Microsoft: Expand The TAM

On Tuesday, Microsoft reported results for Q1 FY22 – and it was another stellar showing for the tech giant. In reviewing the quarterly results, I was reminded of something that comes to mind periodically: it’s much more enjoyable to review the performance of, and to be the long-term owner of, a company that is firing on all cylinders (and where the investment question inevitably comes down to the valuation) than it is to dig through the messiness of a business that consistently struggles to execute but which trades at a seemingly ‘cheap’ valuation. (Alas, whether the former offers the prospects of better returns is what truly matters.)

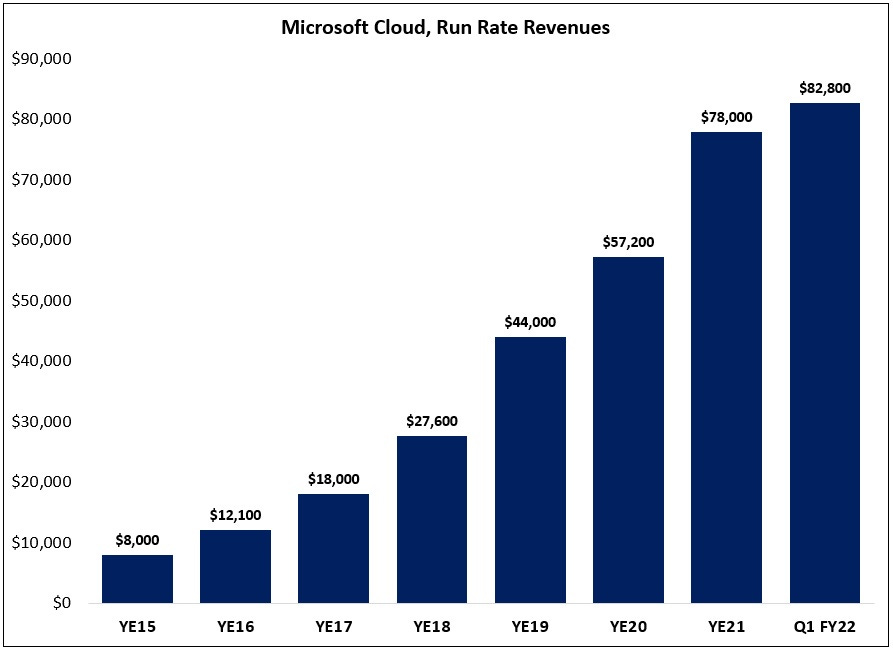

In Q1, Microsoft Cloud (formerly Commercial Cloud) revenues increased 36% YoY to $20.7 billion. As shown below, run rate cloud revenues have now reached ~$83 billion, a 3x increase since the end of FY18 (For context, Microsoft’s total revenues in FY21 were $168 billion).

We’ve reached a point where Cloud, which has seen its growth rate accelerate to the mid-30’s (%) since the end of FY20, accounts for just under 50% of Microsoft’s revenues. Said differently, even if the company’s remaining businesses are unable to grow (they can and they will), the current contribution from Cloud alone is enough to drive double digit topline growth. Naturally, these growth rates will not hold in perpetuity – but it’s worth noting how quickly Cloud has become the driving force of Microsoft’s business (the original Commercial Cloud financial targets – $20 billion in run rate revenues by FY18 – were set in April 2015).

Subscribe to the TSOH Investment Research service for complete access to high-quality equity research, including deep dives on companies like Spotify, Costco, Dollar General, GoodRx, Twitter, Airbnb, Disney, Netflix, and Microsoft, in addition to the disclosure of all portfolio changes before they’re implemented.

