Dollar General: From Bad To Worse

In March 2023, the Dollar General investment thesis appeared intact.

The company had reported +4% comps over the prior year (fiscal 2022), with 2023 guidance calling for a similar outcome (roughly in-line with reasonable normalized expectation for the retailer). In addition, with help from ongoing new unit growth and repurchases, the company was expecting EPS growth of roughly 10% against the $10.7 per share that it earned in 2022 (adjusted for the 53rd week). At ~$210 per share, DG traded at ~20x 2023e earnings.

Fast forward to today: the stock closed on Friday at $130 per share.

As opposed to ~$11 per share, management’s 2023 EPS guidance (at the midpoint) is now at ~$7.7 per share – 25% below 2022. What has led to such significant downward pressure on the financial results for a seemingly straightforward business (a rural grocery store)? In addressing that question, we will move one step closer to an investment decision: has something fundamentally changed at Dollar General, or is recent pressure on the stock (and business) an attractive opportunity for long-term owners?

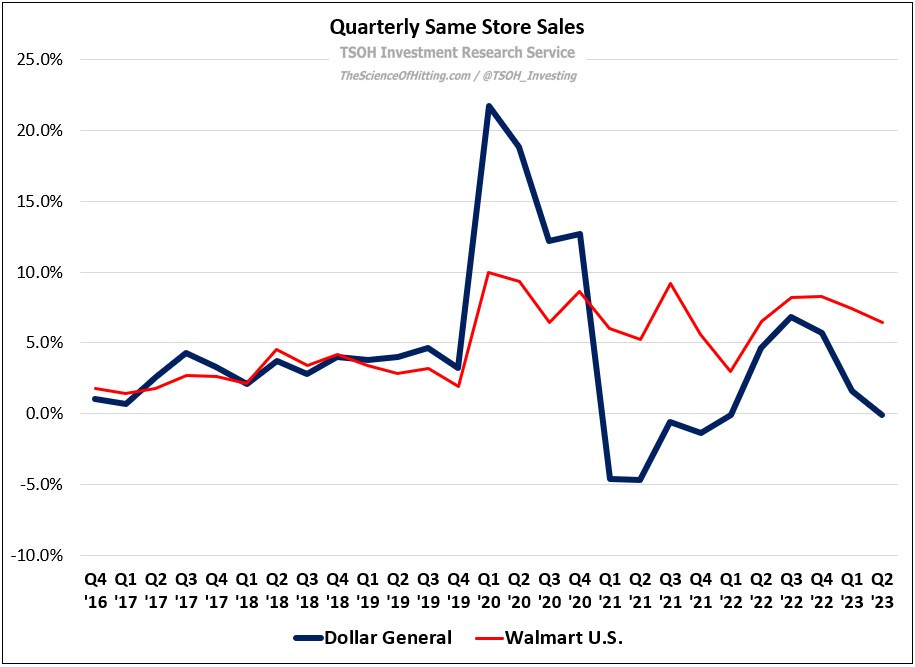

To answer that question, I think we need to start by taking a step back; before we can talk about where DG is going, we need a good understanding of where they’ve been. As I think about this, I find it helpful to compare DG to its foremost competitor, Walmart (the U.S. segment). As shown below, they reported very similar comps in the years leading up to the pandemic: from Q4 2016 to Q4 2019, the widest gap in any quarter was less than two percentage points. That has completely changed over the past three and a half years: since the beginning of 2020, comps that have been anywhere near each other for DG and Walmart U.S. has been the exception, not the rule.

