Microsoft: "The Ultimate Tailwind"

In his opening comments on Microsoft’s Q1 FY23 conference call, CEO Satya Nadella said the following: “To start, I want to outline the principles that are guiding us through these changing economic times. First, we will invest behind categories that will drive the long-term secular trend where digital technology as a percentage of world’s GDP will continue to increase. Second, we’ll prioritize helping customers get the most value out of their digital spend so that they can do more with less. And finally, we’ll be disciplined in managing our cost structure.” The need for that preface is telling; Microsoft is not immune from the broader macroeconomic pressures being felt throughout the economy, and it seems likely more pain lies ahead.

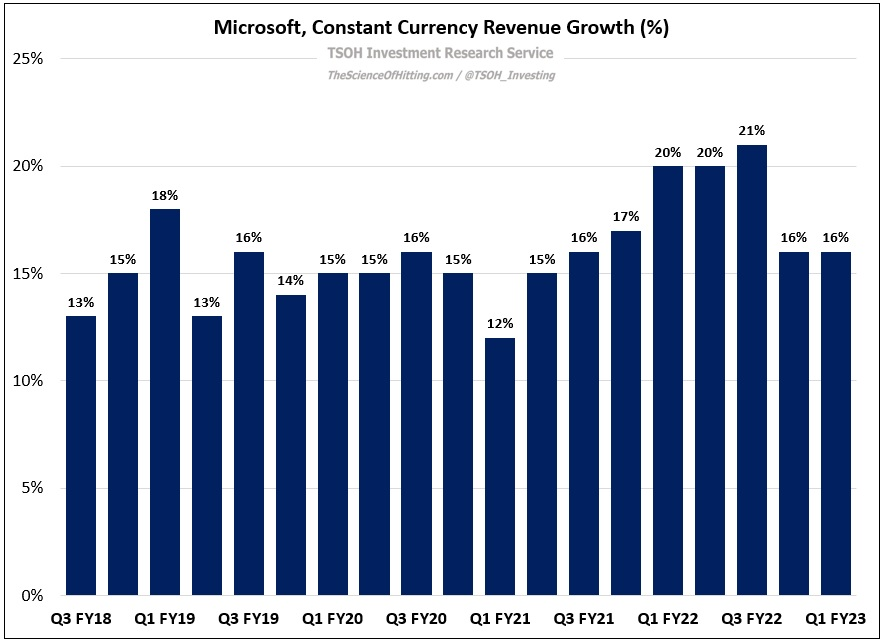

The specific impact of those macro headwinds, in combination with some COVID pull-forward over the past few years, will largely be felt in the Consumer businesses, most notably due to weakening advertising spend and PC demand. On the other hand, the Commercial businesses appear set for ongoing strength, with management guiding to ~20% constant currency revenue growth in FY23. (In Q1, the consolidated business continued to perform solidly, with constant currency revenues +16% YoY.) The reason why is largely attributable to the next focal point of Nadella’s discussion on the Q1 call: Microsoft is a key technology partner as client’s pursue “digital transformation”, which is imperative to their long-term competitiveness.

This need is structural, with Nadella arguing it’s importance rises during tough times (like now): “Moving to the cloud is the best way for organizations to do more with less. It helps them to align their spend with demand and mitigate risk around increasing energy costs and supply chain constraints.”

As he often does during the prepared remarks, Nadella spoke on the Q1 call about a few clients who are employing Microsoft solutions to operate more efficiently and effectively. For example, he spoke about Azure Arc, a service that enables customers to run Azure services regardless of the complexity within their IT environment (which may span on prem, multi-cloud, etc.).

While I do not deeply understand these things from a technical perspective, what’s evident to me is that services like Azure Arc are built to flexibly serve a wide range of client needs (his discussions on SAP workloads and Oracle databases are another example). It may be a somewhat obvious point, but this is reflective of a mindset that starts with customer’s needs first, not Microsoft’s; this mindset enables Microsoft to truly be a partner who’s working in service of their end clients. (From there, it helps when you’re able to offer a number of best-in-class solutions across the tech stack, alongside potentially meaningful cost savings for clients: “Security continues to be a top priority for every organization. Microsoft is the only company with integrated end-to-end tools spanning security, compliance, identity and device management, and privacy across all clouds and platforms… [Clients] can save up to 60% when they consolidate our security stack…”)