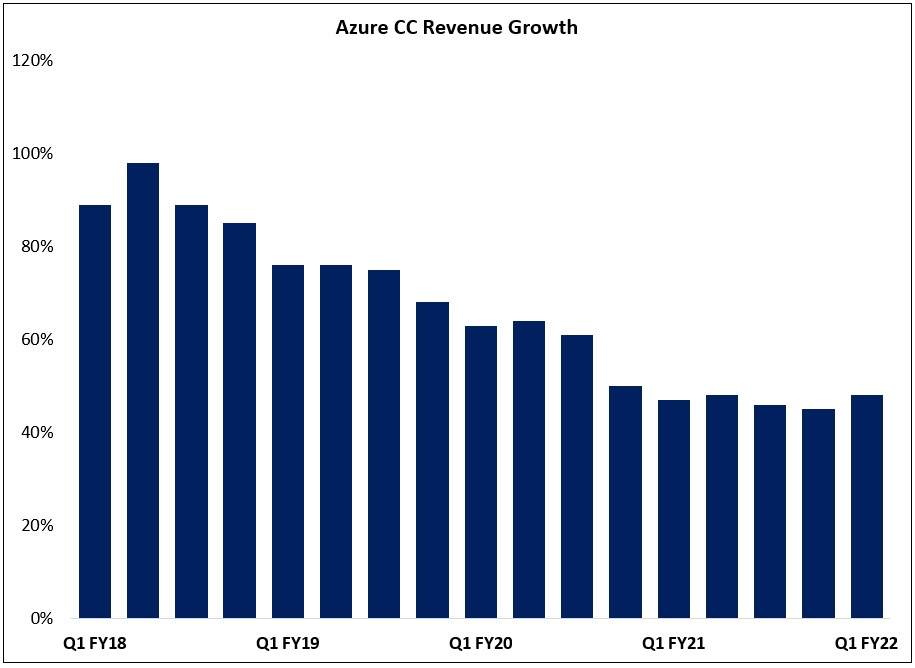

Within Cloud, Azure (Microsoft’s hyperscale global cloud platform) reported Q1 constant currency revenue growth of 48%. While the company doesn’t break out Azure’s financials, analyst estimates peg FY21 revenues at more than $30 billion, with the current growth rate implying ~$45 billion in FY22e revenues. As shown below, Azure (CC) revenue growth has held steady at ~50% YoY in each of the past six quarters, which is notable for a business that will add $10 - $15 billion in incremental revenues over the next year.

