Ally: From Headwinds To Tailwinds

From “Ally Financial: Moving Pieces” (April 2023): “The storm clouds have not passed. The combination of normalized credit losses and NIM pressures (along with broader concerns in the banking industry following the events of March 2023) has clearly led to a more defensive tone / posture from management… While I believe Ally is positioned to navigate through the present storm, the next 12-18 months are unlikely to be a walk in the park.”

Following a difficult year for Ally, we can now see the light at the end of the tunnel; headwinds on credit quality and the asset yield / funding cost spread (NIM’s) are likely to become tailwinds in a few quarters. In addition, industry turmoil in 2023 presented an encouraging sign on the role that Ally serves for retail customers, as well as for their ability to effectively grow deposits.

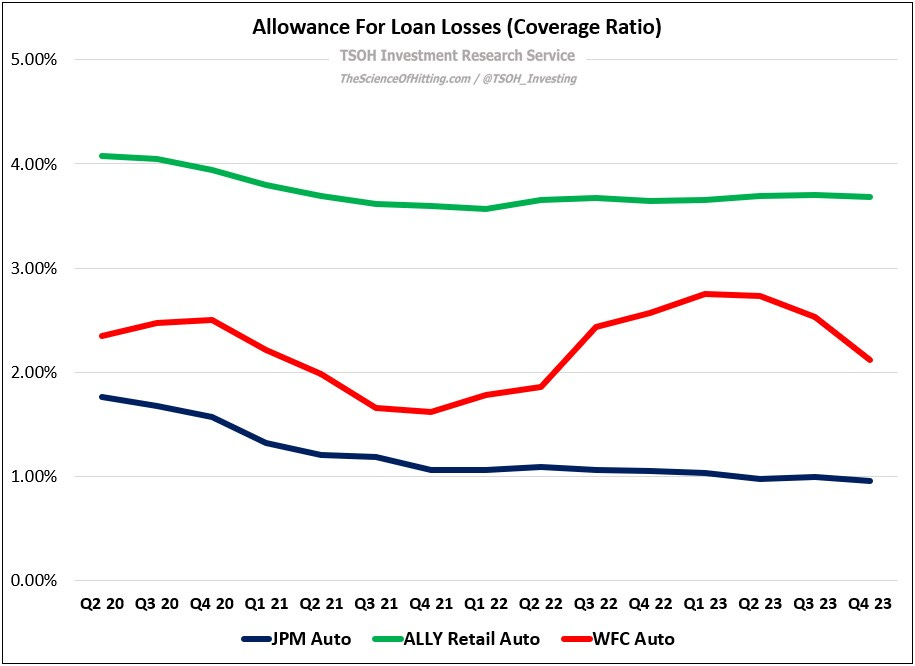

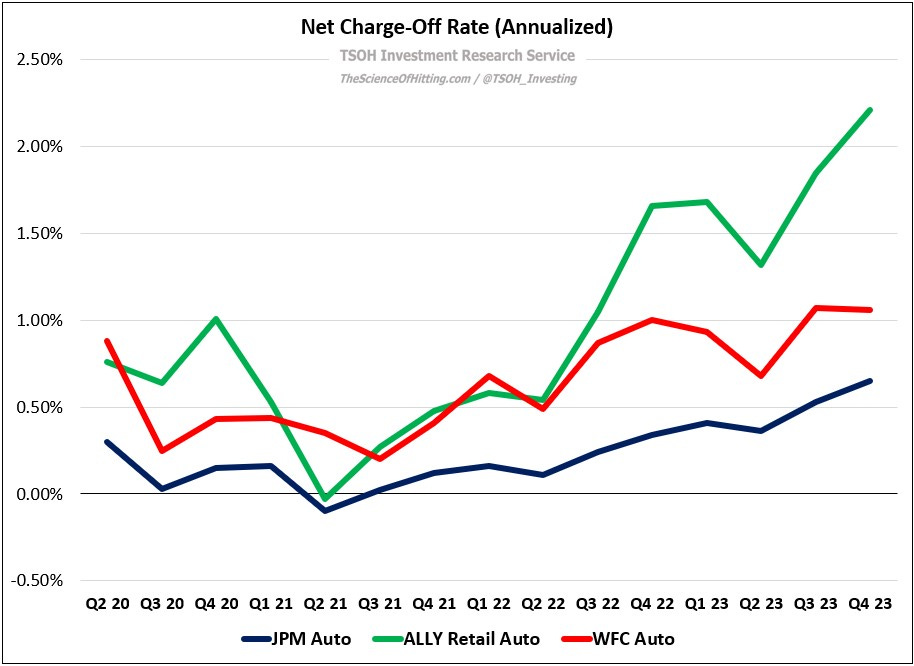

Let’s start by reviewing credit quality and NIM’s. As discussed in “It's About Returns, Not Growth”, a tumultuous period in auto lending has presented an opportunity for Ally to become more demanding on its underwriting criteria.

