Netflix: "A Terrible Business"

From “Netflix: The Cost Of Success” (April 2023): “The FY23 / FY24 results serve as (early) validation of the strategy Netflix pursued over the past 10 - 15 years. They’ve established a dominant global leadership position in this industry… The investment to get there [ >$10 billion of FY14 - F19 negative FCF] was substantial; that was the cost of success. My view for some time has been that the legacy media companies are unlikely to replicate that outcome, which will present additional long-term opportunities for Netflix.”

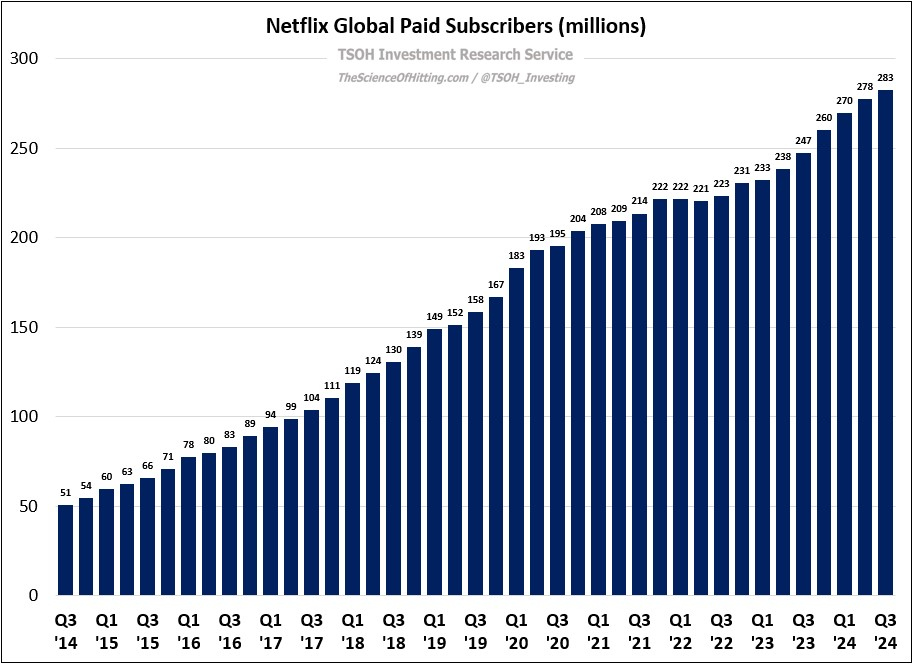

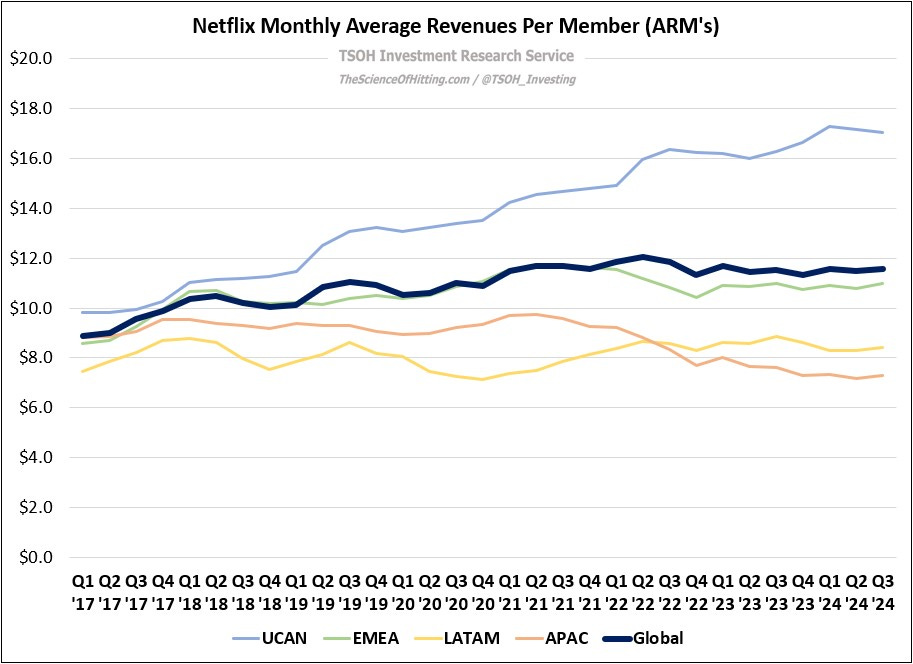

Over the past 18-24 months, I think Mr. Market has come to more fully appreciate two key factors on the Netflix investment thesis: (1) the company’s likelihood of sustaining, and even extending, its strong leadership position in the global video streaming business (primarily for movies and TV shows); and (2) the long-term financial attractiveness of that business should they achieve that outcome. On the first point, Netflix now has 283 million paid members around the world, who collectively watch roughly 200 billion hours of content on the platform each year (roughly two hours per membership per day). In exchange, the average member pays the company a subscription fee of less than $12 per month, or roughly ~$0.20 per hour of platform engagement.

