Monster: A Beast Unleashed

Energy drinks and ~200,000% stock price appreciation

Note: Today’s write-up on Monster Beverage continues the discussion from last week on Celsius, as well as the most recent update on Fever-Tree.

In the late 1990’s, Rodney Sacks and Hilton Schlosberg were searching for Hansen Natural’s next leg of growth. They had purchased the company in 1992 for $14.5 million, but Hansen Natural was still looking for “a real point of differentiation” in ready to drink (RTD) beverages. Their most recent attempt was an energy drink, Hansen’s Energy, that hit the U.S. market in 1997 (after focusing on Europe for a decade, Red Bull also entered the U.S. market in 1997). That effort ultimately paved the way for the April 2002 launch of Monster Energy Drinks, which Hansen sold in 16-ounce cans for roughly the same price as the 8.4-ounce Red Bull offering. (A strategy reminiscent of Pepsi’s “twice as much for a nickel” advertising campaign from the 1930’s.)

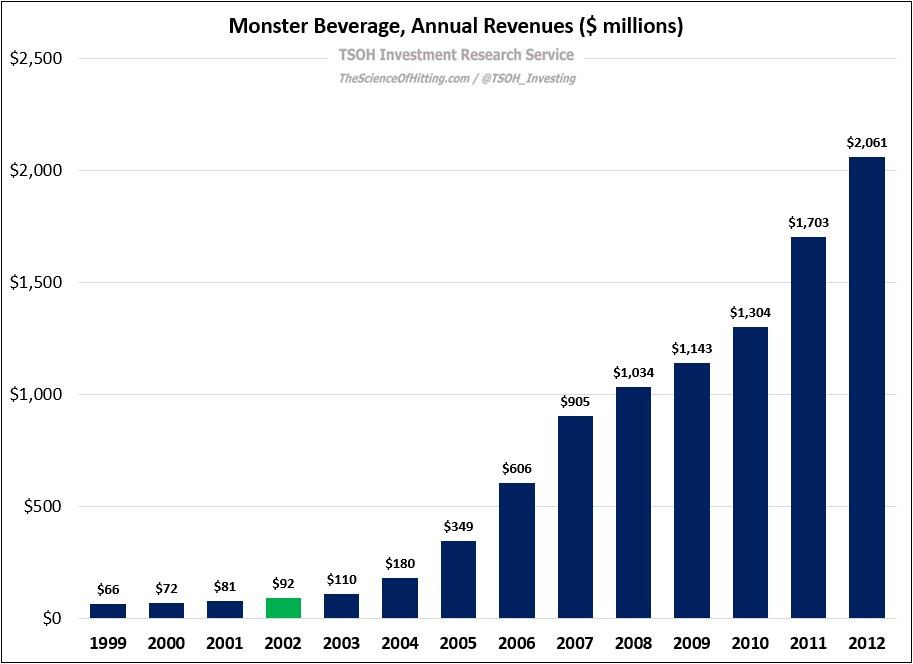

From a business perspective, the beast had been unleashed: by 2012, annual revenues had crossed $2 billion - up >20x from a decade earlier (Hansen Natural would change its name to Monster Beverage in 2012).

This success didn’t go unnoticed; as discussed in the Celsius write-up, Monster’s distribution in the early 2010’s was handled by a combination of Coca-Cola’s network and Anheuser-Busch wholesalers. That lasted until a momentous 2014 announcement: through a strategic partnership, Coca-Cola would contribute its energy drink brands (NOS, Full Throttle, etc.) and pay $2.15 billion in exchange for a 16.7% equity stake in Monster, which would be the beverage giant’s “exclusive energy play” (as a result of subsequent share repurchases, Coca-Cola’s stake is now up to 19.6%). In addition, the Coca-Cola system would become Monster’s global distribution partner; as Sacks said in 2017, “The key for us was International distribution… To truly be an International brand, we needed a distribution partner with their reach.”

As we think about the strategic rationale for Coca-Cola in this arrangement, as well as Monster’s success over the prior decade, it’s interesting to consider this comment from former Coca-Cola marketing executive Joseph Tripodi in 2012: “[Red Bull and Monster], they eat what they kill. They are ruthlessly focused on one area. It's a little different when you’re playing across 13 different non-alcoholic ready-to-drink (RTD) beverage categories; it creates more challenges. What we’ve learned more and more is we need to get specialists in particular categories… A lot of brands are not built by just loading them on the big, red truck and stacking it high at retail. They are more handcraft brands built outlet by outlet… It requires a certain degree of corporate patience; sometimes we have that and sometimes we don't. It requires discipline and patience within the organization to say, the best thing for this brand is to build slowly, to have targeted outlets and to be very specific on the channels you go into… If you don't have that discipline, you're probably better off putting it in a separate area… Understanding the strengths and the limitations that you have as a large company is very, very important in order to build those brands that are fundamentally in a very different space and at a different evolution than your big, global brands. We've learned a lot from that, and we continue to learn every day.”

Fast forward to the present, and we can see that Monster’s impressive growth has continued: FY23 revenues exceeded $7 billion, with a trailing 10-year CAGR of +12%. This outcome reflects continued strength in the U.S., with sales growing ~10% per annum over the past decade to $4.4 billion. In addition, the combination of the Monster and Coca-Cola assets has proven successful in International markets, with revenues +19% per annum since FY13. (The U.S. still accounts for ~60% of sales, down from ~85% in 2010.)

