Microsoft: "Drive Optimization"

From “The Ultimate Tailwind” (October 2022):

“As I think back on my experience with this investment, it has served as a useful reminder that long-term business results are what ultimately drive outcomes for the stock price (assuming you start and end with a ‘reasonable’ valuation). As I look to the years ahead, I remain as confident as ever that Microsoft is well positioned to help organizations of all shapes and sizes to embark upon their own digital transformation, while being properly compensated for the value that they bring to the relationship. (‘In a world facing increasing headwinds, digital technology is the ultimate tailwind.’) While it won’t be a straight line, I remain convinced that Microsoft will be a much more profitable business in five to ten years than it is today.”

Microsoft delivered solid results in Q3 FY23, with revenues, operating income, and EPS all climbing double digits YoY in constant currencies.

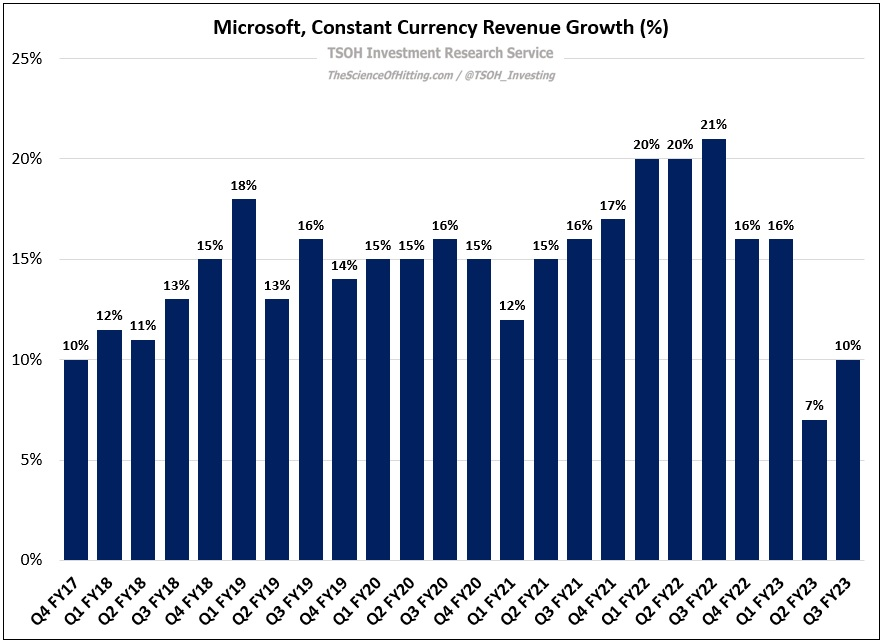

This reflects the continuation of an impressive string of results for the tech giant: over the past six years, constant currency revenues grew by 10% or more in every quarter except for one (+7% in Q2 FY23). The net result has been ~14% annualized sales growth over the past five years (FY18 - FY23e).

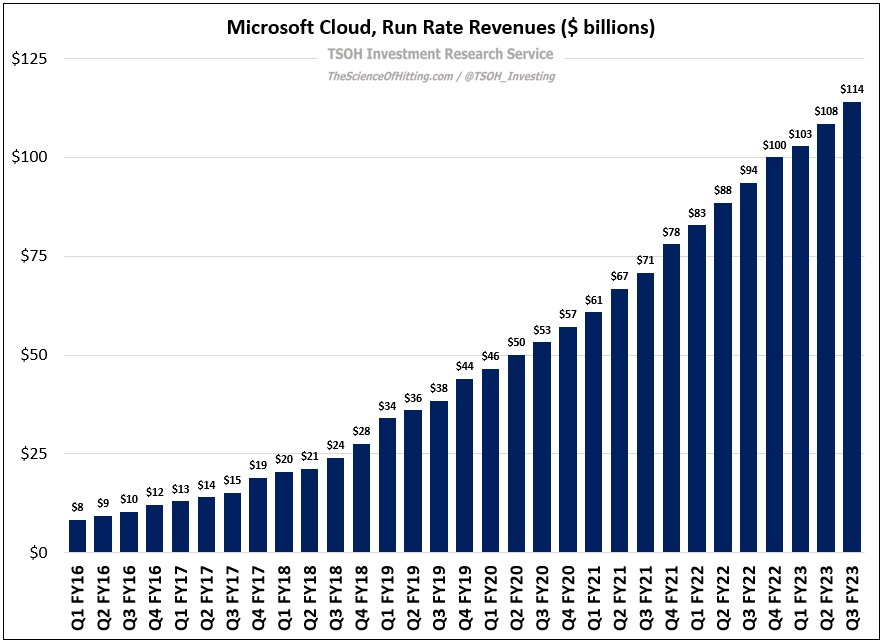

As I’ve discussed since the launch of this service, the primary driver of this outcome has been the Cloud businesses. Five years ago, in Q3 FY18, run rate revenues for Microsoft Cloud were ~$24 billion; as shown below, in Q3 FY23, run rate revenues reached ~$114 billion. (For context, consolidated revenues first surpassed $114 billion in FY19 – only four years ago.)