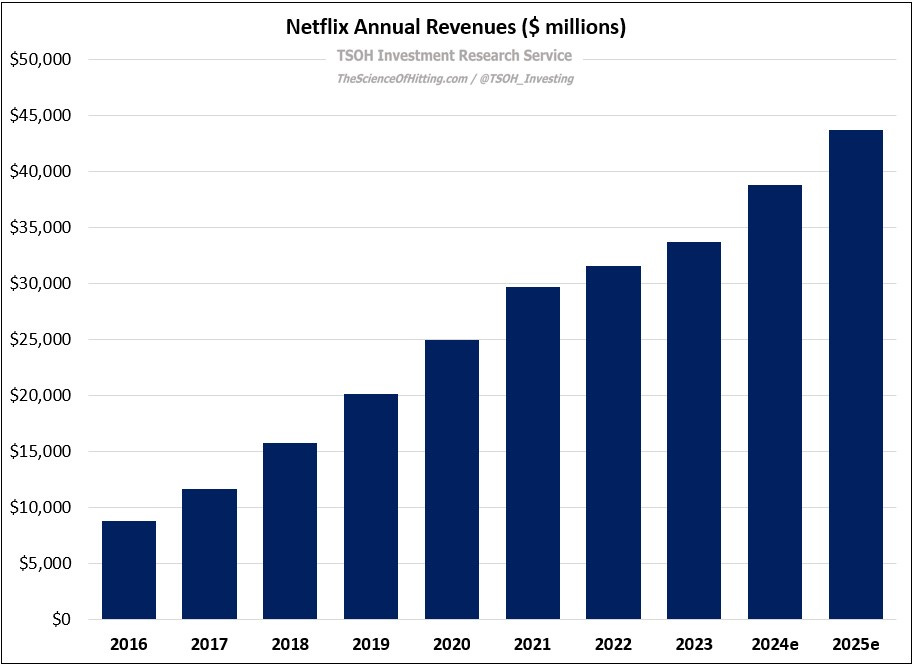

Those inputs underlie a business that is on track to generate FY24e revenues of ~$39 billion, with guidance calling for a low double digit increase in FY25e (to ~$44 billion). What’s critical to recognize, as often I’ve discussed, is the interplay between those two variables (volumes and pricing). While regions differ depending upon competitive dynamics and the maturity of Netflix’s business in a given market, the overall trend continues in the right direction. The result is a business that few have, or will, come close to replicating.

As we work down from revenues, I think that the following historic data is paramount for understanding how Netflix has improved its per subscriber financials over time. The short summary is they haven’t done it but spending less per subscriber on content, tech spend, etc.; instead, they’ve used subscriber / revenue growth to invest significant incremental dollars into those buckets, which has then allowed them to ask subscribers to pay higher prices. (Co-CEO Ted Sarandos made a comment on the Q3 FY24 call that hints at this way of thinking: “AI needs to pass a very important test: can it help make better shows and films? That is what we will need to figure out… We benefit greatly from improving the quality of our movies and TV shows, much more so than we do from making them a little cheaper.”)