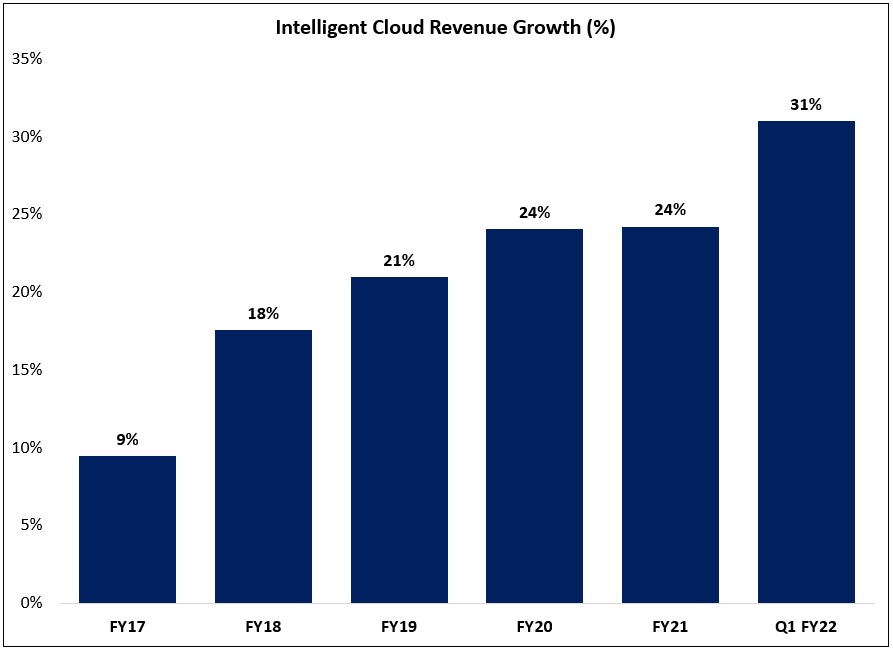

From a segment perspective, business strength remained broad-ranging in Q1 FY22: revenues and operating profits grew in each of Microsoft’s three reporting segments, with Productivity & Business Processes (PBP) and Intelligent Cloud (IC) both reporting 20%+ revenue and EBIT growth. Most notably, revenue growth in the IC segment was +31% YoY (+29% in constant currencies), led by strength in Azure, as well double-digit growth in the company’s on premise and hybrid solutions (Q1 FY22 call: “78% of the Fortune 500 use our hybrid offerings”). As shown below, top line IC growth has shown sustained improvement over the past five years (by the way, IC generated $26.1 billion in FY21 segment EBIT, nearly 3x higher than FY17).

Office 365 Commercial

As I think about Microsoft’s evolution over the past 5-10 years, the ongoing transition that we’re witnessing in the Office business is indicative of the broader investment thesis (specifically in Commercial O365, though the Consumer business has put up very strong numbers as well: O365 Consumer reached 54.1 million subs in Q1). The strategy for O365 Commercial has been focused on a combination of paid seats growth and higher-value services (expanding the Office 365 value proposition), which drives ARPU growth.

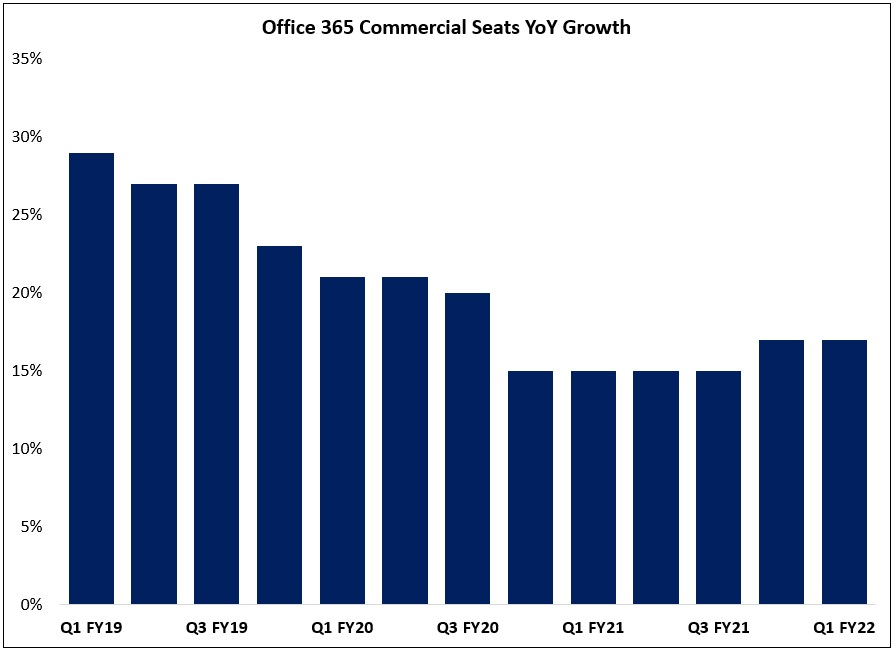

Starting with user growth, Microsoft reported that O365 Commercial seats increased by 17% in the first quarter, maintaining a streak of strong double digit growth in the business (based on prior disclosures, I’d guesstimate that Office 365 currently has roughly 300 million paid seats).