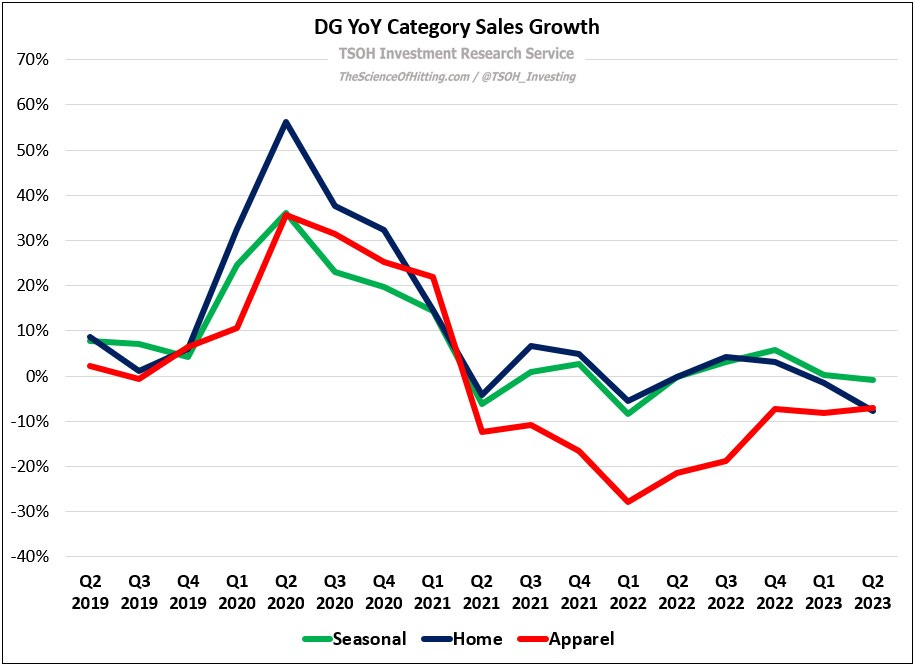

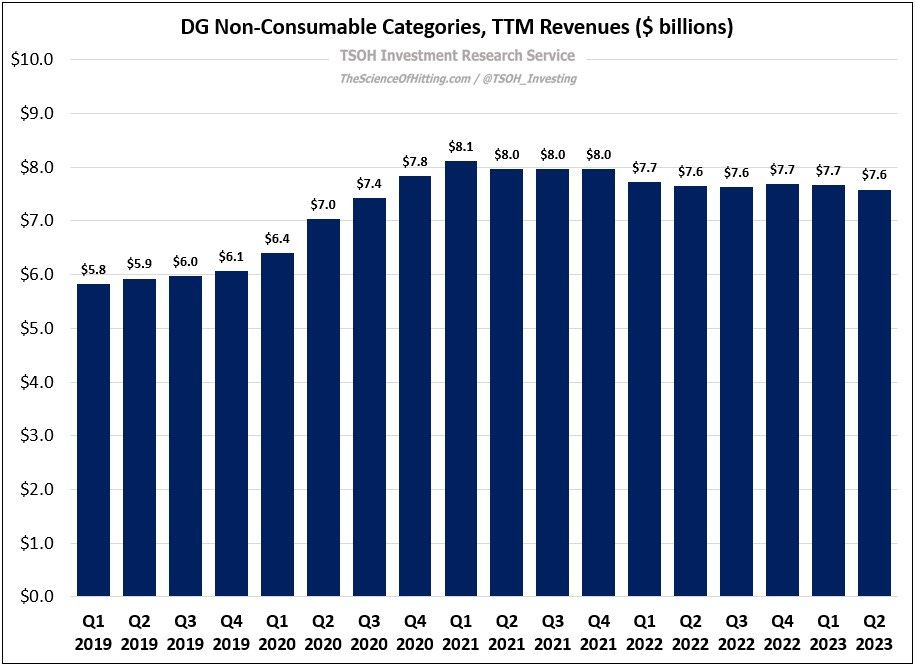

While DG outperformed in 2020 (by a huge margin), largely due to a ~30% YoY increase in Non-Consumable category revenues (Home, Apparel, and Seasonal), they’ve lagged ever since. Let’s zoom in on the most recent quarter: as discussed on Walmart’s call, the ~6% increase in its U.S. comps was attributable to a high single-digit increase in grocery and a high-teens increase in health & wellness, partially offset by a low-single digit decline in general merchandise. By comparison, Consumables sales at DG were +6% YoY in Q2, which implies (after adjusting for ongoing unit growth) comps up low-single digits. In addition, as you can see below, the Non-Consumable categories at DG have continued to struggle against the strong results (base) set back in 2020. Said differently, I don’t think you can argue the current shortfall is a mix issue; the explanation that appears more closely aligned with reality is DG has been outran on all fronts as of late (particularly in Apparel, where its business in Q2 2023 was ~15% smaller than in Q2 2019).

Now, with all that said, a quick reminder that DG’s Consumables business has added ~$10 billion in incremental revenues since the end of 2019 (+47%); by comparison, Walmart’s U.S. Grocery revenues increased by roughly 30% from yearend FY20 (~$192 billion) to yearend FY23 (~$247 billion). Long story short, some headwinds have clearly crept in over the last few quarters – but I do not think the recent results, particularly in DG’s Consumables business (which accounts for about 80% of the company’s revenues), support the conclusion that this has been simmering for years.

