Ally: End Of The Tunnel

From “Ally Financial: Inflection Point” (July 2024): “On a few key metrics, most notably credit quality (net charge-offs) and spreads (NIM’s), we’re nearing or at an inflection point… Ally Financial is poised to report much higher EPS in the coming years… There is light at the end of the tunnel.”

As we close out FY24, I see reason for optimism at Ally. That conclusion is based on end market tailwinds (more favorable conditions in underwriting used auto loans), along with strategic adjustments that will return their focus to areas of the lending business they are best positioned to compete in.

The flip side of that comment is management has not done a stellar job on either of those buckets in the past few years, with the business falling into a few potholes along the way; in my view, the underwhelming stock price performance of recent years has been a fair response in light of that reality.

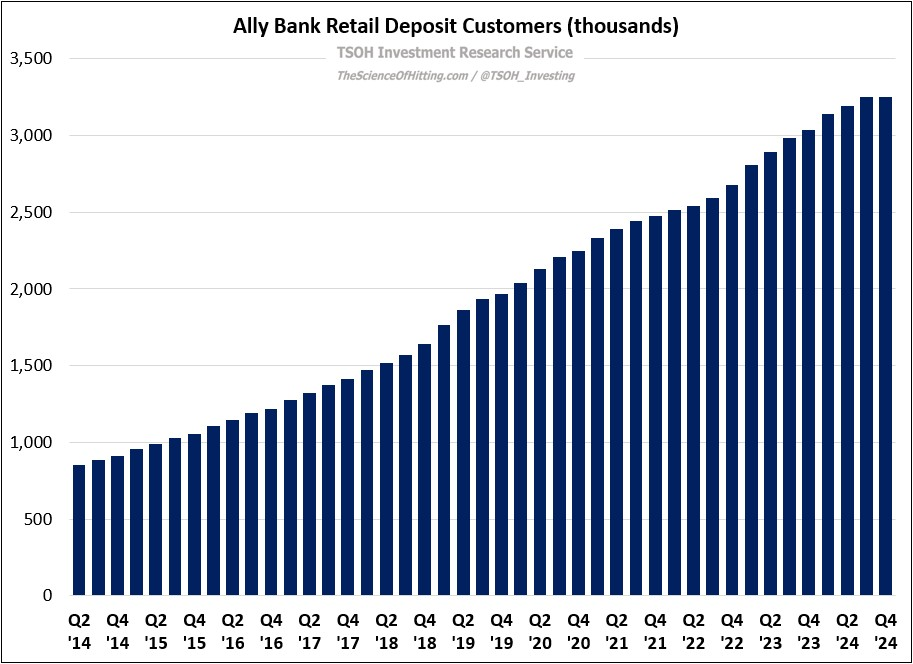

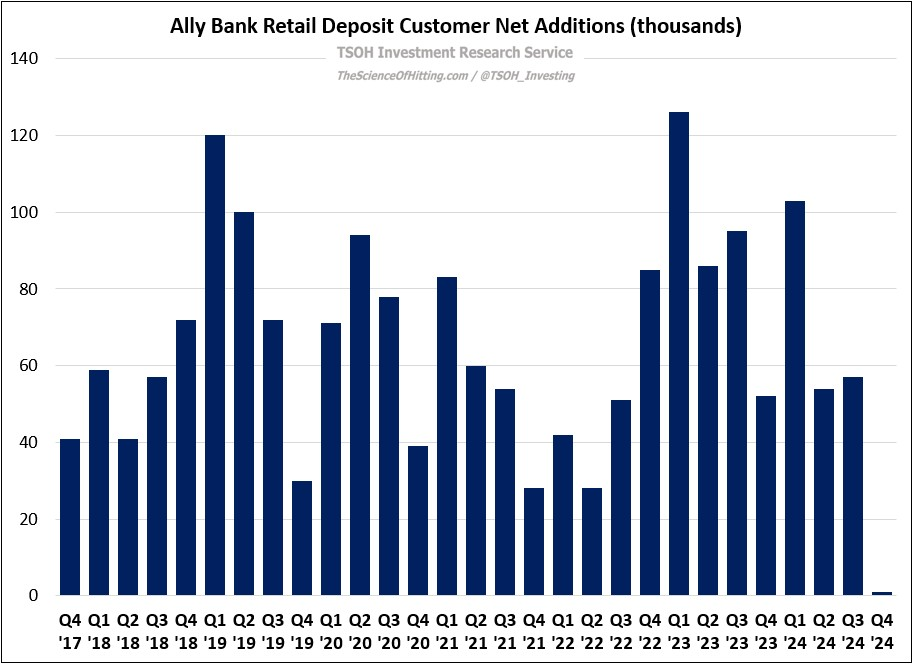

Let’s start today’s discussion with Ally Bank, where retail deposits ended the year at ~$143 billion (accounting for ~90% of total funding). With the number of deposit customers up ~8% YoY in FY24, to ~3.3 million, we have further evidence that Ally’s value proposition is one that continues to attract a certain segment of American savers (they’ve reported net customer growth in every quarter for 10+ years). However, as you can see in the second chart below, that result is inclusive of immaterial sequential (QoQ) growth in Q4 FY24.