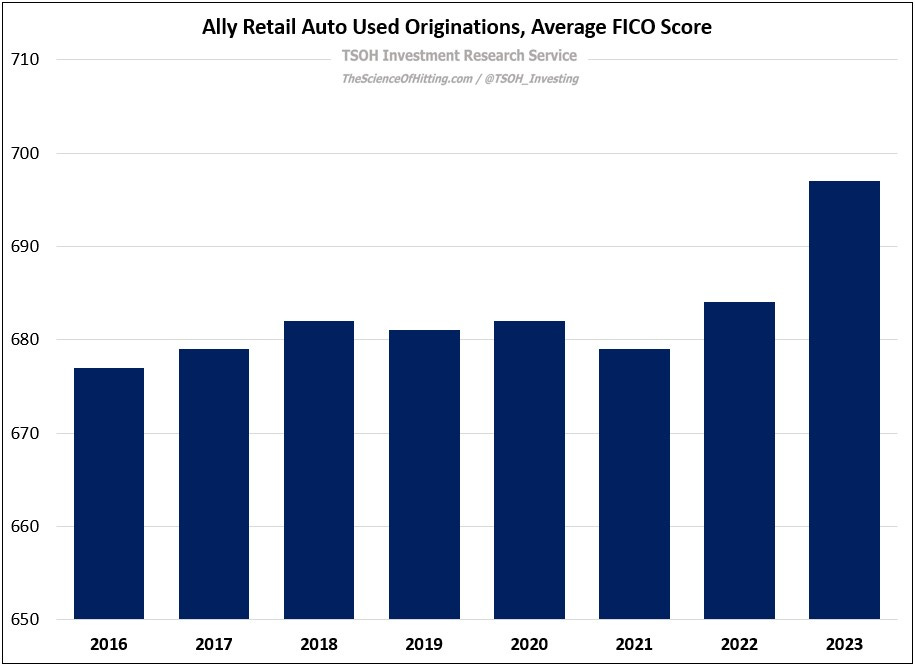

As an example, 43% of Ally’s retail auto origination volumes were from its highest quality credit tier in Q4 FY23, compared to 31% in the year ago period. (As you can see below, the average FICO score on used originations also moved higher). In addition, auto origination yields remain above 10%, nearly 400 basis points higher than what was generated 2-3 years ago.

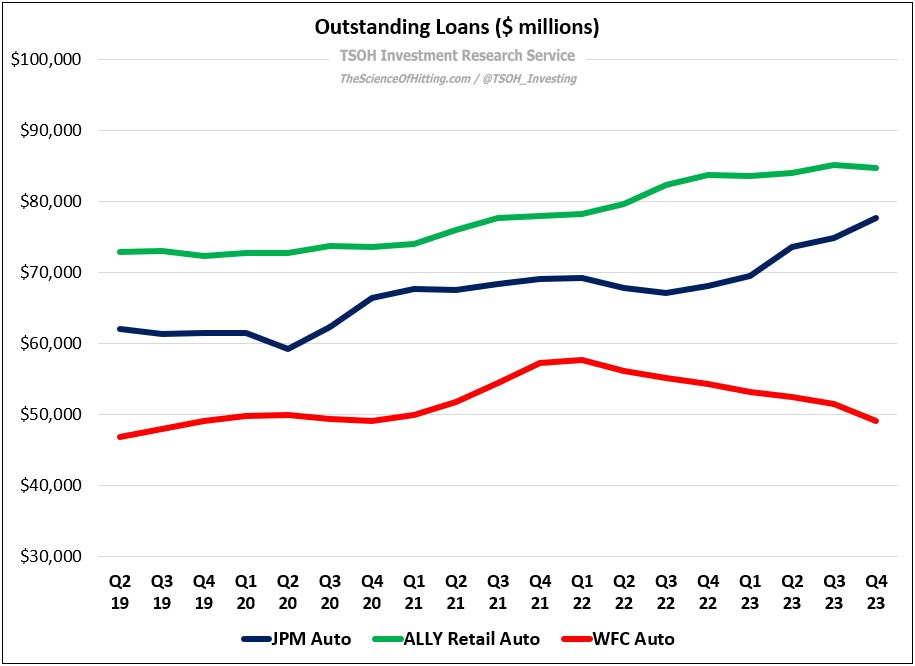

As noted on Ally’s Q3 FY23 call, these developments were partly reflective of competitive dynamics: “Some players haven’t just dialed back their originations; they’ve exited the market altogether”. One notable example is Wells Fargo, which has seen the size of its auto portfolio decline in each of the past seven quarters due to credit-tightening actions (with the Q4 FY23 balance -11% YoY). On the other hand, J.P. Morgan’s auto originations were +32% YoY, with management noting on their Q4 FY23 call that they gained market share “while retaining strong margins”. Ally’s view falls in between those two notable competitors, which strikes me as a reasonable place to be for now; said differently, while JPM’s opportunism provides noteworthy affirmation of the current opportunity in the asset class, I think Ally’s less aggressive posture is indicative of the fact that they may have overplayed their position at the top of the cycle in 2022 (see the divergence in outstanding auto loans for ALLY and JPM from Q1 FY22 to Q4 FY22).