"The Enigma Of Success

An update on Microsoft (MSFT)

Today’s post is sponsored by AlphaSense, which recently launched Deep Research to give users access to leading-edge Gen AI reasoning models. Click here to learn more about Deep Research and to start a free trial.

From “Drive Optimization” (May 2023): “I’ve owned Microsoft for ~12 years (call it 50 quarters). Every 90 days, after digging through the latest quarterly results, I’m left with an investment decision: is now the time to adjust the Microsoft position? What I’ve come to appreciate over time is that this quarterly dance can lead to some questionable investment decisions, particularly for someone who aspires to be a long-term investor… It brings the focus back to the valuation: at what point is the price too high? The short answer is I don’t really know (with specificity). The longer answer is that, barring something that strikes me as extreme, I’m comfortable ‘paying’ (continuing to own) a great business with a great management team at a seemingly high price. That answer is influenced by the risk I’ve observed from the alternative approach – specifically, constantly cutting off right tails… Naturally, this isn’t just blind faith: I’ve done a lot of research over the past 10+ years that underlies my confidence in Microsoft’s long-term prospects, along with some views on how to think about the size of their opportunities… As was the case in the vast majority of the previous ~50 quarters, I once again conclude this is a company and team that I want to partner with long-term. There is some point where opportunity costs would push me to alter its position size, but my conclusion is we’re not there. I remain very confident about Microsoft’s future; for that reason, I am comfortable with its current portfolio weighting [~16% as of the Q2 2023 Portfolio Update].”

Microsoft’s FY25 results, with revenues, EBIT, and EPS increasing at a mid-teens YoY rate, highlight two key points on the long-term MSFT investment thesis: (1) despite its massive size, with revenues set to cross $300 billion in FY26, this business can still generate double digit top-line growth; and (2) despite huge investments to support that ongoing growth, the company has been able to drive efficiencies that allow for as good, or better, profit growth.

