Microsoft: The Third Pillar

TSOH Weekly #2: Meta (here’s the link to the inaugural episode on Netflix)

From “The Ultimate Tailwind” (October 2022):

“That change in expectations will also work its way through the income statement… On my numbers, FY23 EPS is likely to land a bit shy of $10 per share. At Friday’s close of ~$236 per share, the stock trades at roughly 24x FY23 earnings… I’ve owned Microsoft since 2011 (it has been one my largest positions over that entire period). As I think back on my experience with this investment, it has served as a useful reminder that long-term business results are what ultimately drive outcomes for the stock price (assuming you start and end with a “reasonable” valuation). As I look to the years ahead, I remain as confident as ever that Microsoft is well positioned to help organizations of all shapes and sizes to embark upon their own digital transformation, while being properly compensated for the value that they bring to the relationship.”

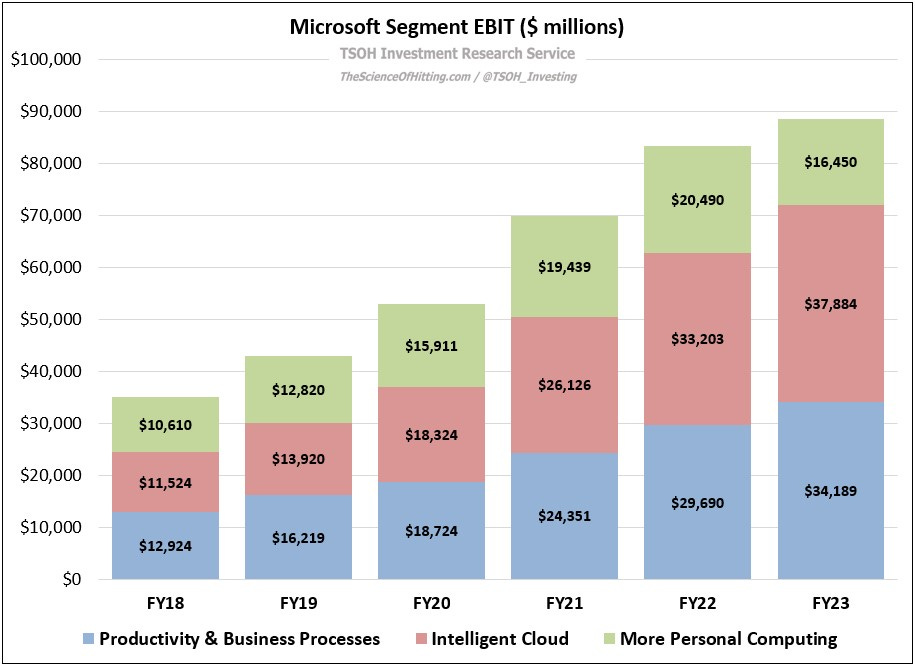

Microsoft reported its Q4 FY2023 results last week, with the annual figures landing within spitting distance of that prediction from October; the company reported FY2023 adjusted EPS of ~$9.8 per share (+12% versus FY2022 in constant currencies), with a trailing five-year EPS CAGR of +20%. (For 2023, mid-teens EBIT growth at Intelligent Cloud and Productivity & Business Processes was offset by the previously discussed headwinds within MPC).

