Netflix: Removing The Ceiling

From “The Cost Of Success”: “[The FCF inflection is] validation of the strategy that Netflix pursued over the past 10 - 15 years. They’ve established a dominant global leadership position in this industry, and it is now showing up in a big way… The investment to get there was substantial; that was the cost of success. My view for some time has been that the legacy media companies are unlikely to replicate that outcome, which will present additional opportunities for Netflix… This course of events has taken longer to play out than I once believed it would, but I think the end game is unchanged.”

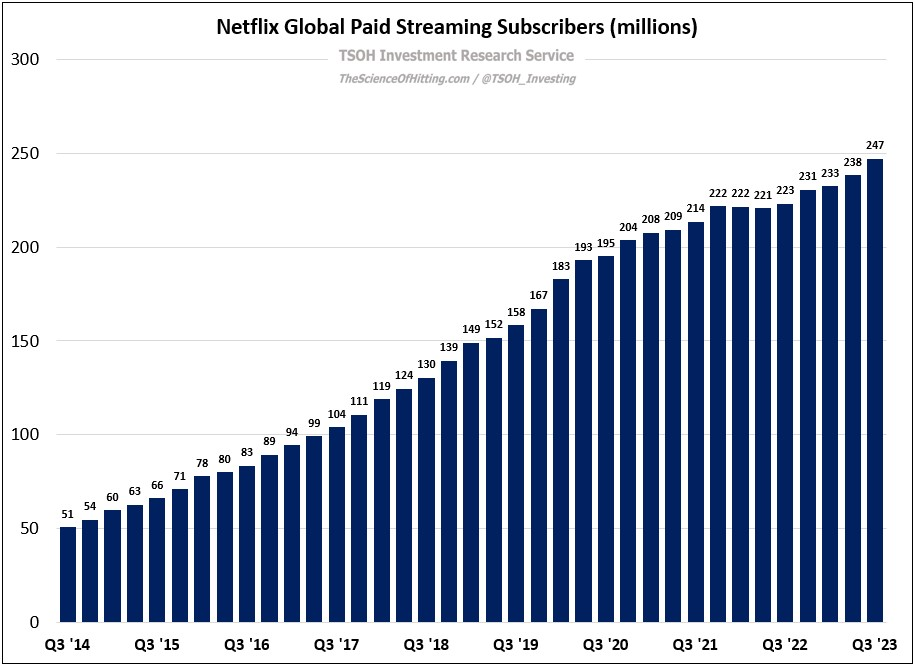

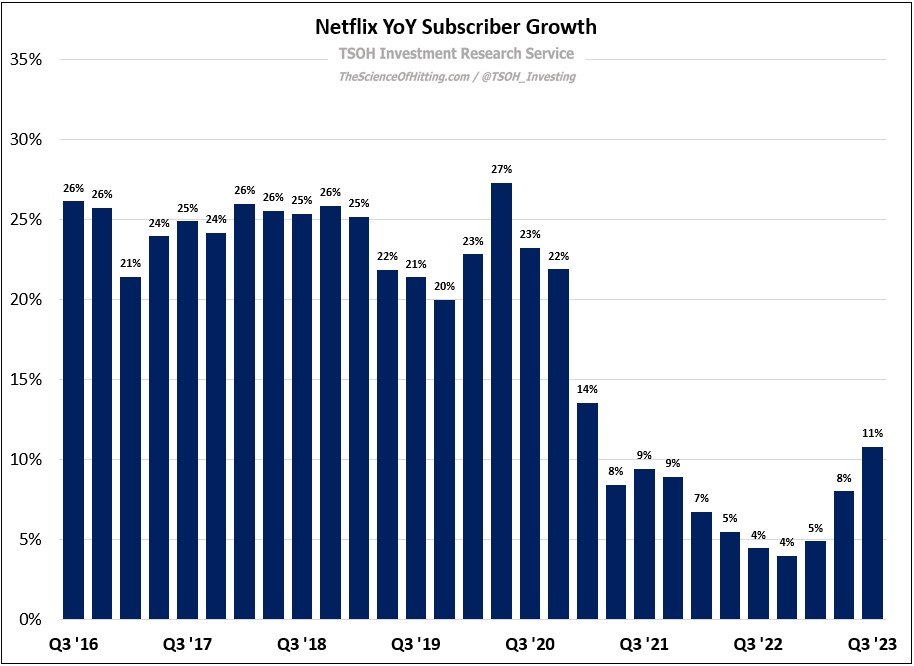

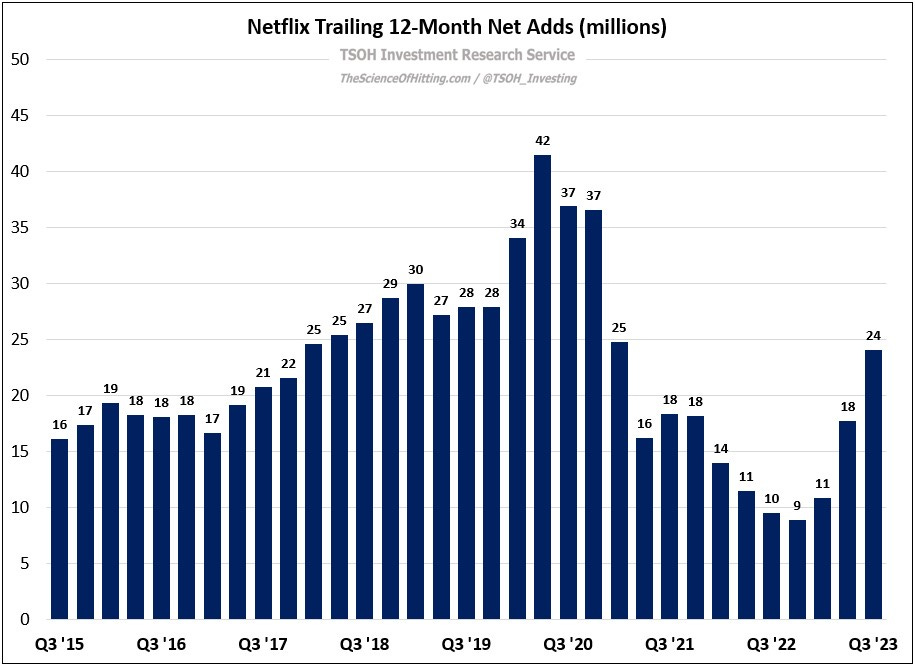

In Q3 FY23, Netflix reported 11% YoY paid subscriber growth. This return to double digit volume growth, an outcome that some may have said they’d never achieve again if you had asked them 12-18 months ago, is a testament to the clarity of Netflix’s long-term strategic vision, its sustainable competitive advantages, and the tailwinds of structural change in the media industry (despite some blips along the way). As we approach the end of 2023, it’s worth taking a step back to frame where Netflix stands: they will exit the year with more than 250 million paid subscribers globally. Those members pay the company ~$11.5 per month, on average, to access a massive library of content across every vertical of entertainment programming (something for everybody in the household). Those subscribers are the foundation for a business that generates ~$35 billion in annual revenues and ~$7 billion in annual operating income (run rate). And yet, despite all that Netflix has accomplished over the past decade, the movie is just getting underway; as we look to the future, I believe massive opportunities remain for Netflix.

