Microsoft: "It's Showtime"

From “The Ultimate Tailwind”:

“The ongoing strength in the Commercial businesses is being partially offset by weakness in Consumer. Most notably, Windows OEM revenues were down 15% YoY in Q1, inclusive of a five point benefit from the prior year Windows 11 accrual. Given that management expects the ‘materially weaker’ PC demand that they saw at the end of Q1 to continue into Q2, alongside much tougher comps (lapped +10% in Q1 FY22, with Q2 FY22 at +25%), Windows OEM will report some ugly Q2 numbers: for the quarter, CFO Amy Hood expects Windows OEM revenues to decline by more than 30% (and those are some high margin revenue dollars for Microsoft).”

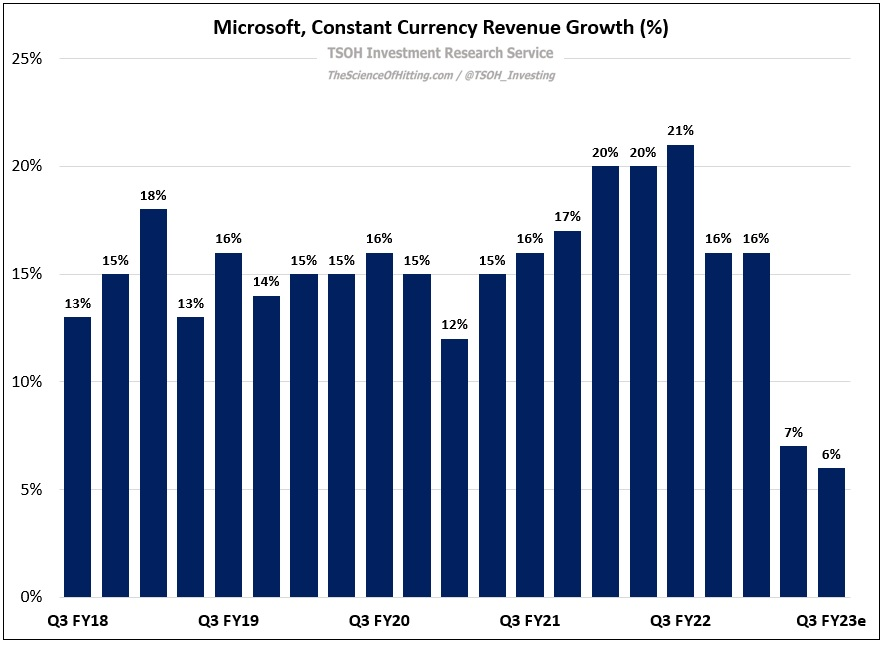

In Q2, Microsoft reported 2% revenue growth (+7% in constant currencies); as shown below, this is the first time Microsoft hasn’t reported double digit constant currency revenue growth in more than five years. In addition, the guide suggests this pain will continue in the short-term, with the midpoint implying ~6% constant currency revenue growth next quarter (Q3).

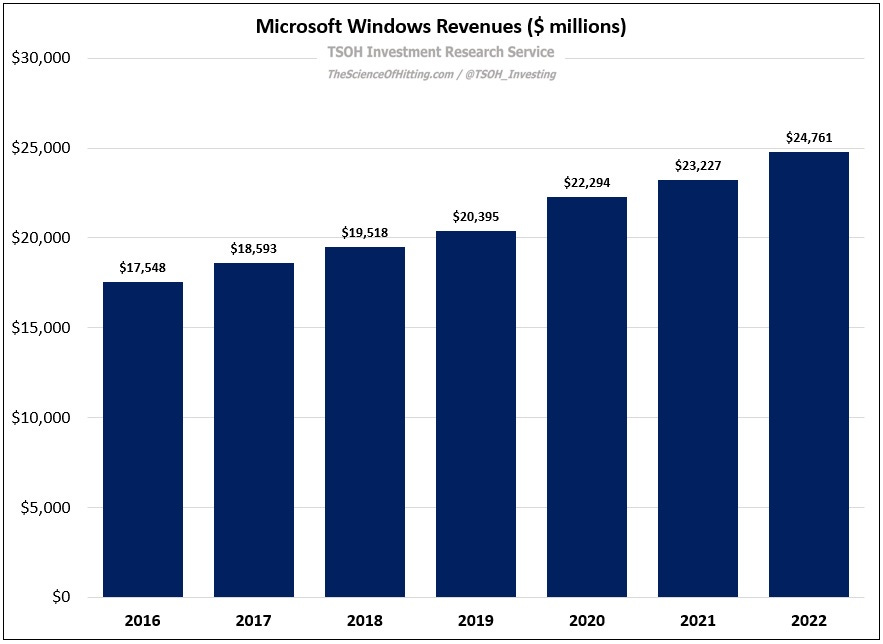

The primary culprit is Windows, with OEM revenues down 39% YoY in Q2 (inclusive of a small headwind from the prior year Windows 11 revenue deferral). This reflects ongoing weakness in the PC market, as well as the strong prior year comparable called out in “The Ultimate Tailwind”. We don’t have granularity on the quarterly financials (P&L) for Windows, but the overall results for More Personal Computing (MPC) do a sufficient job of telling the story: segment EBIT declined by 47% YoY in Q2 FY23 (to ~$3.3 billion).

