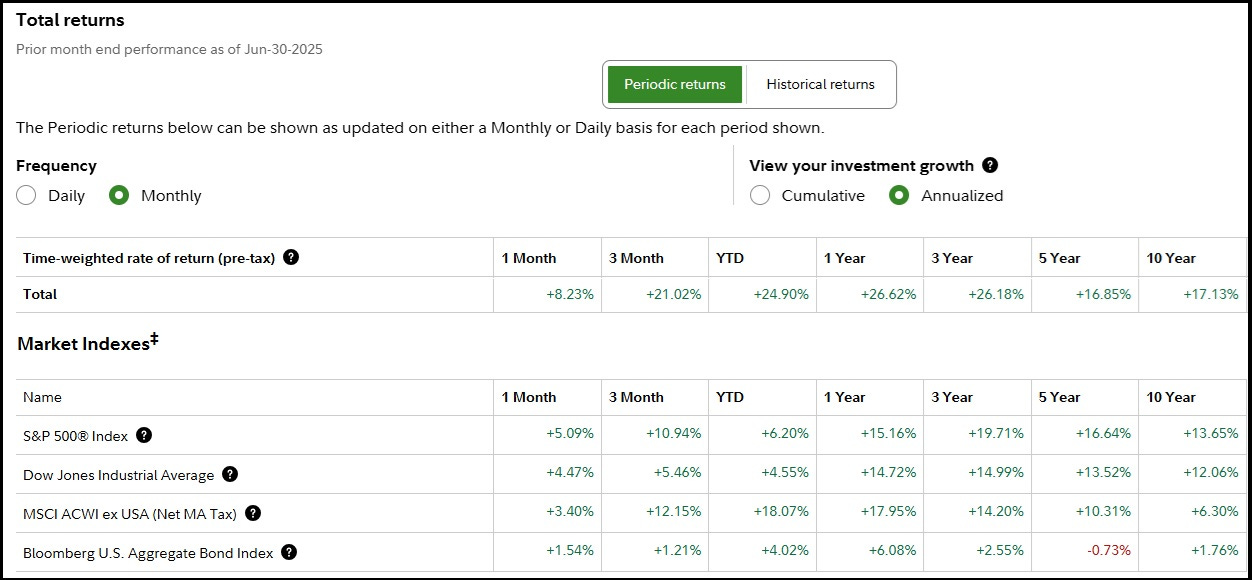

My promise is complete honesty and transparency in the pursuit of better than average long-term returns. Below are historic returns for the TSOH portfolio as of Q2 2025. As you can see, the long-term results have been encouraging. (These results were shared publicly ahead of a price increase; ongoing quarterly updates and real-time portfolio changes are available exclusively to paid subscribers.)

What To Expect:

Paid subscribers receive:

Six research reports per month (every Monday and every other Thursday)

New company initiations, with 100% clarity on my investment decision

Periodic updates on current TSOH holdings and watch list companies

Prior disclosure of every portfolio change, with a detailed explanation for both sides of the transaction (what I’m buying, what I’m selling, and why)

Complete access to all TSOH research since 2021, including deep dives / initiations and updates on companies like ABNB, BBW, BF.B, BRK.B, CELH, COST, DG, DIS, DKS, DLTR, FEVR, FND, GO, HD, HIBB, IMAX, META, MNST, MSFT, MTCH, NFLX, NKE, ONON, PTON, RBLX, TKO, VITL, and many more

Quarterly portfolio updates, which detail every position and its current weighting, along with trailing portfolio returns. (Historic returns for my portfolio were made publicly available at the launch of the service; all subsequent updates are the intellectual property of TSOH subscribers.)

Through TSOH Investment Research, you can effectively outsource a full-time equities analyst role for just $199 per month or $799 per year (if you directly hired an equities analyst, their salary would likely be around $799 per day).

About Me:

CFA Charterholder, MBA from the University of Florida

10 years of experience as a buyside equities analyst (2011 - 2021); TSOH Investment Research has been my sole professional endeavor since 2021

Start Here:

“The Evolution Of A Value Investor”

This is an overview of my approach to investing.

Netflix: “This Is When It All Matters”

This article highlights my thought process during a period where a business and its stock price are facing intense pressure. It should give you some insight into how I think and act during difficult situations - specifically, while being 100% transparency with TSOH subscribers and staying focused on the long-term.

To give you a sense for the companies and industries that I follow and own, here’s a list of the research sent to TSOH subscribers over the past six months.

Feedback From TSOH Subscribers:

Thank you for considering TSOH Investment Research.

Please let me know if you have any questions (thescienceofhitting@gmail.com).

- Alex Morris (@TSOH_Investing)