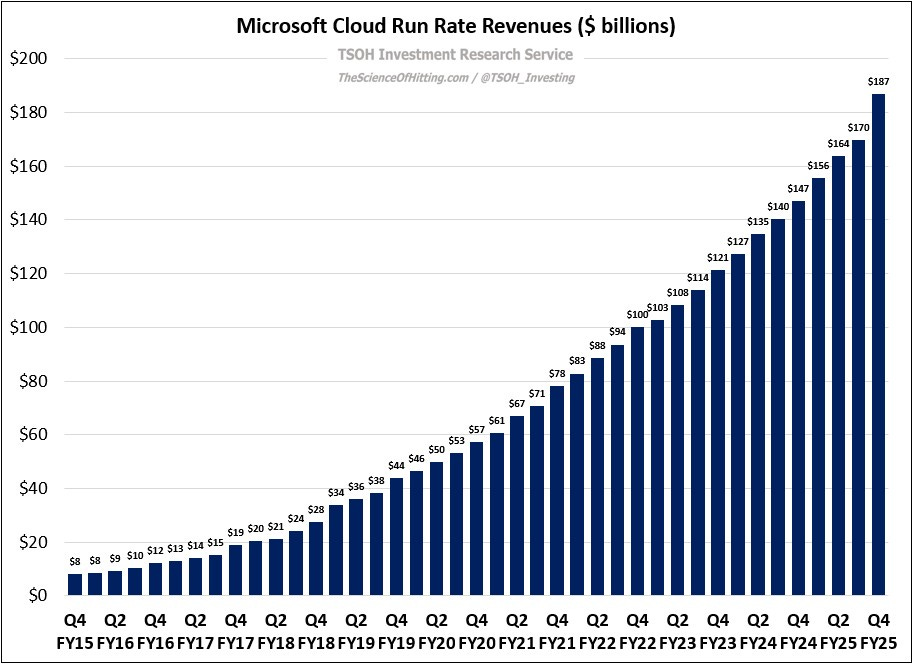

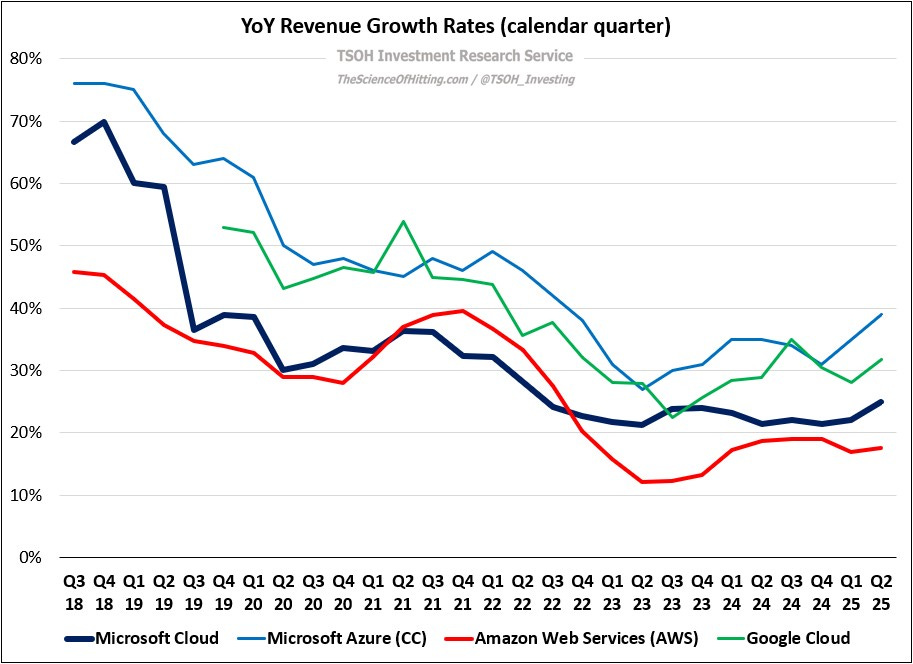

The star of the show continues to be Microsoft Cloud. As a reminder, financial targets for this business were first set a decade ago, at an investor event in April 2015. Management’s initial objective - $20 billion in run rate revenues by the end of FY18 - was cleared by a wide margin, and the business has kept galloping forward ever since: Microsoft Cloud exited FY25 with run rate revenues of $187 billion, and with a +27% trailing five-year revenue CAGR.

