Grocery Outlet: "Pressure Release Valve"

“We’ve been really focused on the values we deliver, the way we buy and sell. It has worked really well, and we think it will work for many more years.”

- Former Grocery Outlet CEO Eric Lindberg Jr.

While Lindberg has described Grocery Outlet as “the TJ Maxx of grocery”, a comparison that may be more applicable to TSOH subscribers is Ollie’s.

Grocery Outlet is a chain of nearly 500 U.S. stores that dates back to the 1940’s, when founder Jim Read opened a military surplus store in San Francisco after WWII. After changing hands among private equity (PE) firms in the late 2000’s and 2010’s (including Berkshire Partners, the former owner of Portillo’s), Grocery Outlet went public in June 2019 at $22 per share.

Grocery Outlet’s primarily focus is “extreme value” for consumable goods. Its stores feature a consistent supply of essentials - dairy, produce, deli, frozen foods, etc. - supplemented by a treasure hunt assortment of frequently changing products. (As noted in the S-1, while the stores hold ~5,000 SKU’s, they purchase ~85,000 SKU’s annually.) Like Ollie’s, but with the kicker of a SKU mix exposed to spoilage (perishables were ~35% of their FY23 sales), Grocery Outlet offers a channel for suppliers to quickly sell unwanted product volumes - at the right price. As Lindberg puts it, “We’re a pressure release valve for the CPG industry. We have created a market for products that would have otherwise ended up in a landfill or would have been exported.”

Grocery Outlet is able to offer sizable product discounts – “a typical basket is priced 40% lower than conventional grocers and 20% lower than the leading discounters” – due to product cancellations, manufacturer overruns, packaging changes, and products that are approaching their “sell-by” dates. (“A small percentage of our products are a little past the date… Even for those that are, it is a quality date, not a safety date. Once our customers understand that - they buy something that might be past the date, but they can save 70% to 80% - there are actually people who gravitate to that.”)

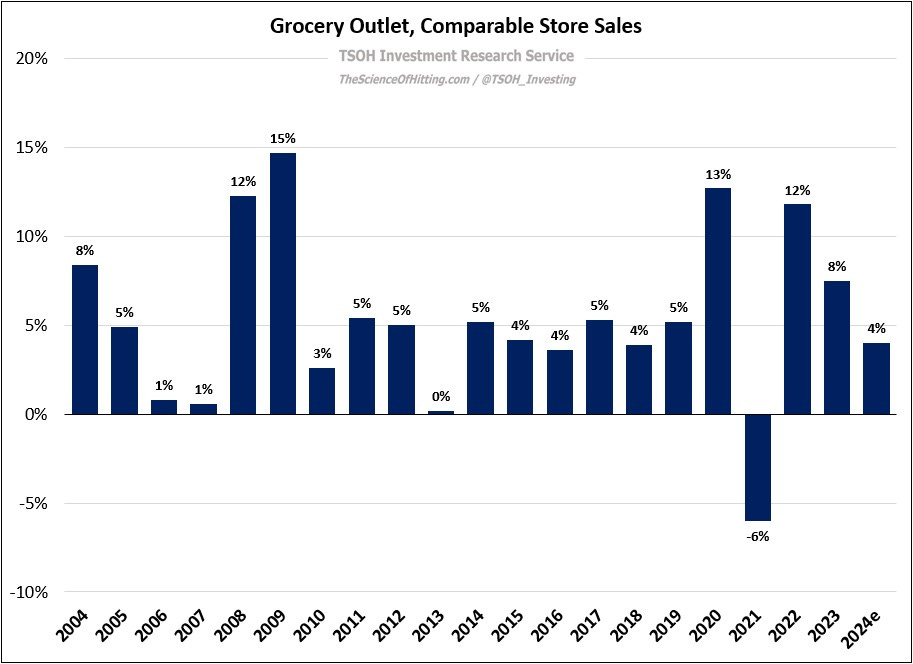

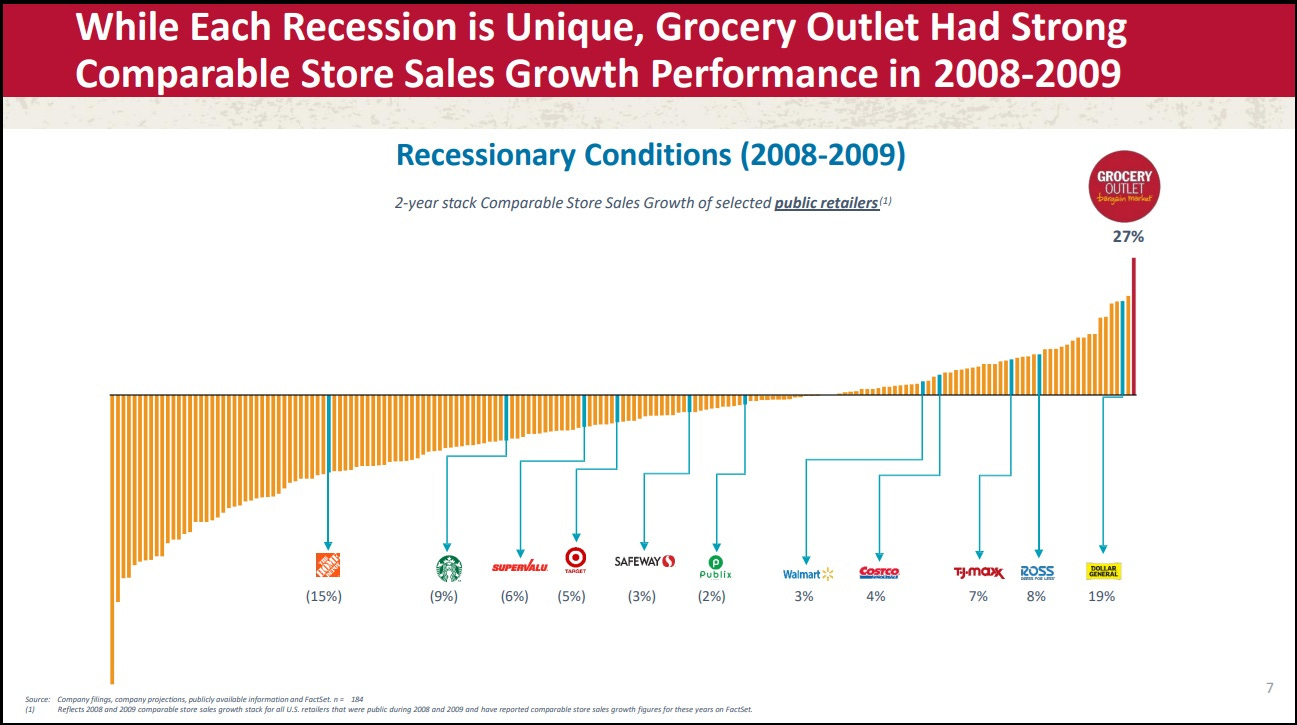

While this format isn’t for everyone, it’s a value-add for the core customer. (“Of the companies Goldman crunched numbers on, Grocery Outlet had the highest exposure to SNAP dollars.”) That is evident in Grocery Outlet’s comparable store sales, which increased in 19 of the past 20 years, including double-digit comps in both 2008 (+12%) and 2009 (+15%) – resulting in a best-in-class two-year stacked comp for GO during the financial crisis.