DG: Competitive Concerns?

Note: My fiancé and I tied the knot a few weeks ago, and we’re heading to California for our honeymoon (as a dutiful Berkshire Hathaway shareholder, I purchased her engagement ring and her wedding ring from Borsheims).

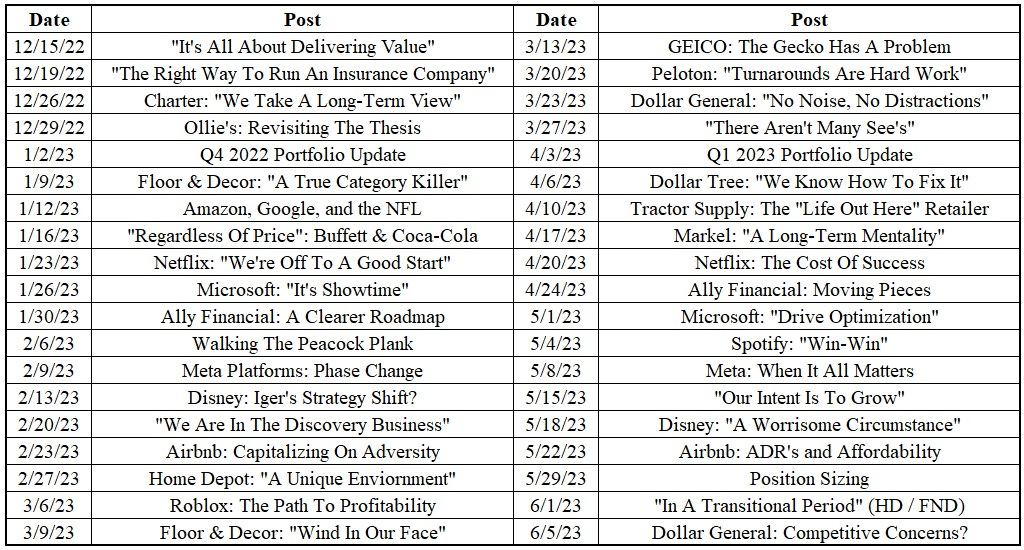

As a result, TSOH will be off next week; if you need some reading material in the interim, see below for a list of TSOH posts from the past six months. I’ll be back on Monday, June 19th, with a deep dive on EDR and WWE / TKO.

From “Short-Term Stumbles” (December 2022):

“The relative results at DG and Walmart speak to the importance of the two variables called out above (convenience and value). In a tough macro environment with significant cost inflation, you can appreciate why Walmart’s everyday low prices resonate with consumers. The fact that DG has been able to roughly keep pace with Walmart’s growth during a period like this is a testament to their unique value proposition; DG doesn’t necessarily have the lowest prices, but their customers also value convenience, which helps to level the playing field (with an average ticket of less than $15, you can understand why someone might be willing to pay another $1 - $2 to avoid ~15 minutes of extra driving / shopping time on their way home from work).”

