Netflix: “Heads Down and Execute”

Note: On Friday, I launched a new podcast with Francisco Olivera of Arevilo Capital Management called “TSOH Weekly”. On the podcast, we will have short discussions (~10 minute episodes) about interesting developments in the industries we follow. We’ll focus on a specific company each week, with new episodes every Friday. Please let me know if you have any questions.

From “In The Right ZIP Code” (July 2022):

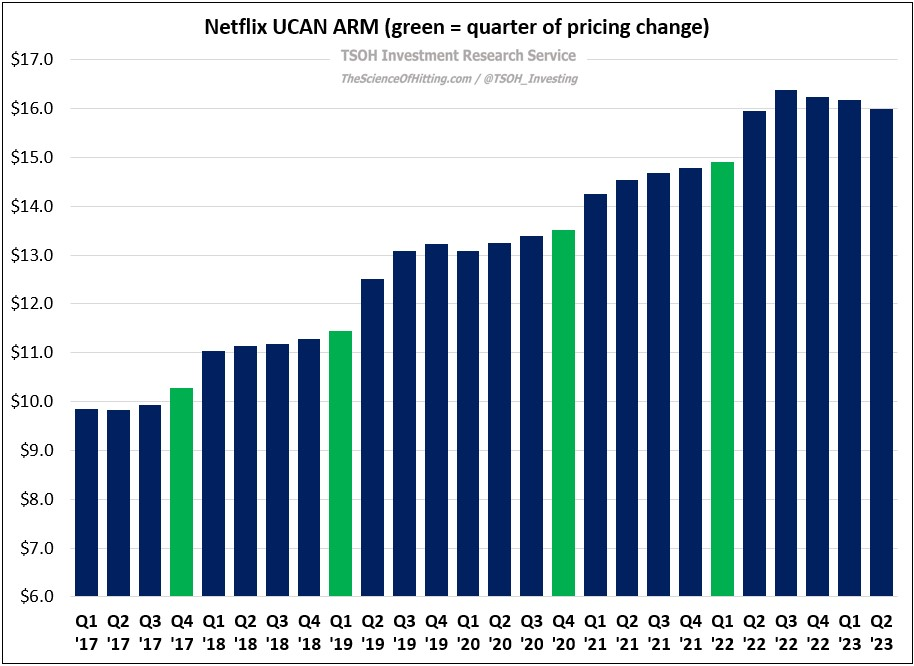

“In light of the competitive realities in the marketplace, I’d argue the UCAN results over the past few years have been impressive. Netflix has managed to thread the needle between volume (paid subs) and pricing (ARM) growth, which is the key to optimizing revenues… They’ve done so while maintaining industry leading engagement metrics, which covers the two key pieces of the puzzle for their content partners / suppliers: monetary considerations and reach (viewers). This is the Netflix playbook – and it’s working.”

Netflix reported its Q2 FY23 results last week, and my primary takeaway mirrors what I said 12 months ago: while there is some noise to navigate in the short-term, the playbook is working. As we look at the trajectory on paid subs, ARPU (ARM), run rate revenues, content costs, and FCF, it is evident that the company is on strong footing - and that they’re well positioned to report much improved financial results over the coming years. That said, as discussed in the Q2 letter, streaming is, and will continue to be, intensely competitive; while we’re likely to see an adjustment to the strategies of some notable competitors (specifically from the legacy media companies) following a period of aggressive pricing, those changes shouldn’t be viewed as an “all clear” signal for Netflix. Thankfully, I think their key strategic initiatives - the crackdown on password sharing and the roll-out of the ad tier – point to a company that recognizes the need to strike a balance between offense and defense. Amidst ongoing turmoil in the media industry, the questions around inorganic opportunities (M&A) are also growing louder. As we look to 2H 2023 and beyond, Netflix starts from a greatly advantaged position; with effective execution, they will reinforce their dominant global lead in the years ahead.

Volumes and Pricing

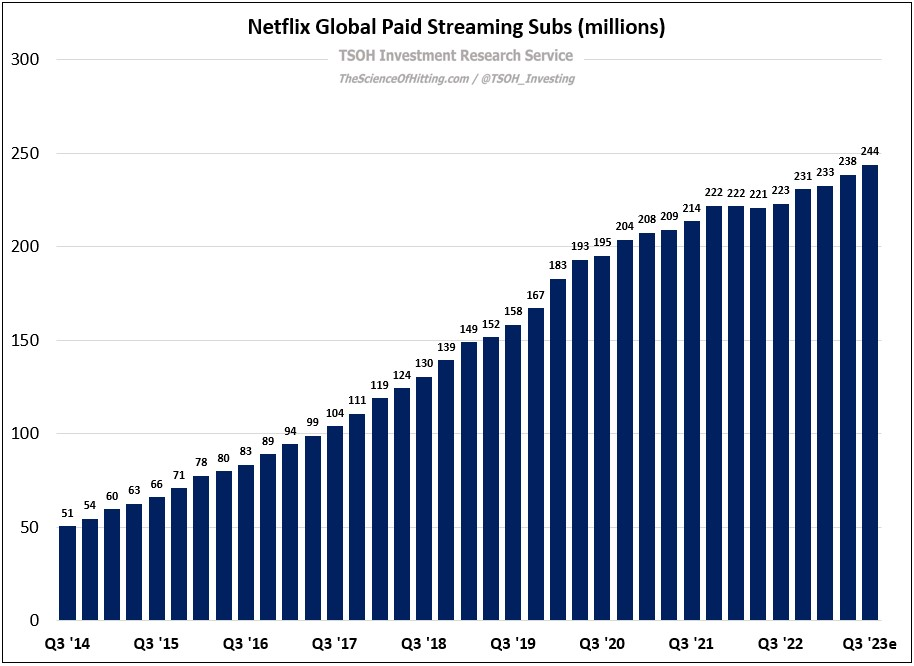

Netflix added 5.9 million net subs in Q2 FY23 (sequentially), ending the quarter with 238 million paid subs globally (+8% YoY, with management’s commentary suggesting nearly 10% YoY sub growth is likely in Q3 FY23).

