Dollar Tree: Turning Point

I’ve been following Dollar Tree for the past five-plus years (to date, that flirtation hasn’t led to an investment). Throughout much of that period, the company has been stuck in a bit of a rut, most notably as it relates to the turnaround efforts at Family Dollar. In my view, that is starting to change.

Two key events led to this moment: (1) “breaking the buck” and the rollout of the multi-price assortment at the Dollar Tree banner and (2) pressure from activist investor Paul Hilal of Mantle Ridge, which led to the hiring of CEO Richard Dreiling (the C-suite has seen significant turnover since he became Chairman of the Board in March 2022). Dollar Tree’s 2023 Investor Day, which was held on June 21st, provided an opportunity for management to lay out its assessment of the current state of affairs, along with their plan for the years forward – and it didn’t disappoint. As I’ll discuss today, I think we now have a clear vision for the future at each of the ~8,000 store retail banners.

I won’t bury the lede: I’m of the opinion that DLTR management has laid out a credible plan for significantly improving the unit economics at Dollar Tree (primarily by driving incremental wallet share, sales per store, and margin dollars, not a higher margin rate); the pricing changes announced at Dollar Tree (banner) over the past few years are critical to its long-term evolution.

Dollar Tree

Dollar Tree co-founder Macon Brock: “I viewed the dollar-only concept as sacred. It was everything. Without it, we’d be just another discount retailer, a smally fry among bigger, hungry fish. How could we compete against Family Dollar and Dollar General, variety-store chains already ensconced in thousands of small towns? How could we avoid being crushed by Walmart, which would always be able to undersell us on general merchandise?”

Unlike management, which made the noteworthy decision to start the Investor Day by focusing on Family Dollar, I’ll begin this discussion by talking about the company’s namesake banner (by my estimates, the Dollar Tree banner accounts for the vast majority of the company’s intrinsic value).

As I wrote in December 2021, my sense at that time was that Dollar Tree’s attractive value proposition (relative to the prices charged at your typical grocer or drug store), particularly in categories like greeting cards, balloons, etc., provided cover for the move to a higher price point. A few of the specific SKU’s I cited were discussed at Investor Day; consider this comment from Dollar Tree (banner) Chief Merchandising Officer Richard McNeely:

“I've got one example here, helium filled balloons. The helium shortage is driving costs up, and margins have been compressed over time. The marketplace has moved to $2 as an opening price point. So, we tested 142 stores [~2% of the base] in April at $1.50 - and we experienced zero unit decline… We can upgrade our offering; we can add licensed product, which is a better value for the shopper, as we take the price point to $1.50, while remaining well below the market price. We continue to be the price leader.”

This perfectly captures why I was confident that “breaking the buck” was a logical decision for Dollar Tree. While there are certain merchandise categories where a large percentage of the incremental price charged will ultimately be passed back to the consumer (i.e., the customer pays 25% more, but the unit size is ~20% larger), there are others – like helium balloons and greeting cards – where Dollar Tree typically offers superior value versus competitors, even at the $1.25 or $1.50 price point. McNeely’s example provides clear evidence that this theory is aligned with reality.

As McNeely noted, this decision was informed by market realities (cost pressures and competitive dynamics). These pricing changes, which apply beyond helium balloons, were a necessary response to COGS inflation; said differently, the constraint of the $1 price point presented a material risk to Dollar Tree’s business (ability to effectively merchandise its stores).

Another noteworthy example is in bagged ice:

“We've upgraded our ice program from a 5-pound bag to a 7-pound bag. The 5-pound bag was basically custom made for us. The market was at a 7-pound bag. We converted 2,800 stores in Q1, driving an 11% comp. We’re adding 2,100 additional stores this year at $2. We improved the margin and the value for the shopper, and we've also improved sales. We were on the verge of losing the ice program at $1.25. It was custom made. The vendor didn't want to make the item. They were raising the price, and we had nowhere to go. By the way, ice is in the top 50 for us every week. It's a key item, the customer is loving it, and now it’s working at $2.”

This one stands out to me because it probably caused DLTR to lose its price leadership in the category (as an example, a 7-pound bag of ice at my local Publix costs $1.79). The helium balloon and the bagged ice examples, along with others discussed at Investor Day, show the balancing act faced as they continue down this road - which may require periodic course correction (at Investor Day, management said that ~5% of SKU’s are being repriced at a buck: “we're looking at the market price, and we're going to move them back to $1”). Threading this needle is critical to their long-term success.

