TKO: "A Transformative Deal"

From “Positioned To Capitalize” (June 2023): “If you share my view that live sports will ultimately play a prominent role in the content slate for a few of the leading DTC services / streamers, you can start to appreciate why the WWE and the UFC are attractive properties - particularly given the flexibility of their format / scheduling, the size and demographics of their audience, and the price tag of their rights relative to other sports. As overall content budgets at major media companies are being thoroughly scrutinized, my view is that sports rights are one area where spending will continue to rise (the latest example is Peacock’s ~$110 million deal for a single NFL playoff game).

As it relates to the leading player in streaming, Netflix, I’d note that they have had significant success with sports docuseries like ‘Drive To Survive’ and ‘Full Swing’… I think the introduction of the ad-supported / AVOD tier will eventually lead Netflix to conclude that they should be in live sports.”

On January 23rd, the global leader in DTC video streaming took a major step forward in their distribution of “live sports entertainment”: Netflix announced a 10-year, ~$5.2 billion deal for “Raw”, WWE’s flagship weekly program. I won’t rehash the ground covered in the most recent Netflix update (“Reaping The Rewards”), other than to reiterate that I think this is a good fit for Netflix given the flexibility of WWE’s format / scheduling, the size and demographics of its audience, and the structure / price for “Raw” relative to other (global) sports.

I also think this is an intelligent deal for the WWE / TKO. As a reminder, here’s what Netflix co-CEO Ted Sarandos said after the deal was announced: “We believe that the WWE has historically been under-distributed outside of North America, and this is a global deal. We can help them and they can help us to build that fandom around the world.” TKO CEO Ari Emanuel shared a similar conclusion: “This strengthens the WWE brand on a global basis.”

Based on management’s commentary, I think the AAV (average annual value) on the Netflix deal was in a similar ballpark to the ~1.4x increase received for the NBCU / “Smackdown” deal (they secured a ~1.7x increase on the CW / “NXT” deal, but that’s only for ~$25 million a year). One key difference between the “Smackdown” and “Raw” deals is their length: the NBCU deal is for five years, while the Netflix deal runs for ten years (in addition, Netflix can opt out after five years or extend the term another ten years to 2045). Long story short, TKO made some concessions to ink the Netflix deal. (Netflix CFO Spencer Neumann: “This is a type of sports entertainment programming that’s going to work well for our members in many parts of the world... We felt it was an attractive value, in terms of member impact relative to our cost.”)

