Q3 2024 Portfolio Update

Portfolio Changes, Q3 2024:

Popular Posts, Q3 2024:

“Fully Seize The Opportunity” (Meta)

"Competition Has Never Been Greater" (Celsius and Monster)

The Dollar Store Downturn (Dollar General and Dollar Tree)

The “crossroads” that I wrote about in the Q2 2024 update have continued over the past three months. In terms of the TSOH portfolio, that widening gap has primarily materialized in an undesirable fashion: the laggards lagged further, which weighed down consolidated returns. On the other end of the spectrum, a few of the larger positions that contributed to a strong 2023 have continued to pull their weight in YTD 2024 (most notably Meta and Netflix).

As I wrote last quarter, my desire to own businesses is balanced against an understanding of the impact on 5 - 10 year expected returns when we start talking about 50% - 100% moves to the upside. If that occurs for certain portfolio holdings, and if I’m able to find other investment opportunities that meet my requirements, then I’m likely to take action. That happened during the third quarter, as detailed in the portfolio change posts linked above.

In terms of taking more aggressive action here, it’s interesting to reflect on the following quote from Warren Buffett (at the 2020 Berkshire Hathaway meeting, when discussing his decision to sell out of all the airline stocks):

“When we sell something, very often, it’s going to be our entire stake. We don’t trim positions. That’s just not the way we approach it… If we like a business, we’re going to buy as much of it as we can and keep it as long as we can. But when we change our mind, we don’t take half measures...”

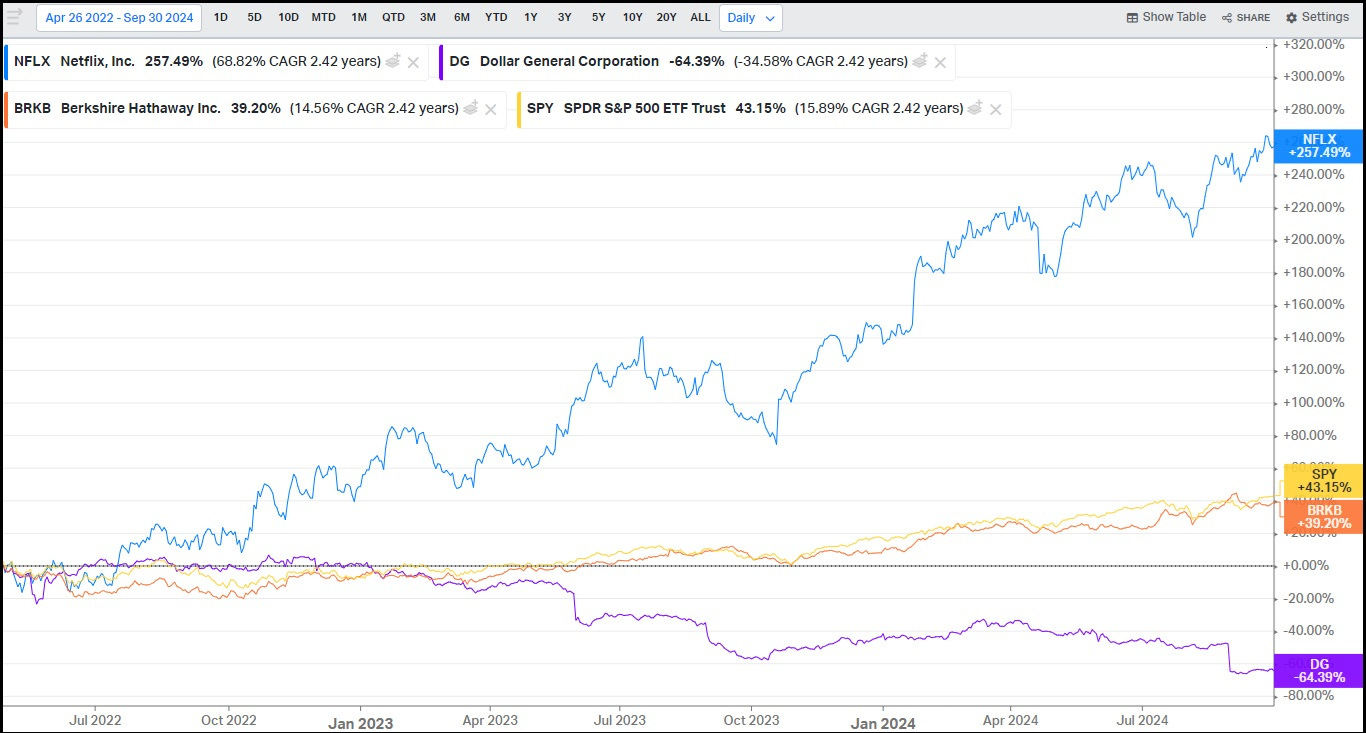

Let’s take that at face value, and compare it to one TSOH investment decision: in April 2022, I increased my Netflix allocation, funded by trims to Berkshire Hathaway and Dollar General. Based on the subsequent stock price performance, this has been a good call (particularly on NFLX vs DG).