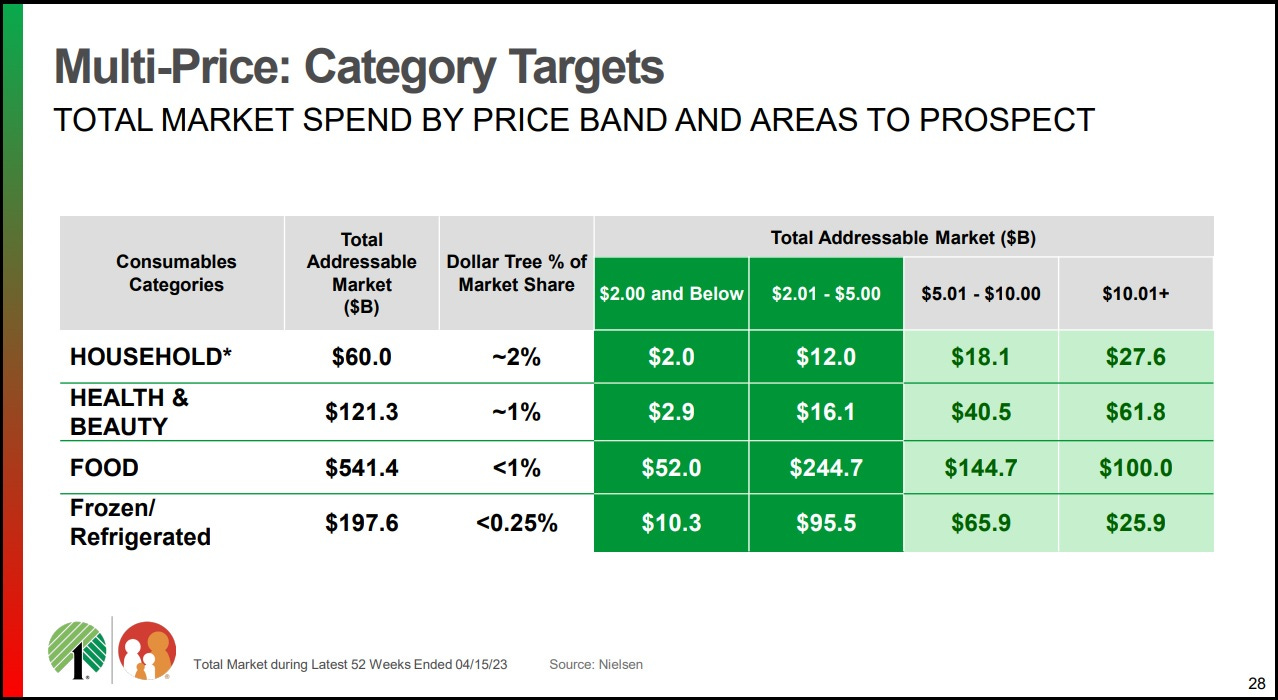

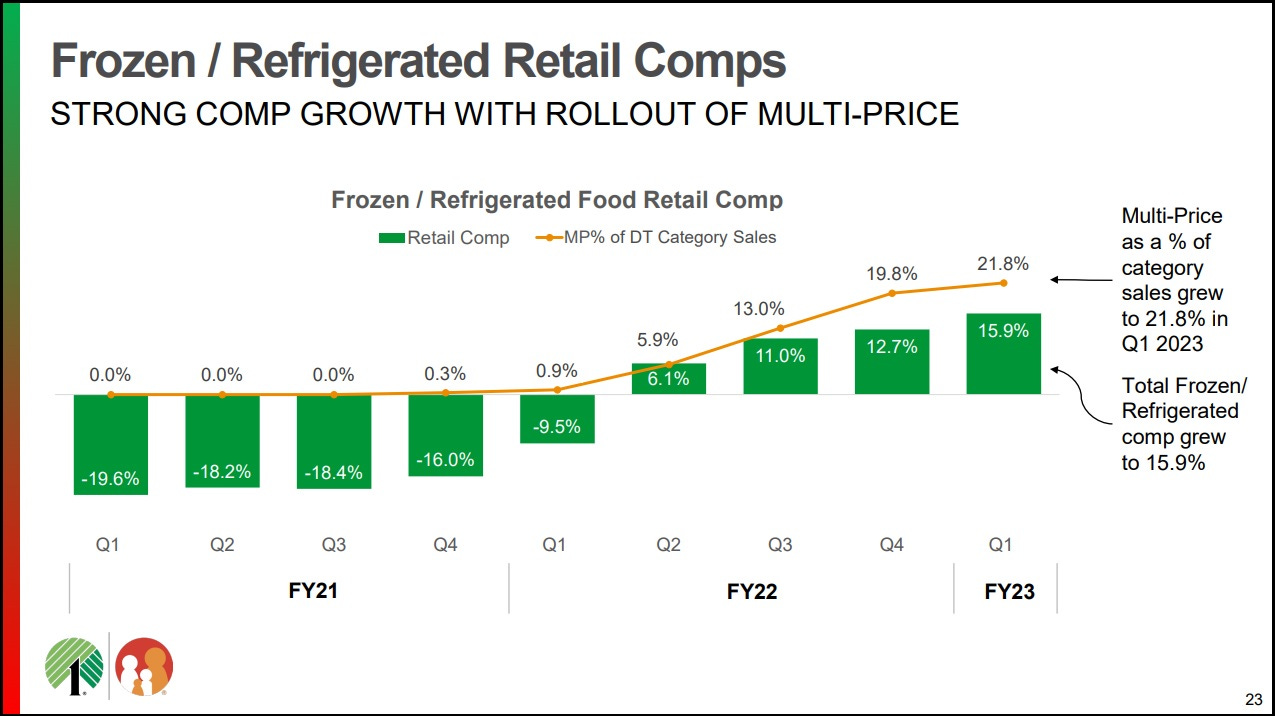

A similar idea applies in food (as you can see below, a category with U.S. retail sales of >$500 billion annually). When Dollar Tree was tied to the $1 price point, they were competing for a small sliver of the market (less than 10% of the category is attributable to SKU’s with a price point below $2). With multi-price, they can now merchandise across a wider range of customer needs; that applies to the size and the type of the offerings. (“At $1.25, we were really selling single-serve novelty [food] offerings. As we move to $3, $4, $5, the assortment includes [family] meals. We've added protein, like chicken, that fell out of the assortment… These make us more relevant, providing a better and more complete shopping experience.”)

This change will enable a significant upgrade to the quality and breadth of Dollar Tree’s food offering. (With the stores, and particularly the cooler doors, remerchandised