Family Dollar

The comps comparison between DG and Family Dollar tells a different story than with Walmart. After consistent outperformance by DG in the years prior to the pandemic, the patten has been less clear since 2020. Zooming in on the performance over the past six months, which coincides with another turnaround effort at FDO, DG is now underperforming by a wide margin.

This is most evident when looking at Consumables; as shown in Dollar Tree’s Q2 supplemental financial presentation, FDO comps in the Consumables category grew by nearly 10% in 1H 2023 (as a reminder, that compares to my estimate of low-single digit Consumables comps at DG). While Consumables are a bright spot at FDO, the banner is facing its own share of difficulties in Non-Consumables (Discretionary). In addition, there is no reason to believe at this time that sales growth at Family Dollar is translating to sustainable profit growth (1H 2023 EBIT margins for the banner were down 200 basis points YoY). If this outcome at FDO coincides with short-term pressures at Dollar Tree’s namesake banner, I continue to question how much leash Mr. Market – and ultimately the company’s management team – is willing to give Family Dollar (DLTR’s stock also fell 10%+ after reporting Q2). All-in, I think that FDO remains a manageable long-term competitive threat for DG.

Financials

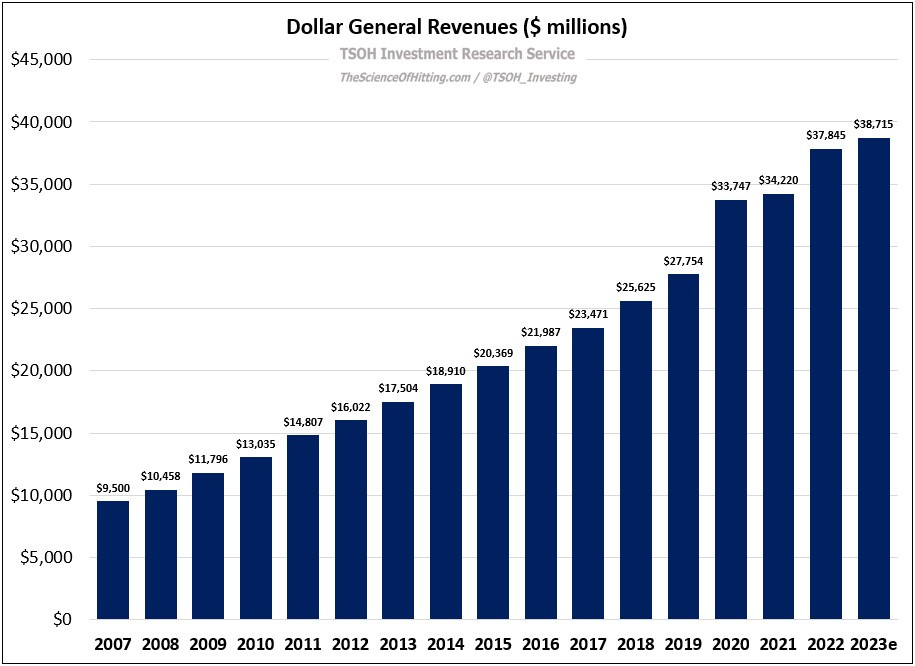

On updated guidance, DG management expects 2023 revenues of ~$38.7 billion. If we compare this to pre-pandemic levels (2019), that works out to annualized revenue growth of 9% (roughly in-line with what analysts were likely expecting over a multi-year period for DG before the pandemic).

The problems arise as we move down the income statement. Specifically, DG is likely to report 2023 EBIT margins of less than 7% - by far its worst result over the past 15 years. This reflects sustained margin pressures from a number of sources (Consumables mix shift, shrink, product cost inflation), as well as incremental labor investment / SG&A deleverage against lackluster comps; these factors have culminated in a significant hit to profitability. (And on a few variables, like labor, the higher spend is likely to be sustained.)

Will these pressures endure?

As I see it, the bear case for Dollar General is best explained by examining Walmart’s results since Doug McMillon became CEO. Over the past decade, the company has invested to sharpen its price points, to improve the cleanliness and efficiency of its U.S. stores, and to build out e-commerce (omnichannel) solutions like pick-up / delivery that can more effectively compete with DG’s value proposition (said differently, better positioned to compete for certain purchase decisions that they may have been losing to DG previously). While I think these investments were clearly the right ones for Walmart over the long-term, their sustained impact is still evident in today’s P&L: Walmart U.S. FY23 EBIT margins are still well below FY13 levels.

