Celsius: The Rise Of A Billion Dollar Brand

“The energy drink category is now a three-team race.”

When John Fieldly became CFO of Celsius Holdings in January 2012, the company was in the early stages of a turnaround – with good reason to believe failure was the most likely outcome: “Celsius was performing so poorly it had been delisted from the NASDAQ; soon, its drinks would no longer be stocked by Costco, which accounted for ~60% of their revenues.”

Alongside CEO Gerry David and majority shareholder Carl DeSantis, the focus was on attracting habitual, repeat business: “We needed to build a strong foundation of loyal consumers. Loyalty is the name of the game in consumer products. You can get trial, but if you can’t build loyalty, you won’t be able to build a brand. We focused on the fitness community. That’s a slow road…. Carl saw the bigger opportunity. We got to profitability in 2015.”

Celsius’ brand image and target customer has evolved over time. In the early days, the sales pitch was focused on functionality, with emphasis on diet / weight loss claims (“A single 12 oz can of Celsius burns 100 - 140 calories by increasing a consumer’s metabolism an average of 12% for up to a three-hour period.”) That evolved into a pre-work beverage sold in gyms like 24 Hour Fitness and Gold’s Gym, as well as health / vitamin & supplement focused retailers like GNC and Vitamin Shoppe. More recently, Celsius has become more broadly positioned as a lifestyle / wellness brand, which stands in contrast to the brand positioning of some notable energy drinks like Monster or MTN DEW Energy (“it’s almost like a multivitamin in a can”).

As Fieldly says, this tweaked messaging was an “aha” moment for the company: “We were marketing a product, a liquid in a can. Once we realized that the beverage is an extension of who you are, that it says something about you, it changed the way we went to market. It changed us to be more of an aspirational brand versus a beverage for a specific need state.”

This differentiated the brand with consumers, as well as with distributors and retailers: “It positioned us for this healthy / better-for-you energy segment. When we spoke with distributors, they had a void; historically, they had sugary energy drinks in their portfolio. We had a different offering for them to sell to the better-for-you consumer… That was our go to market strategy with distributors and retailers, to carve that space out in retail planograms.”

By the late 2010’s, the strategy was clearly bearing fruit: FY19 revenues were $75 million, or >3x higher than in FY16 (Fieldly became CEO in 2017). Throughout the late 2010’s, Celsius landed new / expanded distribution across grocery, drug, and C-stores. As an example, Celsius struggled to gain significant distribution in the convenience channel before 2019; as noted on the Q4 FY18 call, they were only sold in ~10% of U.S. C-stores. As Fieldly later said, “2019 was the trigger point… We had great success and gained substantial distribution in C-stores, which have traditionally accounted for about 70% of energy drink sales. You have to win in convenience.”

As the company grew across key retail channels, a focal point of their strategy was to expand availability and visibility (number of SKU’s / flavors) on the shelf and in coolers, which had a halo effect on the brand: “Once you show the retailer you need [can support] additional flavors, the billboard effect is critical… When we started at Target, we had two flavors on the warm shelf… Once we got to about five flavors, we were able to create a billboard / Celsius brand on shelf that was incremental. When we added flavors, it wouldn’t cannibalize our sales; it actually increased our sales because more consumers saw the product as we created that billboard.”

The impressive growth in the back half of the decade accelerated further during the pandemic (FY20 sales +71%), and led to a transformative deal in August 2022: PepsiCo invested ~$550 million for an ~8.5% stake in Celsius. It included a long-term distribution agreement, with Celsius reaching nearly full U.S. distribution within 18 months (“~98% ACV”), along with a pathway for the brand to more efficiently pursue International growth (in the near term, they will expand to Canada, the UK, Australia, New Zealand, and France).

From a financial perspective, the recent results are astounding: Five years ago, in FY18, Celsius’ revenues were $53 million; last year, in FY23, they exceeded $1.3 billion (with a trailing five-year revenue CAGR of +90%).

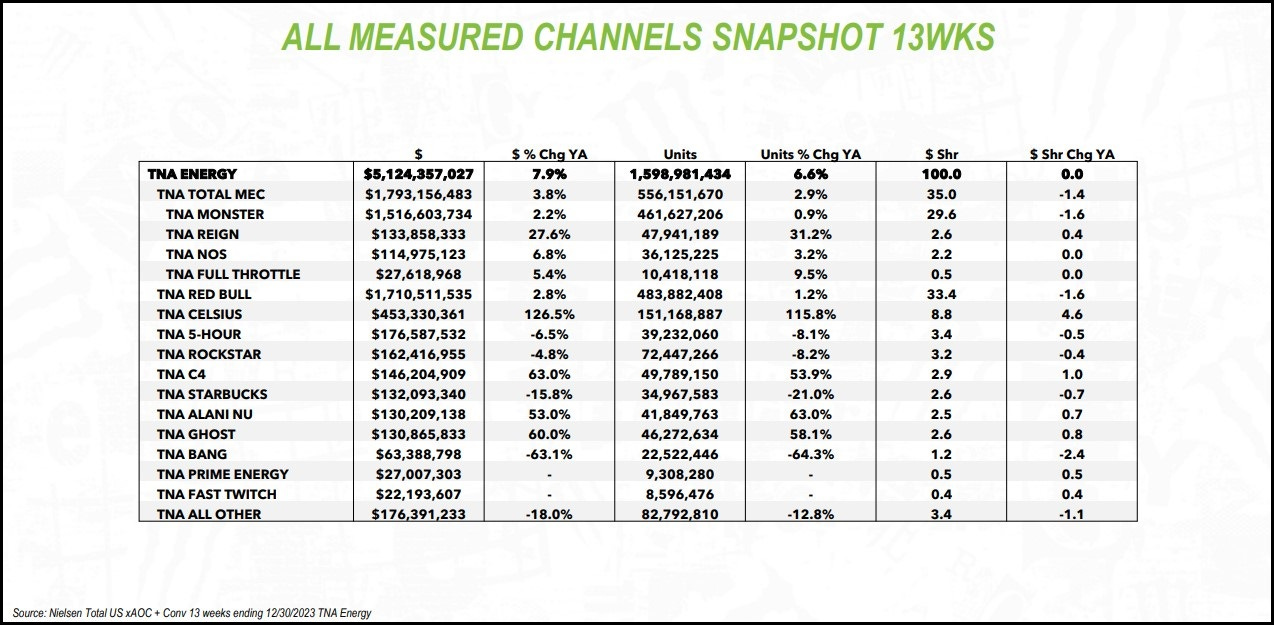

The following data, from Monster’s 2024 Investor Meeting, shows that Celsius had ~9% dollar share in the U.S. energy category in Q4 FY23 (across all measured retail channels), with its share roughly doubling over the prior year period. As you can see, Celsius and a few smaller brands like C4, Ghost, and Alani Nu have taken share at the expense of Monster and Red Bull, which account for ~70% of the category. Put differently, the Celsius brand has ~9% market share, but it has recently been responsible for more than 30% of the category’s incremental unit volumes and sales dollars; naturally, if they sustain that momentum, it would position the brand for continued market share gains in the years ahead. (Note that Celsius’ market share over indexes to e-com and club, and under indexes to C-stores; Amazon and Costco accounted for 8% and 12%, respectively, of Celsius’ FY23 sales.)

As we think about Celsius’ astounding growth over the past five years, it’s important to have some context on the history of energy drink distribution in the United States. As recently explained by Stifel analyst Mark Astrachan, there were a number of meaningful developments over the past two decades: