Q2 2022 Portfolio Update

As the saying goes, a picture is worth a thousand words.

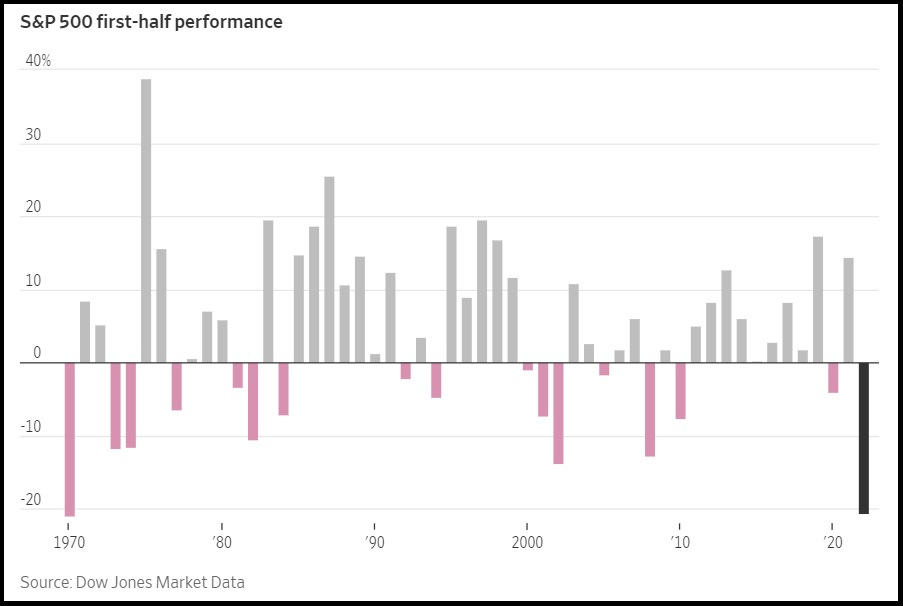

The S&P 500 has declined by ~21% year to date, its worst first half performance in more than 50 years (and only the eighth year since 1960 that the index has declined by more than 10% in the first six months).

Today, there are rampant concerns about macroeconomic and geopolitical issues; it has many market participants fearing for the worst, with the Wall Street Journal capturing those sentiments: “More Gloom, More Volatility, and Few Gains”. As that article notes, we face numerous headwinds, “including weak corporate earnings, high stock prices, and the expectation of rising interest rates”. Given the rocky road that foretells, it’s understandable why many now question whether this is the right time to keep owning stocks.

The only problem is that this actually wasn’t from an article published at the end of Q2 2022; it was written in December 2015. Even after the very difficult start to the year that we just lived through, the index is ~90% higher than where it traded at that time, before dividends. My apologies for that sleight of hand, but I think you can appreciate the point that I’m trying to make in doing so. (It mirrors the sentiment expressed in last Thursday’s post.)

The actual WSJ article published after Q2 2022 ended, which is the source for the chart at the beginning of the article, included the following: “Investors seem to be in agreement about only one thing: More volatility is ahead.”

Whenever I read about heightened volatility or uncertainty, I think back to something Warren Buffett wrote in the 2010 Berkshire Hathaway shareholder letter: “Commentators today often talk of ‘great uncertainty.’ But think back, for example, to December 6, 1941, October 18, 1987, and September 10, 2001. No matter how serene today may be, tomorrow is always uncertain.”

Risks, both known and unknown, are ever present. As an investor, I don’t operate under the illusion that the management teams I’ve partnered with will be able to predict changes in the tides (specifically in terms of short-term macroeconomic developments). Instead, I look to entrust people who accept and prepare for the natural uncertainty that the world will always offer.

Today’s concerns will eventually fade; as they do, new worries will arise.

TSOH Portfolio Update

This was the portfolio allocation as of Friday’s close.