Subscribers

CFO Spencer Neumann (Q3 FY22 call): “Now that we have an account sharing solution, we have a clearer path to more deeply penetrate that growing addressable market of 500 million connected TV households.”

In “Heads Down And Execute”, I wrote the following on UCAN growth: “The likely outcome here is that volume growth, which hasn’t been a material contributor to UCAN revenue gains for the past three years, could return to low-single digit or mid-single digit annualized growth (I think we could be in for some surprises on how high this number can go over 2-3 years).”

That second comment (“over 2-3 years”) was based on a few factors: (1) the size of the UCAN market, with ~140 million households; (2) Netflix’s attractive consumer value proposition, which is becoming more finely tuned to meet the needs of different customer segments; (3) the likely (large) amount of sharing underway given the company’s strategy over the past 5-10 years (which, as I’ve argued, really encouraged Family plans / password sharing); and (4) the pace of the crackdown, with reason to believe it was slowly implemented.

It's still early, but we’re starting to see a notable change in the trajectory: UCAN added 1.75 million net paid subs in Q3 FY23, it’s highest sequential gain in 18 quarters (excluding the pandemic tailwind in Q1 FY20 and Q2 FY20). Over the past six months, UCAN has added 2.9 million net paid subs, compared to 4.4 million over the previous three years (Q1 FY20 to Q1 FY23).

