Cable's Convergence Calamity?

In late July, Comcast and Charter reported their Q2 FY22 financial results.

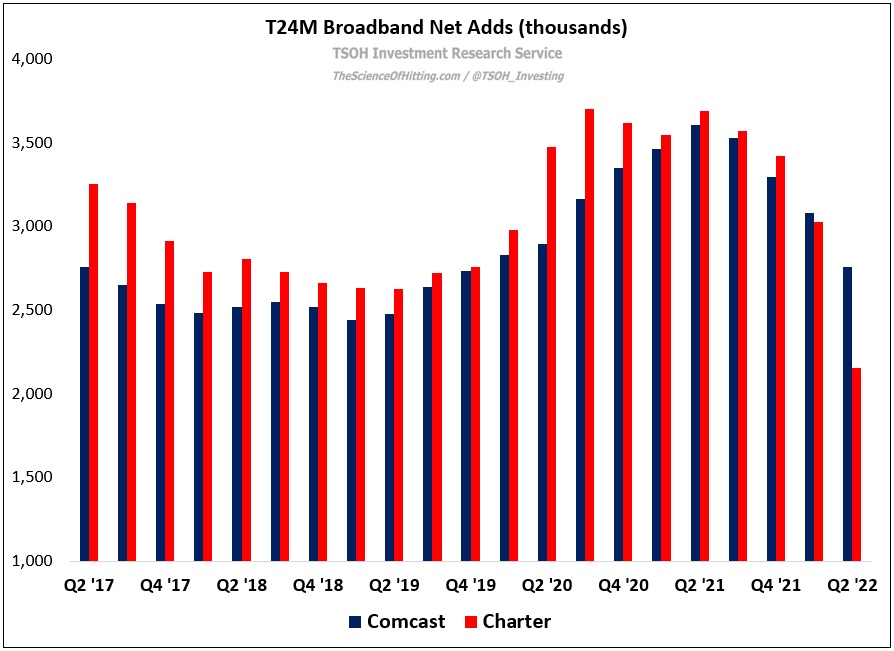

As I first wrote in September 2021 (“Is The Party Over?”), a big question looms over the cable industry: after years of very strong results, with these companies consistently reporting broadband net subscriber growth in excess of one million customers annually, have we entered a new era?

