"You've Got A Very Good Business"

Some thoughts on price increases for O365 Commercial

“Basically, the single most important decision in evaluating a business is pricing power. If you have the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price a tenth of a cent, you have a terrible business. I’ve been in both and I know the difference.”

- Warren Buffett, FCIC Interview (May 2010)

Last Thursday, Microsoft (MSFT) announced price increases for the Commercial SKU’s of Microsoft 365 and Office 365 (effective March 1st, 2022). As Jared Spataro, Corporate VP for Microsoft 365, noted in a blog post, this was the first “substantive” price increase for the service since Office 365 was launched in June 2011 (Microsoft 365, which launched in 2017, includes Office 365, Windows 10 and EMS within a single offering).

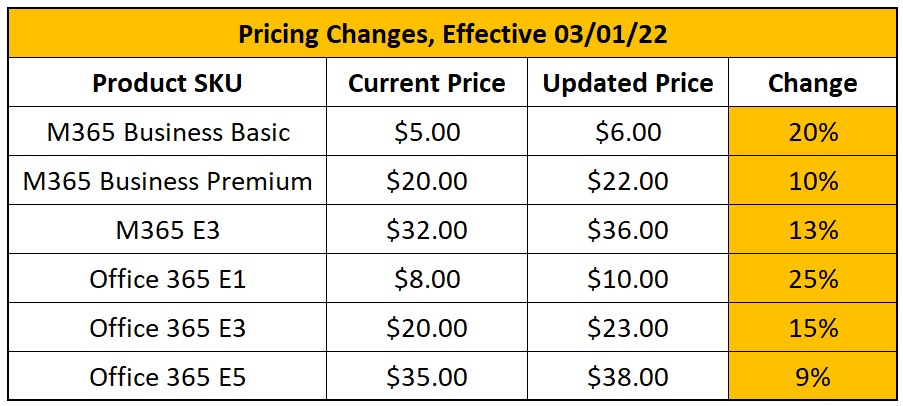

The pricing changes are as follows:

Two things about these pricing changes jump out to me.

First, these are significant price changes; the simple average across the six plans is a mid-teens increase (+15%). Naturally, this should result in a nice bump for the financials over the coming 12-24 months (more on this in a minute).

Second, the changes are structured to encourage the adoption of higher value tiers; for example, the Office 365 E1 price increase (+25%) is significantly larger on a percentage basis than the E5 increase (+9%). That is also true for the Microsoft 365 SKU’s, with the price for the highest (E5) tier remaining unchanged at $57 per month, while the other tiers will see double digit price increases. Mix shift to the higher value tiers has been a notable development in recent years, with Office 365 Commercial revenue growth consistently outpacing paid seats (in FY21, O365 Commercial revenues were +22%, while paid seats were +17%). Considering that <10% of the Office 365 Commercial installed base is on the E5 SKU (disclosed on the Q4 FY21 call), this is a massive long-term upsell opportunity for Microsoft (Spataro: “We've just seen tremendous, tremendous strength and momentum in E5 lately”).

I also think this comment from the blog post is noteworthy:

“Since introducing Microsoft 365, we have added 24 apps to the suites - Microsoft Teams, Power Apps, Power BI, Power Automate, Stream, Planner, Visio, OneDrive, Yammer, and Whiteboard - and have released over 1,400 new features and capabilities...”

A few of these apps, most notably Teams, have become foundational to the Office ecosystem. This speaks to an important competitive dynamic for Microsoft: given their industry leadership (over 300 million Office 365 commercial paid seats), they are well positioned to support the growth and adoption of new apps (as CFO Amy Hood put it in 2015, “adding new things to the Office umbrella”). As a result of expanding the scope of Office, while simultaneously continuing to add new features and capabilities to the legacy applications within it, they can take pricing to support further investment, as well as to increase revenues and profitability (EBIT margins in the Productivity & Business Processes segment have increased by roughly 900 basis points over the past three years). That, in my mind, is one the key competitive advantage of this business.

The transition to a recurring revenue (SaaS) model has created significant financial tailwinds for Microsoft, in addition to tangible benefits for customers (the 1,400 new features and capabilities mentioned earlier can be deployed to everyone, everywhere, with the push of a button). These thoughts apply to the Consumer Office business as well, where the total subscriber base has roughly doubled over the past four years (the Personal plan costs $69.99 per year and the Family Plan costs $99.99 per year, at least for now).

Conclusion

As you can see, Office Products & Cloud Services revenues increased to roughly $40 billion in FY21, with a trailing three-year revenue CAGR of +12%.

What impact will this decision have on Microsoft’s financials? Based on disclosures in the 10-K, we can estimate Office Commercial revenues of $33 billion a year, with ~75% of paid seats attributable to the cloud offerings (the company disclosed in Q1 FY21 that Office 365 accounted for >70% of its Office Commercial paid installed base). If we assume a 15% ARPU increase across the entire Office Commercial customer base, these price hikes will add roughly $5 billion in incremental (and high margin) revenues.

For the company as a whole, relative to FY21 operating income of $69.9 billion, that amounts to a mid-single digit EBIT increase (+7%). Naturally, this conclusion is overly simplistic (it assumes perfectly inelastic demand), but that gives you a rough sense of the broader impact of this price change.

Overall, as a long-term Microsoft investor, I think it’s the signal from this pricing decision that I find most encouraging. It speaks to the broad dominance of the Office productivity suite, as well as management’s confidence in its ability to maintain – or more likely strengthen - its position in the years ahead.

I’ll leave CEO Satya Nadella with the final word (this was in response to a question on the Q3 FY19 call about the long-term opportunity for Office):

“We continue to see significant opportunity going forward on multiple dimensions. For example, in the past we never participated much in, I would call it, non-developed market SMB’s… now, with SaaS, you can reach a much broader base of business customers all over the world. The second opportunity, if you look at Teams for example, we are reaching a lot of front-line workers. So, whether it's in health care, manufacturing, or retail, not just knowledge workers, but you now have messaging solutions as well as business process workflows integrated. So, it's that combination of going from knowledge workers to first-line and the ability to reach businesses of all sizes of that’s going to continue to help us have overall feet growth or socket growth [user growth].”

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial adviser or in any fiduciary capacity.

Great O365 SKU update! Not sure about MSFT, but I'm starting to feel that in a few years people will start to get irritated by the whole SaaS/subscription model. Anecdotally whenever I see a Teams or WebEx invite, I sort of cringe because I prefer Zoom at this point. As an investor I totally understand trying to buy cheap 'annuities' but as a consumer I'm starting to dislike it. I have a large position in $UI because they sell license-free networking and video cameras. On the enterprise side, Cisco/Meraki have a boat load of licensing fees and equipment becomes a dead brick if they aren't paid, which strikes me as a bit unfair. For security cameras I've unsubscribed from Arlo since I feel the fees are unreasonable for a simple job of storing camera footage and $UI has no monthly data storage fee. At some point if fees become unreasonable and products don't add value there will be a customer revolt. "There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else."- Sam Walton

Your comment made me realize I can like and comment on these! lol Office go brrrrrrrrrr