DG: The Road To Recovery

“If you find yourself in a hole, stop digging.”

From “Back To The Basics” (December 2023):

“Dollar General has clearly struggled in recent quarters. That would not have been a major concern for me if those pressures were solely macro related (that’s life when you own a business). What was difficult to say, particularly given outsized results at Walmart and Family Dollar, was the source and magnitude of the headwinds. As I wrote in June, I believed that Jeff Owen (who became CEO in late 2022) had work in front of him to prove that he was the right person for the job. In October, the board concluded that he wasn’t, with Todd Vasos returning effective immediately. In my view, the Q3 call did a good job of showing why this change was needed. My read is that Vasos has a good grasp on what ails Dollar General, both externally (macroeconomic / competitive) and internally… That was an important step back in the right direction… With some assurances on the issues that DG must navigate, which I believe will prove fixable, along with further clarity on the macro and competitive situation, my conclusion is that ~$127 per share is an attractive price. For that reason, I have decided to add to my DG position.”

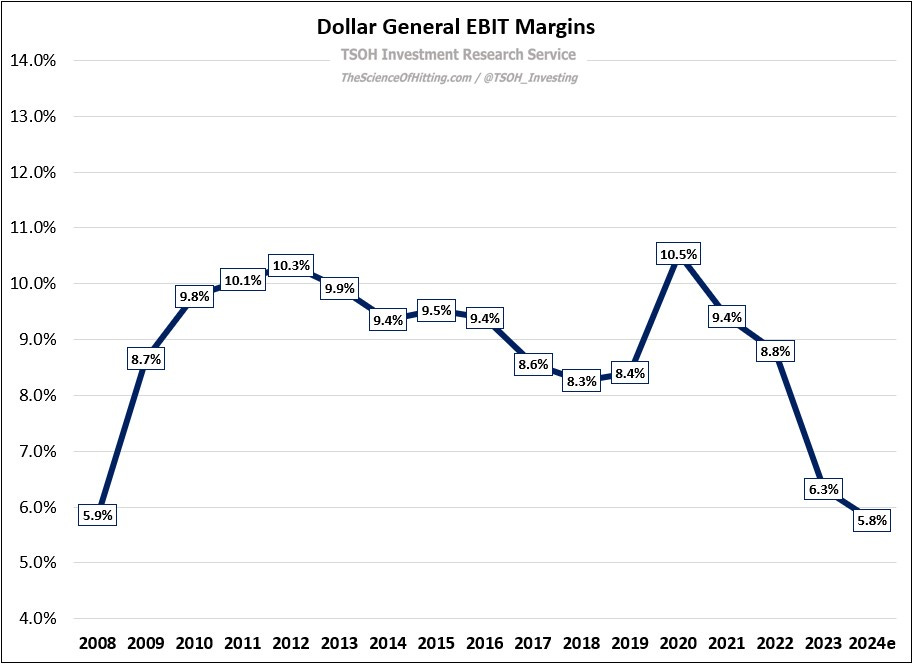

DG’s Q4 FY23 results and FY24 guidance were another step in the right direction: while we’re a long way off from historic levels of profitability, with FY24e operating margins ~300 basis points below the FY15 – FY19 average, the competitive concerns that I’ve previously discussed are being addressed. (And, as I’ll discuss today, Dollar Tree management is responding decisively to Family Dollar’s ongoing struggles, as I suspected they would).

While material headwinds remain for DG, including inflationary pressures, reduced government / SNAP benefits, and shrink, this isn’t their first time navigating choppy waters. While the source of these issues may be beyond management’s control, they must find a more effective response to minimize their deleterious impact. For example, in a similar vein to the “buy online, pickup in store” (BOPIS) shift that I wrote about in December, DG is making material adjustments to its self-checkout option: In addition to prioritizing the traditional associate-assisted checkout (with self-checkout as a backstop during peak hours), they will also limit the number of items per self-checkout transaction. Finally, for the 2% - 3% of stores with the highest shrink, self-checkout will be removed entirely. This is a top priority: as noted on the call, shrink headwinds increased by >100 basis points in FY23. (DG isn’t alone; DLTR and FIVE also face P&L pressure from a material increase in shrink.)

Remedies include the actions discussed above, along with other operational fixes like stronger inventory management and SKU rationalization (“when you have too much inventory, you are going to have too much shrink and damages - and damages are just known shrink”). In my mind, while the solution is coming more slowly than we would’ve hoped, this is an example of DG responding to the realities of the marketplace; this is a fixable problem, and its resolution will have a material impact on the income statement.