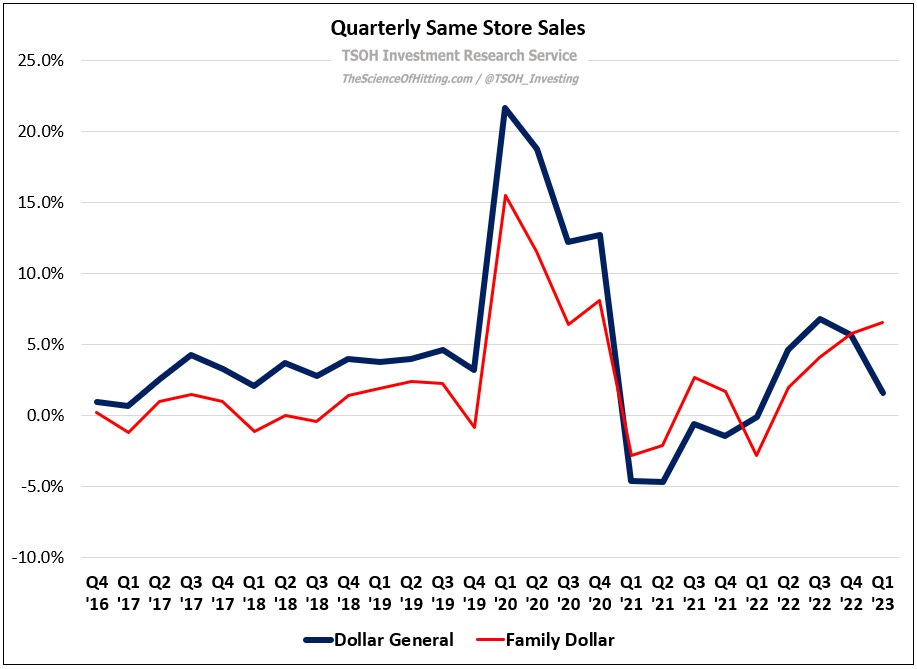

Dollar General reported underwhelming results in the first quarter. As I’ll discuss in today’s post, I think those results were particularly discouraging when compared to the performance at some of their competitors, most notably Walmart U.S. and Family Dollar. As noted in the above quote, DG’s customer value proposition is built upon striking the right balance between convenience and value. In order to sustain its competitive advantages, the company must repeatedly reinforce that position in the marketplace; this is a competitive industry that continuously demands effective execution.

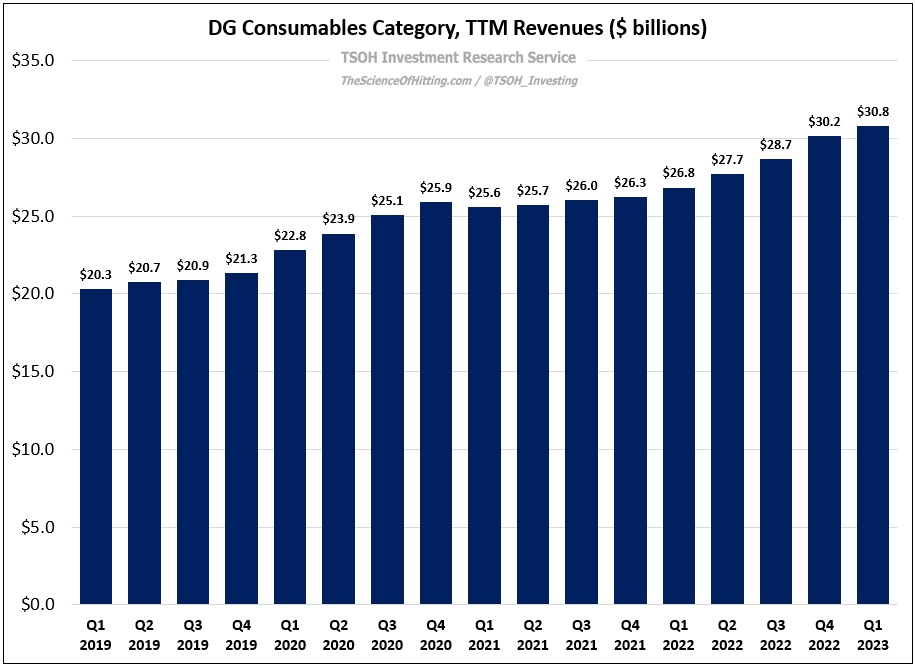

As I’ve discussed previously, DG is effectively a (largely) rural grocery store – and while the business has historically been driven by consumables, that mix has drifted even higher over the past two years. (Consumables accounted for 80% of TTM revenues in Q1 FY23, up 400 basis points from Q1 FY21; all else equal, that shift was a 40 - 80 basis point headwind to gross margins.)