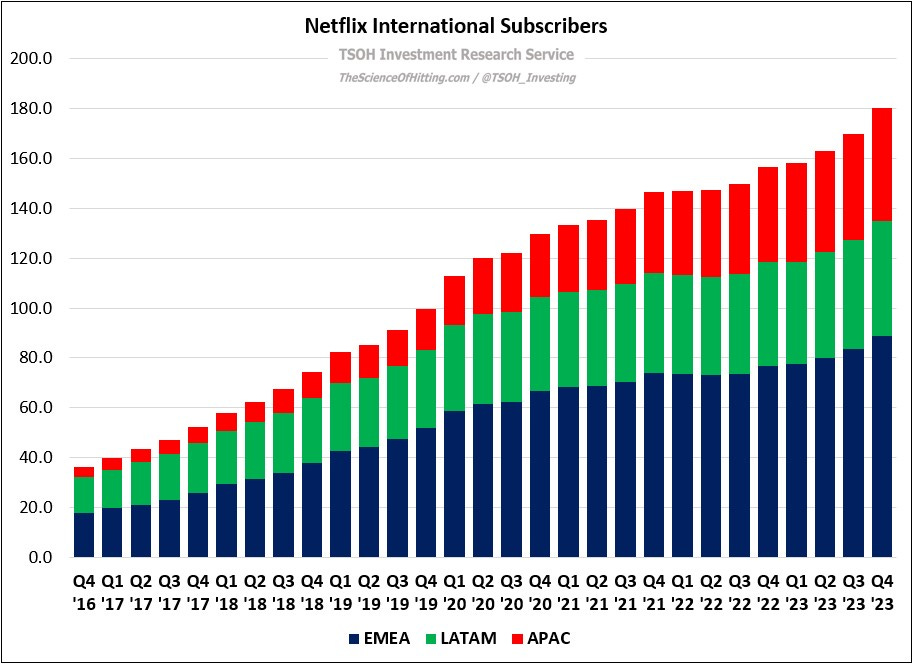

In the end, they had to come to an assessment of the long-term value Netflix brought to the table. The streaming service has more than 180 million paid subscribers in International markets (ex-UCAN), a number that has grown by >100 million over the past five years. (“Raw” will be on Netflix beginning in January 2025 in the U.S., the UK, Canada, and Latin America, with other markets around the world to be added as their existing media deals expire.)

As TKO COO Mark Shapiro noted on the Q4 call, this deal is about much more than media rights’ dollars: “This is the best platform in the world, with the largest audience in the world… By the way, Netflix is also one of the best marketers in the world. The idea of seeing ‘Raw’ on the front page when you open Netflix is something we're really excited about… Netflix has unbelievable reach and global scale… This is a transformative deal.”

If we assume the alternative opportunity for WWE was a collection of regional deals that offered 10% or 20% higher AAV’s, I much prefer this decision. Netflix will add significant value for the WWE, particularly outside of the United States. It should also help with reaching younger fans domestically, many of whom have abandoned pay-TV. Finally, I think this is the first step of a long-term partnership, with opportunities for expansion in the years ahead (on live rights, as well as with shoulder programming). For a management team at EDR / TKO where I’ve been a bit uneasy at times with how much concern they seem to place on outside considerations - for example, how they’re viewed by Mr. Market - this helps restore my confidence that they’re focused on the long-term decisions that are critical to sustaining and building the value of the enterprise. (To be fair, the situation at Endeavor may help to explain why that perception issue has been top of mind for management.)

Here’s another way to frame it: what roles should the WWE and the UFC fulfill for fans? What are their core competencies? In my opinion, the answer isn’t running their own OTT DTC services (FIGHT PASS and the WWE Network). Instead, I think their primary focus on media rights monetization should be securing long-term deals that offer the prospect of “substantial and predictable economics” as well as broad viewership / exposure. The Netflix deal is a perfect example, with the WWE Network to be shut down over time. (As discussed in June, I also think ESPN / ESPN+ was a well-fitting partner for the UFC.) None of this is to suggest media rights, at ~65% of TKO’s revenues, should be a secondary consideration; instead, it’s to recognize that AAV’s should be considered alongside ease of access and driving fandom.

Beyond that, I think TKO management should largely focus on leveraging revenue and cost synergies associated with owning the WWE and the UFC (to be clear, as they are currently doing). A notable example is live event site fees, where they are paid by local governments or tourism authorities to account for the economic benefits that accrue to the host city. As Shapiro noted at the Morgan Stanley TMT Conference, this is still early days: “the majority of our fights aren't getting site fees”. As some recent examples have shown, this can amount to $10 million, $20 million, or more for a single event.

Another example is on marketing partnerships, such as the Anheuser-Busch (Bud Light) deal and WWE’s first “surface of play” sponsorship with Prime Hydration (“the sponsorship will run two years at an eight-figure cost and is the largest deal in the entertainment brand’s history”). As we think about the combined opportunity for the WWE and the UFC - their partnership teams were unified earlier this year - I think there’s upside to their current results.

