"All Viewing Is Not Equal"

An update on Netflix (NFLX)

From “Netflix: Evolution” (April 2024): “While I appreciate management’s commitment to continued EBIT margin expansion (‘our goal is to increase our operating margin each year, though the rate of expansion may vary year to year’), they should also spend as much as possible when they can efficiently do so. As Reed Hastings noted on the Q3 FY21 call, ‘We're entertaining the world. Even ex-China, if we're able to pull that off, to be the place that the whole world goes to for most of their entertainment, then you're definitely thinking too small [at 2x - 3x today’s content spend]. Now, it will take a couple of decades to get there, and we’ve got to be able to monetize it. We need revenue growth and margins, but it would be incredibly satisfying if we could build up to much bigger content budgets than today, to usefully deploy it for our members.’ Investors shouldn’t be disheartened by reaccelerated growth in content spend, even if it temporarily impacts EBIT margins; if anything, that is likely to be the better long-term scenario for Netflix.”

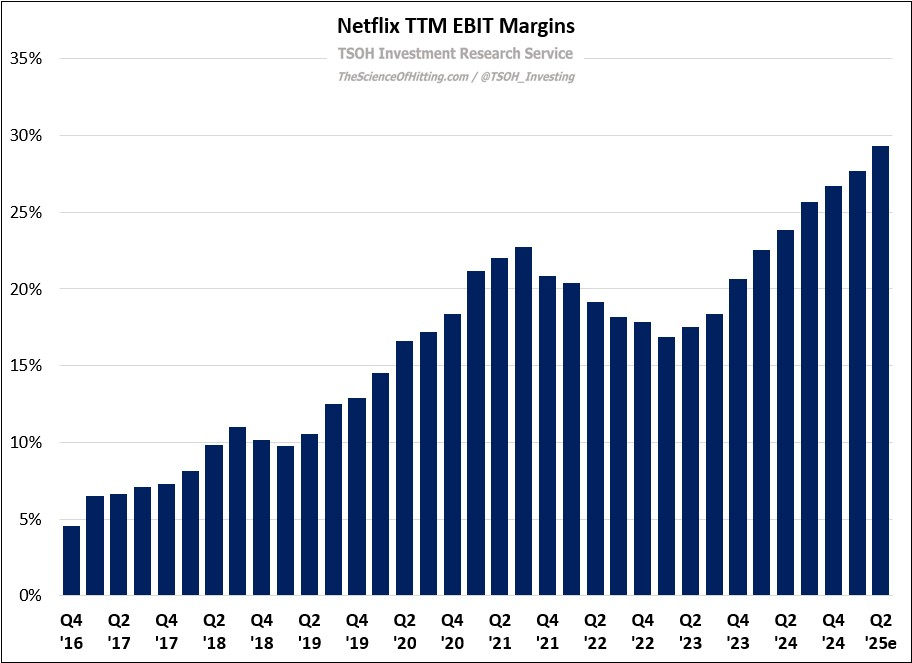

Netflix’s Q1 FY25 results were impressive, with revenues and operating income increasing +13% and +27%, respectively. Inclusive of management’s Q2 FY25 forecast, the figures imply 1H FY25 EBIT margins of 32.5% - an improvement of nearly 500 basis points from 1H FY24 (27.7%). This has been the Netflix story for the past decade, with TTM EBIT margins climbing from ~5% to ~30%; that has not come about due to a lack of spending, with their annual cash content budget roughly quadrupling over the same period.