This brings us to the most notable figure in DG’s Q1 FY23 results: despite the pressure from ongoing mix shift to lower gross margin consumables and product cost inflation, the company’s gross margins increased by ~30 basis points, to ~31.6% (as noted in the press release, a key driver of this result was higher inventory markups). To put that number in context, Walmart U.S. gross margins declined by ~40 basis points in the most recent quarter, with Family Dollar gross margins declining by ~100 basis points, to ~24.8%, partly due to the impact from pricing actions taken last year to bring FDO pricing “more in line with direct competitors”. (Walmart doesn’t break out its U.S. segment gross margins, but I estimate that they’re in the mid-to-high 20’s.)

As you think about those results, note that DG’s consumables revenues increased by ~9% YoY in Q1, to $7,583 million; after accounting for store growth over the past year, DG’s per store (comp) consumables revenues were up ~4% YoY. By comparison, Family Dollar’s consumables revenues were up ~11% YoY in Q1 FY23, to $2,714 million, with per store (comp) consumables revenues up ~9% YoY. Finally, as disclosed on Walmart’s most recent quarterly call, their food and consumables sales in the U.S. business increased low double digits YoY (WMT’s U.S. unit count actually declined by ~1% YoY, so this understates its per store / comp consumables growth; as shown in the 10-Q, U.S. Grocery sales were +12% YoY to $63,407 million.).

Long story short, these figures suggest that DG underperformed / lost market share relative to its closest competitors in Q1. When combined with the gross margin data, I wonder if a partial explanation for that outcome is related to pricing decisions. (The relevant thing to consider on the DG / FDO gross margins chart shown below is the trend; specifically, the spread has widened by ~150 basis points since 2020. The absolute figures are not solely reflective of product pricing, given certain cost advantages at DG from ~30% higher per store revenues, different accounting treatments for occupancy costs, etc.)

There’s some nuance required here – most notably, we’re talking about three months of financial results - but I think that this could be a fair summation of what happened: The macroeconomic environment is putting pressure on each of these retailer’s core customer; at the same time, Walmart is dealing with its own mix issues (ongoing headwinds in their general merchandise categories), and DLTR has implemented pricing actions at Family Dollar in hopes of reviving the struggling banner. The combination of these factors led to acutely competitive conditions in Q1, particularly within consumables. When we layer on the YoY change in gross margins reported at each retailer, it makes me wonder if DG wasn’t as aggressive on its pricing decisions as these competitors, most likely for essentials (less attractive price gaps).

If that’s the case, it would explain why some customers voted with their wallets and chose to shop elsewhere. (If there’s an alternative explanation that is uniquely specific to DG’s business, I think management did a poor job of explaining it.) If this conclusion aligns with reality, I think the right decision for DG is to defend its customer relationships; taking the short-term hit to profitability is a better route than ceding wallet share to WMT and FDO for an extended period of time. (On that point, note that Walmart raised its full year revenue guidance, partly attributable to higher expectations for the U.S. business; DG, on the other hand, reduced its FY23 revenue guidance.)

Here's DG CEO Jeff Owen with his thoughts on the retailer’s Q1 print: “We had softer-than-expected sales, which we believe was primarily driven by deterioration in the macro environment, including headwinds from lower tax refunds than customers expected, reductions in SNAP benefits, and unfavorable weather in March and April.” While those factors clearly contributed to the underwhelming results in the quarter, I question whether they fully explain the shortfall. (I think this comment from the Q1 call was revealing: “There's an opportunity to get even sharper [pricing] on certain items that matter most… we are taking action to lower prices.”)

Capital Allocation and Guidance

One notable change announced on the call related to pOpshelf; specifically, the company only expects to open 60 locations this year, compared to a prior guide for 150 new stores in 2023. Given that they added 24 new pOpshelf locations in Q1, with another 30 - 40 openings likely in the pipeline for Q2, I’d read this as effectively bringing all new store openings to a halt (for now).

