Planting Trees

An update on DLTR and DG

Note: Thank you for the overwhelming response to last week’s news about my new book, “Buffett And Munger Unscripted”. I put a lot of time and effort into this project over the past three years, and I hope it will prove to be a valuable addition to your library. Thank you, as always, for your support.

A notable market theme in recent years has been a growing appreciation for companies that are - or at least appear to be - secular winners. On the other hand, Mr. Market seems troubled by companies where the future is less assured, particularly relative to the first set of companies. An investor who can correctly identify overstated or wholly inaccurate views from Mr. Market on which bucket a company belongs in will (eventually) be well rewarded.

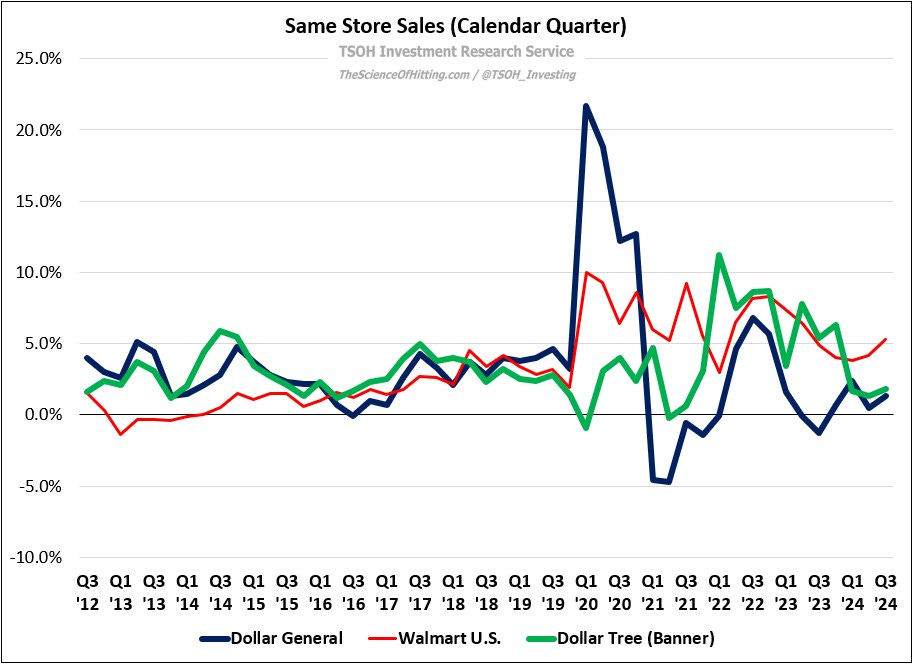

As it relates to today’s discussion, I recently wrote about an example of how valuations have evolved for two retailers: “There’s no question Mr. Market has greatly changed his odds on these bets relative to three and a half years ago: at that time, the forward P/E’s were ~23x and ~21x for Walmart and Dollar General, respectively; today, I have them at ~32x and ~12x, respectively.”

As I noted then, that is an understandable directional change given what has taken place; said differently, I see some merit to the buckets Mr. Market has put each of those companies into. What’s less clear to me is whether the magnitude of the swing is justified. In my view, certain opportunities have arisen as a result, which has led to recent (meaningful) portfolio changes.