Netflix: "Thinking Too Small"

From “Netflix: This Is When It All Matters” (April 2022):

“That conclusion suggests Netflix should reassess some of their priorities, especially as they’ve shifted their views on an ad-supported tier. I think this development will likely lead Netflix to reconsider its presence in recurring / live programming like sports and news. They’ve toyed with these ideas in the past, but I think it’s likely that this period will lead them to reconsider what kind of programming is ‘right’ for Netflix long-term… It’s early days, but I expect a meaningful evolution in Netflix’s offering over the next five years.”

We’re just past the halfway point on that prediction, with the content slate in the final months of 2024 offering some notable examples of that evolution - a list that included two NFL games on Christmas Day and the Paul / Tyson fight (which reached ~65 million concurrent streams). As we think about Netflix’s growing interest in live sports rights, it’s important to understand how we got here. This comment, from (now co-CEO) Ted Sarandos in late 2017, captures management’s long-held position on the topic: “There's always this debate: are we going into live sports? Is it the best use of the next billion dollars? So far, we have come to the conclusion that it isn’t.”

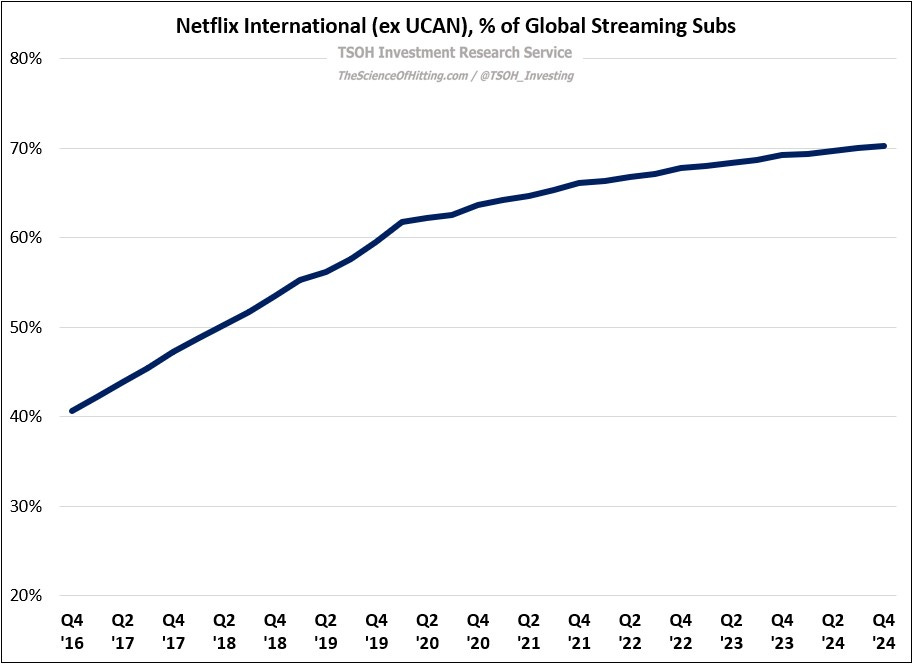

The answer to that question has started to change, which reflects a few developments: continued growth in the overall content budget (more on this later), International subscriber mix shift, the introduction of the ad-supported tier, and the willingness of leagues like the NFL to sign bespoke deals. While the WWE and FIFA Women’s World Cup deals both point to a willingness to make a more significant commitment to certain sports (in terms of the hours delivered, i.e. not one major event that lasts a few hours), this was a critical comment from Sarandos on the Q4 FY24 call: “We want to be able to bring value to the sport like we have to date with the WWE and the NFL, too, where we were able to bring a big, young, and more global audience than linear television would - but that will have to be reflected in the deal as well.”

With an unrivaled global position in DTC streaming, Netflix is the best partner for a wide variety of content suppliers; alongside an ~$18 billion annual content budget, that leaves the company in position to reconsider the mix of spend that maximizes the value of what they can supply to more than 300 million subscribers around the world (who, on average, watch the service for about two hours per day, for a total of more than 200 billion hours per year).

