Build-A-Business

The Build-A-Bear (BBW) Turnaround

In October 1997, founder Maxine Clark opened Build-A-Bear’s first location in the Saint Louis Galleria Mall. As Clark later discussed, her lightbulb moment came while shopping during the Beanie Babies craze: “I was looking to see if there were any factories that made stuffed animals that I could buy, to reverse engineer and to put in a retail store where you could make your own stuffed animals.” When Build-A-Bear IPO’d seven years later, in October 2004, it had expanded to 170 North American locations, along with nine international stores. That breakneck pace of expansion continued over the next few years, with the number of company owned doors climbing to 346 at the end of 2008.

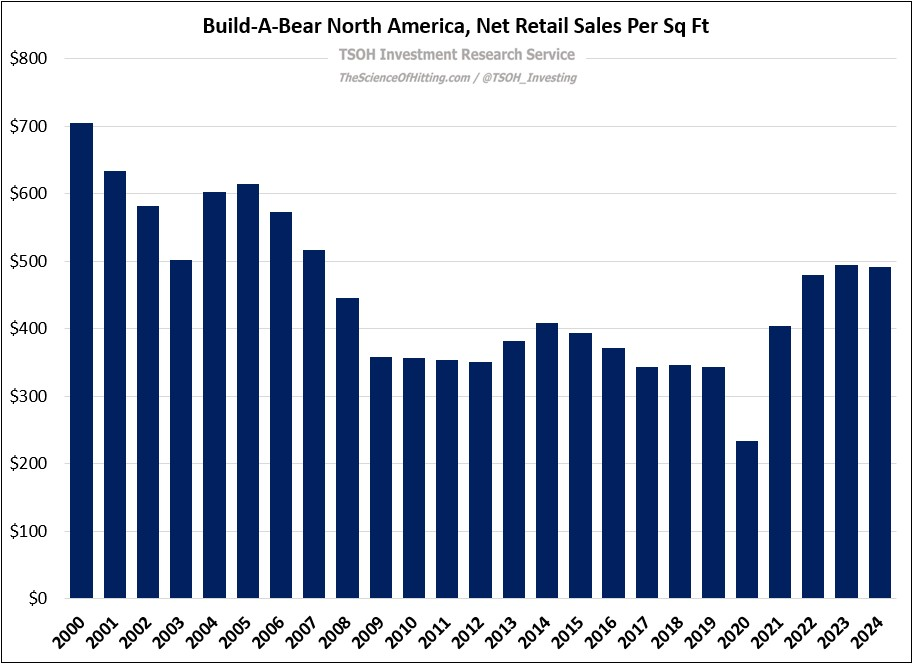

Under the surface, the company’s unit economics revealed that a problem was brewing: same store sales declined 7% in FY06, 10% in FY07, 14% in FY08, and 13% in FY09, which resulted in FY10 net sales per square foot that were >40% below FY05. (In addition, other experiential retail concepts Build-A-Bear had invested in, such as “friends 2B made”, were shuttered.)

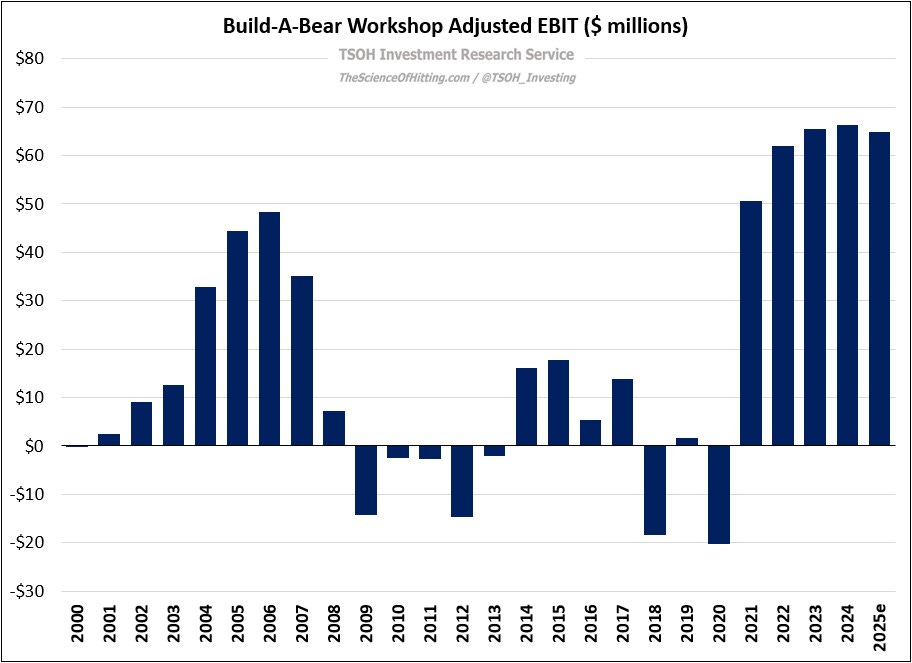

The business, which reported ~$40 million in average annual EBIT from FY04 to FY07, was suddenly struggling to stay in the black. Over the next 13 years (FY08 – FY20), BBW reported a cumulative adjusted operating loss of ~$13 million. As we think about their struggles throughout this period, Clark was aware of the risk from oversaturation, as seen at other mall-based retailers like KB Toys. But in due time, Build-A-Bear would face similar challenges, exacerbated by an underappreciation in the 2000’s of the changes underway in U.S. retail, particularly for the mall-based retailers. Over the past ~15 years, BBW management has focused on repositioning the business, with emphasis on international and franchised / partner doors for growth. With all of that said, I think the founding vision was, and still is, a compelling idea: Build-A-Bear is a unique retail concept centered around experience and product customization, with some price flexibility given the infrequency of average customer visits and the nature of the purchase - for example, buying a personalized stuffed animal for your kids while on vacation. (Clark stepped down in 2013; her replacement, Sharon Price John, is still running BBW.)

But as noted above, Build-A-Bear struggled to consistently turn a profit for many years; they turned a corner in 2021, with >$300 million of cumulative operating profits generated over the past five years (FY21 – FY25e) - nearly 2x greater than BBW’s cumulative EBIT over the prior two decades. What explains Build-A-Bear’s turnaround, and what lies ahead for the company?