The YouTube of Gaming?

A few weeks ago, in preparation for this deep dive, I created a Roblox account. Within minutes, I was immersed in a seemingly unending world of virtual experiences (most of which can be fairly categorized as games). I drove around town doing my rounds as a taxi driver, I was a solider in a shooter that resembled a low-quality version of Call of Duty (CoD), and I was the left fielder in a baseball game with 17 other users (in my first at bat, I struck out looking on a 3-2 count; “no called strikes” only applies to investing).

Honestly, I found the experience underwhelming. When I was dropped into these virtual worlds, it took me awhile to figure out how to “play”. In addition, the gameplay is simply incomparable to the experience of a AAA game like FIFA or CoD on an Xbox / PlayStation. From my perspective, Roblox as a gaming platform pales in comparison to other industry offerings.

But that conclusion is painted by my personal experience. It assumes the average user has the same options as I do, which is unlikely (most 10 year old’s don’t have ~$500 lying around to go buy an Xbox). In addition, it assumes that the value add for the core user aligns with my own desires, which is also incorrect (for example, the social component of the service).

These considerations point us in the right direction: as a result of its price (free / freemium), low friction / accessibility, and certain product features (UGC, identify / friends / social functions), Roblox has become hugely popular; it ended FY21 with nearly 50 million daily active users (DAU’s) globally, or nearly 4x higher than its user base at yearend FY18 (since Q2 FY20, the number of monthly payers has held at ~25% of total DAU’s).

This disconnect between my personal experience on the platform and the reported results is telling. It demands that we answer a seemingly straightforward question: what is Roblox? In my opinion, the answer to that question is key to determining whether this business is worth investing in.

History

Roblox was founded in 2004 by David Baszucki and Erik Cassel (Baszucki, aka Builderman, is still CEO; Cassel passed away in 2013). The Roblox platform went live three years after the company’s founding (2007) and was added to iOS and Android in 2011 and 2014, respectively (as noted in the FY21 10-K, roughly 75% of platform usage is attributable to mobile). The company went public in March 2021 through a direct listing, with a reference valuation of ~$29 billion. The stock responded favorably to the massive tailwind experienced as a result of the pandemic, reaching ~$135 per share in November 2021; Mr. Market has since grown more fickle, with the stock closing Thursday at ~$42 (slightly below the March 2021 reference price).

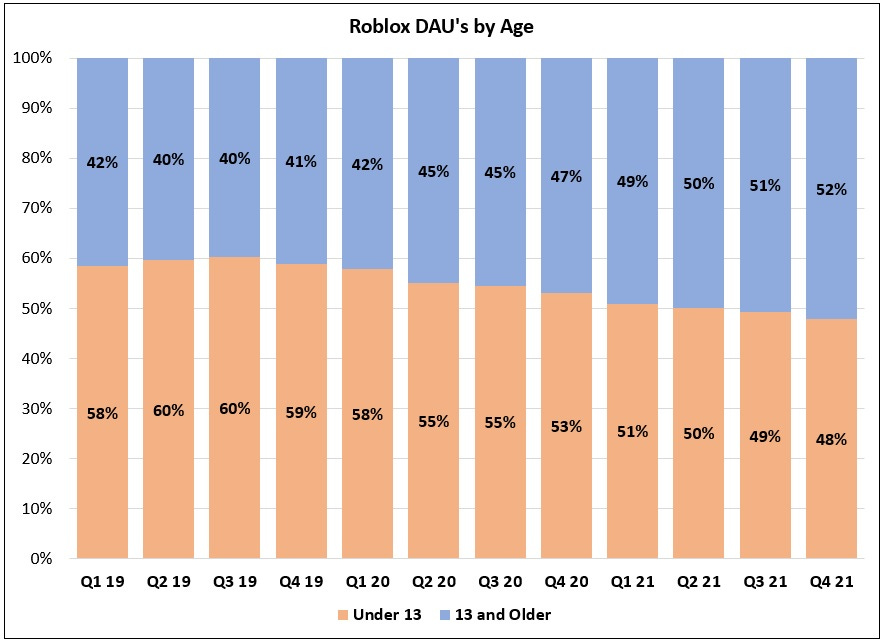

As shown earlier, the platform took off over the past 2-3 years. Notably, this reflects success outside of the core geography / demographic (young kids in the U.S. and Europe). The company ended 2021 with ~25 million DAU’s in APAC and Rest of World (RoW), up from ~5 million at the end of 2018. In addition, the platform now has ~26 million DAU’s who are at least 13 years old, compared to ~6 million at the end of 2018. Continued growth among international and older users is critical to Roblox’s long-term vision of reaching one billion users. (That said, propensity to pay remains low in many international markets: when the S-1 was filed, the company noted that UCAN, which accounted for ~33% of DAU’s, was ~68% of bookings.)

Flywheel (“The YouTube of Gaming”)