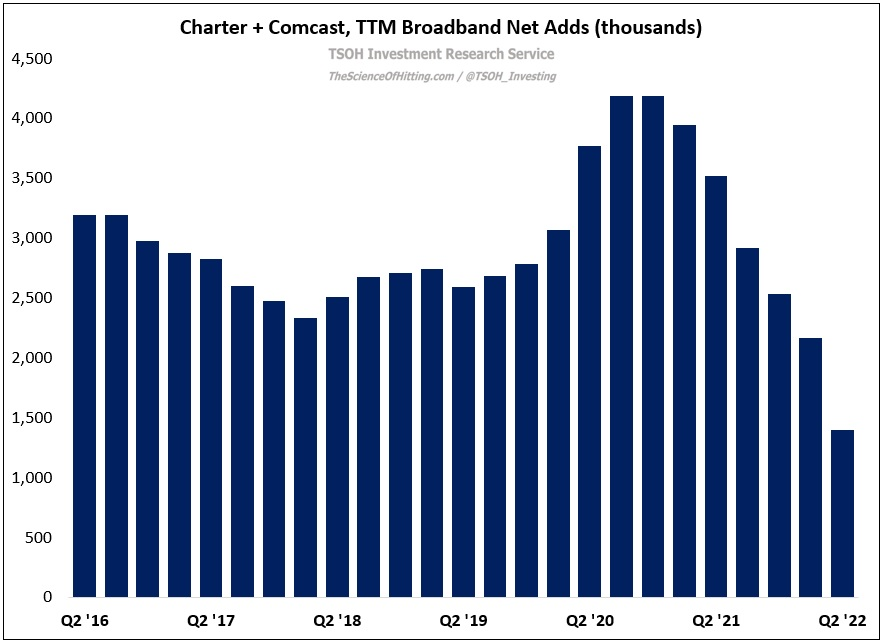

The most recent results, which continue to be negatively impacted due to the COVID pull forward, have caused those concerns to grow louder; as shown below, Comcast and Charter collectively added ~1.4 million net broadband customers over the past year (TTM) – roughly half of the ~2.8 million delivered in late 2019 (before COVID started impacting the numbers). In addition, their sequential Q2 FY22 results actually showed a slight decline in their customer base, with Comcast flat QoQ and Charter down 21,000 subs.

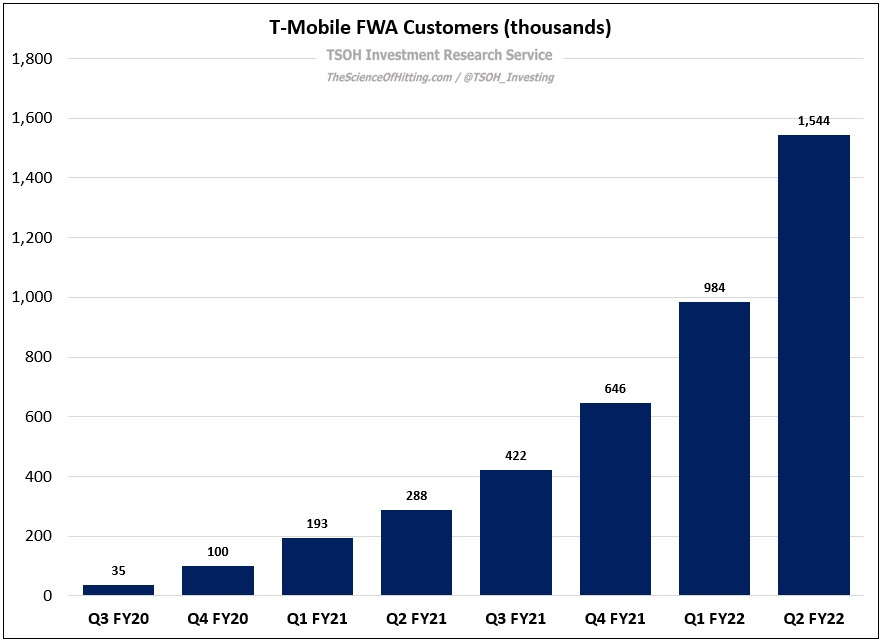

On their quarterly calls, management pointed to the continued impact of limited mover churn / new household format (fewer “jump balls” to win). But increasingly, cable companies are also pointing to another factor impacting their growth: competition. (Comcast Cable CEO Dave Watson: “We have local competition. We have large national scaled competition. And most certainly, fixed wireless (FWA) is the newest [competitor]. You go through a launch phase that typically adds pressure, and we’re seeing that on the front end.”) The clearest example of disruption is coming from T-Mobile: in the first six months of 2022, the company added ~900,000 (net) Home Internet / FWA customers, bringing its customer base to ~1.54 million.

(Here’s how T-Mobile describes their “Internet Freedom” initiative, which is clearly focused on competing with Charter, Comcast, and other legacy cable companies: “T-Mobile launched a customer-first disruption to broadband for consumers and businesses and expanded Business Internet nationwide, making it easy for broadband customers to break up with Big Internet, lock in their price with massive savings, and finally feel appreciated”.)

