Ally Financial: Speed Bump

Note: Tomorrow afternoon at 1 pm eastern time, I will be speaking with Bill Brewster of The Business Brew about the role of U.S. sports rights in the ongoing evolution of Disney’s video businesses. If interested, sign-up here.

From “Ally Financial: Inflection Point”: “With the benefit of hindsight, it’s apparent that Ally kept their foot on the gas at an inopportune time: among a peer group of Capital One, J.P. Morgan, and Wells Fargo, Ally reported the highest YoY increase in outstanding auto loans in 2022. The good news is that management believes that the losses from the 2022 vintage peaked in Q2 FY24, which should position Ally for moderating NCO’s in 2H FY24…”

That expectation for moderating 2H FY24 NCO’s is no longer in the cards.

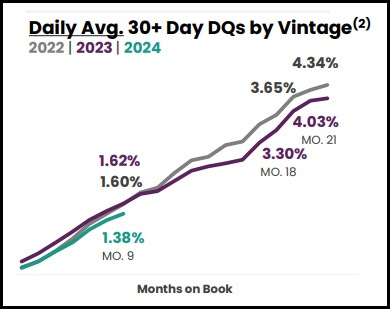

When Ally management presented at the Barclay’s Financial conference on September 10th, they noted that credit challenges had “intensified” due to a more difficult macroeconomic environment: “In July and August, [retail auto] delinquencies were up ~20 basis points versus expectations, with NCO’s up ~10 basis points versus expectations. We are clearly dealing with a cohort of borrowers who are struggling.” (Slide 13 from the Q3 FY24 deck highlights how trends worsened in recent months, i.e. the gap on 30+ day delinquencies between the 2022 vintage and the 2023 vintage has tightened even further.)

As I see it, (new) management seeks to draw a clear distinction between the outcomes on the 2022 and 2023 vintages. In doing so, they hope to frame the primary source of today’s pressures - avoidable or not - which weighs on how investors view management’s ability to forecast what’s likely to come next.