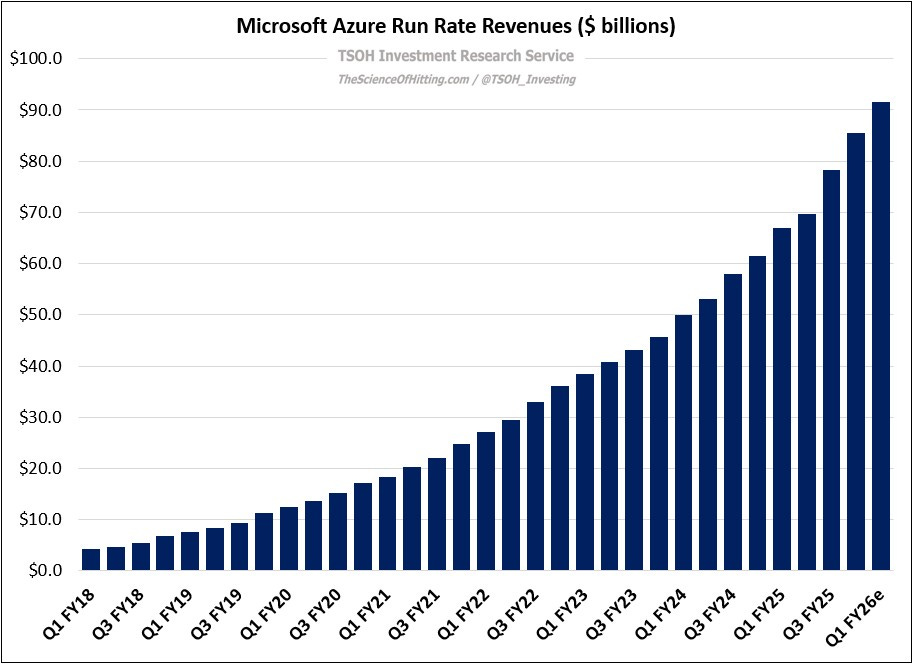

A cornerstone business in Microsoft Cloud is Azure. As I discussed in “It’s Always About The People” (December 2023), Satya Nadella played a crucial role in the early support of, and ultimately the long-term success of, Azure (originally Red Dog). This quarter, management provided financial disclosures that reveal just how important Azure has become, with FY25 revenues of more than $75 billion (+34% YoY). As you can see below, this implies that Azure run rate revenues will exceed $90 billion next quarter – or ~5x larger than its size five years ago (~$18 billion run rate as of Q1 FY21).

In the context of being a long-term owner of Microsoft, it’s instructive to consider the thought exercise from “It’s Always About The People”: “In a different scenario, where 68-year old Alan Mulally took charge at Microsoft, how would this have played out? Would he have shared Nadella’s conviction and willingness to accept material P&L pressure through the mid-2010’s that ultimately led to the astounding revenue and EPS growth in recent years?”

What I can say with confidence is that hiring Satya was a critically important decision for Microsoft’s long-term evolution. For me, his continued leadership materially impacts my level of confidence on this investment. Said differently, if Satya announced his resignation tomorrow, that news would present some difficult questions; my hope is that we will be lucky enough to avoid having to navigate that issue for at least another five or ten years (he is 57 years old).