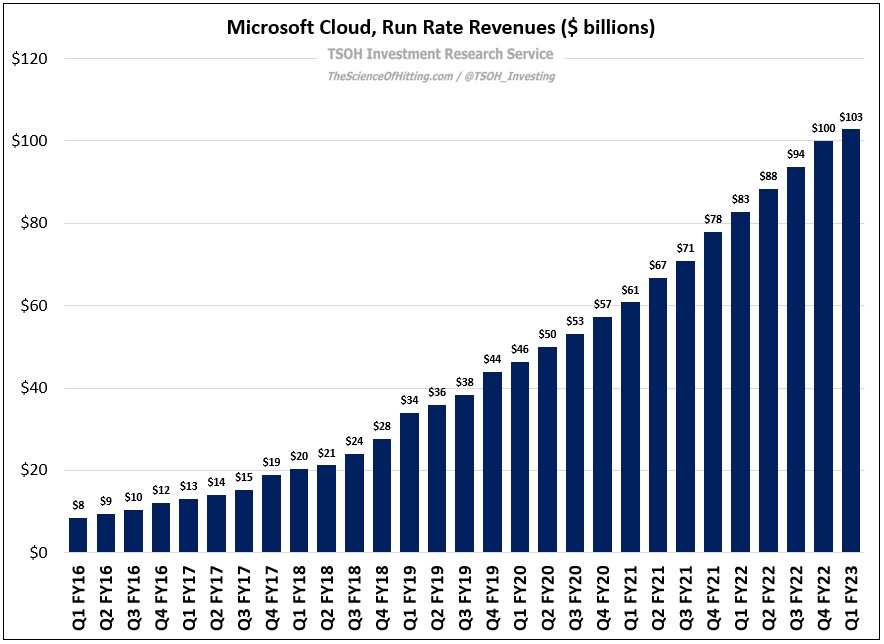

Microsoft Cloud reported another solid quarter in Q1, with constant currency revenues +31% YoY. As shown below, the Cloud businesses ended Q1 with run rate revenues of ~$103 billion, up >5x from five years ago (~$20 billion in Q1 FY18). Over this period, Cloud gross margins expanded by ~1,500 basis points, which speaks to the inherent leverage that this business offers at scale. At a time when the investment community is obsessively focused on quarterly results (even more so than usual), a review of the long-term results serves as a useful reminder that this is what ultimately matters. In the case of Microsoft Cloud, I’d argue you can own a best-in-class competitor operating in a structural growth market with an immense TAM; that doesn’t tell us much about how the results will shake out over the next few quarters, but it leaves me highly confident that the Cloud businesses will be much stronger when we look back in five years. (On that point, if Azure misses quarterly estimates by a point or two because Microsoft is helping customers optimize workloads, that’s a good thing in my mind; as CFO Amy Hood put it, “This is how you drive share gains, build customer loyalty, and help customers grow”.)

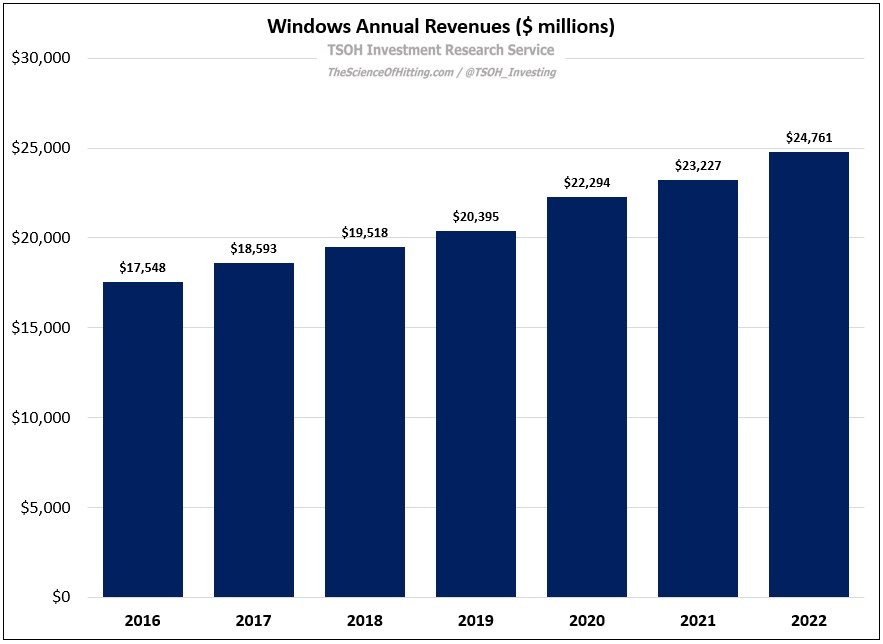

The ongoing strength in the Commercial businesses is being partially offset by weakness in Consumer. Most notably, Windows OEM revenues were down 15% YoY in Q1, which was inclusive of a five point benefit from the prior year Windows 11 accrual. Given that management expects the “materially weaker” PC demand that they saw at the end of Q1 to continue into Q2, alongside much tougher comps (lapped +10% in Q1 FY22, with Q2 FY22 at +25%), Windows OEM will report some ugly Q2 numbers: for the quarter, Hood expects Windows OEM revenues to decline by more than 30% (and those are some high margin revenue dollars for Microsoft).

