Q3 2022 Portfolio Update

From the Q2 2022 Portfolio Update:

“Risks, both known and unknown, are ever present. As an investor, I don’t operate under the illusion that the management teams I’ve partnered with will be able to predict changes in the tides (specifically in terms of short-term macroeconomic developments). Instead, I look to entrust people who accept and prepare for the natural uncertainty the world will always offer.”

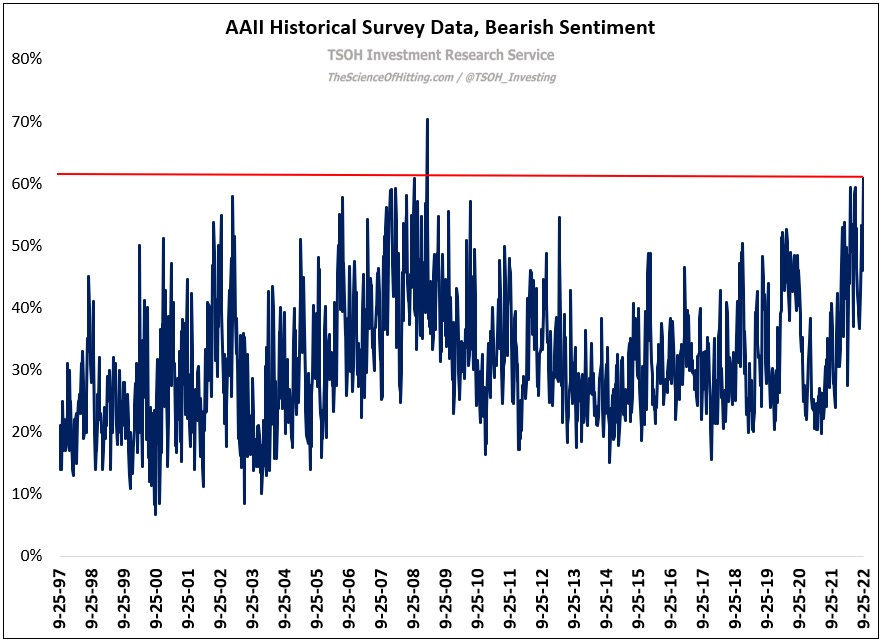

Q3 didn’t provide any reprieve from the difficulties experienced in 1H 2022; the S&P 500 ended September down ~25% YTD, it’s worst outcome through Q3 in the past two decades. The WSJ’s quarterly update provided a timely view of the current state of investor / market sentiment: “With so many assets trading at steep discounts to their earlier prices, this could seem like a time to buy. But a murky view into the path ahead is keeping many investors from making big bets… Bearish sentiment, or expectations that stock prices will fall over the next six months, rose to its highest level since March 2009 in a recent poll from the American Association of Individual Investors (AAII).”

That last data point is an interesting one. The S&P 500 bottomed during the financial crisis on March 9th, 2009 (at 677), or four days after that record high bearish AAII reading; when Q3 2009 came to a close (seven months later), the index was at 1,057 – up more than 50% from the March 2009 lows. Needless to say, with the benefit of hindsight, the last time bearish sentiment among individual market participants (those surveyed by AAII) approached record highs, it was an ideal moment for investors to accept the murkiness that is an inherent and unavoidable part of being a long-term business owner.

To be clear, I have no idea if this survey data will - once again - prove to be a useful contra indicator. Importantly, even if I did, it would have zero impact on how I invest given the structural asset allocation I’ve committed myself to.

That said, some of the companies I own (like Comcast / LBRDA and Meta), alongside a few on the watchlist (like Match and Roku), have clearly seen their results worsen over the past few quarters. A key part of my job, as I see it, is to distinguish between the changes in business results that are macro related / short-term in nature and changes that point to underlying concerns about the business that could materially impact its long-term trajectory and intrinsic value. As we’ve seen with the companies mentioned above, this can be incredibly difficult to do in real time (especially as we try to quantify the mix between those buckets in the face of other considerations like COVID).

In an attempt to find a solution to this problem, investors may begin to shift their attention to an overwhelming focus on one or two short-term KPI’s (like quarterly revenue growth), alongside a “do or die” approach to portfolio decision-making that often ends at one of two extremes: sell the stock or double down. I’d also argue that social media (see Twitter) is likely to hurt, not help, investors as it relates to this particular issue; we are being drowned in a constant stream of new information and incremental data points, which can have a deleterious impact on our ability to truly think and act as long-term business owners (for those of us who aspire to operate in that manner).

My “solution” is to lean my behavior towards patience and inactivity.

It starts with new investments, which are made with the requirement of significant size (minimum ~5% allocation) and with the expectation that the shares will be held for many years. After the initial purchase, I intend to give the thesis sufficient time (measured in years) to run its course, as opposed to constantly jumping between different conclusions based on short-term price action or even the short-term business results (the latter can be volatile for a number of reasons, in many instances due to developments that have little bearing on long-term expectations). By the way, this patience also applies to current holdings; I tend to move more slowly on incremental additions than I did a few years ago, particularly when the primary justification is “the stock looks even cheaper because it went down a lot”. I’ve taken to the view that incrementally positive business outcomes should be the primary driver of additional purchases, not just an improvement in the price / value equation (especially when the argument is made that a decline in the denominator has been more than offset by the decline in the numerator).

This approach demands that the companies targeted for investment have a strong balance sheet (highly unlikely to be dependent upon the kindness of strangers), alongside a competitively advantaged business and a proven management team that can adapt to new realities. With (very) few exceptions, a long-term investment will require the shareholder, alongside management, to live through changes in industry structure and competitive dynamics, evolving business models, etc.; my objective is to partner with leaders and organizations that are well positioned to effectively navigate through the unavoidable realities of industry evolution and economic cycles.

From where we stand today, I remain confident that my holdings pass that test (that said, some are subject to more intense debate than others).

TSOH Portfolio Update

This was the portfolio allocation as of Friday’s close.