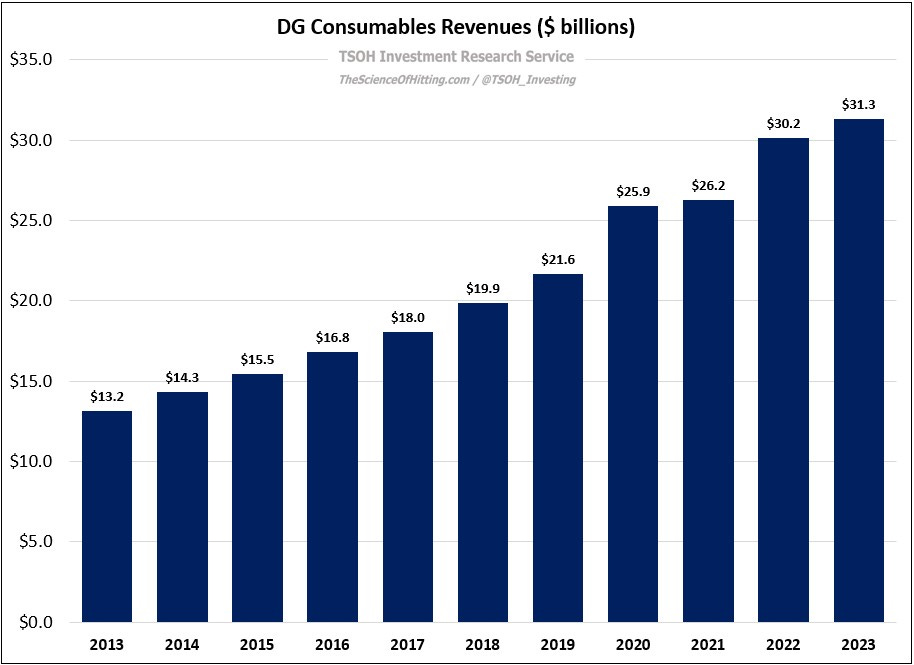

In terms of the business composition, DG has seen continued mix shift towards consumables; at $31.3 billion (+4% YoY), this category accounted for ~81% of the company’s FY23 revenues, up from ~78% in FY19. While the ride has been uneven, note that consumables revenues have grown by ~10% annualized over the past five years (and up ~4% p.a. on a per store basis).

By comparison, while overall non-consumable revenues grew by ~5% p.a. over the past five years, they’ve fallen ~8% (cumulative) over the past two years. While inflation / macro and tough comparisons have impacted the results, other factors are worth noting. For example, you can see below that the pressure has been outsized in apparel, where per store sales totaled ~$55k in 2023, down >25% versus FY19. While DG’s product offering skews toward basics – think Hanes t-shirts and socks - I wouldn’t be surprised if they were losing sales on the margin to competitors like Temu. (That said, apparel accounted for less than 3% of the company’s FY23 revenues.)

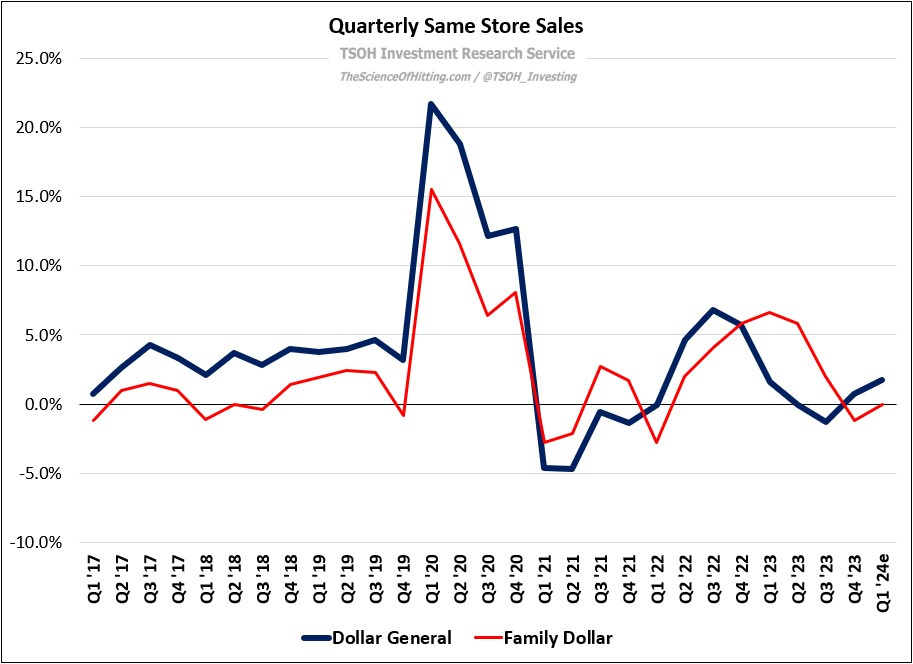

While FY23 presented top-line pressures for DG, with comps only up 0.2%, they exited the year with reasonable momentum (Q4 comps +0.7% on “nearly 4%” traffic growth). As we look to FY24, management is expecting revenue growth in the mid-single digits (up 6% - 7%), driven by a combination of new unit growth and 2% - 3% comps. This is a return to a more normal cadence, which helps to alleviate at least one layer of concern for investors. Long story short, I think that DG’s “back to the basics” strategy is starting to bear fruit.