CapEx and Efficiency

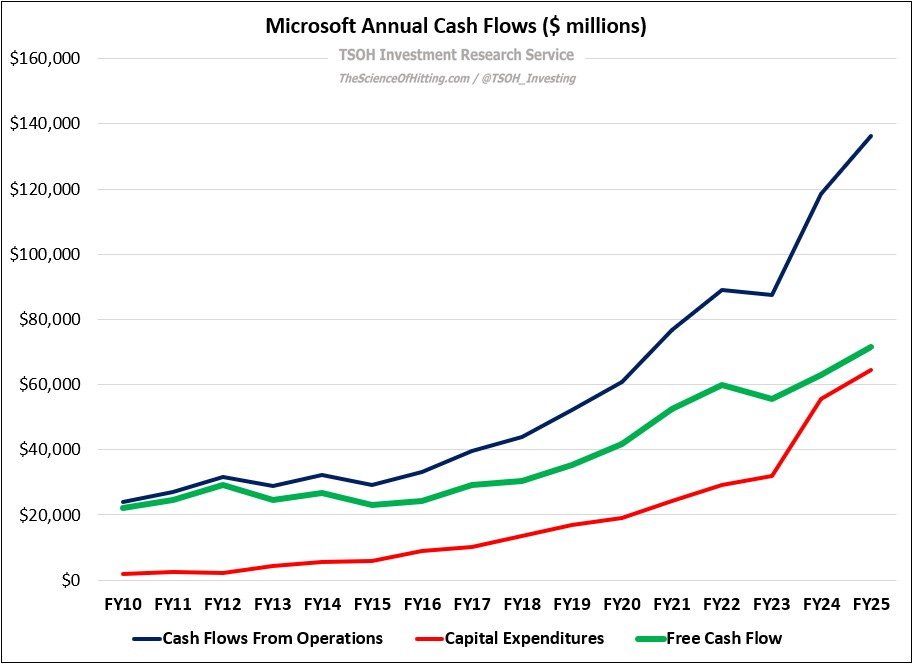

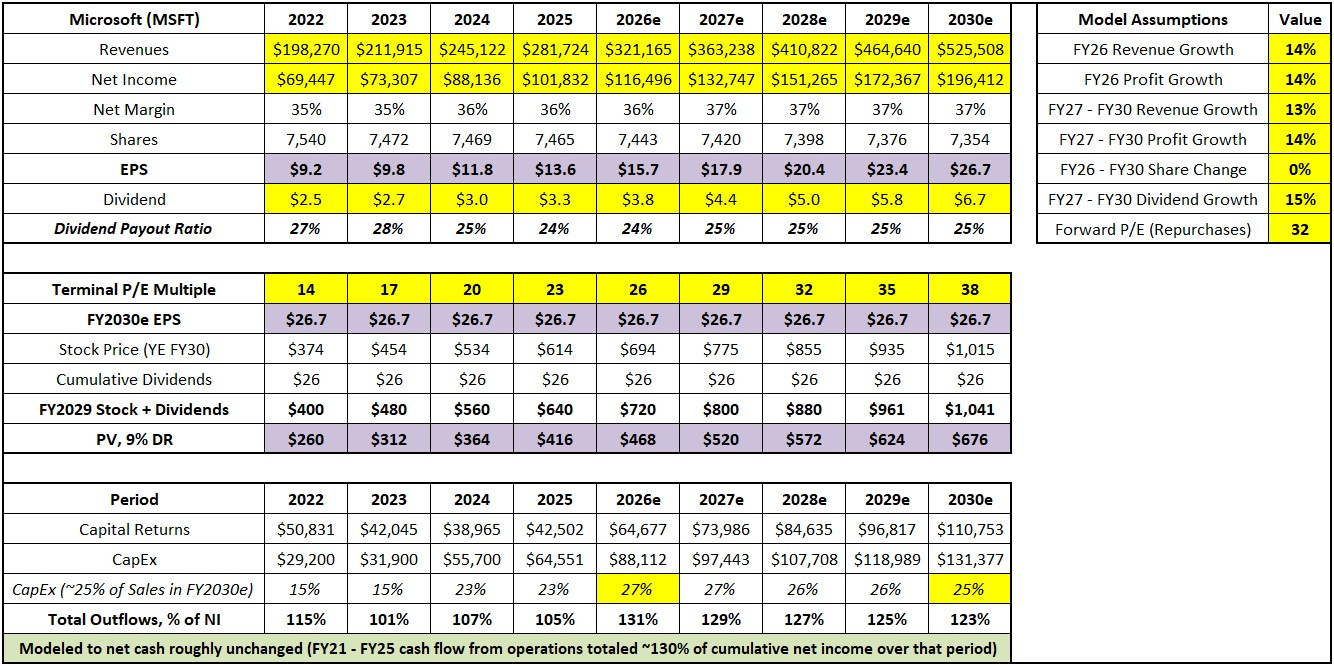

The impressive revenue growth cited above has coincided with even more astounding growth in Microsoft’s capital expenditures. As shown below, I expect that FY26e CapEx will be equal to roughly 27% of the company’s revenues – a level of CapEx intensity that’s ~2x higher than five years ago (in dollars, from ~$24 billion in FY21 CapEx to ~$88 billion in FY26e CapEx).

This is an important and closely followed part of the Microsoft story; I wrote about this in “CapEx Conundrum” (August 2024), so revisit that report for a more detailed discussion on that topic. (Here’s a notable comment from CFO Amy Hood on this topic during the Q4 FY25 call: “We have $368 billion of contracted backlog [which was up >$50 billion sequentially] across Microsoft Cloud. So, in terms of the ROI, growth rates, and the correlation, I feel very good that the spend we're making is correlated to basically contracted, on the books, business. We need the team to execute at their very best to ensure we get that capacity in place as quickly and effectively as they can.”)

