"The Importance Of Focus"

Today’s post is sponsored by AlphaSense, the leading market intelligence and search platform that helps investors to make more thoughtful decisions. AlphaSense is a key part of my investment research process, particularly for document search and expert transcripts (a library of 150,000+ proprietary expert transcripts that is growing by 6,000 per month). Earlier this month, AlphaSense hosted an expert webinar series on tariffs, an example of the timely research that is available through the platform. If you are interested in accessing the webinar, sign-up at the link or click the banner image below.

From “Ally: End Of The Tunnel” (January 2025):

“I see reason for optimism at Ally. That conclusion is based on end market tailwinds (more favorable conditions in underwriting used auto loans), along with strategic adjustments [like exiting the credit card business] that will return their focus to the areas of the lending business they are best positioned to compete in. The flip side of that comment is management has not done a stellar job on either of those buckets in the past few years, falling into a few potholes along the way; in my view, Ally’s underwhelming stock price performance in recent years has been a fair response in light of that reality.”

While the Ally thesis has faced its share of challenges, some of which are still present in 2025, the pieces are in place for stronger results ahead. That reflects improvement in the core businesses, most notably auto lending, as well as the impact of strategic adjustments. With those changes underway, we are also living through an interesting experiment within the deposit franchise – specifically, the balance between pricing and other factors that influence Ally Bank customer counts and deposit flows. At a high level, I think this all supports an encouraging conclusion for owners: Ally is positioned to generate attractive results if they remain focused on their core franchises.

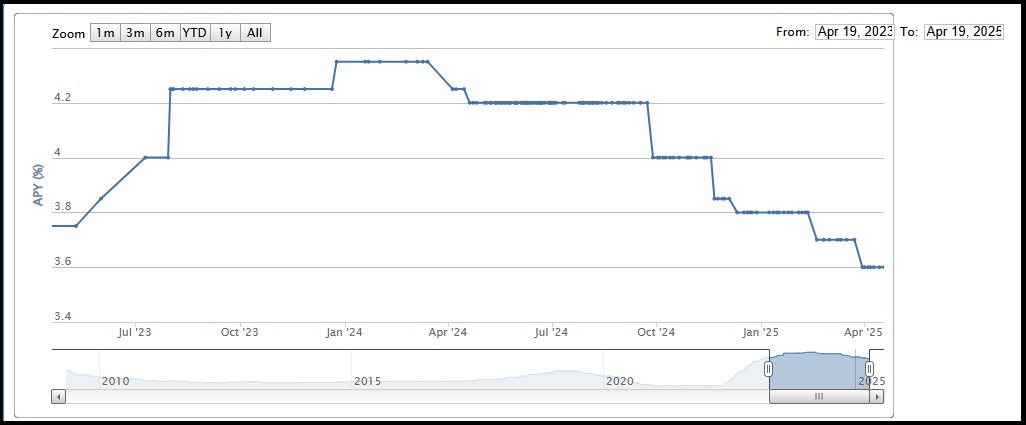

A focal point of “End Of The Tunnel” was Ally Bank pricing, primarily for savings accounts (OSA’s) and CD’s. With Ally in a position where downward pressure on loan growth presents the choice, or even the need, to be less aggressive in attracting incremental deposits, they had started to let their OSA pricing lag top rate payers by a wider margin (as noted on the Q1 FY25 call, the expectation is roughly flat deposit balances for the year, “aligned with what’s needed to support the asset side of our balance sheet”). The 3.8% APY Ally offered on OSA’s was reduced by 20 basis points in March to 3.6%, a move that came despite no change to the fed-funds rate since late 2024.