Family Dollar

From “Dollar General: Bad To Worse” (September 2023): “There is no reason to believe at this time that sales growth [at FDO] is translating to sustainable profit growth (1H 2023 EBIT margins for the banner were down 200 basis points YoY)… I continue to question how much leash Mr. Market – and ultimately Dollar Tree’s management team – is willing to give Family Dollar.”

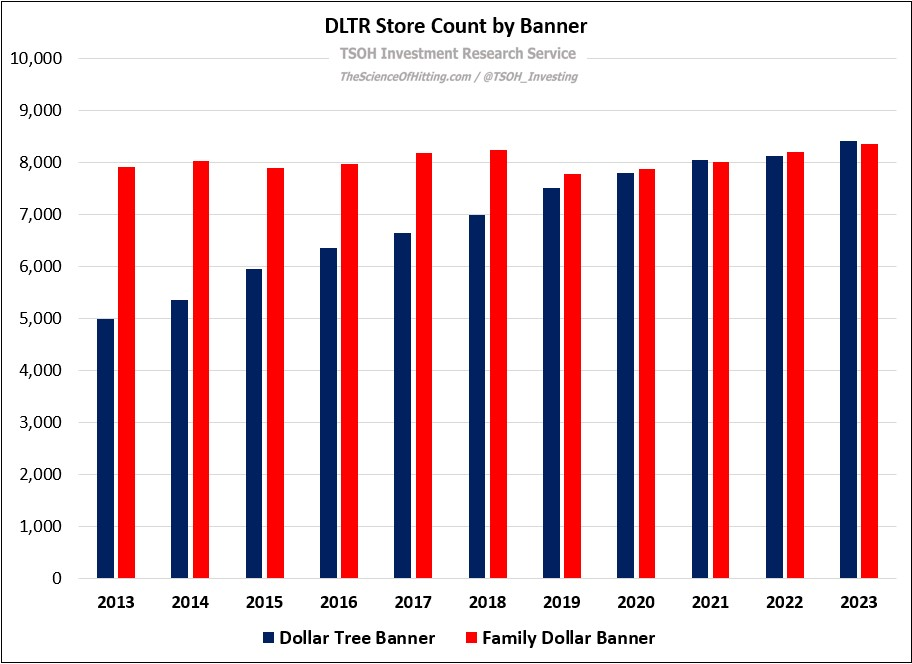

A few months after that was written, Dollar Tree management announced the Family Dollar banner was working through a “Portfolio Optimization Review”. When the company reported its Q4 FY23 results on March 13th, they revealed that they’d come to an answer: the company will shutter 600 Family Dollar stores in 1H FY24, with another 370 locations to be closed over the next several years (at the end of their lease term). That’s a total of 970 stores, or roughly 12% of the FDO store count at yearend FY23. (Based on the disclosed financials, we can guesstimate that these stores have AUV’s of $1.1 - $1.2 million, with high-single digits negative operating margins.)

Similarly to Dollar General, Family Dollar is facing material external (macro) pressures. As noted on Dollar Tree’s Q4 FY23 call, management estimated reduced SNAP payments were a five percentage point hit to Family Dollar’s quarterly comps. As CEO Richard Dreiling put it, “Family Dollar is a victim of the macro environment.” Whether or not we would’ve ended up here in a less difficult macro environment is a moot point; the banner has a long way to go to reach its mid-single digit EBIT margin target, and shuttering ~1,000 stores that are losing ~$100k per year (on average) is a helpful step towards that goal. This also speaks to the inherent difficult of a turnaround: with a large number of stores that are not generating sufficient profits, management has to decide which one’s are likely to be materially improved through incremental investments (add cooler doors, H2.5 renovation, etc.). Simply put, this is a more difficult game than stamping out new units for a retail format that has a bright future (i.e. Dollar Tree as they continue down the multi-price strategy, a la Dollarama). Through that lens, I thought this comment on the company’s 2024 plans was revealing: “We are placing a greater emphasis on Dollar Tree opening’s given the attractive returns and performance; we expect that the vast majority of our new store openings in 2024 will be Dollar Tree’s.”