These results have been attained through ongoing execution in the core knowledge worker customer base (your typical enterprise or SMB Office user), but also through an expansion of the addressable market into frontline workers (from the Q1 FY22 call: “Coles, one of Australia’s largest retailers, chose Teams to bring two-way communication to more than 120,000 frontline employees”). This comment from Jared Spataro, Corporate VP of Microsoft 365, speaks to the growing importance of frontline to O365 seats growth:

“Over the long term, starting with that idea of the Office install base, we believe that anyone who uses Office will need what Teams has to offer… We think everybody is going to need the collaboration and communication capability. We get excited because we think the penetration number should be very high for us… We can go well beyond the total addressable market that's associated with people who would use Office… It allows us to look at frontline in a whole new way. These are folks who largely have been left behind by the PC revolution because they didn't sit behind a desk and they didn't carry a laptop. And we're seeing a tremendous uptick in people using Teams (mobile edition) for their frontline workers and using it to connect frontline to the rest of the company. So, not only do we think penetration of the office space will be high, but we also think that it helps us to expand the TAM.”

In addition to expanding the paid seats TAM, Microsoft has improved the O365 Commercial value proposition (Teams is a notable example, with telephony / voice via Operator Connect becoming an important contributor as well). As I discussed in “You’ve Got A Very Good Business”, this is what encourages companies to move their workforce to higher tier SKU’s (improving the penetration rate for E3 and E5); in addition, this is what gives Microsoft the ability to command sizable price increases for its offerings over time (as I noted in that write-up, the March 2022 changes will result in a simple average price increase in the mid-teens (+15%) across the six M365 and O365 plans). This has already been evident in prior results (a sustained gap between seats growth and revenues; in Q1, O365 Commercial revenues increased 23% on a 17% increase in paid seats). Based on my analysis, there’s good reason to believe this will continue in the years ahead.

This combination of seats growth and higher ARPU’s are the underlying drivers that will enable Microsoft to report strong double digit Office 365 Commercial revenue growth for the foreseeable future. With a starting Office Commercial revenue base of $33 billion (FY21e), the business is likely to exceed $50 billion in recurring revenues within the next three or four years.

Subscribe to the TSOH Investment Research service for complete access to high-quality equity research, including deep dives on companies like Spotify, Costco, Dollar General, GoodRx, Twitter, Airbnb, Disney, Netflix, and Microsoft, in addition to the disclosure of all portfolio changes before they’re implemented.

Valuation

In Q1, Microsoft’s revenues increased 22% to $45.3 billion (+20% in constant currencies), with slightly outsized growth in operating income (+27% to $20.2 billion; excluding the accounting change in the useful lives for servers and network equipment, EBIT margins expanded by roughly 400 basis points in Q1). Free cash flow in the quarter was $18.7 billion (+30% YoY), with roughly 60% returned to shareholders via dividends and repurchases.