I think a discouraging outcome for DG investors could take a similar shape: an extended period of margin compression from a combination of price investments and rising costs. (From the opening remarks on the Q2 call: “We are continuing to improve execution… providing our customers with even lower prices and an improved shopping experience.”) Again, to the extent that this materializes, I think it’s not insignificant to consider what that would ultimately mean for Family Dollar. (Remember that Dollar Tree management has guided to 5%+ EBIT margins at the banner by FY26; as that date gets closer, I’m confident that they’ll prioritize profitability over sales growth.)

Conclusion

As noted at the outset, the DG story has gone from bad to worse over the past six months. The Q2 results and guidance were both underwhelming, and there’s clearly work to be done to improve the trajectory of the business.

In times like these, it’s natural to become excitable. More often than not, as a clearer picture of reality emerges, it’s often not so different from what existed previously (as they say, “this time is different” are four dangerous words).

Since the TSOH Investment Research service launched in April 2021, we’ve faced a few of these situations together; some that come to mind are Netflix, Meta, Disney, Comcast, and Liberty Broadband. Each case has been difficult because it simultaneously demanded patience / a long-term perspective and a willingness to act aggressively in the face of opportunity or risk (as I once wrote, “this is when it all matters”). I’m just as susceptible to these emotions as anybody else. That said, I find it helpful to try and remember what the (or at least my) objective is: to own high-quality businesses with best-in-class management teams for the long-term. The “right” decision may be to add more, but only if it passes that test (i.e. not just because it’s “cheap”).

So, with that, I want to be clear about where my head is currently at on Dollar General: (1) I think this is a high-quality business that has succeeded over time by consistently providing an attractive value proposition to its core customer – specifically, a balance of convenience and good prices; (2) Its geographic mix and scale (unit count + AUV’s) supports certain competitive advantages; (3) I have some concerns about present management, which has been further exacerbated this quarter; (4) While Family Dollar has generated impressive sales figures as of late, I believe that this will be a manageable competitive concern for DG; (5) My biggest competitive concern, on the margin, is Walmart’s ability to leverage e-commerce / omnichannel to effectively meet certain use cases that it did not truly have effective solutions for 10 years ago (specifically, I’m thinking of an online grocery order that can now be picked up in Walmart’s parking lot or delivered to a customers’ home).

At $130 per share, DG has a market cap of roughly $28 billion; relative to management’s EPS guidance, it trades at ~17x 2023e earnings. As shown earlier, that is with EBIT margins of less than 7% (~250 basis points lower than what DG has reported, on average, over the past decade). If you believe this is a temporary blip, you’re likely to do quite well buying at current levels.

Personally, I’m not ready to take that step at this time. While I believe Dollar General has competitive advantages, that alone does not guarantee success (with enough time, business quality in retail will be impacted by management quality). Specifically, I think it is imperative for DG to close the comp gap with Walmart U.S. / Family Dollar; in the coming quarters, my primary focus is some assurance that management is unwilling to lose significant mind / wallet share (again, I think Dollar Tree management will face a lot of pressure on their turnaround efforts if the results at Family Dollar become more challenging in the coming quarters). Until that happens, I’m unlikely to add more; along those lines, if the trajectory at DG does not change (the comp gaps relative to WMT and FDO), I will likely sell.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.

This is a very minor thing but it'd be helpful if graphs that cross from positive to negative values could have the "0" guide specially marked in some way. The YoY category sales and Quarterly SSS graphs in this post were a little tricky to read; category sales in particular where "seasonal" and "home" spent time bouncing across the border, which made it hard for me to get an immediate visual intuition about while reading the rest of the article.

Alex - Really appreciate the honest assessment. Curious to get your view. Does this steep drop in margins break the investment thesis? I doubt anyone had EBIT margins dropping from > 9% to < 7% even in the downside case scenarios. I assume most folks had DG as a source of stable earnings through economic cycles. Does it raise any concerns that the business might not be as strong as you initially believed?

To me, it feels like DG is more of a “B” business (names like MSFT, SPGI and V would be examples of “A” businesses). Maybe I am 100% wrong, and this poor margin performance is just the perfect storm combined with management execution errors. But I just am not nearly as confident as I used to be that I could forecast DG earnings. And with all of the operating leverage, even small changes to margins really move the needle.