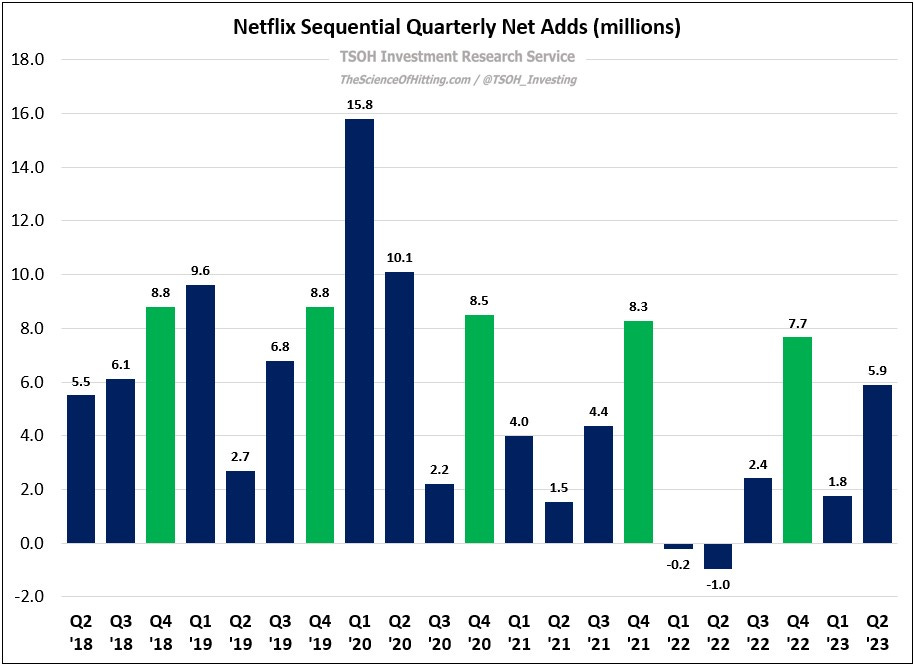

As you can see below, if we exclude the seasonally strong fourth quarter (highlighted in green), this was the strongest period of sequential paid subscriber growth for Netflix since the beginning of the pandemic.

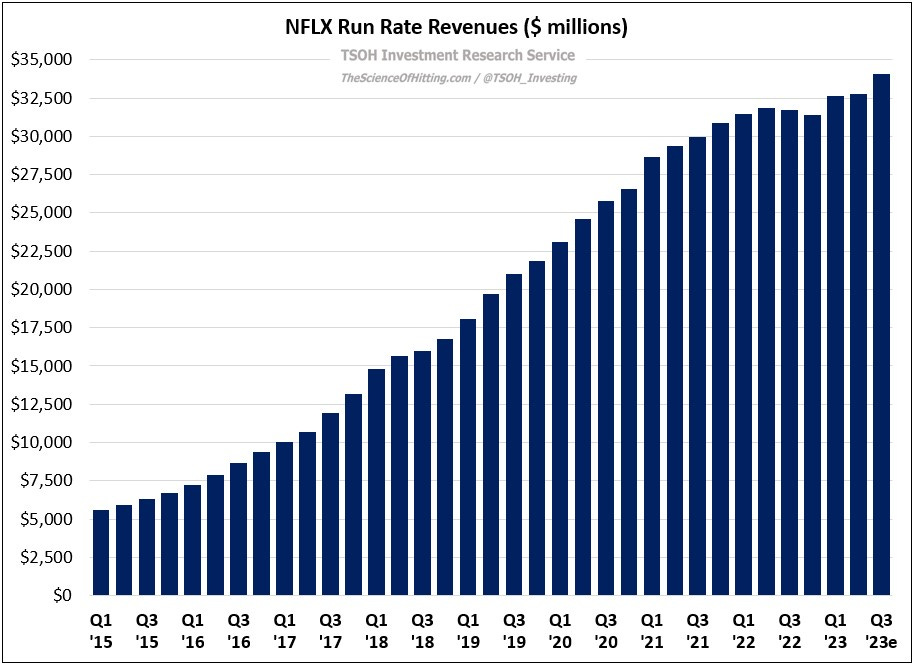

Volume growth was wide-ranging, with each region reporting more than one million sequential net adds in Q2. After accounting for a headwind from lower average revenue per membership (ARM -3% as reported, -1% in constant currencies), Q2 FY23 revenues were +3% YoY to $8.2 billion. Importantly, the days of low-single digit revenue growth should be temporary for Netflix. In addition to management’s Q3 guidance (revenues +7.5% YoY to $8.5 billion), recent strategic actions and plan structure changes provide clarity on how the growth algorithm will shift over the next few quarters (and maybe years).

The UCAN Growth Algorithm

To see where we’re going, it’s helpful to understand where we came from (for those who are interested, you can pull regional financials for the current reporting structure back to Q1 FY17). In total, UCAN run rate revenues have increased by ~130% since Q1 FY17, from ~$6.4 billion to ~$14.4 billion. That reflects a roughly 40% increase in paid subs (~53 million to ~76 million, but with <5% cumulative sub growth since Q2 FY20), along with a roughly 60% increase in monthly ARM’s (from ~$9.8 to ~$16.0). As you can see below, there have been four UCAN price increases since the start of 2017, with each leading to a $1 - $2 ARM lift over the following 2-3 quarters.