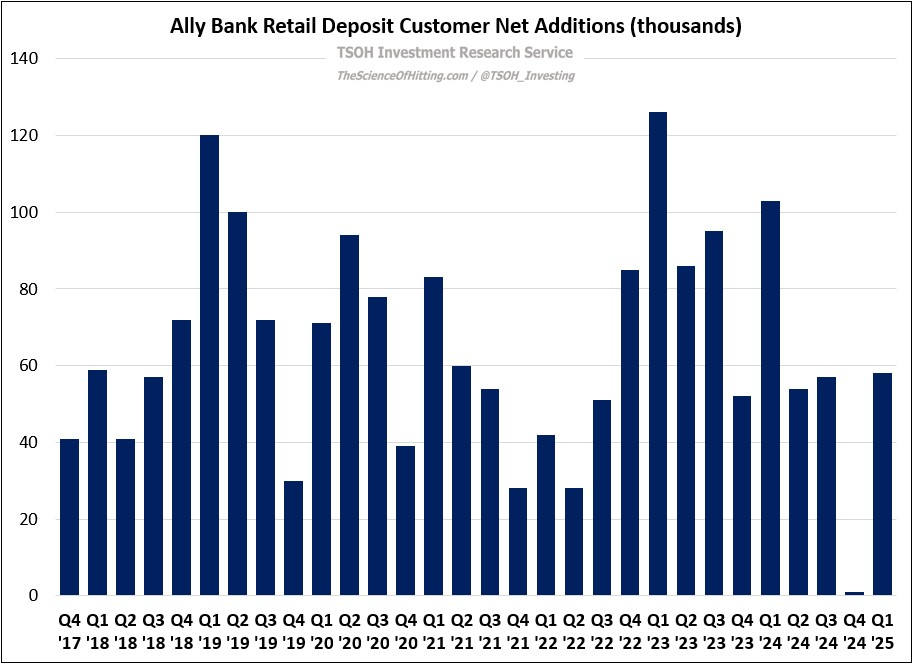

The follow-on question is the impact on customer activity: it's nice to be in a position where you can pay less for deposits if it’s sustainable. In my view, the answer – at this time – is so far, so good. The number of Ally Bank customers grew +5% YoY in Q1 FY25, to ~3.3 million, with roughly 60,000 sequential customer additions in Q1 (seasonally, their strongest quarter of the year). On the call, CEO Michael Rhodes commented on a desire to attract lower balance customers that hints at Ally’s distinct deposit pricing risk (relative to deposit pricing at banks like Wells Fargo or Bank of America): they have outsized exposure to deposit customers who are primarily focused on pricing / APY. As I wrote last quarter, this is a significant test that has implications for the long-term attractiveness of Ally’s business model.

This applies to OSA’s and CD’s, with ~$38 billion of the latter maturing in FY25 at an average yield of ~4.5%. Given that these account for >20% of Ally’s total funding, and are likely to reprice at 3.5% - 4.0%, this will drive a ~20 basis point improvement on consolidated funding costs. (In Q1 FY25, ~$151 billion of deposits had a cost of 3.78% - down 50 basis points YoY.)

