"Nothing Is A Must-Have"

Netflix (NFLX) Q3 FY25 Update

Note: Tomorrow afternoon, AlphaSense is hosting a webinar with Doug O’Laughlin of SemiAnalysis to discuss the AI infrastructure boom. Doug shared his insights in a similar discussion a few months ago, which was informative and thought-provoking. If you’d like to attend, sign-up here.

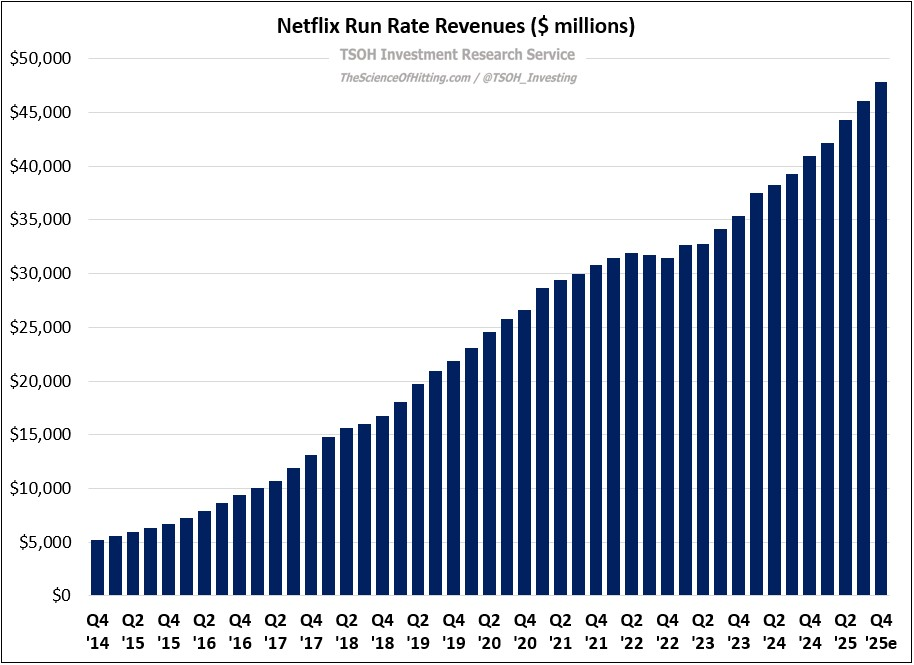

From “All Viewing Is Not Equal” (April 2025): “As Netflix evolved from a U.S.-focused streamer with a few billion dollars in annual revenues to a global behemoth with ~$50 billion in FY26e revenues, so have its long-term objectives… Their ambitions - in terms of the number of people they want to entertain and the breadth of content they want to serve - have grown larger.”

From a financial perspective, FY25 will be another stellar year for Netflix: revenues are set to climb ~16%, to ~$45.1 billion, with adjusted EBIT climbing ~31% to ~$13.7 billion (FY25 will be the third consecutive year with incremental operating margins above 50%). The company has relentlessly pursued global scale for 15+ years, while making key adjustments along the way in support of their two religions. Today’s financial success is a testament to building a best-in-class streaming platform, with an unrivaled breadth of content, to serve a global base of more than 300 million paid subscribers.

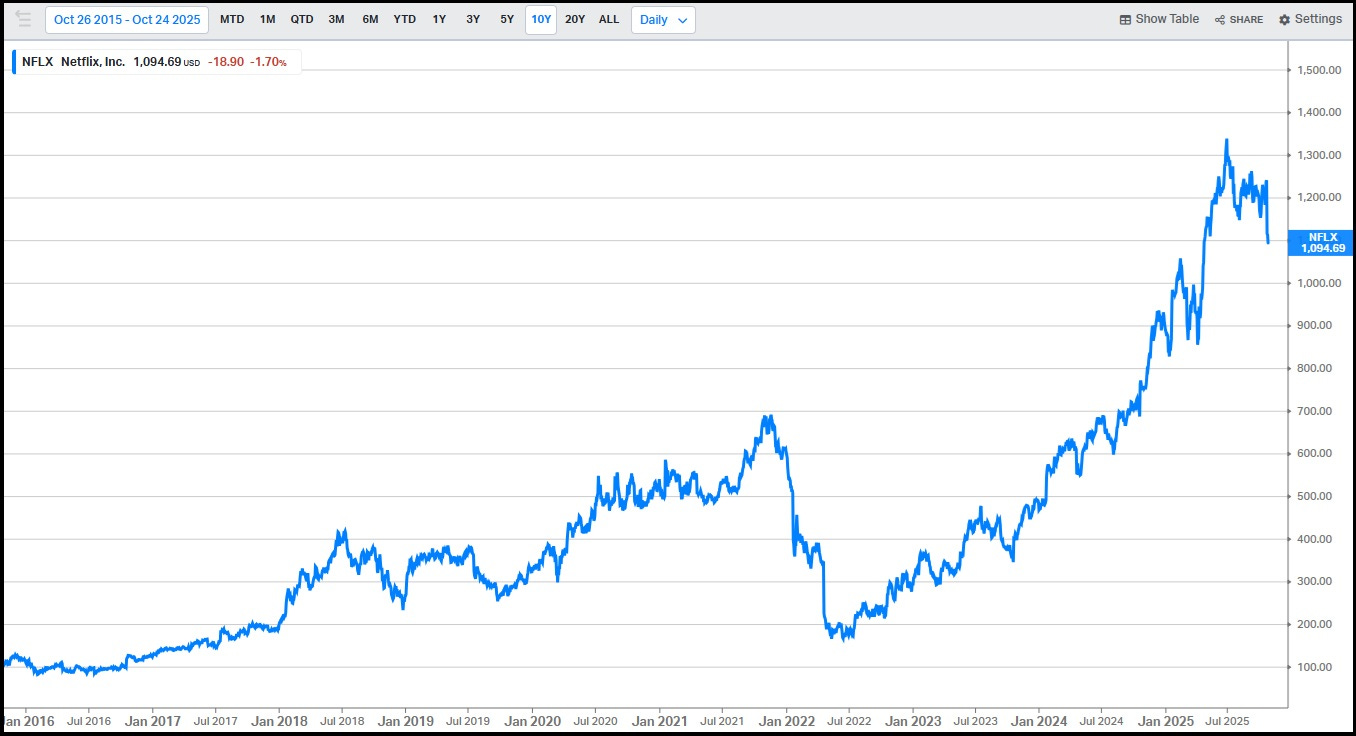

This success, the result of a focused long-term strategic vision and effective execution, has been met with applause by Mr. Market: even after last week’s ~10% decline, to ~$1,095 per share, NFLX is up ~6x from the 2022 lows; it has an enterprise value (EV) of ~$480 billion and trades at ~35x EV/EBIT.

While this statement doesn’t carry the same weight as it did when their EV was ~$100 billion, I think significant long-term growth prospects remain for the global leader in video streaming. At the same time, with the potential sale of some or all of Warner Bros. Discovery (WBD), we are at another critical juncture in the long-term evolution of the media industry. As Netflix has extended its reach into advertising, gaming, and live events / sports, this next phase of consolidation poses a pivotal question: is it time for management to pursue a game-changing media acquisition, or should they stay the course?