Ally Financial: A Clearer Roadmap

From “Past The Peak” (speaking about Ally’s auto loan book): “Is that sufficiently conservative? As always, it’s very difficult to say with anything close to certainty. Personally, as discussed in the deep dive, I take comfort in how this asset class performed during other difficult periods… That said, the world changes and this time may be different (for example, Ally’s shift to slightly higher risk content in auto). I think that concern may be overstated (properly accounted for in reserves), but time will tell whether I’m mistaken.”

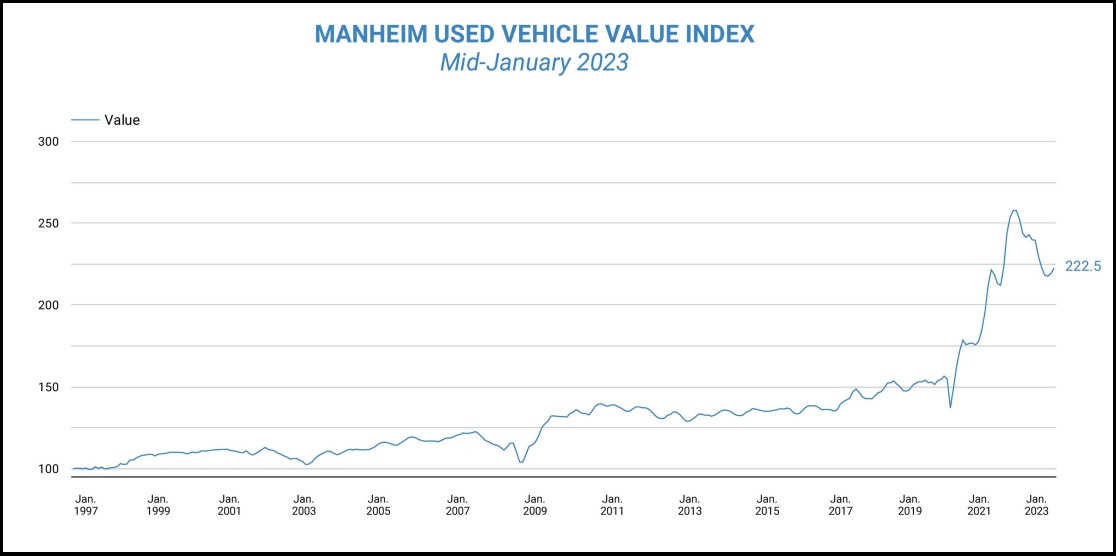

Ally Financial reported its Q4 FY22 financial results on January 20th, and I think it was a big step in the right direction; specifically, management did a good job of addressing some important topics that speak to the current state of affairs in the business, in addition to laying out a roadmap for how they plan to navigate the next 12-24 months. To be clear, a difficult environment still lies ahead for Ally in 2023. After a period of rapidly rising used car prices, we’re now seeing a significant (albeit unsurprising?) move in the other direction. In December 2022, the Manheim Used Vehicle Value Index was down ~15% YoY - the largest decline in the 25+ year history of this data set. (That said, as you can see below, the value of the index as of mid-January 2023 is still meaningfully higher than where it stood in early 2021.)

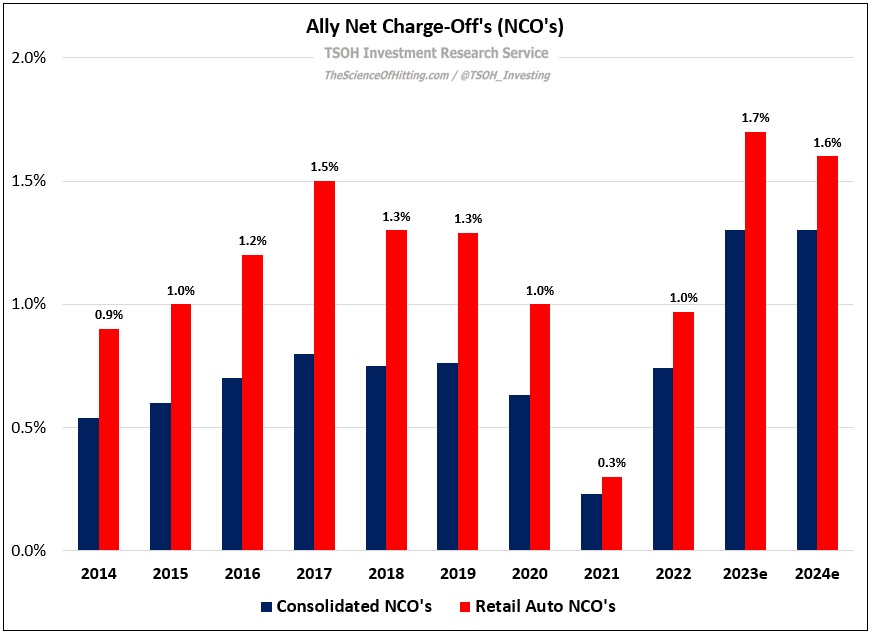

In the fourth quarter, net charge-off’s (NCO’s) in Ally’s retail auto business increased to 166 basis points, pulling full year auto NCO’s to nearly 1% of outstanding loans. As shown below, the company expects NCO’s to remain elevated in each of the next two years, at roughly 1.6% - 1.7% of average loans (and pulling consolidated NCO’s to heights unseen in the past decade).

There are a few important points to address here.