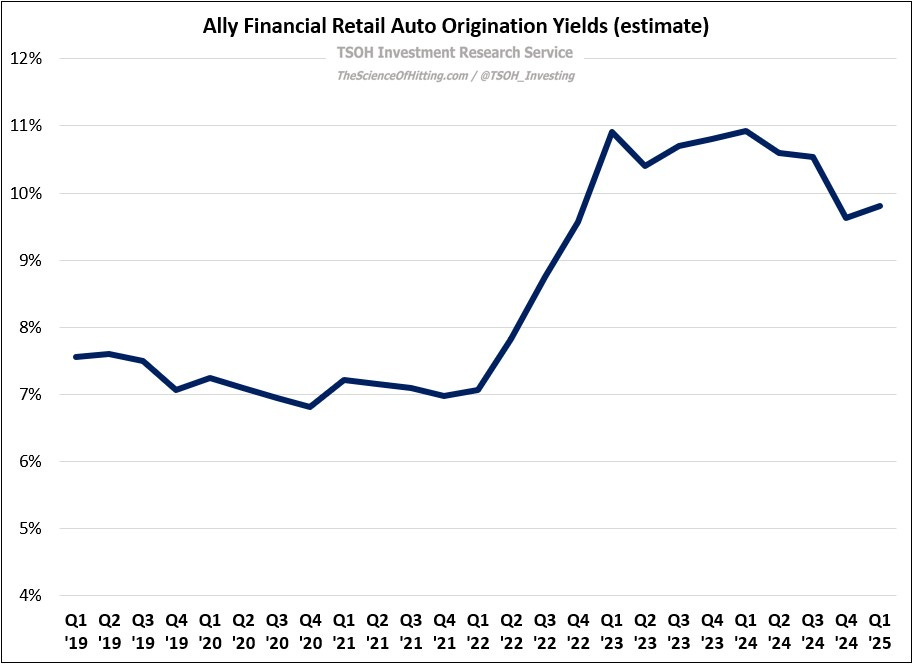

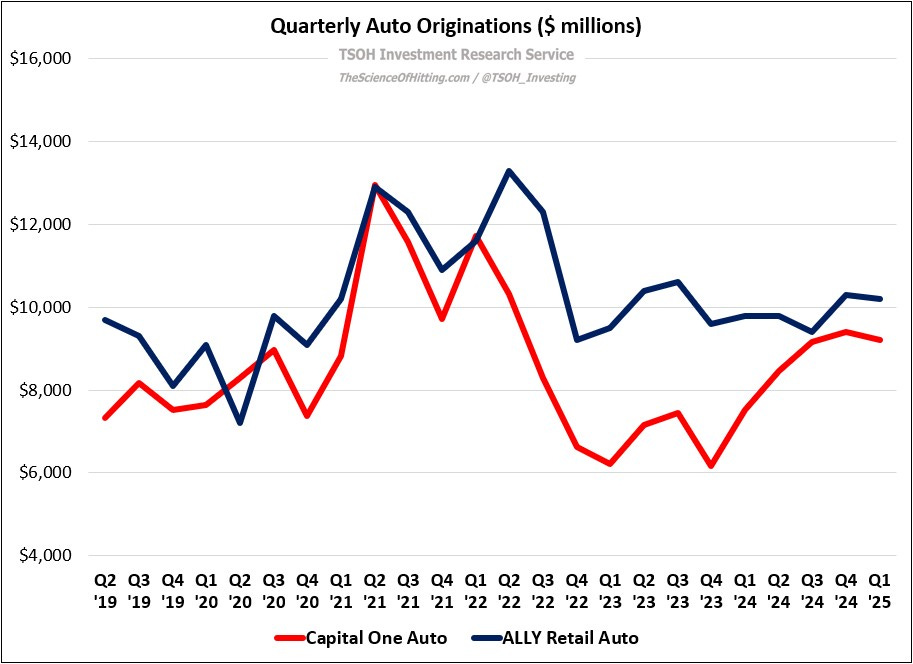

The other side of the Ally equation - credit - also looks more encouraging, albeit with some lingering concerns on how they’ve navigated this cycle versus notable peers. In auto, Ally originated ~$10.2 billion of new loans at a ~9.8% average yield in Q1 FY25, which were sourced from a quarterly record of ~3.8 million auto loan applications (“underscoring the strength of our dealer relationships and the scale of our franchise”). Strong application volumes gives the company flexibility in how it balances credit quality and pricing, with their highest quality credit (S) tier coming in at 44% of originations during the first quarter – down from 49% in Q4 FY24, but well ahead of the 25% - 35% of originations that were sourced from S-tier in FY22 and 1H FY23 (slide 12).

