Q4 2025 Portfolio Update

Prior TSOH Quarterly Updates:

Q2 ’21, Q3 ’21, Q4 ’21, Q1 ‘22, Q2 ‘22, Q3 ‘22, Q4 ‘22, Q1 ‘23, Q2 ‘23, Q3 ‘23, Q4 ‘23, Q1 ‘24, Q2 ‘24, Q3 ‘24, Q4 ‘24, Q1 ‘25, Q2 ‘25, Q3 ‘25

2025 Portfolio Changes:

Top TSOH Posts, Q4 2025:

Crocs: Durable Brand, Distracted Company

Meta: Financing The AI Frontier

Note: With the five-year anniversary of TSOH Investment Research approaching in April, I want to reiterate my continued commitment to this service. I love the work that I get to do, and I plan on continuing down this road for many years ahead. As discussed below, my hope is that continued coverage of a range of companies and industries will help to compound knowledge over time. With diligence and disciplined decision-making, I’m confident recent strong equity returns will prove sustainable in the future.

2025 was another encouraging year, with the TSOH portfolio delivering a return of +26%. (As a reminder, this isn’t for a side account or an equity sleeve; it accounts for 100% of my family’s investable assets, i.e. everything except checking cash balances maintained to cover daily living expenses.)

The path to that outcome felt quite different than the market’s own road to another impressive year – a total return for the S&P 500 of ~18% - a statement evident from reviewing a short list of the top returning stocks for the TSOH portfolio in 2025: Dollar General, Dollar Tree, and Ally Financial.

Zooming out, it has been a pretty challenging environment over the past 10+ years for traditional value investors, a group that I consider myself a part of; a decade of mid-teens annualized returns (TSR) for the S&P 500 hasn’t been particularly accommodating to a crowd that approaches investing with an emphasis on downside protection and an eye towards a margin of safety. Generally speaking, the posture that has been rewarded in recent years is one with a higher risk tolerance; we’ll see if that holds in the year(s) ahead.

At the same time, I don’t think an appropriate response, nor an effective one, is to point at (to blame) external factors like indexing or broken markets; as evidenced by developments over the past 10-15 years, value investors should be doing some soul searching about how to productively respond to a world that is changing. As an example, understanding the logic of base rates shouldn’t then become a crutch that hinders further analysis, reducing equity research to a cursory process that largely focuses on near term valuations.

