Ally Financial: Inflection Point

From “Ally: A Clearer Roadmap” (January 2023): “While I appreciate the nature of those concerns, I remain comfortable with the long-term risk / return profile of their credit book, specifically in (used) auto; that reflects a number of considerations generally relevant to the asset class, including intent (the nature of the purchase and use case for the asset), loan size, loan term length, etc. With [all] that said, it has honestly been tough to own Ally over the past few quarters… For me, a comfortable (maximum) position size for Ally will be lower than for other names in the portfolio, regardless of its price / valuation. In summary, while I think that Ally looks quite attractive at current levels, it has a shorter leash on sizing than other holdings.”

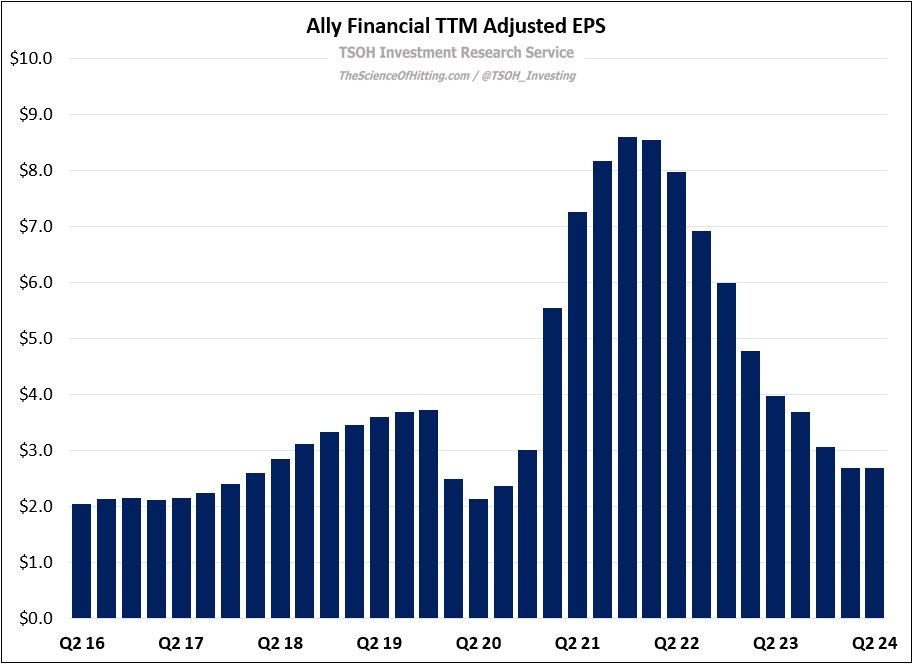

After reporting significant YoY declines in each quarter for two years, Ally returned to EPS growth in Q2 FY24 (after a string of quarters with EPS down 40% or 50% YoY, a return to growth is much welcomed, even at a paltry +1% YoY). On a few key metrics, most notably credit quality (NCO’s) and spreads (NIM’s), we’re nearing or at an inflection point. While starting from depressed levels, with TTM adjusted EPS of ~$2.7 per share, Ally is poised to report much higher EPS in the coming years. As I wrote in January, there is light at the end of the tunnel for Ally (of course, much pain has preceded this, which helps to explain why the stock price has roughly doubled from the 2023 lows).