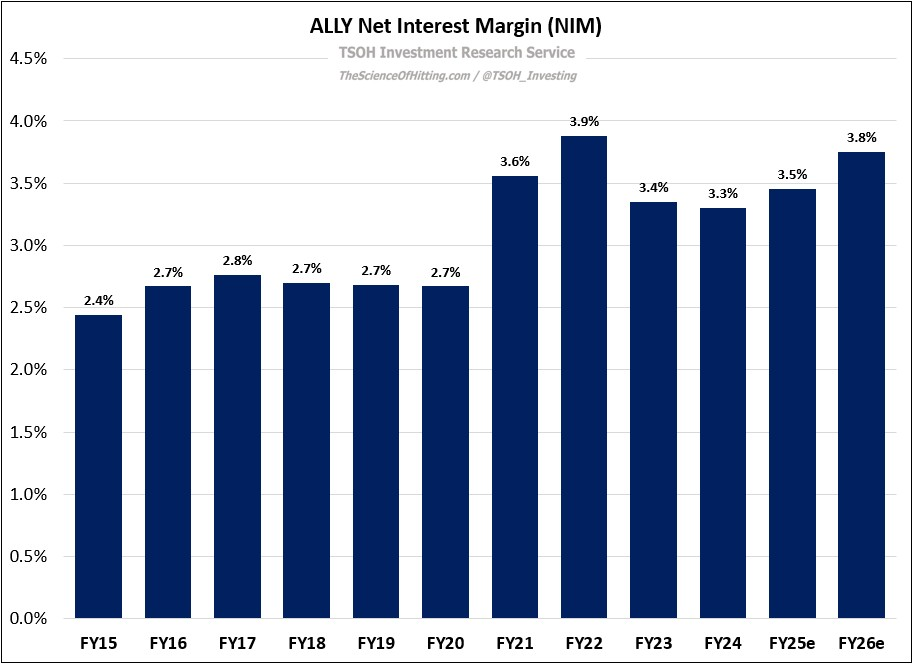

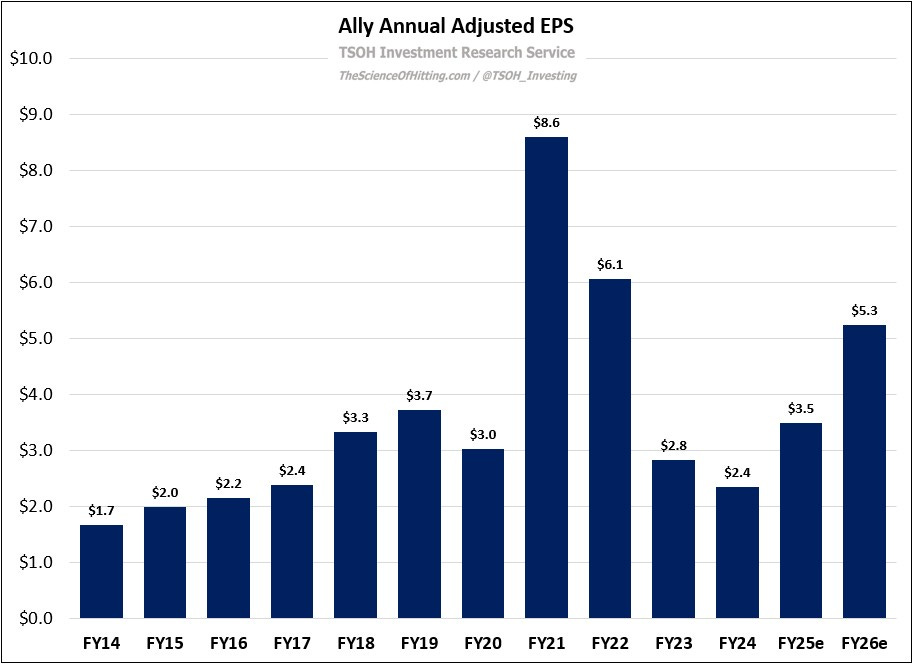

In combination, the expectation is that deposit repricing should outpace any pressure on earning asset yields, resulting in higher net interest margins (NIM’s). As you can see below, I expect a roughly 30 basis point improvement in FY26e, to ~3.8%, which is a meaningful tailwind to earnings: each five basis point NIM improvement should lead to roughly +$0.25 in annual EPS.

