"Back To The Basics"

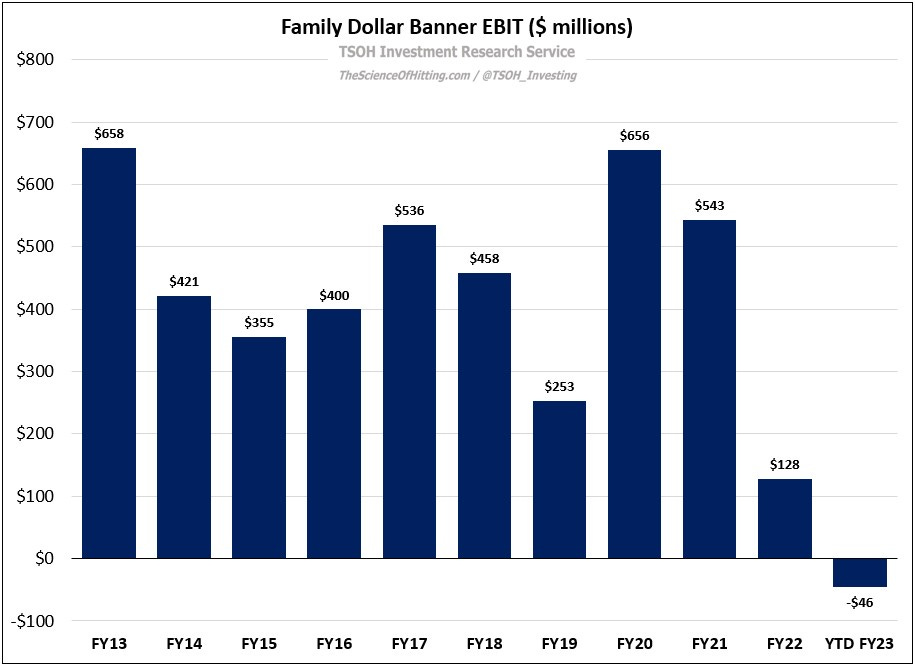

From “Dollar General: From Bad To Worse” (September 2023): “While Consumables are a bright spot at Family Dollar, the banner is facing its own share of difficulties in Non-Consumables. In addition, there is no reason to believe at this time that sales growth is translating to sustainable profit growth (1H 2023 EBIT margins for the banner were down 200 basis points YoY). If this outcome coincides with short-term pressures at Dollar Tree’s namesake banner, I continue to question how much leash Mr. Market - and ultimately the company’s management team - is willing to give Family Dollar.”

On November 29th, Dollar Tree reported its Q3 FY23 results. Page three of the release included a section titled “Portfolio Optimization Review” that disclosed a notable new development at the retailer: “The company has initiated a comprehensive review of its Family Dollar portfolio to address stores that are not aligned with its transformative vision for the company.”

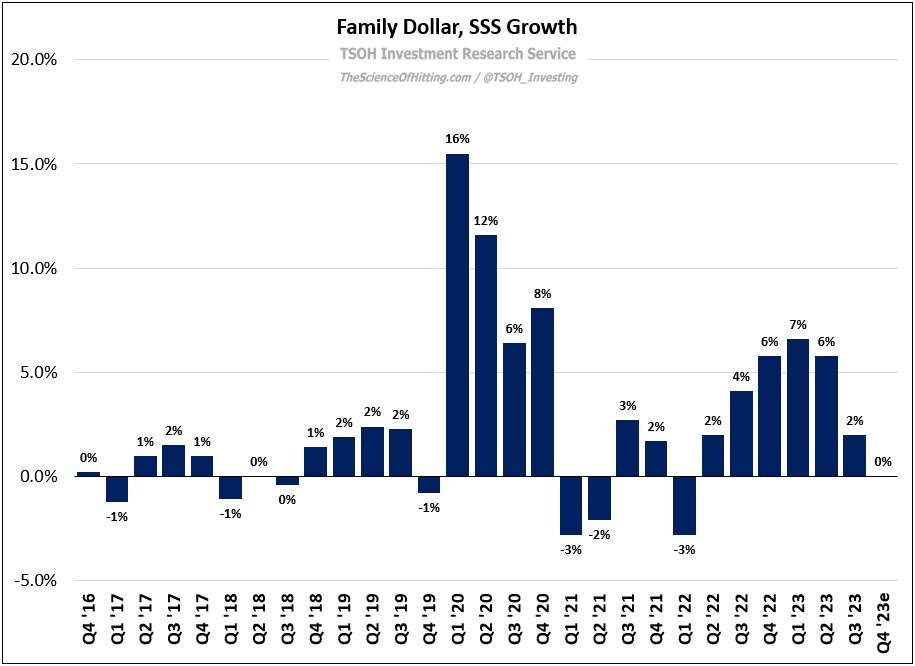

Results at Family Dollar weakened throughout Q3 FY23, with a mid-single digit Consumables comp at the banner offset by a low double digit decline for its Non-Consumable categories (disclosed in the supplemental deck). As noted on the quarterly call, “We are seeing more macro pressures than we did earlier in the year, particularly among lower-income consumers… Family Dollar comps are expected to remain soft, reflecting the unfavorable macro environment for low-income households, continued discretionary [non-consumables] weakness, and elevated promotional activity in the market.”

The combination of weaker comps, higher shrink, Consumables mix shift, and investments to support the turnaround efforts, has led to further pressure on the P&L: as opposed to $126 million of operating income through the first nine months of FY22, the banner has reported $46 million of YTD operating losses. Clearly, there’s a large gap between the Investor Day targets and the current figures (with Q4 FY23 guidance suggesting tougher results ahead).

As highlighted in the opening quote, I think the long-term strategy at Family Dollar will be influenced by a broader focus on Dollar Tree’s (corporate) financial goals – most notably, the path to $10+ per share of FY26 EPS.

In my view, that is what makes this new development quite noteworthy: the inclusion of the “Portfolio Optimization Review” is coming at a time when management has recently shared some of their most optimistic commentary on Family Dollar’s competitive position, relative pricing, etc.; in addition, thousands of FDO stores have been renovated over the past few years, with the Investor Day commentary calling for another ~1,000 per year “over the next couple of years” (as a reminder, they also went through a similar optimization exercise in Q2 2019). That all begs the question: why now?

I think the most plausible answer is that, even while some bright spots have emerged (like the recent Consumables comp strength), the Family Dollar turnaround efforts have a long way to go. As I’ve argued previously, I also think the incentives of key DTLR stakeholders are such that FDO will be given a shorter leash. (On that point, there’s an argument that this would be the logical choice even if you solely focused on the long-term justification for further investment.) Said differently, the path to material near term profitability at Family Dollar would be much clearer if there were able to cut some of the dead weight from their 8,350 stores - or, as management put it, to remove “underperforming stores that are not aligned with our transformative vision”.

I’m very curious to see which actions this latest round of portfolio optimization will lead to (“we will update you no later than the Q4 FY23 call”). While CEO Richard Dreiling reaffirmed his long-term confidence on the turnaround, my suspicion is that we may be in the early stages of bigger decisions at Family Dollar - which, on the margin, could also be impactful for Dollar General.

Dollar General

Before we discuss Dollar General’s Q3 FY23 financial results, I want to start by taking a look at a seemingly inconsequential decision: as revealed by an employee subreddit, and confirmed on DG’s website, they recently stopped offering their “buy online, pickup in store” (BOPIS) service across all stores.

Why does this matter?