BF.B: The American Spirit

Brown-Forman (BF.B) initiation

Note: Tomorrow is a day I’ve anxiously awaited for some time – the official release of “Buffett And Munger Unscripted”. While I’m obviously excited to see what comes next, I am also grateful for what has already happened: the publisher tells me that the early response to “Unscripted” has been very encouraging. That outcome is undoubtedly attributable to readers like yourself – the same people who have supported TSOH Investment Research since April 2021. Needless to say, I am incredibly appreciative. Thank you.

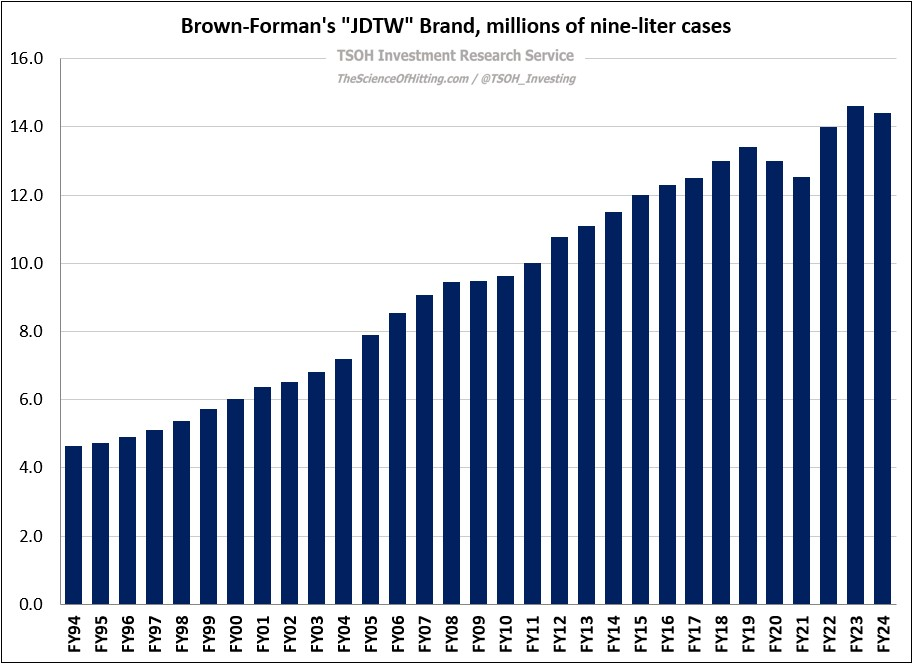

While Brown-Forman is a spirits company that competes across various categories like rum and gin, its heritage and value is largely attributable to its American whiskey brand, Jack Daniel’s, with “Jack Daniel’s Tennessee Whiskey”, or JDTW, selling more than 14 million nine-liter cases globally in FY24 (that’s enough to make about three billion Jack and Coke’s – cheers!).

As you can see below, JDTW has steadily grown product volumes over time, with a roughly 4% CAGR over the past two decades (FY04 – FY24). That outcome is inclusive of a difficult period during the pandemic due to its large mix of business attributable to out of home consumption: as noted on the Q3 FY21 call, JDTW is the 2nd largest on-prem spirits brand globally by volume.

This ~14 million doesn’t include other varieties within the JD family – for example, their Honey, Fire, and Apple flavors, which collectively sold more than 3 million nine-liter cases in FY24, and RTD’s. To put that >3 million figure into context, it’s larger than the volumes for any of BF’s other brands - a list that includes Woodford Reserve, Herradura, el Jimador, Old Forester, Glenglassaugh, Gin Mare, Fords Gin, Diplomático Rum, and others. In total, the Jack Daniel’s brand family accounts for about 75% of Brown-Forman’s annual volumes. As noted at the 2024 Investor Day, that is indicative of their dominant position in American whiskey: in 2022, Brown-Forman’s retail sales value in the category was larger than the next four competitors combined.

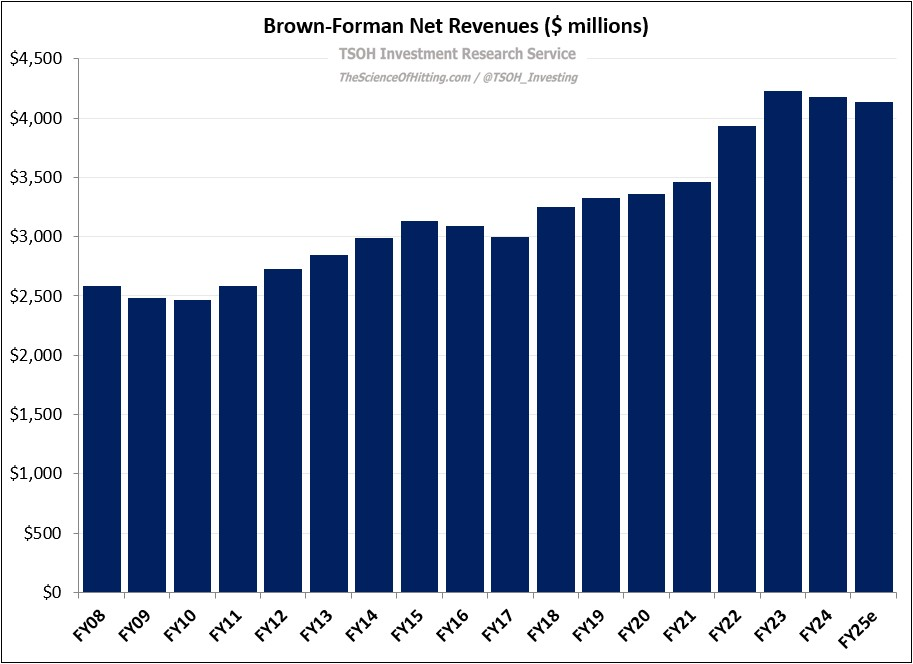

But while there’s much to like about Brown-Forman, the recent results have left something to be desired: at ~$4.1 billion, FY25e revenues are only expected to be ~5% higher (cumulative) than three years ago. To put that figure into context, the company’s net revenues increased by ~4% per annum over the prior decade (FY12 – FY22). Given some recent announcements – for example, the decision to lay off ~12% of their global workforce – it’s safe to conclude that BF management expects these current pressures to linger.

In combination with slower top-line growth, Brown-Forman has also seen headwinds on margins and free cash flow. The latter metric has been impacted by an inventory build, with total inventories climbing by roughly 40% over the past two years, to ~$2.6 billion as of yearend of FY24. That metric deserves an asterisk, given that the company primarily sells aged products (whiskey sitting in barrels for many years before its sold), along with a desire to keep moving upmarket (which is correlated to the number of years that it remains in those barrels). What gives me pause is when we separate the inventories by bucket: as you can see below, both barreled whiskey and its other inventories have each moved meaningfully higher in recent years.