accordingly.) As opposed to selling a single serve off-brand frozen hamburger, the company can expand into products like frozen pizzas, family offerings / meals, and branded ice cream. The opportunity for Dollar Tree is to sustain its value offerings in the $1 - $2 price range, while serving incremental customer needs at $3, $4, and $5. (Dreiling: “The multi-price journey at Dollar Tree is one of the biggest unlocks that we have.”)

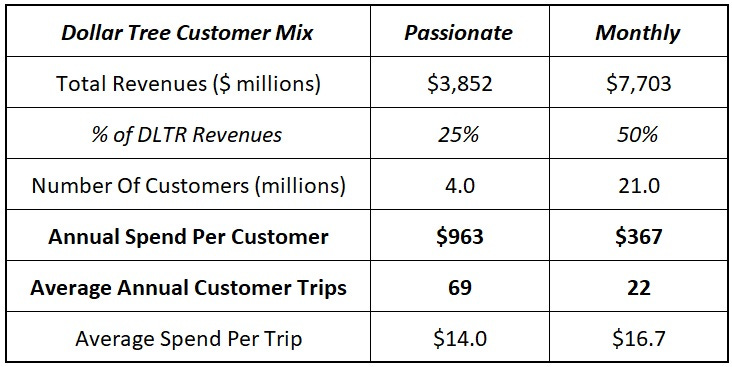

Given that individuals in their primary customer bases, which collectively account for ~75% of the banner’s annual revenues, are in the stores multiple times per month on average, this is an opportunity to take wallet share (for the diehard “Passionate” customers, increasing the spend from ~$1,000 per year to $1,250 - $1,500 per year). While there is execution risk ahead - as highlighted in the Macon Brock quote, this will alter their competitive set - a successful outcome here would be a significant tailwind for Dollar Tree.