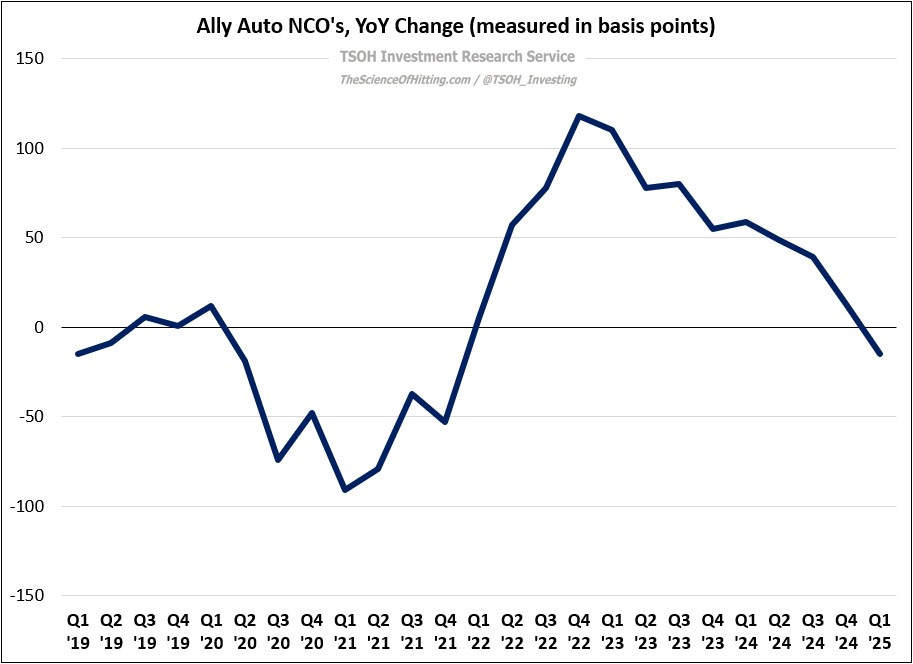

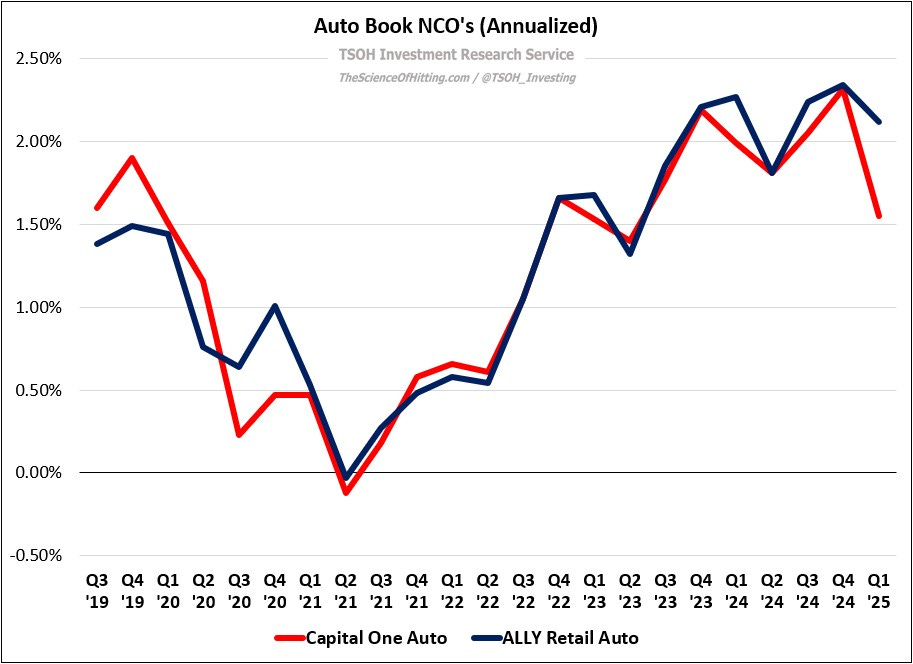

As I’ve discussed previously, Ally is seeing headwinds from prior underwriting actions, most notably on the 2022 vintage. The good news is that the 2022 vintage will account for just ~10% of the auto book at yearend (slide 12). This changing mix is a key reason why Ally’s retail auto net charge-offs (NCO’s) declined by 15 basis points in Q1 – their first YoY decline since Q4 2021.

With that said, as you can see below, the improvement in Ally’s auto NCO’s lagged the rate of change at Capital One by a wide margin, reflective of better decisions by their competitor in prior periods. (COF Q1 FY25 call: “The auto charge-off rate for the first quarter was 1.55%, down 44 basis points YoY, largely as a result of our choice to tighten auto credit and pull back in 2022.”)

