Fever-Tree: A Premium Business?

Note: Subscription prices for the TSOH Investment Research service will increase after tomorrow’s market close (Tuesday, September 19th). If you sign-up beforehand, you will be grandfathered in at today’s price in perpetuity. (The monthly subscription is increasing from $49 per month to $74 per month, with the annual subscription increasing from $349 per year to $499 per year.) Please let me know if you have any additional questions.

Shortly after the turn of the 21st century, Charles Rolls was ready for another challenge. The inspiration for his next endeavor came from an insight he had while reviving the Plymouth Gin brand: distillers dedicated significant time and resources to the production of high-quality spirits (liquors), but that wasn’t the case for mixers. For a gin and tonic, where the tonic is the majority of what’s in the glass, Rolls argued that these cheap, low-quality mixers with artificial sweeteners, preservatives, and flavors were diminishing the spirits (“It fundamentally undermined the idea of why you created a premium gin, if everything just tastes the same when you make a G&T”).

When Rolls met advertising executive Tim Warrillow in 2003, the two discovered they shared a similar vision: “The mixer category was long-forgotten and overlooked; it was dominated by large conglomerate brands [like Schweppes and Canada Dry] who were focusing more on manufacturing efficiency than quality or flavor…. People were willing to pay ever more money for high-quality spirits, yet they had no choice with increasingly artificial mixers.” That insight led to the creation of Fever-Tree (“FT”), which launched its first product, Indian Tonic Water, in the UK in 2005. (Warrillow has been FT’s CEO since 2014, the same year the company went public.)

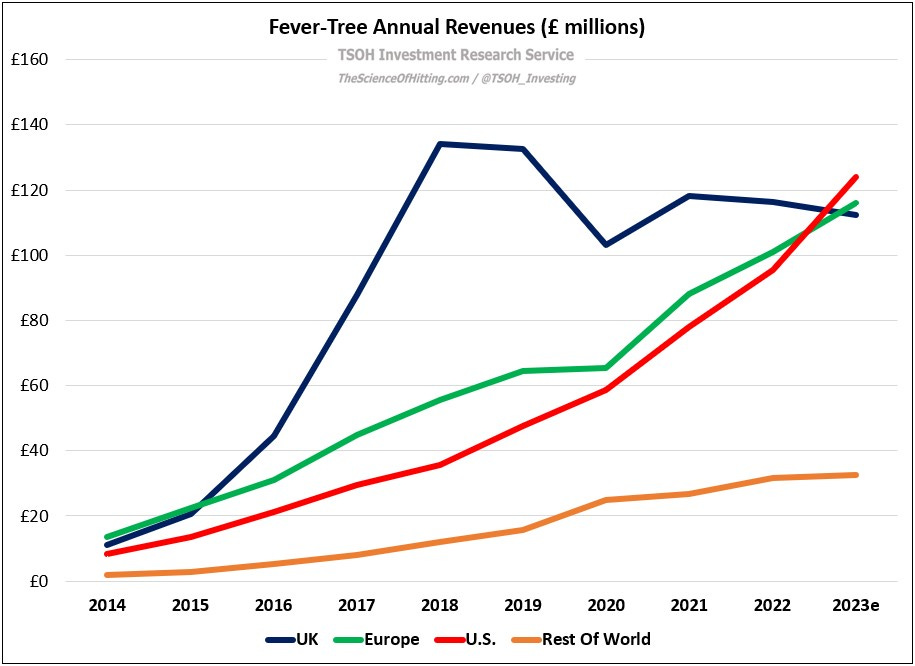

Over the ensuing 18 years, FT has expanded its geographic focus and range of offerings; in addition to single serve tonics, ginger beers, etc., they also sell premium soft drinks and non-carbonated cocktail mixers (for margaritas, mojitos, etc.). As a result, FT expects 2023 sales of ~£385 million (trailing five-year CAGR of +10%). What started as a UK-focused business selling tonic water has evolved into the world’s leading premium mixer company.

While top-line growth has been a clear bright spot for the company (except for some recent headwinds in its home market), the story gets trickier as we move down the income statement: adjusted EBITDA margins have fallen precipitously from pre-pandemic levels, with FY23 guidance calling for EBITDA margins that are ~2,000 basis points below what FT reported in 2019. (As you can see, they’re guiding for a recovery to begin in FY24.)

