Meta: Financing The AI Frontier

Meta Platforms (META) Q3 FY25 Update

From “Meta: The Decisive Period” (August 2025):

“It’s clear that this latest [CapEx] inflection is a bit different. That speaks not just to the magnitude of the expected spend, but also the purpose it serves for Meta – specifically, to directly improve their hand at FOA or for broader use cases… The risk / reward on the investment is starting to change as a result of these developments… I think Mr. Market will shrug this off if FOA’s results provide sufficient cover… If revenues disappointed in the face of huge expense growth, I think that Meta’s stock would likely face significant near term pressure. It’s up for each investor to determine how much influence considerations such as these should have on their decision-making.”

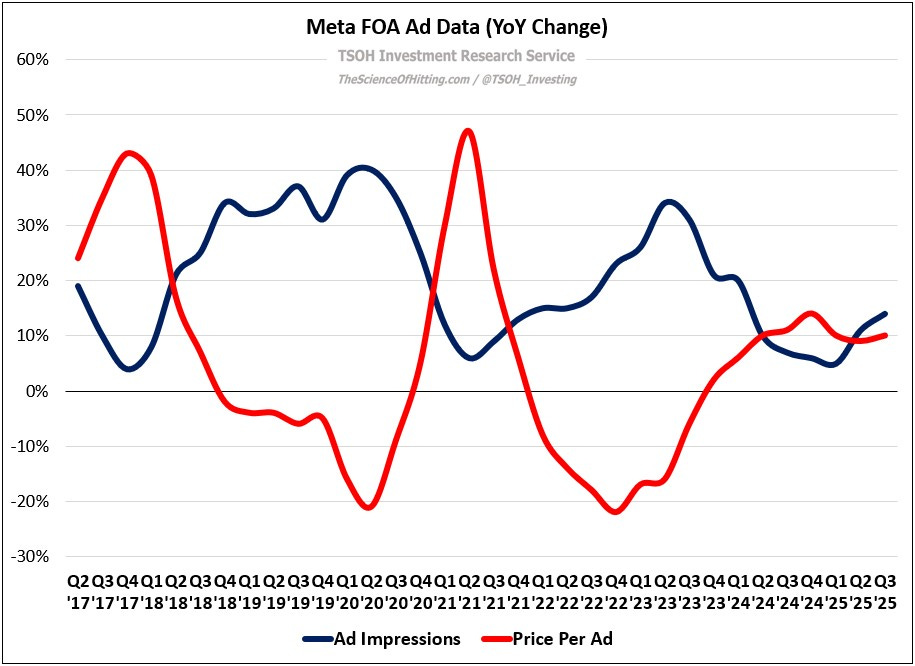

The encouraging news from Meta’s Q3 FY25 results is that the company continues to deliver impressive topline growth; revenues in the quarter were +26% YoY, with FY25 revenues likely to reach ~$200 billion, up more than 20% from the ~$165 billion generated in FY24. With sustained gains on daily active users and time spent, along with improved ad performance, the pieces are in place for mid-teens FY26e revenue growth, to ~$233 billion; in dollars, that’s nearly $70 billion higher than in FY24. (CFO Susan Li: “In the U.S., time spent on Facebook and Instagram grew double digits YoY, driven by video strength as well as healthy growth in non-video time on Facebook.”)

The problem is the breakneck pace of CapEx and total expense growth.