This comment, from Owen on the Q1 call, suggests that the banner is starting to see some pressure on its unit economics: “While sales in this economic environment are softer than our earlier results, we continue to be pleased with the customer response. Looking ahead, we are taking a balanced approach to opening the right number of new pOpshelf stores… As a result of our slower pace of openings, we are reevaluating our plans with regards to our timing of reaching 1,000 stores by the end of 2025 and plan to provide an updated expectation at a later date. We still believe pOpshelf adds ~3,000 opportunities to our total addressable market over the long term; we remain as excited as ever about the growth opportunity.”

(As an aside, DG has also lessened its growth plans in Mexico; they expect to have 20 stores by the end of 2023, down from a prior target of 35 stores.)

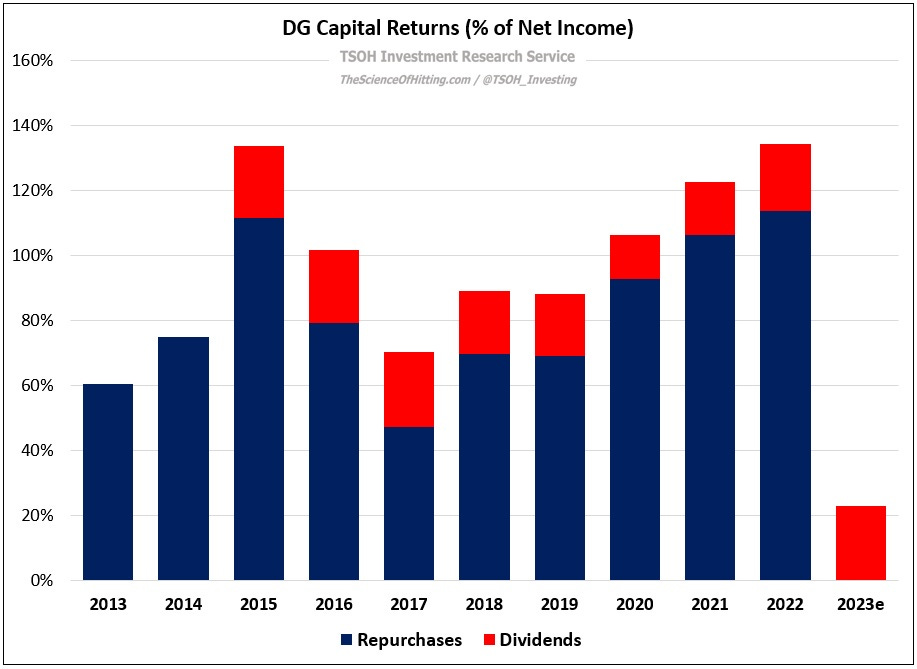

In addition to the pullback at pOpshelf, the company announced that they do not plan to complete any share repurchases in 2023 (the prior guide called for ~$500 million). As you can see below, this will be the first year that the company hasn’t repurchased any of its shares in over a decade; it follows a three-year period where capital returns exceeded 100% of net income in each year, with the diluted share count declining by roughly 15% over that period. (This is a natural outcome when you run repurchases / capital returns tightly to a leverage ratio target – you’ll buy back a lot of shares when the business is humming, but you’ll slam on the brakes when the tide turns.)

