TSOH Announcement

On Thursday, July 24th, subscription pricing for the TSOH Investment Research service will increase to $199 per month / $799 per year. If you sign-up by Thursday, your subscription will be at current rates of $99 per month / $499 per year. In addition, your subscription will be grandfathered in at that lower rate in perpetuity (for as long as you maintain an active subscription).

Today, my goal is to quickly give you the necessary information to make a thoughtful decision. I’d love to have you as a subscriber, but only if it’s going to be a value-add to your investment process. To help answer that question, I’ll address three topics below: (1) what to expect as a subscriber to TSOH Investment Research; (2) my historic portfolio returns; and (3) an overview of my investment philosophy, with a few examples of recent investment activity.

If you have any additional questions, please let me know (reply to this email).

TSOH Investment Research

After ten years as a buyside equities analyst, I launched TSOH Investment Research in April 2021. I view myself as an outsourced equities analyst solely working on behalf of subscribers. I provide complete access to my research and 100% portfolio transparency (more below) - but instead of the >$100,000 you’d pay to hire an analyst directly, the cost is $499 per year.

There are three main deliverables with the service: (1) scheduled posts, sent every Monday and every other Thursday at 6:30 am ET; these include initiations on new investment ideas, updates on portfolio holdings / watchlist companies, and investment philosophy discussions; (2) portfolio change posts, which are sent at 5:00 pm ET the day before any portfolio changes are made; these updates include 100% portfolio transparency – all names, all weightings, and an explanation of all changes; (3) quarterly updates, with updated historic returns for the portfolio. For a sense of the deliverables, here’s a list of the research shared with subscribers over the past six months; as you can see, my universe includes a variety of companies and industries.

TSOH Investment Research is my full-time job, and I solely work on behalf of paid subscribers; I do not have fund investors who receive preferential treatment over TSOH subscribers, nor do I offer different subscription tiers with varying levels of benefits or access. The value proposition for TSOH Investment Research is rooted in 100% alignment and 100% transparency.

You will always have a complete understanding of how I’m thinking about an investment, along with how it impacts portfolio activity. Finally, I am open to suggestions on companies / ideas that you’d like covered (for example, the IMAX initiation from last week was requested by a TSOH paid subscriber).

My sole focus is producing equity research that adds value for subscribers.

TSOH Track Record

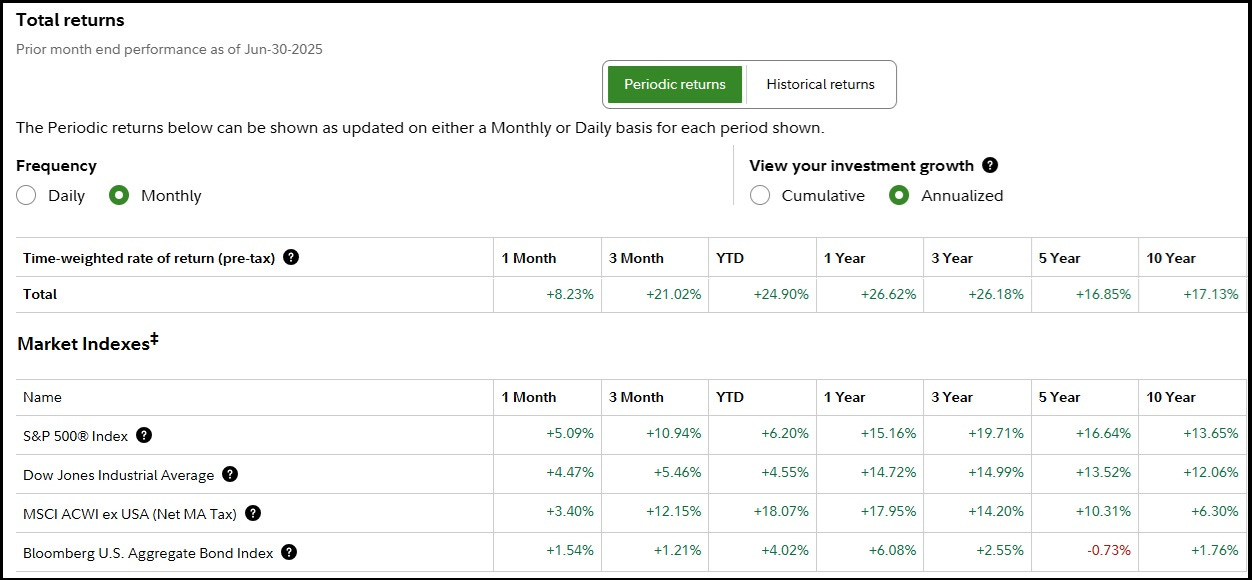

As shown below, the TSOH portfolio has generated solid long-term returns, outperforming the S&P 500 over the past one, three, five, and ten year periods. (This portfolio accounts for 100% of my family’s investable assets, i.e. everything except cash held in a checking account for living expenses.)

While certain years have included their fair share of difficulties, most recently in 2022, the long-term performance has been encouraging; in my mind, this speaks to a clearly outlined philosophy and process. These strong results have continued as of late, with the TSOH portfolio up ~25% in 1H 2025.

While my objective is continued outperformance, and I believe a sound philosophy and process provide good reason to believe that’s attainable, it surely isn’t a guarantee. The only thing I can promise to you is that I’ll work tirelessly to produce high-quality research that I hope will lead to attractive long-term returns, along with complete transparency no matter the outcome. (Performance data is from Fidelity, where 100% of my assets are held.)

TSOH Investment Philosophy

My investment philosophy, in a sentence, is focused on owning high-quality businesses in size. Each of those three qualifiers - (1) to own, (2) high-quality businesses, and (3) in size - are fundamental to who I am as an investor.

I take those words very seriously, which is evident in my portfolio actions over the years. (For more on my investment philosophy, see “The Evolution Of A Value Investor”.) Examples of this investment philosophy in practice are (1) Microsoft, a top portfolio holding since 2011; (2) Netflix, which became a large holding in early 2022 and remains a significant TSOH position today; and (3) Dollar Tree, which became a top holding in September 2024 and has since become my largest position. (For more on Dollar Tree, see “Planting Trees”.)

Conclusion

Through TSOH Investment Research, you can hire an experienced, full-time equities analyst with a clear philosophy / process and a compelling track record for $499 per year. This is the second price increase since the service launched, and I plan to keep raising prices for new subscribers over time.

If you are interested in the service, now is the ideal time to subscribe.

Thank you,

Alex Morris, CFA

NOTE - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.