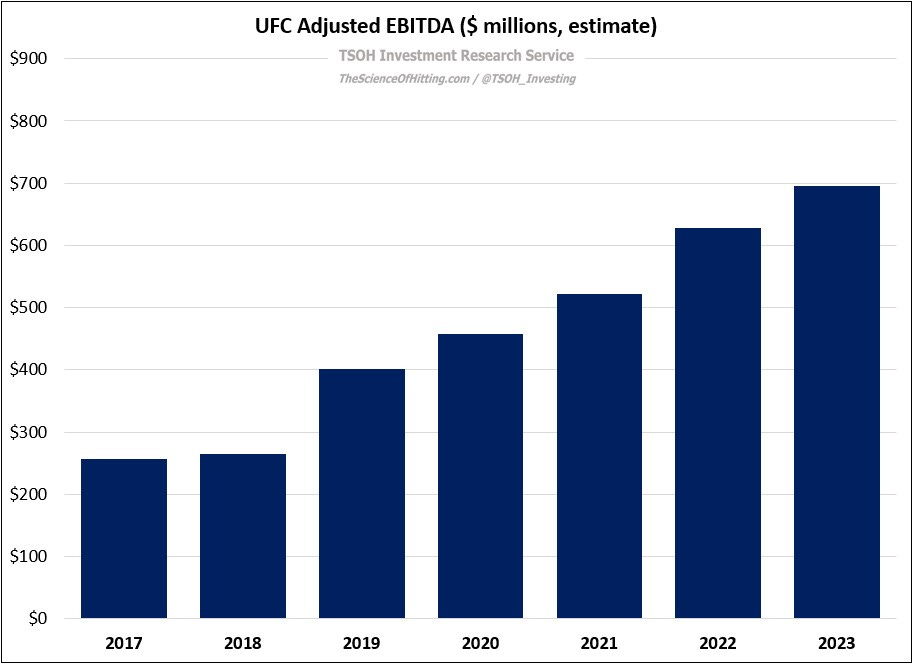

These are two notable examples of the commercial components where this team can add value, just as they have done at the UFC over the past seven years. (“For the UFC, 2023 marked the fifth consecutive year with record revenues and record profitability… When we bought the UFC, they were at about $40 million of sponsorship revenues; now it’s $200 million.”)

In summary, I think the Netflix deal will prove to be a very intelligent decision for the WWE, and potentially a first step towards a larger relationship; when viewed holistically, it will position them to maximize various commercial opportunities at TKO. (“We are a dialed in machine at the UFC; when you look at the WWE, Ari saw the opportunity to go out and cut new TV deals… to get sponsorship and licensing up, and other things he could add value to.”)