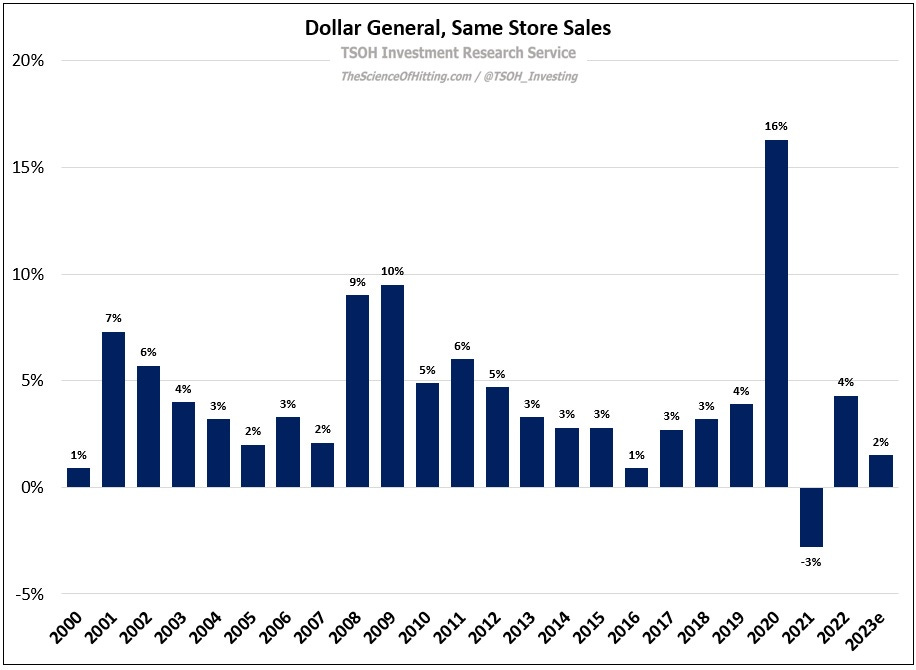

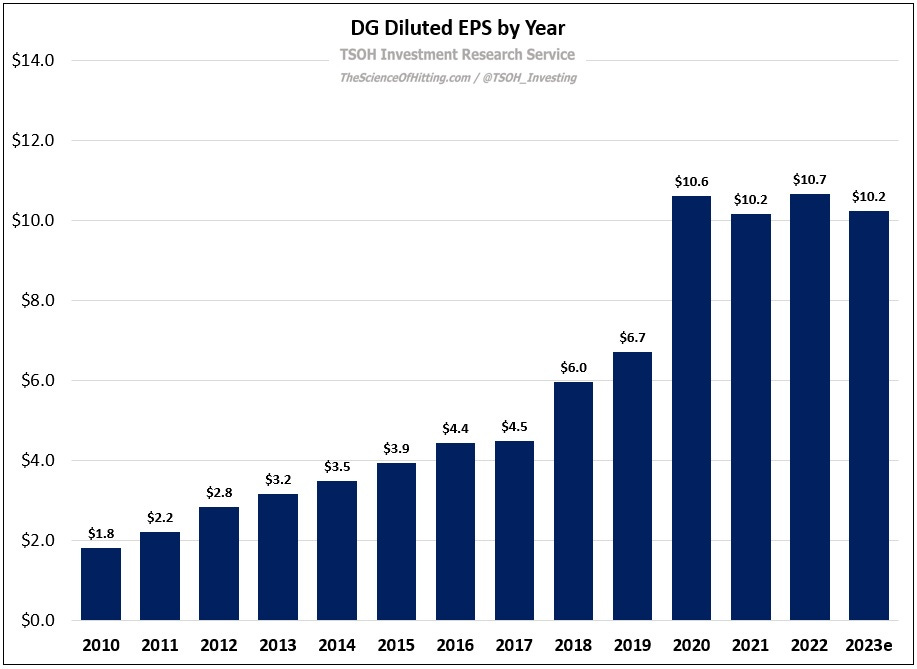

Alongside the pullback on repurchases, DG cut its FY23 guidance: for the year, management expects sales growth of 3.5% - 5.0%, down from prior expectations of 5.5% - 6.0% growth (both figures include a two point headwind from the 53rd week in FY22). The FY23 revenue guidance is inclusive of same store sales growth of 1.0% - 2.0%, down from 3.0% - 3.5% previously; as we compare this target to DG’s performance in previous difficult macroeconomic environments, remember that comps were +9.0% in 2008 and +9.5% in 2009. Due to the combination of sales deleverage, SG&A pressure from incremental wage investments, and likely gross margin headwinds, this has led to a meaningful change for profitability: the company now expects FY23 EPS to decline by 4% (midpoint), compared to a prior expectation of 5% growth (with both figures inclusive of a four point headwind from the 53rd week). Even on the lowered guide, note that this would still result in a trailing four-year EPS CAGR of ~11% for DG (2019 – 2023e).