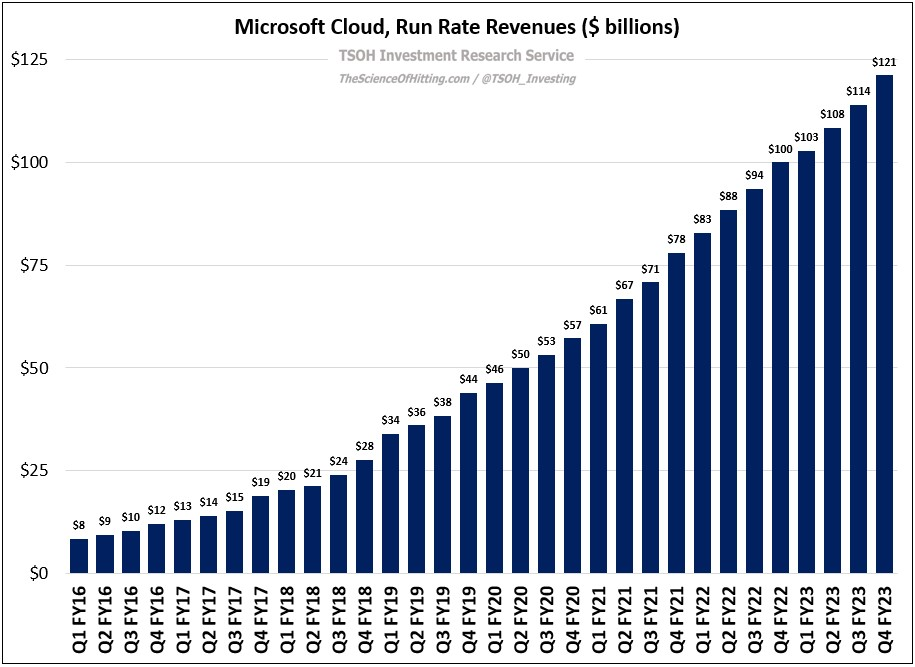

The impressive results over the past five years, with incremental annual revenues climbing by more than $100 billion ($211.9 billion in FY2023 versus $110.4 billion in FY2018), is largely attributable to the success of Microsoft Cloud. The Cloud businesses exited FY2023 with run rate revenues of ~$121 billion, with Q4 YoY growth of +23% (in constant currencies).

While management provided notable Azure financial disclosures this quarter (implying ~$55 billion in FY2023 revenues, up ~100% from FY2021), I’m going to focus on another part of the Cloud business: Office 365 Commercial.

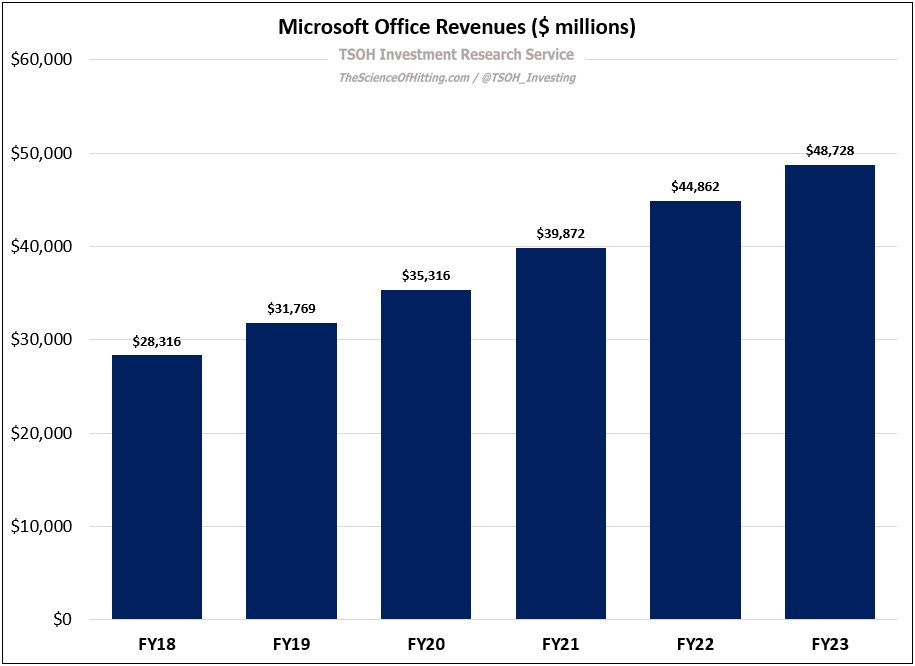

I wrote a post about this topic in August 2021 (“You’ve Got A Very Good Business”), but I want to revisit it for two reasons: (1) the trailing results and its current trajectory are a good example of why Microsoft’s core businesses remain well positioned for long-term success; and (2) there have been major developments here, particularly in the past few months. Let’s start with the headline figures: as shown below, Office revenues reached ~$49 billion in FY2023 (up ~70% from FY2018); Office 365 Commercial now has ~400 million paid seats, up >100% from yearend FY2018. (Globally, its estimated there are ~600 million information workers and ~2 billion frontline workers.)