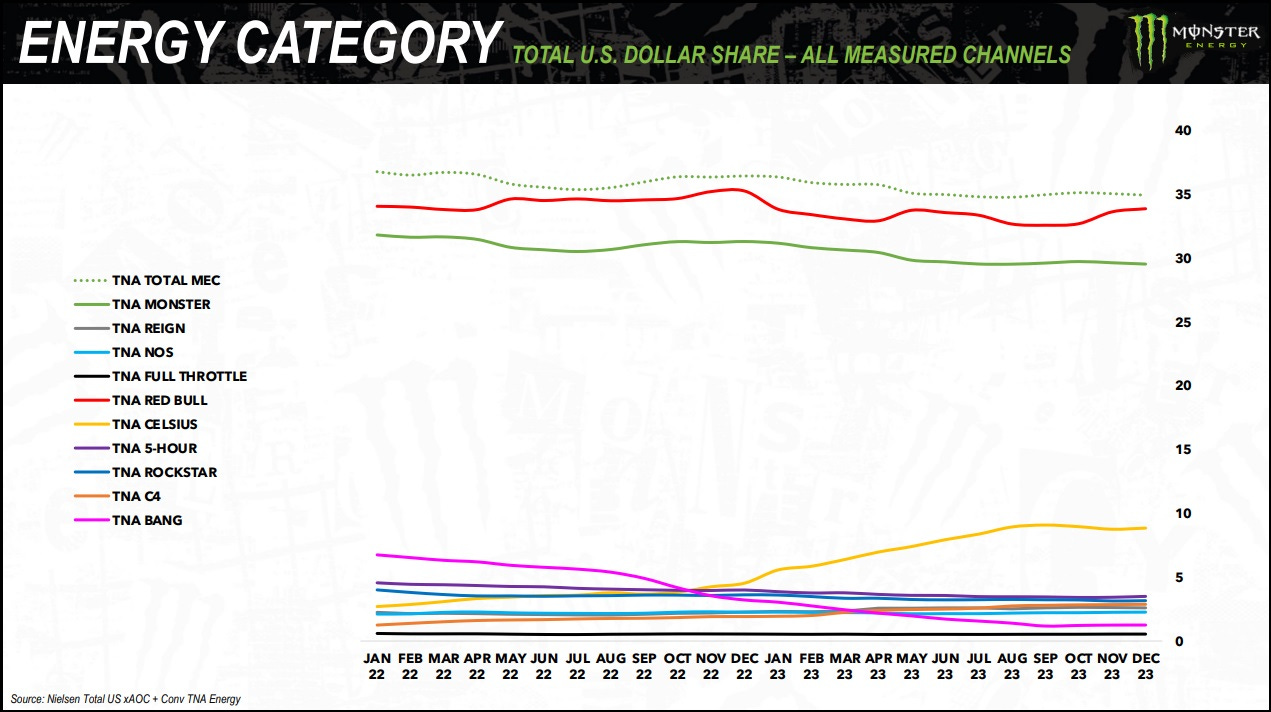

In the United States, the company’s results over the past two decades reflect an impressive ability to maintain a leading position in a category that has consistently taken share within non-alcoholic beverages. Specifically, Monster and Red Bull have each maintained 35% - 40% market share within energy drinks over the past 10+ years. (When they inked their first distribution deal with Anheuser-Busch in 2006, Monster’s share was ~20%.) Among the other energy brands, the most notable winner of late has been Celsius, and the most notable loser has been Bang Energy. The latter was sued by Monster in 2018 over misleading and overstated health claims, which led to a nearly $300 million settlement; Monster acquired Bang out of bankruptcy in 2023.

In addition, energy drinks have consistently taken a greater share of the U.S. non-alcoholic beverage market. For example, slide ten of the December 2012 investor deck shows that energy drinks and soft drinks (sodas) accounted for ~26% and ~34%, respectively, of U.S. convenience (C-store) RTD beverage sales. By comparison, slide six of the January 2024 investor deck shows that energy drinks now account for ~37% of the category at C-stores, up ~1,100 basis points since 2012, with soft drinks at ~28%, down ~600 basis points.

This data suggests that some consumers now turn to energy drinks in place of sodas, coffee, etc.; at the same time, I think Monster (core brand) should be somewhat concerned that Celsius’ rapid ascent is indicative of growing demand for “healthier” alternatives in energy drinks. (“Traditional energy drinks have ingredients that you can’t pronounce: glucuronolactone, inositol, taurine. We took all those things out.”) The release of Monster Energy Zero Sugar in 2023 is indicative of a desire to evolve the namesake brand and to serve incremental use cases that are likely being taken by competitors. (To be clear, Zero Sugar is a refresh of Absolutely Zero, which launched in 2010.)

As we think about pricing power, note that Monster’s average net sales per energy drink case equivalent (192-ounces, or 12 of the 16-ounce cans) was $9.0 in 2023 – down ~10% from a decade earlier. While this has been impacted by a higher International revenue mix (lower unit revenues than in the U.S.), as well as pressure from Strategic Brand pricing (discussed below), it points to an industry that remains competitive. (Coca-Cola released an energy drink under its namesake brand in 2020; while it was discontinued, that’s a noteworthy decision by Monster’s close partner and ~20% owner.)