As a result, FT is expected to generate ~£40 million of adjusted EBITDA in 2023, or nearly 50% lower than the result in 2019 (£77 million). This course of events has been met with an unwelcome response by Mr. Market: the shares are down by more than 60% over the past five years.

In preparation for this deep dive, I dutifully accepted my role as a proper equities analyst and did some scuttlebutt (I’d recommend the Elderflower Tonic). In comparison to store brands / private label tonics and traditional offerings from competitors like Schweppes, I can confidently say that FT produces a higher quality product. As investors, the question we need to answer is whether a high-quality product is enough to produce a high-quality business and an attractive investment opportunity; is FT positioned for long-term success, or will “short-term” headwinds keep lingering?

The UK

As evidenced by its current market position in the company’s home market, the long-term FT playbook has been a success. (From the 2022 annual report: “The brand continues to lead the UK mixer category, with 44% value share - more than 20 times larger than the next premium mixer brand, and ~50% larger than Schweppes.”) As noted at the company’s March 2023 investor event, that compares to a market share of just ~5% in 2014. (The UK sales mix is roughly split between On-trade and Off-trade, i.e. between bars / restaurants and at-home consumption. The On-Trade business, which declined ~60% in FY20, was still ~20% smaller in FY22 than in FY19.)

With that said, the UK results have been less encouraging of late: 2023e revenues of £113 million are down ~15% from a high of £134 million in 2018. This is partly due to weakness in the nearly £1 billion UK gin category, which has lost market share to other spirits (“peak gin”). As we look ahead, the commentary in the 2022 annual report suggests investors should have subdued expectations in the region. (Page 34: “Unlike in many of our other markets, where significant whitespace exists for the category and the brand, the fantastic job we’ve done in the UK in achieving such a strong market share, high household penetration, and widespread distribution across channels means that we will naturally be more exposed to further softening of consumer sentiment.”) While UK revenues increased ten-fold from 2014 to 2023e, this suggests a result anywhere close to that outcome is unachievable in the future (at this point, a return to growth would be a win).

As disclosed on the company’s 1H FY19 call (July 2019), they had reached ~45% and ~40% value share in the UK On-Trade and Off-Trade channels, respectively, by that time, and it sounds like they’re in a largely similar place today. It’s surely an impressive outcome – but given that it only translates to ~£110 million in annual revenues for FT, it lends itself to the conclusion that mixers are a relatively small part of the broader liquids market. (This is an extreme comparison, but consider that FT sold ~720 million units of its products globally in 2022; on the other hand, The Coca-Cola Company sells more than 2.2 billion servings of its products on an average day.)

The U.S.

FT’s U.S. business, which started back in 2007, has grown strongly over the past five years: FY23e revenues of £124 million imply a +28% CAGR from the £36 million that was generated in the region in 2018. Given that the population in the United States is nearly 5x larger than in the UK, the annual opportunity in this region should exceed £500 million over time (the U.S. premium spirits category is >10x larger than in the UK market). That said, FT’s market share in the region is currently ~5%, compared to ~15% for Schweppes and ~50% for Canada Dry (this calculation is skewed by the inclusion of ginger ale, which is primarily consumed as a soda, not a mixer). As disclosed during the 1H FY23 review, the company has 20%+ market share in the U.S. in both tonics and ginger beer. (For years, FT’s U.S. business was managed by a third party agent; the company took ownership of its sales, marketing, and distribution in the region in June 2018.)

The company has navigated a number of issues in the U.S. over the past few years, which I’ll discuss in more detail in the “Financials” section. That said, the strategic vision is clear: management expects to have 100% local U.S. (bottle) production by the end of 2024, and clearly believes that this should be its largest country in the world over time. (For now, FT’s presence in the U.S. skews to the Off-trade channel.) Having people like U.S. CEO Charles Gibb (former CEO of Belvedere Vodka) and board member Jeff Popkin (previously held executive roles at Red Bull, Vita Coco, and Jägermeister) should help them to capitalize on the large opportunity in the region; given the results reported in recent years, I’d say that they are clearly on track to do so.