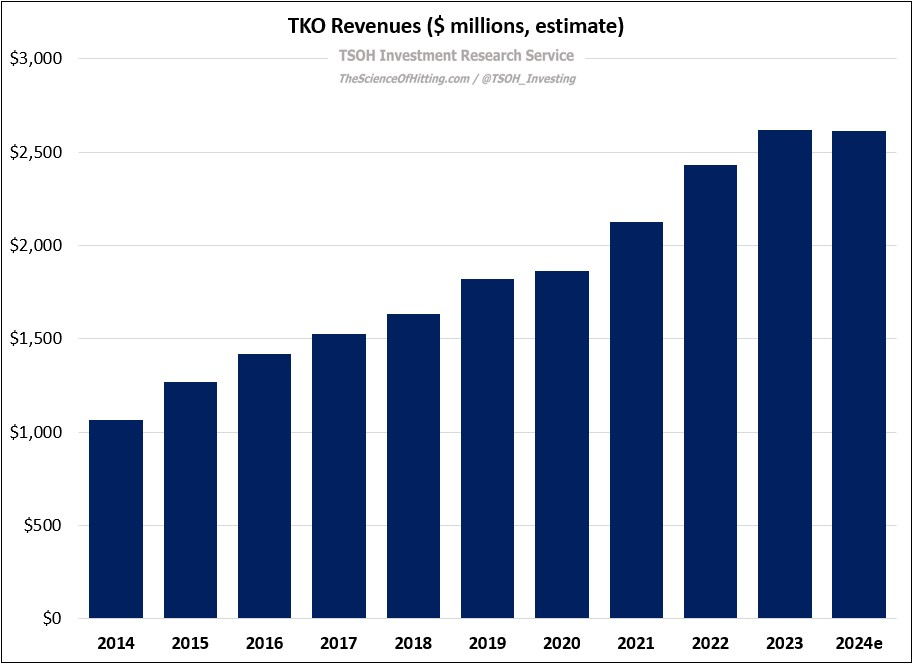

Financials

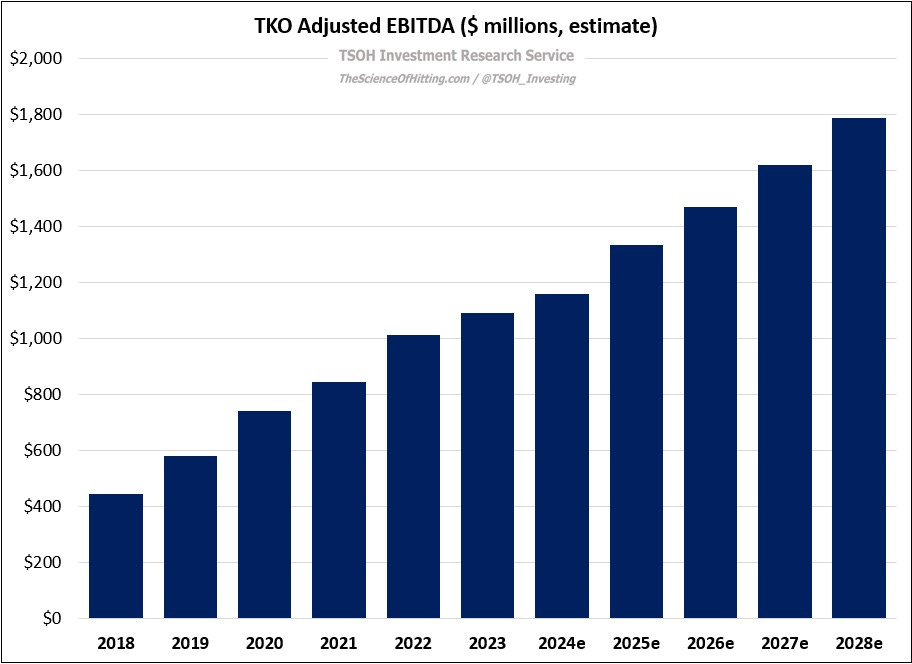

In 2023, TKO’s revenues and adjusted EBITDA were $2.62 billion and $1.09 billion, respectively, both of which were up 8% YoY (margins stable at 42%). This reflects low-double digit increases on revenues and EBTIDA for UFC (helped by a timing comparison on the number of live events), along with low-single digit revenues and EBITDA growth for WWE. (At the midpoint of FY24 guidance, trailing five-year revenue CAGR for TKO in the high-single digits.)

Early FY24 guidance calls for mid-single digit adjusted EBITDA growth, with the asterisk that the three-month gap between the old NBCU “Raw” deal in the U.S. (ends 09/30/24) and the new Netflix “Raw” deal in the U.S. (starts 01/01/25) is a ~$75 million YoY headwind; adjusted for this item, the YoY EBITDA growth rate would climb into the low double digits. In terms of capital allocation, and in contrast to the $100 million of share repurchases completed in Q4 FY23, it sounds like the FY24 plan is conservatism: “we anticipate building up cash over the balance of this year”. If that happens, TKO is likely to enter 2025 with net leverage well below 2x, compared to a previously discussed comfort level of “up to 3x”. (One potential explanation is that they’re preparing for the conclusion of the UFC fighter class action lawsuit.)

Conclusion

As I wrote in June, structural changes in video distribution are a long-term opportunity for TKO: amidst industry evolution, the WWE and the UFC are well positioned to capitalize. Both properties have large (global) fan bases, year-round programming, and format flexibility that makes them an ideal partner for a long list of distributors, including Netflix (we’ll see if Netflix is interested in WWE’s domestic premium live event / PPV rights, which come up in early 2026). In combination with other commercial opportunities, which I believe should greatly benefit from Netflix-type deals, TKO is well positioned to deliver material profit growth. As we look out to FY28, I’m still comfortable assuming high-single digit revenue growth and low-double digit EBITDA growth, which puts TKO on track for >$1.5 billion in FY28e EBIT (as of Friday’s close, the enterprise value is ~$16 billion). That calculation also needs an assumption on capital allocation, with >$5 billion to be available for capital returns / M&A over that period if run at 2.0x - 2.5x net leverage.

I believe this is a high-quality collection of assets in the hands of the right operators at an attractive price (relative to my opportunity set). For that reason, I’ve decided to initiate a position in TKO. I will send an email after the market close disclosing the portfolio changes I will implement tomorrow.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.