Conclusion

DG shares fell by ~20% in response to the Q1 results and the guidance cut. While some of what’s happening at the moment is undoubtedly attributable to factors beyond management’s control, there are legitimate questions to be answered about their recent weakness relative to their closest competitors. As part of this discussion, I don’t think it’s out of line to say that Owen, who became Dollar General’s CEO in November 2022, has some work in front of him to prove that he’s the right person for the job. (I can appreciate the argument that it’s still too early to make a fair assessment of his abilities.)

At ~$166 per share, DG trades at a mid-teens multiple of FY23e EPS. The stock first reached these levels (~$160’s) in September 2019; the difference between then and now is that the company is expected to earn ~$10.2 per share this year, more than 50% higher than its FY19 EPS ($6.7 per share).

As noted on the call, management is making adjustments in response to a difficult Q1 (and in case it isn’t obvious, I think the issues they’re facing are addressable). On the consumer facing initiatives, I will be interested to see the response to a slightly more aggressive posture on (essentials) pricing: “We are taking action to provide even more affordable solutions and lower prices for our customers. We are doing this in a targeted fashion on the items that matter most, as we believe we can be even sharper in our [pricing] … Taking care of our customer is not only the right decision in the near term, but it will prove to be the right answer for the long term as well.”

I think that’s the right mindset, particularly as it relates to competing with Family Dollar. While FDO put up reasonably strong comps / sales growth in Q1, particularly on customer traffic, it doesn’t generate material profitability for DLTR (2023e EBIT of ~$100 million). If DG implements pricing actions that help to stymie Family Dollar’s traction, I question whether DLTR management will be willing to make significant incremental investments in that business over time. (If FDO is taking wallet share and reporting high-single digit comps, that’s a different story.) A more aggressive posture on pricing at DG may result in short-term headwinds to earnings growth, but that’s a price worth paying; from a long-term perspective, I think it’s the right decision.

(This answer, from CEO Doug McMillon at the company’s April 2023 Investor Meeting, offers some insight into how Walmart thinks about the key levers that drive long-term earnings growth: “When I look at what occurred with the 4% [sales growth] and the greater than 4% [EBIT growth] objective, that still feels like it was a reasonable thing to put in place… The 6% and 3% number for the last five years - if we could choose, would we have changed that to 5% and 5.5%? None of us want to give up on growth. We want growth in units and dollars to be as much as possible as we serve customers and members better. But we recognize that the operating margin does need to find its way to a higher level - we just don't want to do that [by] raising prices or anything that's detrimental to the business in the short-term or long-term. So, I think the key is how do we put productivity enhancements in place and how do we change the business model with these other income streams that are very complementary to make that a sustainable change.”)

To be clear, I continue to believe that Dollar General is a high-quality business with sustainable competitive advantages. That said, they compete in an industry that is, and will continue to be, highly competitive; the Q1 results and the updated FY23 guidance are a testament to that conclusion. It’s a business that demands a sound long-term strategic plan and consistent execution; an ability to effectively communicate with shareholders is also important to long-term success (on that point, my view is that management was ill-prepared for the competition-related questions asked during the Q&A).

DG was an 8% position as of the most recent update (given its recent performance, it’s smaller now); while I’m open to the idea of adding more, I want to review Dollar Tree’s Investor Day on June 21st, particularly as it relates to their Family Dollar plans, before making any further decisions.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.

Congratulations Alex !!

❤️