Meta: Peak Profitability?

In Meta: “Appropriately Calibrated”, I wrote the following:

“The market (rightly) expressed concerns around FRL, most notably the scale of investment given management’s own admission that the segment was unlikely to be a material driver of the business at any point in the current decade. With the Q1 commentary, we now have a clearer understanding of how these investments are likely to evolve over the coming years (‘the goal is to continue growing operating profits and to fund FRL through that growth of the FoA business’). Management took Mr. Market’s skepticism as a valid reason to consider an alternative approach, primarily in terms of how they communicate their long-term vision with shareholders; in my opinion, it was a much needed change and an important step in the right direction.”

Just three months later, we’re seeing a significant disconnect between management’s long-term vision (funding FRL through FoA EBIT growth) and the economic realities of the business. In Q2, the company reported a sizable decline in FoA EBIT, along with significant growth in FRL operating losses. How will Meta management square the circle here? Answering this question will be a clear focal point for shareholders over the coming quarters.

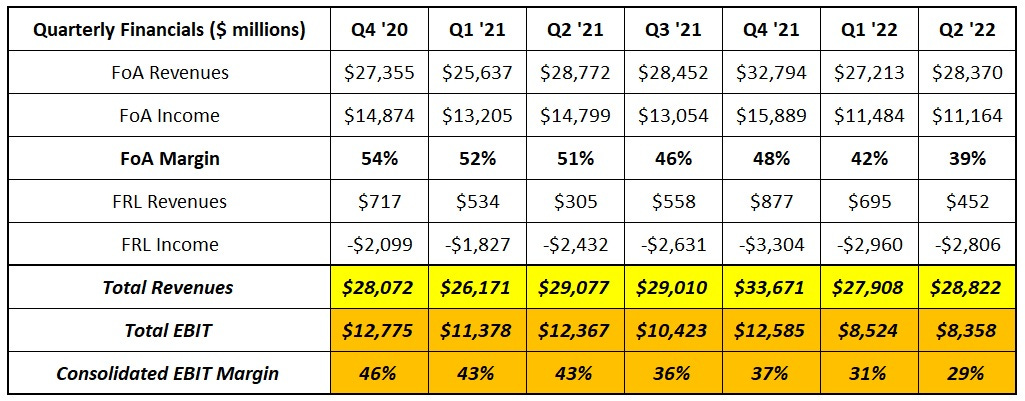

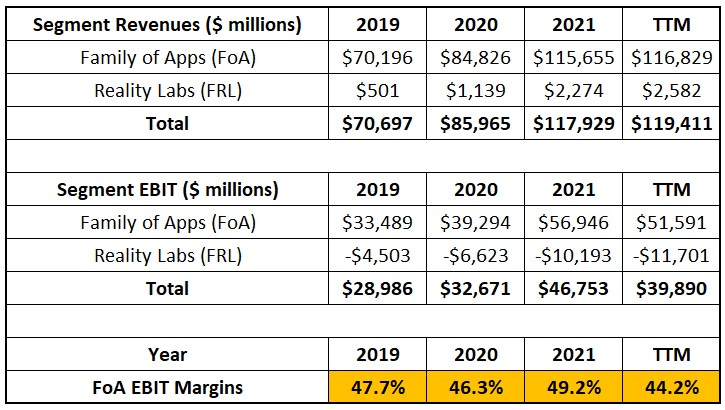

Let’s start with the segment results, which highlights the severity of the problem. As shown below, FoA segment operating income was $11.2 billion in Q2 FY22, down ~25% YoY (with segment EBIT margins down 1,200 basis points YoY). In the FRL segment, the quarterly loss widened by ~$400 million YoY to ~$2.8 billion; in addition, as noted by CFO Dave Wehner on the call, this result was despite a nearly $500 million benefit from a reduction in the estimated losses on purchase commitments (related to the price increase on Quest 2 hardware). With FoA profits declining and FRL investments (losses) growing, the net result was a ~$4 billion decline in Meta’s YoY EBIT.

Clearly, this is a problematic combination; in addition, it’s unlikely to change in the short-term (if anything, it will get worse). My primary question, which I’ll address in this post, is this: in light of the difficulties at FoA, in addition to the large – and growing – sums allocated to FRL, will Meta exceed its FY21 diluted EPS (~$13.8 per share) at any point in the next few years? Said differently, will they actually be able to “continue growing operating profits”?