Match: "Disappointing Execution"

From Match Group’s Q4 FY21 shareholder letter: “Our 2021 performance demonstrates that our portfolio strategy positions us to achieve consistent mid-to-high teens revenue growth over the long-term.”

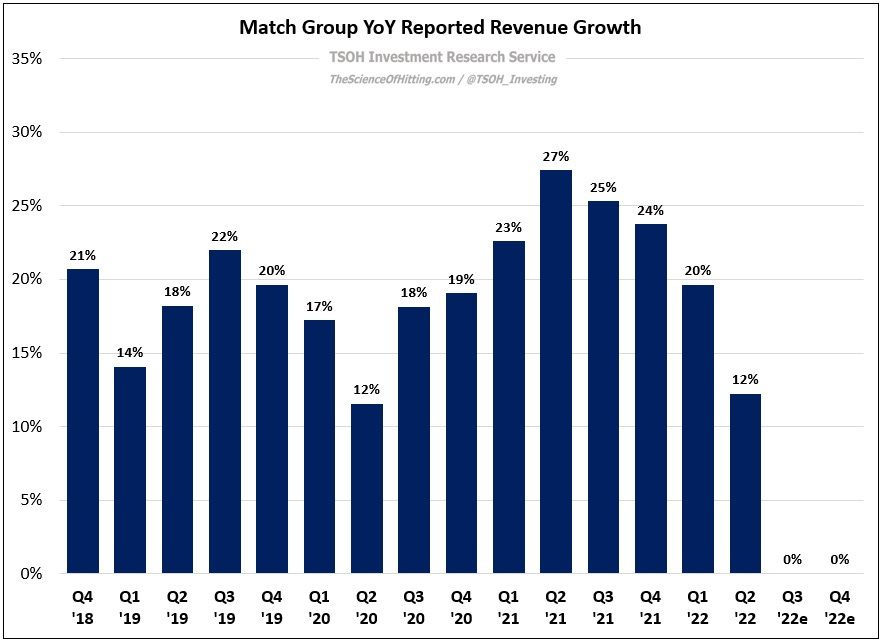

Fast forward six months, and it’s safe to say Mr. Market has some doubts about that long-term forecast. The reason why is evident in the trend of Match’s recent quarterly results: in Q1, Match reported +20% YoY revenue growth (+24% in constant currencies); in Q2, Match reported +12% YoY revenue growth (+19% in constant currencies); now, for Q3 and Q4, management’s guidance calls for ~0% reported revenue growth (up high-single digits in constant currencies). As shown below, this is a significant change in trend from the growth rates that investors became accustomed to in the past few years – and unsurprisingly, it has led the market to question whether Match’s future will be anywhere near as bright as was expected just 6-12 months ago. (The stock is down nearly 70% from its 52-week high).

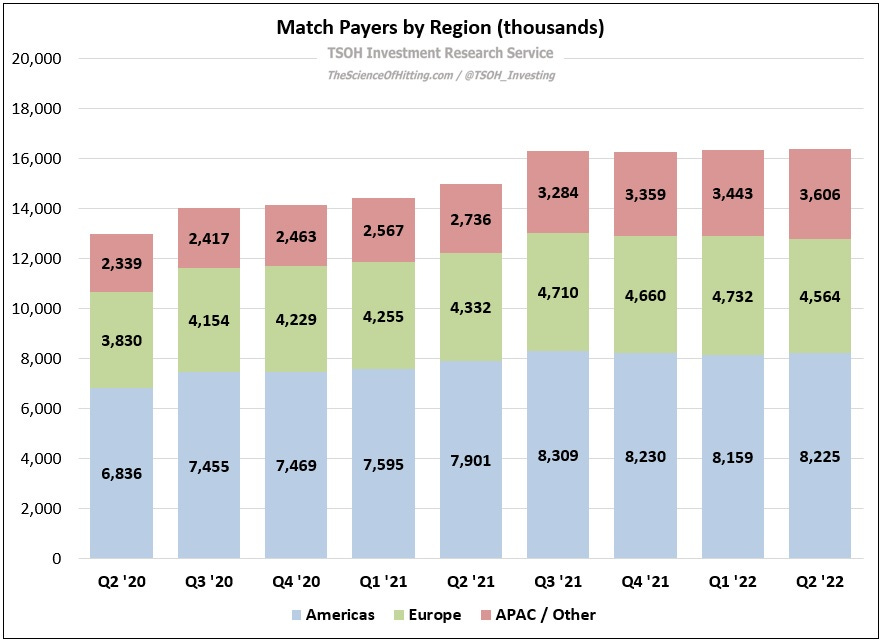

Let’s start this discussion by looking at the key variables that drive revenue growth: the number of paying users (Payers, which as I noted in the deep dive includes users with a subscription to one of Match’s services and users who make a la carte purchases), along with the spend of the average Payer (Revenue Per Payer, or RPP). In Q2 FY22, the number of Payers increased by ~10% YoY to 16.4 million, with RPP up ~3% YoY to $15.9 per month.