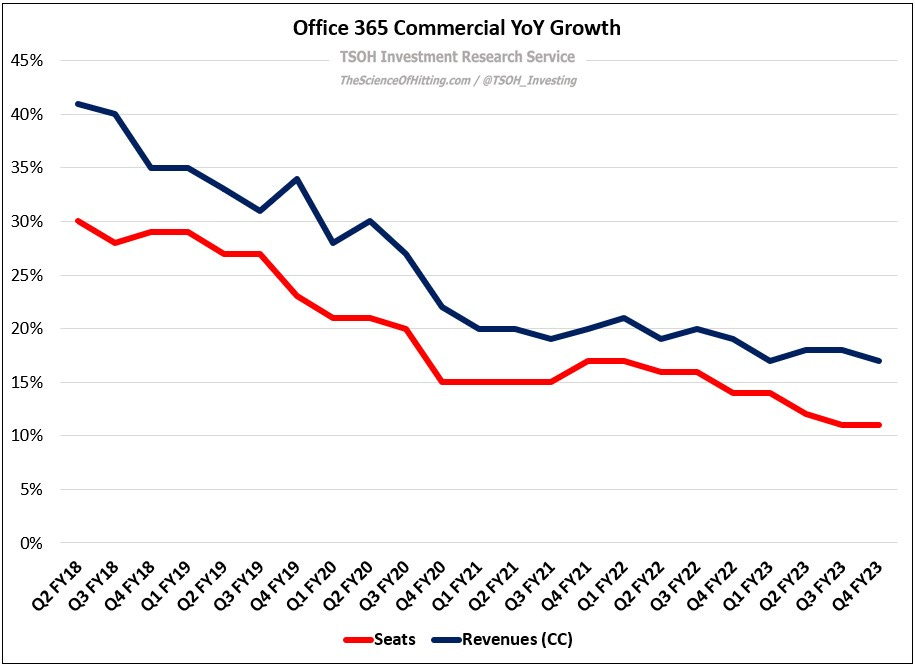

Ongoing strength in paid seats (volumes), at +11% YoY in Q4 FY2023, was led by SMB’s and frontline workers (as I wrote in November 2021, expanding the TAM). In addition, Microsoft is seeing continued success with it’s higher value offerings (and with the effective implementation of the March 2022 price increases); as shown below, Office 365 revenues have outgrown paid seats in every quarter for the past 5+ years. (On the Q4 FY2022 call, management said E5 accounted for ~12% of the Office 365 Commercial installed base, up from ~8% a year earlier; on the Q4 FY2023 call, CFO Amy Hood cited “healthy renewal strength”, particularly for ongoing E5 upsell.)

The playbook has worked wonderfully: put simply, leverage the success of the core suite to drive incremental value-add through new tools and services (Teams / telephony, Viva, analytics, etc.). That brings us to the recent generative AI product announcements, with the FT reporting Microsoft will charge commercial customers $30 per user per month for Microsoft 365 Copilot (to put that in context, the list price for E5 is $38 per month). I found this quote from the article noteworthy: “Evidence that the GitHub service has made coders more productive is ‘what’s giving us real confidence that a more horizontal co-pilot like [Microsoft 365]’ will have a big impact on ‘every [type of] sales, finance, HR, or general knowledge work’, Nadella said.” The GitHub service Nadella referred to in that interview is GitHub Copilot, which is now being used in more than 27,000 organizations (up ~2x sequentially).

The rapid adoption of GitHub Copilot reflects the significant impact that it’s having on developer productivity - which makes it well worth the money, even at a price point of ~$20 per month (Nadella: “it's sort of a no-brainer to add productivity leverage for software developers in any organization”). The Sales Copilot demo from Inspire 2023 is another example of how that idea will apply elsewhere inside a company, along with a clear indication why it can be a very attractive value proposition, even at $20 - $30 per seat. In addition, the Copilot demo highlights why Microsoft is well positioned to be the vendor of choice for many customers (“integrates seamlessly with M365 Copilot”).