Nike's Retail Evolution

An Expert Panel Discussion

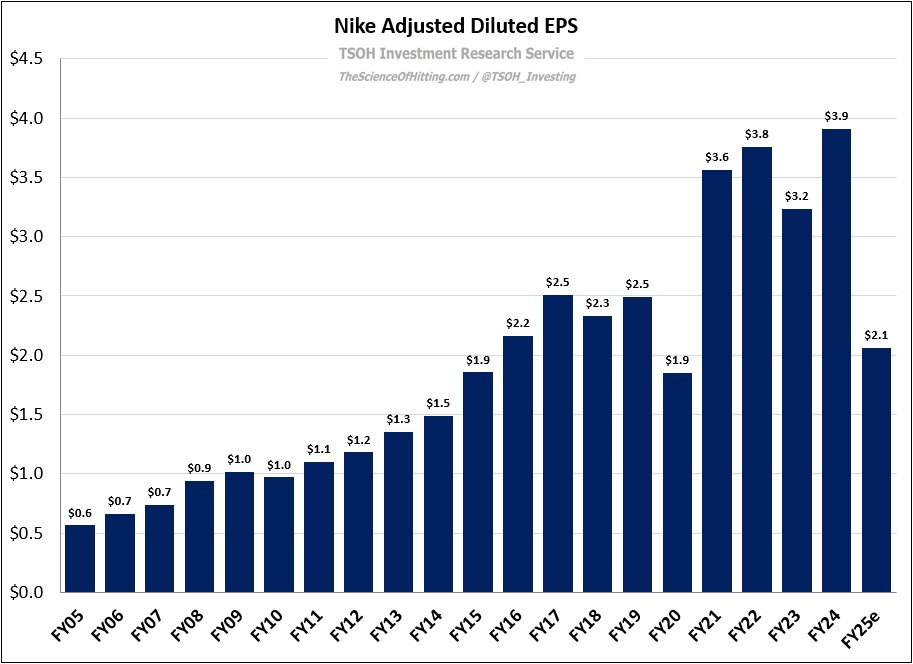

Since publishing “I Hate Advertising” in July 2022, Nike (NKE) has remained top of mind at TSOH Investment Research. Over the past three years, I have documented the challenges they face in an evolving retail landscape, as well as amidst the rise of competitors like On (ONON). Those difficulties are reflected in Nike’s recent financial performance and its stock price: at ~$78 per share, NKE has fallen by more than 50% from the November 2021 highs.

Despite these headwinds, Nike remains in the pole position in the athletic apparel industry. In addition, the company announced in September 2024 that Elliott Hill, a Nike lifer, was returning to Beaverton to rectify missteps under the prior leadership team. This, in turn, presents an interesting question for investors: is now the time to bet on Nike’s turnaround?

On March 18th, I will be hosting a panel discussion with two former Nike employees (the first of three events in 2025 with AlphaSense). I hosted a similar discussion about Dollar General (DG) in September 2024, and the response from viewers was that the experts imparted key insights that informed how they think about the company and the U.S. retail industry.

I suspect that there will be a similar response to the Nike discussion.

Register today to reserve your spot for the panel discussion on Tuesday, March 18th at noon ET. If you are interested in the future of Nike and the broader athletic apparel industry, this is an event you will not want to miss.

NOTE - This is not investment advice. Do your own due diligence.

I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information presented in this report. Assumptions, opinions, and estimates expressed in this report constitute my judgment as of the date thereof and are subject to change without notice. Projections are based on a number of assumptions, and there is no guarantee that they will be achieved. TSOH Investment Research is not acting as your advisor or in any fiduciary capacity.