Digging in on Payers, we can see that Match has a bit of a problem on their hands. As shown below, Payers growth in the most recent quarter was largely attributable to APAC / Other (+32% YoY), with Americas and Europe growing +4% and +5%, respectively, versus Q2 FY21. (Since Q3 FY20, total Payer counts in the Americas and in Europe have only increased ~10% cumulatively). In addition, the growth in APAC / Other has been greatly helped by the Hyperconnect acquisition, which closed in June 2021 (as noted in the Q2 FY21 letter, Azar and Hakuna had over 570,000 payers at the deal close.) As you can see below, the relatively easy comparison in APAC / Other (before Hyperconnect closed) will fall off next quarter; based on the recent trajectory, Payer growth in the region will likely decelerate from the low-30’s in Q2 FY22 to the mid-teens in Q3 FY22. That development, in combination with the relatively weak Americas and Europe results, will pressure overall Payer growth rates (likely falling into the low-to-mid single digits YoY).

The pressure on Payer growth is reflective of some divergent trends within Match’s portfolio. Tinder continues to deliver growth across all geographies, along with the additions reported across the smaller apps that are primarily contributing to the Americas region (Hinge, Chispa, Upward, BLK, etc.); the problem is the company’s collection of Established (older) brands, which saw some short-term tailwinds during the pandemic but are now returning to their prior form (they struggled to grow for years prior to FY20). The wording in the Q2 FY22 letter spoke volumes about management’s view of the future for these brands: “While these brands saw some tailwinds from government stimulus and a less competitive marketing environment during the height of COVID, I expect that they will remain challenged for increased growth in the near-term. As such, I expect us to maintain strict ROI and cost discipline in these businesses while developing longer-term growth strategies… This is the case at several of our Established Brands such as Match and Match Affinity, Meetic, OkCupid and Plenty of Fish.”

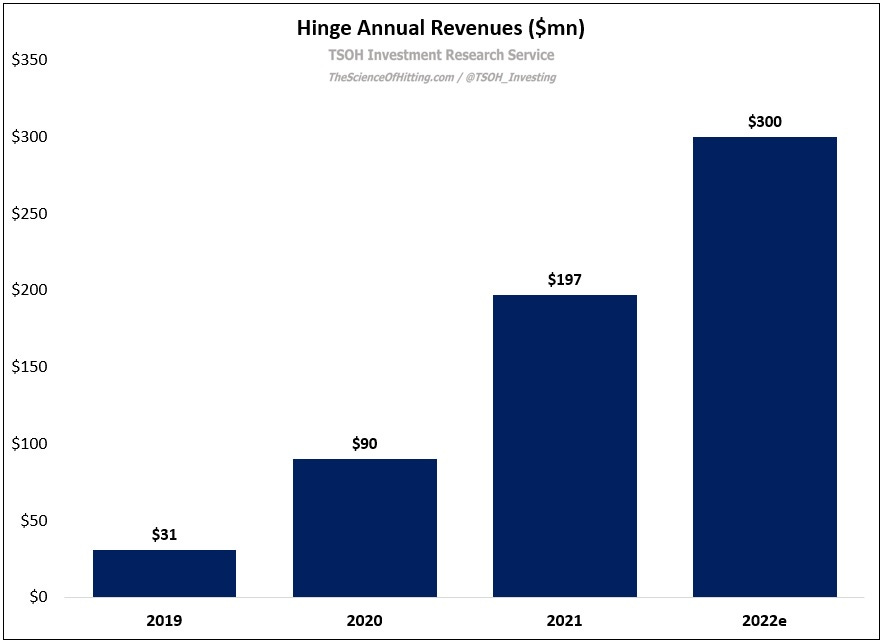

While this recent turn of events puts real pressure on the non-Tinder portion of Match’s business, it’s worth noting that the growth pockets within Other Brands continue to see traction. As discussed in the deep dive, Hinge is on pace to deliver ~$300 million in FY22 revenues, up from ~$30 million in FY19. (From the Q2 letter: “The recent release of the local German [Hinge] product is seeing strong early momentum. In the coming quarters, I’d like to see Hinge expand internationally at a faster clip. The initial plan was to launch a new language / market each quarter, but we’re accelerating that so Hinge will launch in two new markets every quarter.”) In addition, the other demographic specific / niche Emerging brands - BLK, Chispa, Upward, Stir, etc. - are in the early innings of being meaningful contributors to Match’s top-line growth: as noted in the Q2 letter, these brands are expected to generate ~$75 million in FY22 revenues. Collectively, Hinge and the other Emerging brands should contribute ~$375 million to Match’s FY22 revenues (~12% of the total). While the legacy brands are a likely headwind, strong growth elsewhere (if sustained) can mitigate that pressure. (“You're seeing significant growth - and I think a very significant threat - to Bumble from Hinge.”)