This outcome reflects 10+ years of investment and strategic focus for Microsoft. Consider this comment from Satya Nadella, which was made during the introduction of the Q3 FY14 call (his first after being named CEO): “This is a mobile-first and cloud-first world. It's a rich canvas for innovation, and a great growth opportunity for Microsoft across all of our customer segments. To thrive in this world, we will zero in on the things customers really value, and which Microsoft can uniquely deliver… We will push hard and move quickly, and you will see the proof of that, month after month, in the products and services we build for the mobile-first, cloud-first world.”

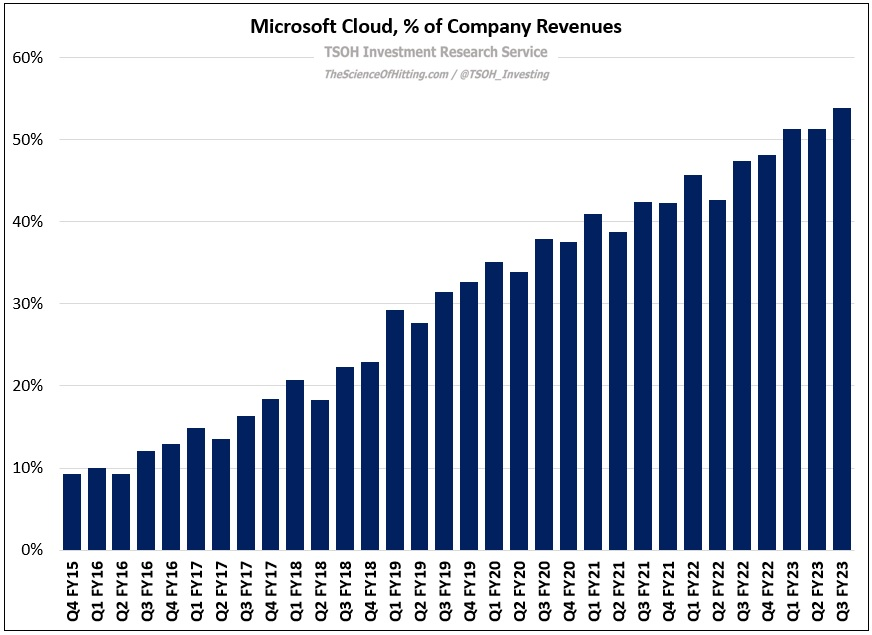

For a massive company like Microsoft, reinvention and transformation takes time (investors primarily think about this in terms of the financials, which was evident in the large CapEx ramp reported during the first few years of Nadella’s tenure against relatively flat net income; as importantly, it’s worth remembering that this hard fought transition often applies to internal / cultural change as well). Slowly but surely, the Cloud has profoundly changed Microsoft’s business: it now accounts for the majority of the company’s revenues, compared to less than 10% of the business at the end of FY15.

From an investment perspective, owning Microsoft for the past decade or so (and particularly since Nadella took the helm in 2014) has required an ability to think about their likely long-term competitive position across the Cloud businesses, along with high level estimates of how large the opportunity could become over time (on that second part, it didn’t require much more specificity than concluding that they were very large). An investment decision-making process that largely focused on the EPS multiple / FCF yield relative to the valuation Mr. Market previously deemed appropriate would’ve led to a painful financial decision – for example, selling the stock in late 2015 when it became “expensive” at ~20x forward earnings, or ~$55 per share (on Friday, MSFT closed at ~$307 per share, with gains in the interim primarily attributable to earnings growth). There’s a fine line here, but this highlights a real risk associated with becoming a value investor who is obsessively focused on short-term price swings / valuations (the risk on the other end of the spectrum from a “value trap”). In my opinion, that’s an important lesson from Microsoft’s performance over the past decade. (For more on this topic, I’d recommend revisiting “I Don’t Defend This Logic”.)

Strategic Vision and M&A