Europe and Rest of World

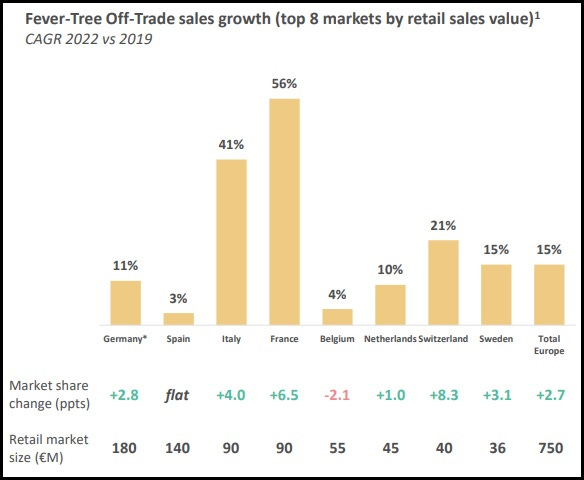

FT also generates £150 million in revenues (FY23e) from other countries throughout Europe, as well as in places like Australia and Canada. As shown below, FT has reported significant growth and taken share across many European markets. (“We have a significant opportunity to extend our position as the highest-quality and market-leading premium mix of brands, and have achieved impressive growth – but we still have a long way to go.”)

While these markets likely offer long-term growth prospects, it’s interesting to reflect on their current size; even if we just account for the eight European countries shown above, along with Australia and Canada, that implies ~£15 million per country on average (the company distributes its products to over 70 countries around the world). On one hand, this is an opportunity; on the other hand, it leads to a lot of focus on regions that individually contribute very little to the consolidated results. That isn’t to say these are unattractive markets long-term. Instead, it simply makes me wonder about the time and attention given to concerns like distribution partnerships / relationships in the smaller markets. At this point in its lifecycle, I think you could make the case it could be beneficial for FT to focus all of their resources on the 10-15 markets that offer the most attractive prospects over the next five to ten years.

Financials

Warren Buffett, 1991: “If you added a penny to the price of every Coca-Cola sold around the world this year, that would add ~$2 billion to their pre-tax earnings. Now, you tell me whether you think there’s a penny, worldwide, of price flexibility per serving of Coke; the answer is, you know there is.”

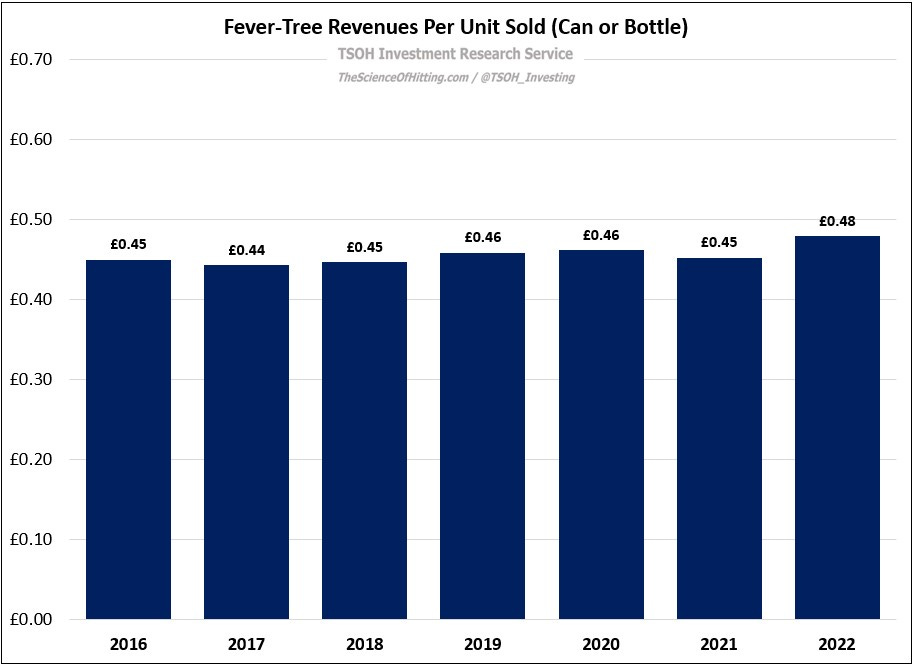

As we think about FT’s growth over time, it’s helpful to break it down between volumes and pricing (unit metrics are disclosed in the annual reports). As you can see below, annual volumes have more than tripled since 2016, while pricing has been a much smaller contributor (up less than 10% cumulatively).