That said, I’d mirror the comments made above about focusing on long-term results. My investment in Microsoft dates back to 2011, a time when “the death of the PC” was a common refrain. With the benefit of hindsight, that conclusion was misguided: Windows revenues in FY22 were $24.8 billion, with a trailing five-year revenue CAGR for the business of +6% per annum. While the short-term results are pressured, this franchise has proven its strength and sustainability over the past decade; personally, I expect that to continue in the years ahead. (From the Q1 call: “ Despite the drop in PC shipments during Q1, Windows continues to see usage growth; there are nearly 20% more monthly active Windows devices than pre-pandemic.”)

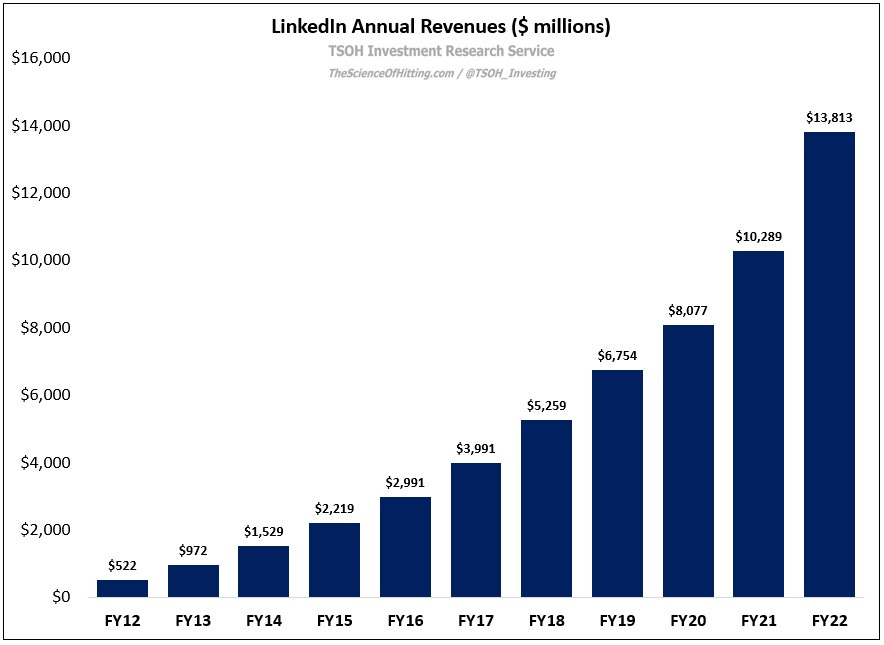

The other notable weak spot in Consumer is tied to advertising. For example, at LinkedIn, despite continued platform engagement growth, management expects mid-to-high single digit revenue growth in Q2 (up low-to-mid teens growth in constant currency), down meaningfully from the mid-30’s revenue growth that LinkedIn reported in FY22. Personally, I think this pressure on short-term results obscurers a bigger – and more important – takeaway: LinkedIn has made significant progress over the past few years. As noted on the Q1 call, the service now has 875 million members around the world, up ~30% from pre-pandemic levels. In addition, as shown below, the business generated nearly $14 billion in FY22 revenues, up >3x since the acquisition was completed in FY17. Finally, Microsoft is making incremental investments to continue improving the service, for users and advertisers alike (the acquisition of EduBrite is a recent example). Long story short, while the macroeconomic environment is clearly impacting its financial results in the short-term, LinkedIn remains well positioned for the long-term.

