Microsoft: CapEx Conundrum

“A technology company that misses multiple trends will inevitably fall behind. At the same time, it’s dangerous to chase untested future technologies while neglecting the core of the current business. That’s the classic innovator’s dilemma – to risk existing success while pursuing new opportunities… Historically, Microsoft has struggled at times to get this balance right.”

- Microsoft CEO Satya Nadella, “Hit Refresh”

From “It’s Just The Beginning” (April 2021):

“Microsoft’s ability to find attractive growth opportunities is clearer today than it has been at any time since my initial investment in 2011. With strategic vision and execution, both of which Nadella has delivered in spades since becoming CEO in 2014, the company should be able to sustain a level of business performance and growth that seemed unfathomable a decade ago.”

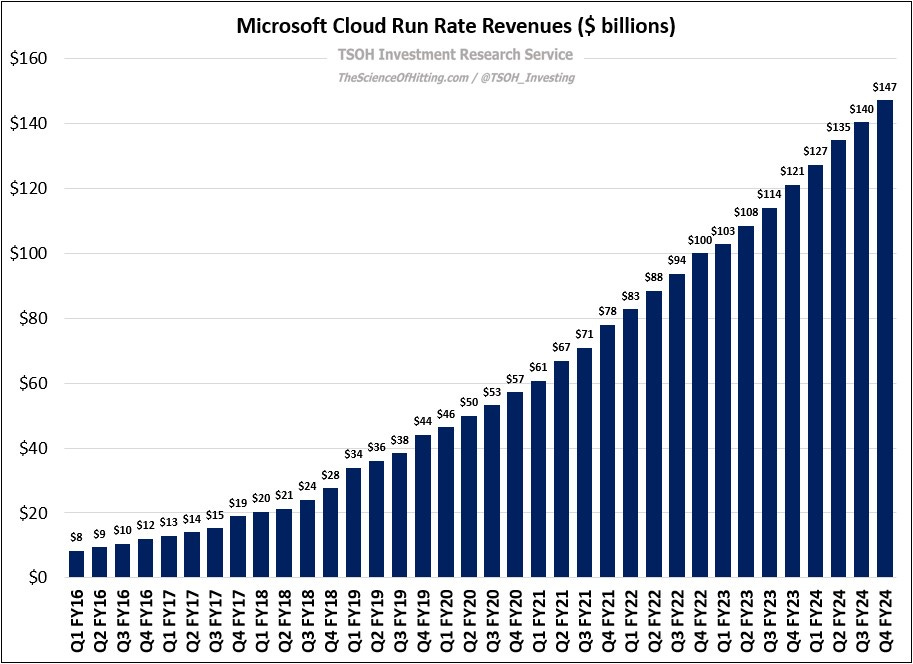

With FY24 behind us, it is noteworthy to consider how Microsoft’s financials have changed over the past five years. The most telling example has been at Microsoft Cloud, which ended the fiscal year with run rate annual revenues of $147.2 billion (+21% YoY) – more than $100 billion larger than the run rate revenues for the Cloud businesses at yearend FY19, and roughly 20% larger than Microsoft’s total revenue base five years ago ($125.8 billion in FY19).