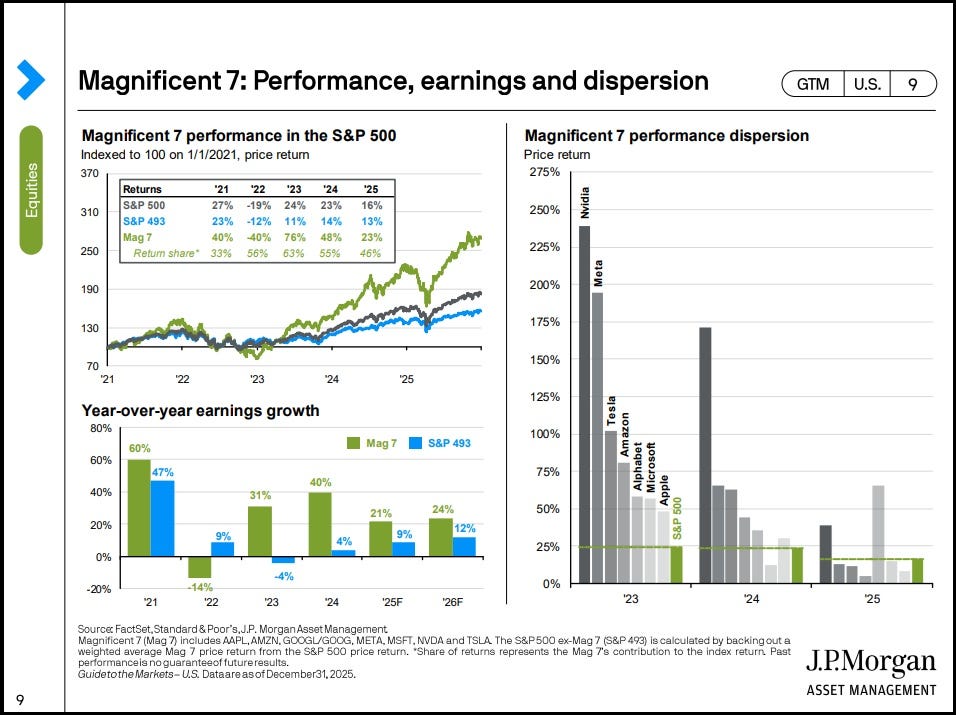

Over the past 10-15 years, a largely unchanged list of tech companies – starting with “FANG” in 2013, since reconstituted to the “Mag Seven” – drove U.S. equity markets higher (slide nine). Along the way, investors who didn’t try to truly analyze and understand some / all of these businesses likely paid a dear price for not doing so – particularly as the index (the S&P 500) then became more heavily exposed to them. I sympathize with investors who analyzed these businesses / stocks at a point in time – say, ten years ago – and didn’t draw a clear conclusion about their long-term prospects. But what that must not then lead to is an unwillingness to revisit the story over time, with a clean slate and an open mind. Failing to do so in this case, with those few stocks accounting for a meaningful percentage of the index’s cumulative performance over the past 5-10 years, has led to an extended period where many value investors struggled to close the gap with the S&P 500’s returns.

What I hope to illuminate is a pressing need for continued learning as part of the investment process, both in the form of researching new companies / industries and in continuing to refine our views about the companies we own and those sitting on the watchlist. This is particularly true as we grow older and settle into a groove; while we must naturally be mindful of where the edges of our circle of competence lie, it should also evolve over time. (I often think about this comment from Warren Buffett when he disclosed his IBM investment: “I have probably read the IBM annual report every year for 50 years. This year it came in, I read it, and I got a different slant on it, which I proceeded to do some checking on. I just read it through a different lens.”)

Inputs and Outputs

While I’m encouraged by the strong performance of the portfolio, that’s an output. My focus is what I can do to improve the inputs, primarily in the form of new companies added to my investment universe – a list that included the following 11 companies over the past year (listed alphabetically): Academy Sports + Outdoors (ASO), Acushnet Holdings (GOLF), Brown-Forman (BF.B), Build-A-Bear (BBW), Constellation Brands (STZ), Crocs (CROX), Dick’s Sporting Goods (DKS), Imax (IMAX), Kinsale (KNSL), Versant (VSNT), and Vital Farms (VITL). In addition, I sent updates throughout the year on another ~30 companies that I currently own or that are on the watchlist. Roughly speaking, this is indicative of the pace I intend to sustain in the years ahead.

What this process should hopefully lead to is a mix of investment ideas at various stages of development / maturity. First, there are portfolio holdings; if I’ve made an accurate assessment of the opportunity, and if Mr. Market doesn’t get too far ahead of himself, those positions are likely to be held in size for many years. Second, there are watchlist companies where I have come to a high degree of confidence on the business, but where there’s a final hurdle to clear, typically the valuation (Airbnb, which was added to the portfolio in early December after years of sitting on the watchlist, is a recent example). Third, there are the watchlist companies where a few hurdles remain – typically questions about the long-term attractiveness of the business, the effectiveness of management’s capital allocation, and the valuation - see BBW, CELH, CROX, DKS, NKE, SAM, SMG, RBLX, and ROKU for a few examples. Some positions will linger in this bucket, but periodically it is where large positions are sourced from as the key questions / concerns are resolved over time (the most notable recent example is DLTR). I think that this is an effective system for discovering, vetting, and – over time – intelligently allocating capital to companies that satisfy my investment criteria.

I’ll close with something I wrote in the Q4 2022 Portfolio Update, at a time when TSOH portfolio returns weren’t nearly as encouraging as they’ve been over the subsequent three years: “While it’s helpful to look at the scoreboard from time to time, my intention is to keep my head down with the goal of continual improvement. If properly applied, I believe I’ve narrowed my focus to an investment framework that can result in attractive long-term outcomes.”

Here’s the current TSOH portfolio, followed by updated portfolio returns.