Conclusion

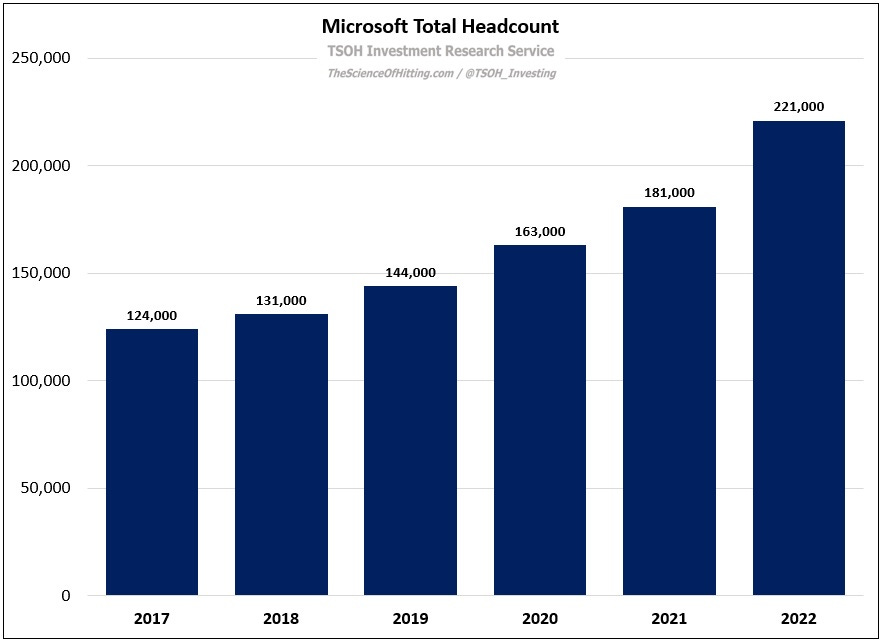

As noted in the Nadella quote at the outset, Microsoft is focused on disciplined management of its cost structure. While Q2 operating expenses are expected to increase high-teens from the year ago period (in constant currency), Hood also noted that the company expects total sequential headcount growth to be “minimal”. Given that Microsoft has added nearly 100,000 employees (net) over the past five years, inclusive of 40,000 net new hires in FY22 alone, I think it’s safe to assume that there’s some room for improvement / efficiency internally. (By the way, I’d argue that’s a perfectly reasonable outcome following a tumultuous period like the past few years.)

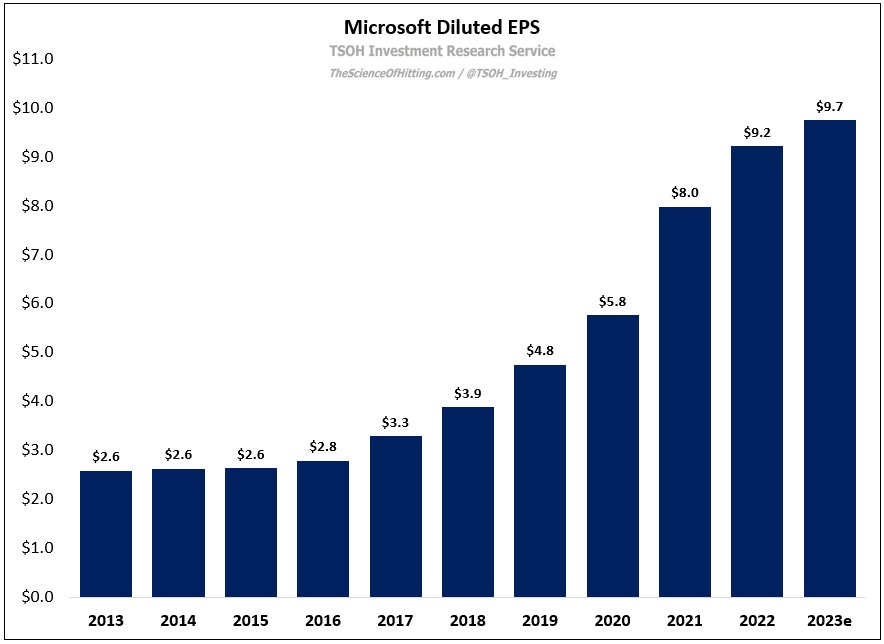

For the full year, management continues to expect double digit revenue growth on a constant currency basis; note that this is a change from the Q4 FY22 commentary, when management said that they expected double digit revenue growth in FY23 in constant currency and on a reported basis (the expected fully year FX headwind to revenues worsened ~100 basis points since then, to ~500 basis points). Said differently, it seems that double digit reported revenue growth is no longer in the cards. That change in expectations will also work its way through the income statement, which ultimately surfaces as a decent headwind to EPS growth (versus prior expectations). On my numbers, FY23 EPS is likely to land a bit shy of $10 per share (up mid-single digits YoY). At Friday’s close of ~$236 per share, the stock trades at roughly 24x FY23 earnings. (Needless to say, the earnings multiple on the stock has contracted meaningfully over the past year or so.)

As mentioned earlier, I’ve owned Microsoft since 2011 (it has been one my largest positions over that entire period). As I think back on my experience with this investment, it has served as a useful reminder that long-term business results are what ultimately drive outcomes for the stock price (assuming you start and end with a “reasonable” valuation). As I look to the years ahead, I remain as confident as ever that Microsoft is well positioned to help organizations of all shapes and sizes to embark upon their own digital transformation, while being properly compensated for the value that they bring to the relationship. (“In a world facing increasing headwinds, digital technology is the ultimate tailwind.”) While it won’t be a straight line, I remain convinced that Microsoft will be a much more profitable business in five to ten years than it is today. For that reason, I think it’s highly likely that Microsoft will continue to be one of my largest positions for years to come.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.