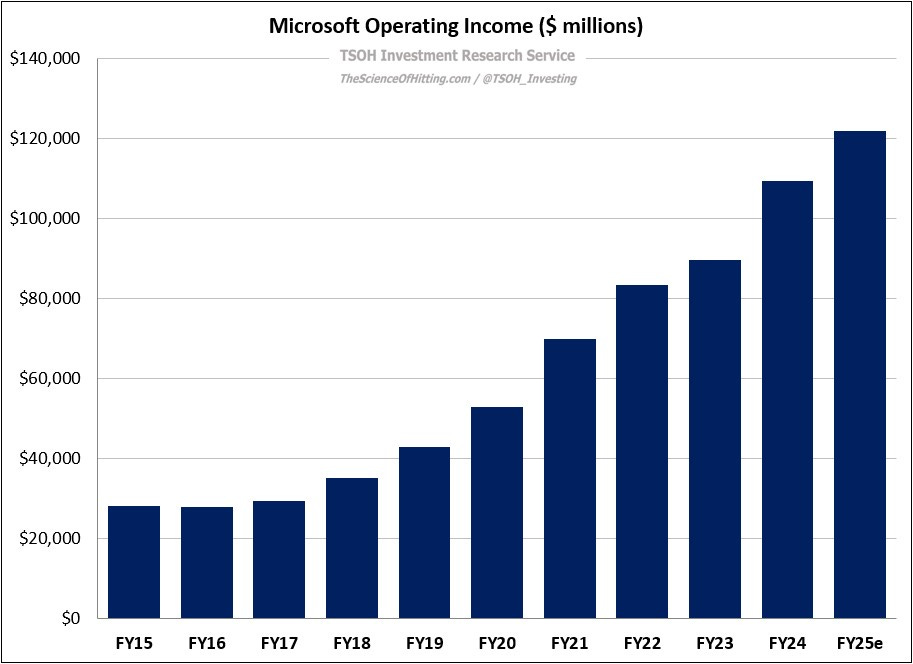

When Nadella became CEO, Microsoft was a laggard in the emerging cloud business: “[Amazon] was the clear leader… without any real challenge from Microsoft.” As he wrote on his first day as CEO, “Our industry does not respect tradition - it only respects innovation. This is a critical time for the industry and for Microsoft.” Under his leadership, Microsoft invested aggressively to secure a leading position across its Cloud businesses. In addition, with operating income up ~16% annualized over the past decade (FY15 – FY25e), Nadella has proven himself to be a visionary technologist / strategist and a great CEO / capital allocator. Those attributes, foundational to Microsoft’s success over the past 10+ years, remain paramount today.

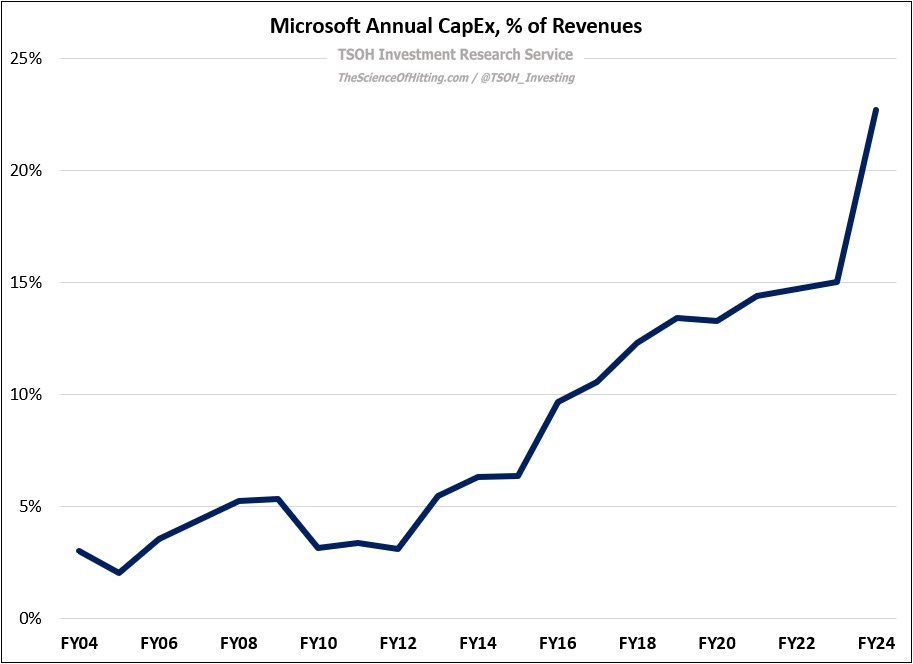

That last statement is most evident when looking at Microsoft’s rising CapEx intensity (capital expenditures as a percentage of revenues); as you can see below, FY24 CapEx was equal to ~23% of revenues, ~2x higher than the average over the past decade. In dollars, FY24 CapEx totaled ~$56 billion – just shy of Microsoft’s cumulative CapEx outlays from FY09 to FY18 (~$58 billion). Put simply, the level of investment behind the AI platform shift is currently making those cloud investments look like a drop in the bucket.