I can appreciate why some market participants are focused on the short-term results in MPC (and its significant impact on the consolidated figures), but I’ll reiterate what I said last quarter: my investment in Microsoft dates to 2011, a time when “the death of the PC” was a common refrain. That conclusion ultimately proved misguided: this franchise has proven its strength and sustainability over the past decade. While this is a significant headwind for Microsoft in the short-term, I expect that the results will stabilize, and eventually recover, in the years ahead. (“Usage intensity of Windows continues to be higher than pre pandemic, with time spent per PC up nearly 10%… monthly active devices reached an all-time high this quarter.”)

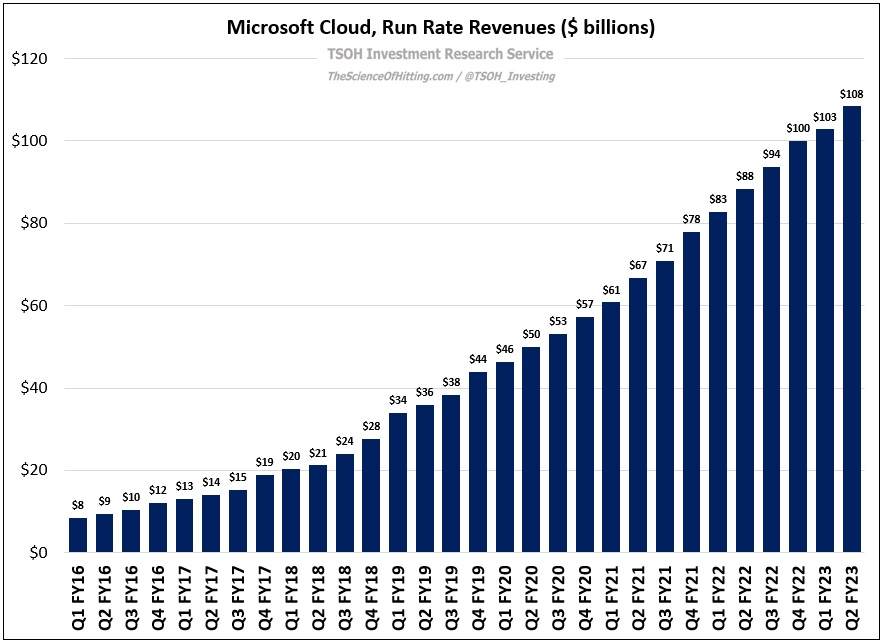

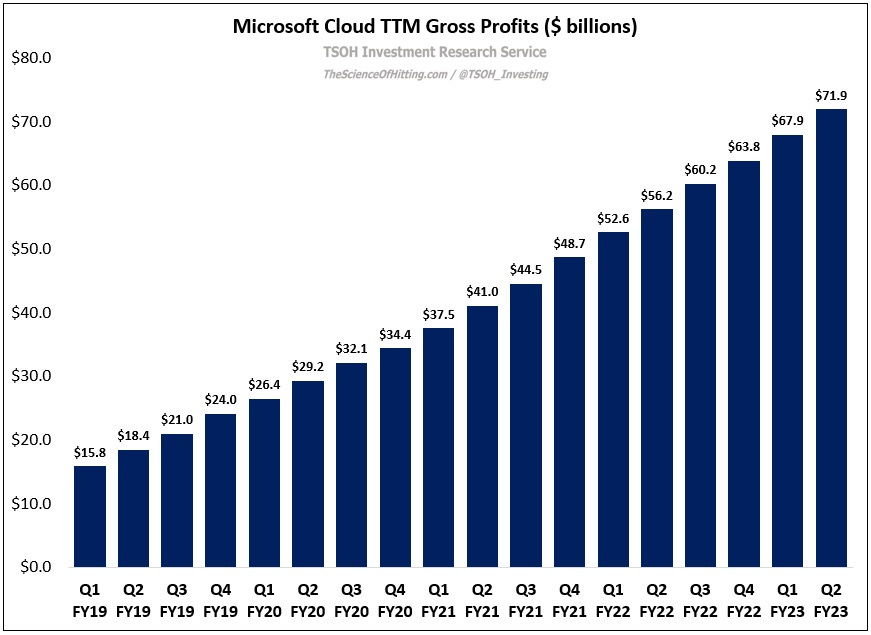

Beyond Windows / MPC, the results in Microsoft’s Commercial businesses remains encouraging (albeit weakening into 2H), particularly in light of the current macro environment and their scale (~30% growth is very impressive on a $10 billion base – but it’s mind-blowing on a $100 billion base).

In Q2, Microsoft’s Cloud businesses exceeded $108 billion in run rate revenues, up 29% YoY in constant currencies. The Cloud businesses, which have grown their run rate revenues >5x over the past five years, are now larger than Microsoft’s total revenue base was in any year prior to FY18.

As CEO Satya Nadella wrote in “Hit Refresh” (which was published in 2017), “Microsoft is at the leading edge of today’s game-changing cloud-based technologies – but just a few years ago, that outcome seemed very doubtful.” The results above clearly suggest that this once doubtful outcome is now in a very different place; Microsoft is, and will continue to be, a leader in this industry (if anything, their position is strengthening further).

How big will this opportunity be over time? Given the objective of the Cloud businesses – “to accelerate the digital capabilities of every organization on the planet” – I believe we still have a long way to go on this journey. (Amazon CEO Andy Jassy: "Less than 5% of global IT spend is in the cloud at this point. That’s going to substantially change in the coming years.")