The DG Playbook

Note: A reminder that I will be hosting an expert panel discussion on Nike, which will be available tomorrow at noon ET. Sign up here to join the event.

From “The Dollar Store Downturn” (September 2024):

“It’s important to think about all of this in the context of Dollar General’s economic model. The company’s stores only generate ~$2 million AUV’s; by comparison, the average Walmart U.S. store generates nearly $100 million a year (inclusive of e-commerce). Obviously their box sizes are very different, but the reality is that DG – at its current level of per store sales – must run with a much leaner OpEx model to survive. In recent years, the company has struggled to strike that balance (the pandemic certainly didn’t help); success requires well run, clean stores with fully stocked shelves and engaged associates. As a result of missing the mark, DG comp store sales lagged, associate / manager turnover has increased, and other costs like shrink have remained stubbornly high. While the current pressures feel particularly acute, it is important to remember that this has always been the reality of DG’s economic model. They must improve on the factors within their control to ensure that they do a better job meeting the needs of their core customer.”

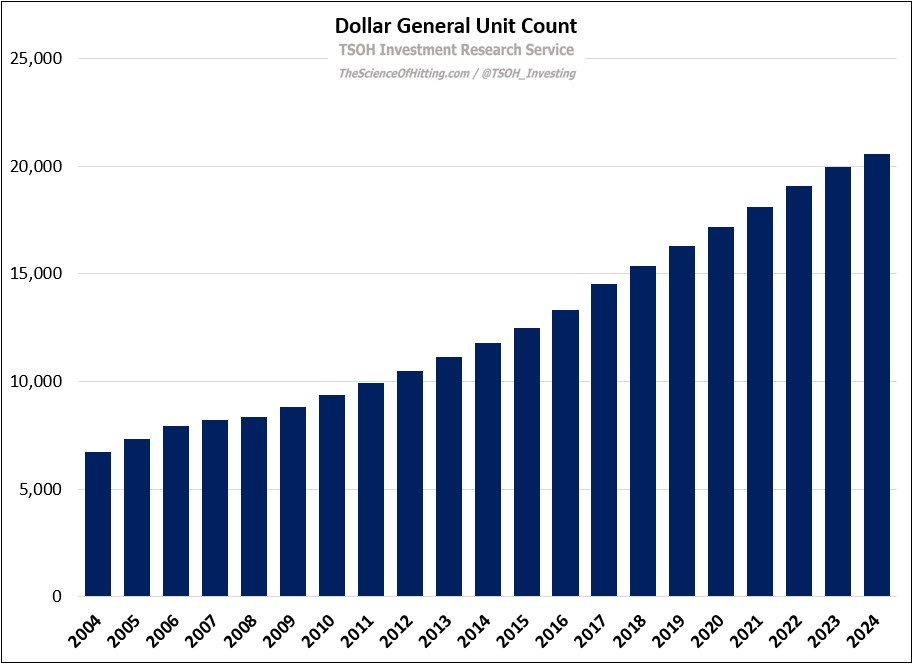

For the better part of the past two decades, a foundational part of the DG story was unit growth: the pace of net unit expansion exceeded +5% YoY in each year from FY09 to FY22, with >10,000 stores added over that period.

Those days are now behind us – and with it, DG shareholders have some difficult questions to answer: is this a sign of more pain ahead, or a notable step towards their version of the Home Depot playbook? (I’d recommend rereading the HD initiation, which discussed the major shift in management’s strategic focus and resource allocation - “We are no longer about new store growth. It is all about driving productivity in the assets that we deploy.”)

Before looking ahead, let’s take a moment to review the recent past.