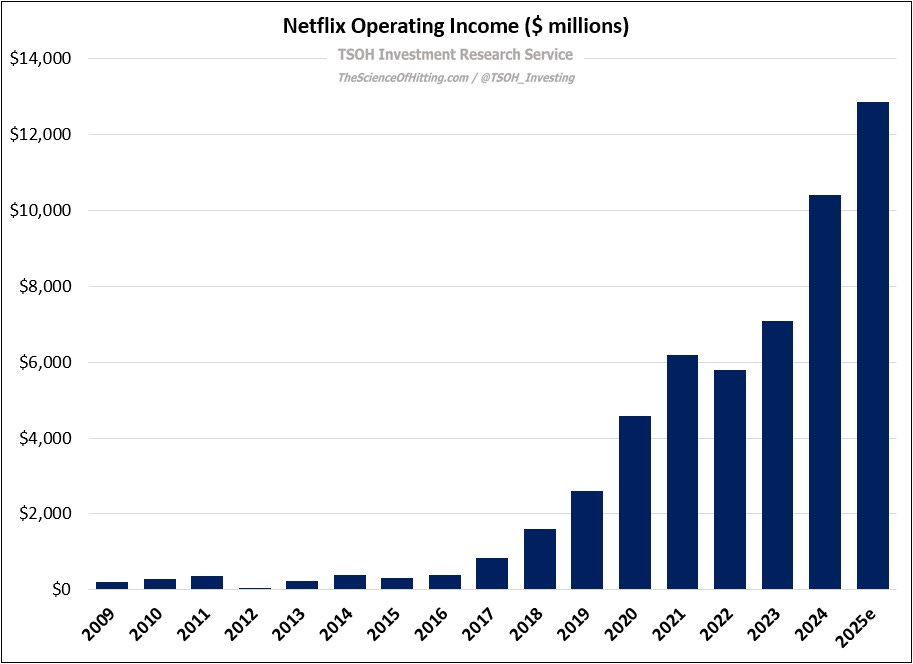

As Reed Hastings once said, “I have two religions: customer satisfaction and operating income. Everything else is a tactic.” Management is exploring various tactics, including live sports, gaming, live experiences, and advertising. While at different stages of progress, I’m personally encouraged by their ability and willingness to keep taking risks and trialing new ideas with the goal of furthering their position – a viewpoint supported by sustained and significant progress against the two religions. While they have established a clear leadership position in this industry, they are not resting on their laurels.

Financials

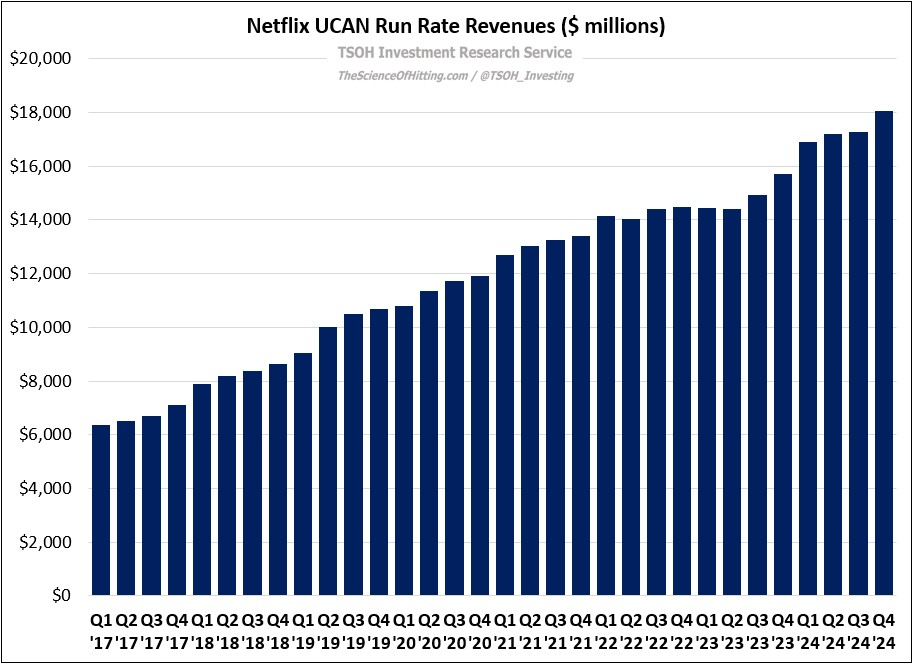

As shown above, Netflix ended the year with 302 million paid subscribers - up 16% YoY, with each geography reporting double digit growth. That is inclusive of ~90 million UCAN subs, a figure that increased by more than 20% over the past two years. For those with a good memory, you may remember that some questioned at that time whether the UCAN sub base had reached a ceiling (at ~74 million in Q4 FY22); we now know that it had not. In combination with higher ARPU’s, this has taken run rate UCAN revenues to ~$18 billion - up ~70% from five years ago. Put simply, the Netflix playbook keeps working.