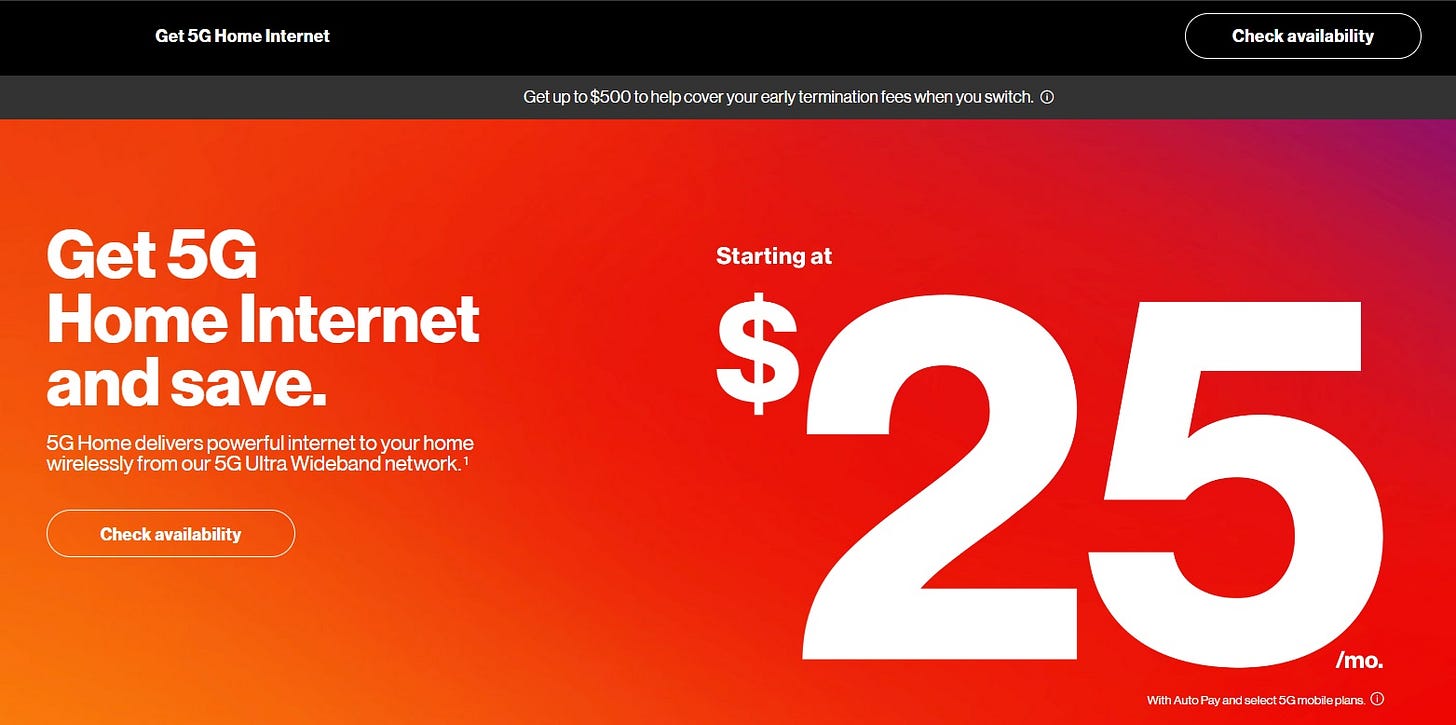

While T-Mobile is exhibiting the most success, we shouldn’t overlook the aggressiveness of others in the industry. Verizon, for example, recently announced a 5G Home Internet offer for just $25 per month, albeit with restrictions (you must be a premium 5G Unlimited mobile plan customer). And while Verizon and AT&T haven’t reported sustained progress on their wireline efforts - their fiber gains have largely offset the loss of customers with inferior Internet products like DSL - the competitive environment is heating up.

Here’s the reality of the situation: while the industry leaders in Cable have been encroaching on the turf of AT&T, Verizon, and T-Mobile with their wireless offerings, those competitive dynamics cut both ways; if Cable undercuts Wireless with a low priced mobile offering and Wireless undercuts Cable with a low priced Home Internet offering, will the convergence of the connectivity industries end up being a fight to the bottom?