Not A Question Of If, But When

An update on Comcast and Charter / Liberty Broadband

From “Convergence Calamity, Revisited” (November 2023): “I’ve become more worried about incremental competitive intensity across the connectivity industries, most notably as it relates to high fixed costs / CapEx needs, operating leverage, and financial leverage. In addition to the long-term threat from Fiber, technological improvements have made FWA (fixed wireless) a real competitor to broadband for some percentage of U.S. households… That suggests the Cable investment thesis is no longer valid… Over time, we will see if Cable’s results provide reason to revisit a potential investment.”

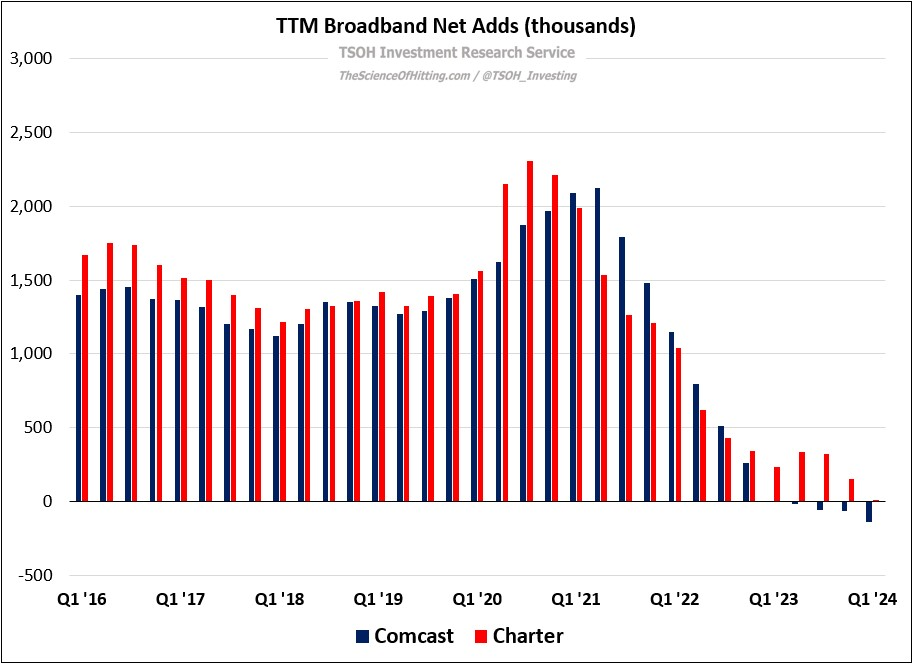

Subsequent results have provided continued support for that conclusion. As you can see below, TTM broadband net adds have deteriorate further for both Comcast and Charter. At Comcast, net TTM losses totaled ~140,000 (-0.4% YoY), to ~32.2 million broadband customers - an outcome that seemed highly unlikely a few years ago. These reductions are despite ongoing investments to support passings growth, with penetration rates falling ~200 basis points from FY22 (~53%) to FY24e (~51%). By comparison, AT&T’s Consumer Fiber penetration rates have increased from ~37% to ~40% over the same period.