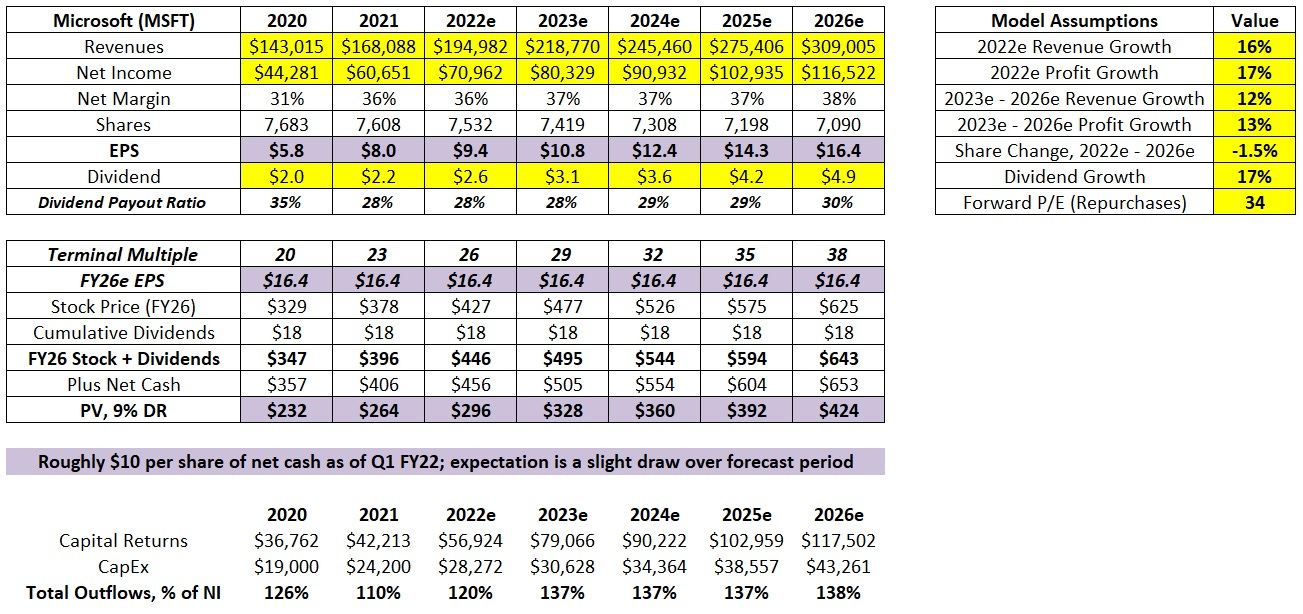

As has happened multiple times over the past few years, the strength of the recent financial results will require further adjustment to my financial model (that’s a good problem to have). As shown below, I now assume that FY22 revenues will increase to ~$195 billion (+16% YoY, prior assumption of +13% YoY), with a comparable change in profitability estimates.

The net result is that the terminal (FY26) EPS estimate has increased to $16.0 - $16.5 per share, which is slightly higher than my prior expectation ($15.5 - $16.0 per share). Assuming a terminal P/E multiple of 20x – 35x FY26e earnings, fair value is currently in a range of $230 - $390 per share.

Conclusion

As noted at the outset, in a scenario where the underlying business is clearly firing on all cylinders, the investment decision inevitably comes down to the reasonableness of today’s valuation. This is a topic I’ve discussed on multiple occasions over the past few years (and specifically as it relates to MSFT).

I’ll revisit something I wrote in June (“I Don’t Defend This Logic”):

“In those rare occasions where you find yourself invested in a great business with a long reinvestment runway being operated by honest and able managers, you should demand a similarly rare valuation to even consider parting ways with your equity interest. In terms of a multiple of current (or normalized) earnings or cash flows, it deserves something much higher than what the average business receives. (That’s another way of saying the companies experiencing this confluence of tailwinds are almost always underappreciated by the market.)

For me, Microsoft fits that description. It’s been a top holding in my portfolio for a decade. Did I think it was the best risk/reward opportunity available to me that entire time? Of course not. For one, I did not foresee much of what has happened over the past ten years. But what I thought I owned, especially after a few years of Satya Nadella’s leadership, was a wonderful business with a fortress balance sheet and a best-in-class management team that had the opportunity to grow at attractive rates for many years as they pursued markets with massive TAM’s. For me, that provided sufficient rationale for accepting “a little silliness” – and so far, it’s worked out well (both in terms of the business results and the stock price).”

My conclusion has not changed.

I continue to believe Microsoft has earned the right to retain its position as my largest holding (a spot it has held for many years). In my opinion, the company’s future prospects have never been brighter: Microsoft’s ability to find attractive growth (investment) opportunities is clearer today than it has been at any time since my initial investment in 2011, which I believe will result in double digit growth in per share profitability for the foreseeable future. There are scenarios where an excessive valuation (and as a result insufficient forward rates of return) would require me to meaningfully reduce my Microsoft stake – but I don’t think we’re there yet.

Subscribe to the TSOH Investment Research service for complete access to high-quality equity research, including deep dives on companies like Spotify, Costco, Dollar General, GoodRx, Twitter, Airbnb, Disney, Netflix, and Microsoft, in addition to the disclosure of all portfolio changes before they’re implemented.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.