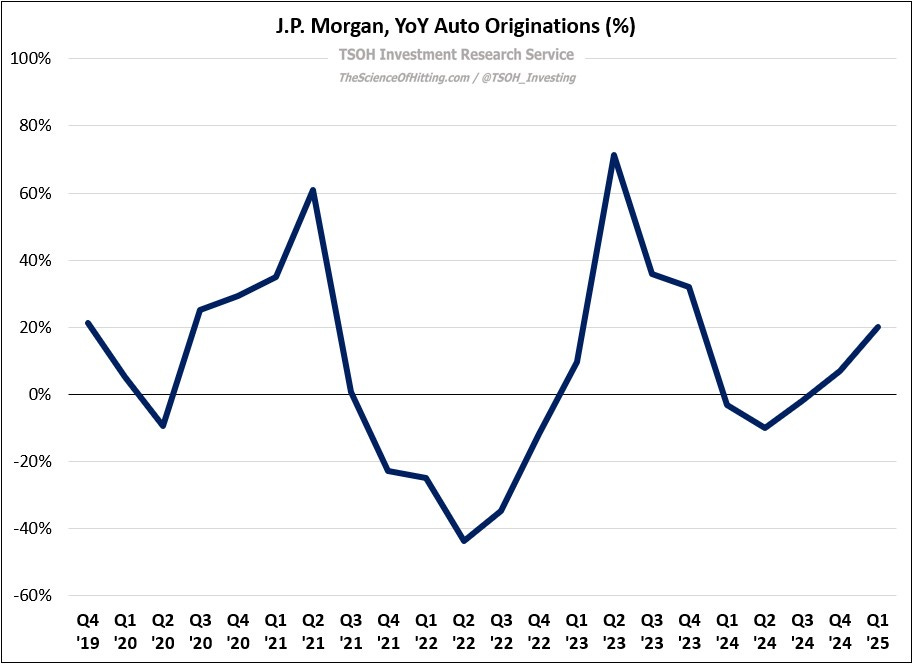

As we look ahead - to the auto NCO’s that Ally is likely to report 6, 12, 18, and 24 months from now - management’s words and actions, along with those of its peers in auto lending, hopefully foretell brighter days ahead. That is most evident on origination volumes, with Capital One (+22%), J.P. Morgan (+20%), and Wells Fargo (+12%) all reporting double digit YoY auto growth during the first quarter. As you can see below, the recent reacceleration in JPM’s auto origination trends has been notable, which directionally mirrors the reacceleration at Capital One shown above (TTM originations up 28%).

On the potential impact of tariffs and broader macro considerations, Capital One CEO Richard Fairbank did a good job of framing the situation (also applicable to Ally): “If the tariff wars continue on, the immediate effect in the auto business would be an almost certain increase in vehicle prices. That would have mixed effects… you could end up with vehicle value disruption. What would be the impact on our business from higher vehicle prices? It supports credit performance of our back book by improving equity positions for borrowers and increasing recovery rates - but for new originations, higher vehicle prices are a headwind in terms of consumer demand and credit.”

Ally’s business over the past five years, with unprecedent levels of (near zero) losses in 2021 followed by the 2022 vintage challenges, speaks to the all-important question in this business: and then what? If higher vehicle prices are the outcome of current geopolitical / macro factors, that will be a short-term tailwind – but it will also present some difficult decisions about what to do from that point forward (a recurring challenge in this business).

Conclusion

As I think about Ally’s recent history, this comment from Rhodes struck a chord: “What’s become more apparent as I’ve settled into the CEO role is the importance of focus… We need to prioritize our resources to win in areas where we have a demonstrated competitive advantage, deep relationships, and relevant scale. Our three core franchises - Dealer Financial Services, Corporate Finance, and Deposits - remain strong with tremendous runway ahead… We see meaningful opportunities for accretive organic expansion.”

Given some of the decisions made in the past year, along with an improving trajectory in credit, I am optimistic about what lies ahead for Ally. As it relates to the current attractiveness of the stock, note that CFO Russ Hutchinson has bought ~$1 million on the open market in recent months: ~$750k in January at ~$39 per share and another ~$250k last week at ~$31 per share. While maintaining the position sizing constraints discussed previously, I remain comfortable with ALLY in the portfolio. If the deposit gathering franchise meets my long-term expectations, along with sound credit underwriting and meaningful capital returns (particularly if it trades, on average, at less than 10x earnings), I think the stock will generate attractive returns over time.

Note - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.