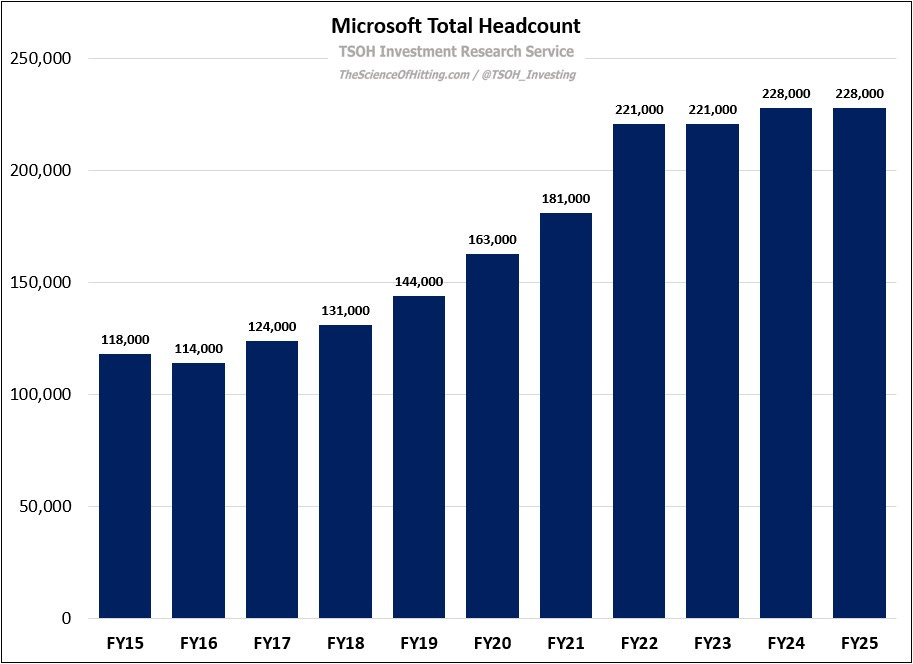

A part of the story that doesn’t receive as much attention is the company’s drive for incremental operating efficiencies. One notable example is on headcount: the ~15% YoY revenue growth that Microsoft reported in FY25 came despite no material change to its total headcount. (You can see in the second chart that EBIT per employee is up ~40% over the past two years.)

Nadella explained how he thinks about this in a recent employee memo:

“By every objective measure, Microsoft is thriving - our market performance, strategic positioning, and growth all point up and to the right. We are investing more in CapEx than ever before. Our overall headcount is relatively unchanged, and some of the talent and expertise in our industry and at Microsoft is being recognized and rewarded at levels never seen before. And yet, at the same time, we’ve undergone layoffs.

This is the enigma of success in an industry that has no franchise value. Progress isn’t linear. It’s dynamic, sometimes dissonant, and always demanding. But this is also a new opportunity for us to shape, lead through, and have greater impact than ever before… We must move forward with the intentionality and intensity that these industry shifts demand.”

Operating income has increased by ~143% over the past five years, with the CapEx ramp resulting in about half as much FCF growth over the same period (up ~72% to ~$72 billion in FY25). Management believes that this is a truly transformational moment for the company, the tech industry, and the world broadly, and its CapEx intensity reflects that view. To paraphrase Nadella, Microsoft is moving with the intentionality and intensity required to deliver strong near term financial results while also making the massive investments that will be table stakes to lead this next era, and which only a handful of companies can keep up with. This sentiment was well captured by Nadella, who said the following on the Q4 call: “We will continue to make investments with decade-long arcs, while making progress every quarter.”

Conclusion

The 50 quarter mark that I discussed back in May 2023 is now climbing up towards 60 quarters, with February 2026 marking the 15-year anniversary of my initial investment in Microsoft. It is the investment that has been the most instructive for me in terms of understanding what is required to truly think and act like a long-term owner; in time, those learnings have undoubtedly influenced other investment decisions on companies like Netflix and Meta.

Periodic trimming (in March 2024 and June 2024), along with the tailwind of a solid run for the broader TSOH portfolio, has left MSFT at an ~11% weighting. I think the financial model shown below includes realistic expectations about how Microsoft’s business is likely to perform over the next five years - but it also reveals that the margin for error on the stock has narrowed over time.

In summary, I’m going to leave the position unchanged at this time. The stock doesn’t appear cheap on traditional valuation metrics (a low 30’s forward P/E), a statement has been true for the better part of the past decade. In my opinion, that multiple appropriately (directionally) accounts for the unique combination of business quality and management quality offered at Microsoft.

The bar has kept rising, and expectations are high - both deservedly so.

The stock clearly will not replicate the ~20x gains delivered over the past 15 years, but I still believe it can be counted on for adequate long-term returns from current levels. Many have argued with that latter statement at points in time over the past 5-10 years as the valuation moved higher, but thus far heading for the exits has proven a costly mistake. There’s undoubtedly some price where that changes, but I think my position sizing reasonably balances my views on that topic with the other relevant (non-valuation) considerations.

NOTE - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.