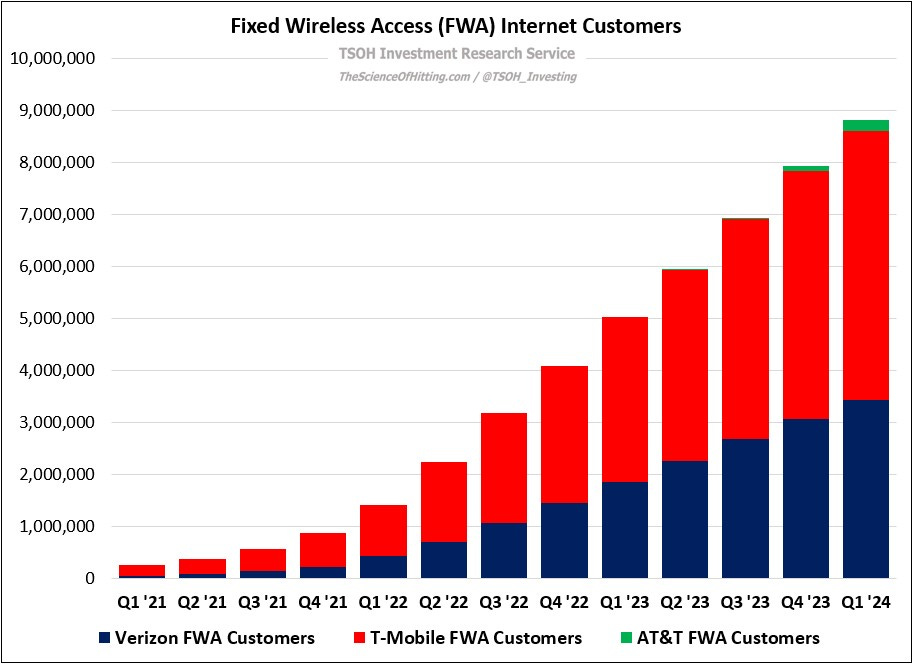

The largest headwind has been fixed wireless (FWA). T-Mobile and Verizon have collectively added more than eight million FWA customers over the past three years, and AT&T recently joined the party (Internet Air reported >100,000 sequential net adds for the first time in Q1 FY24). Even with the recent slowdown in sequential net adds at T-Mobile and Verizon, the three collectively added nearly 900,000 FWA customers in the first quarter; on an annualized basis (>3.5 million net adds), that pace of FWA net adds covers the entirety of Cable’s volume growth shortfall relative to pre-pandemic levels.

The notable thing about FWA is that it faces certain long-term constraints.

T-Mobile, the leader to date in FWA, has consistently told investors that the economic rationale for the business is dependent upon fallow capacity. As CEO Mike Sievert noted on the Q1 call, “Our strategy has always been about selling excess capacity, where we predict normal cellular usage won't suck up that 5G capacity… We saw it leading to 7 - 8 million customers, and we don't have any updates on that.” While that still implies another 18-24 months of growth at the current run rate, we are getting closer to FWA’s finish line (assuming the target doesn’t change; I worry about incentives that may lead to continued FWA support, even if with questionable / poor ROIIC’s).

At the same time, I think Comcast is starting to respond more aggressively to this competitive activity. (“There is currently a lot of activity at the low end of the market, and we have not been as competitive in this space.”) The company launched a new prepaid offering (“NOW” brand), including a 100 Mbps product for $30 per month and a 200 Mbps product for $45 per month (all-in cost, i.e. inclusive of all taxes, fees, and equipment). This comes at a time when FWA is moving past their early promotional pricing strategies, with a desire to drive higher ARPU’s as the business matures. Collectively, these actions provide reason to believe that FWA volume headwinds are starting to dissipate. (Despite much higher NPS scores than Cable, Charter CEO Chris Winfrey remains fairly dismissive of FWA, which he calls “cell phone internet” and “an inferior product”. Personally, I’d rather see him discuss how Charter can segment its customer base to improve volume trends at the low end of the market, as opposed to waiting a few years for FWA to run its course.)

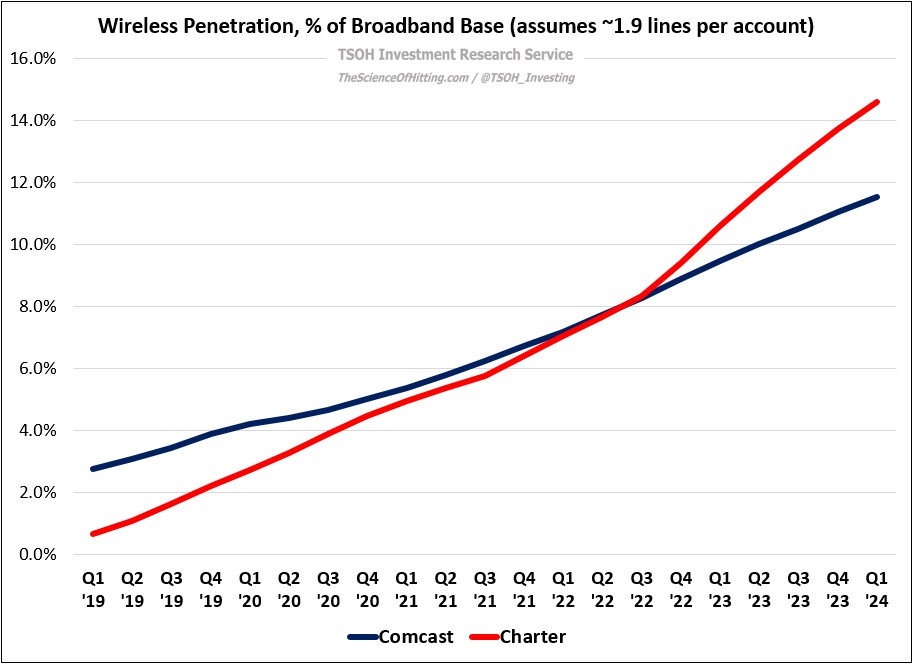

In addition, Comcast and Charter continue to make progress on the wireless opportunity, with broadband base penetration now in the low double digits; I see no reason why those rates shouldn’t be ~2x higher within three years.