These figures provide early evidence on the password sharing crackdown: when forced to decide, many sharers will conclude Netflix is worth paying for. As management noted on the Q3 call, this accelerated growth has come despite a measured pace on the rollout of the password sharing crackdown: “We’ve always thought this change should be done in a steady, considered way… As a result, there are a number of borrower cohorts, which as of today, have not received [the paid sharing crackdown notice]… We're going to continue the roll out for the next couple of quarters… we anticipate that we will have incremental net adds for the next several quarters.”

As we look ahead, what’s a realistic target for Netflix paid subscribers in UCAN and globally? In the U.S., pay-TV penetration peaked at roughly 90%. If Netflix can execute against the (significant) technical challenges associated with effectively policing password sharing, while adeptly segmenting the plan structures to serve various customer needs, I do not see clear impediments to ~100 million UCAN subs, or ~70% household penetration, over time. (For what it’s worth, management used to discuss a long-term U.S. opportunity of 60 - 90 million subs.) That outcome assumes Netflix will continue to cement its leadership position in the DTC VOD industry, while also taking advantage of disruption - as an example, by licensing content from competitors who are quickly realizing they do not have the ability or willingness to stay in this fight.

As we look globally, we can start with the aforementioned ~500 million CTV households (which excludes a few notable markets like China); that increases to roughly one billion if we widen it to households with broadband access. Without getting too cute on these figures, which are changing (getting much larger) over time, I think we can say the addressable market is currently at least 2x larger than Netflix’s sub base, especially when we include mobile-only plans. (He obviously has a certain bias, but here’s Roku CEO Anthony Wood: “In terms of the TAM, every broadband household that watches television is going to switch to streaming. So, it's one billion households.”)

Capitalizing on that opportunity will require that the service becomes highly desired by password sharers and people who have never used Netflix before. The path to get there is a familiar strategy for Netflix: an appropriate mix of local content, while leading on technology solutions like dubbing that make global / non-local content more enjoyable to watch for other viewers. If any company is positioned to capitalize on this opportunity, it is Netflix.

The past few years - specifically throughout 2022 - provided a reminder that the path to the long-term TAM will not be a straight line. That said, my view is unchanged from what I’ve said for the past few years: the global leader(s) in VOD will ultimately have a subscriber base that is measured in the hundreds of millions of subs. (Jason Kilar: “When people talk about a couple hundred million customers… I think that will be seen in hindsight as modest.”)

ARM’s (Average Revenues Per Membership)

While reaccelerated sub growth is a welcomed change, it’s only half of the equation; volumes must be considered in combination with pricing (ARM’s).

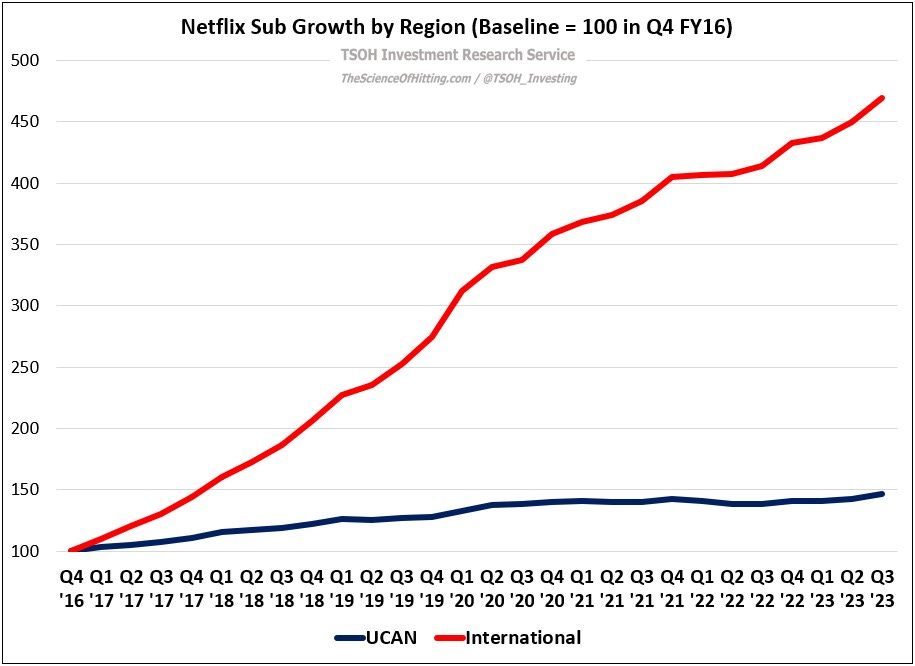

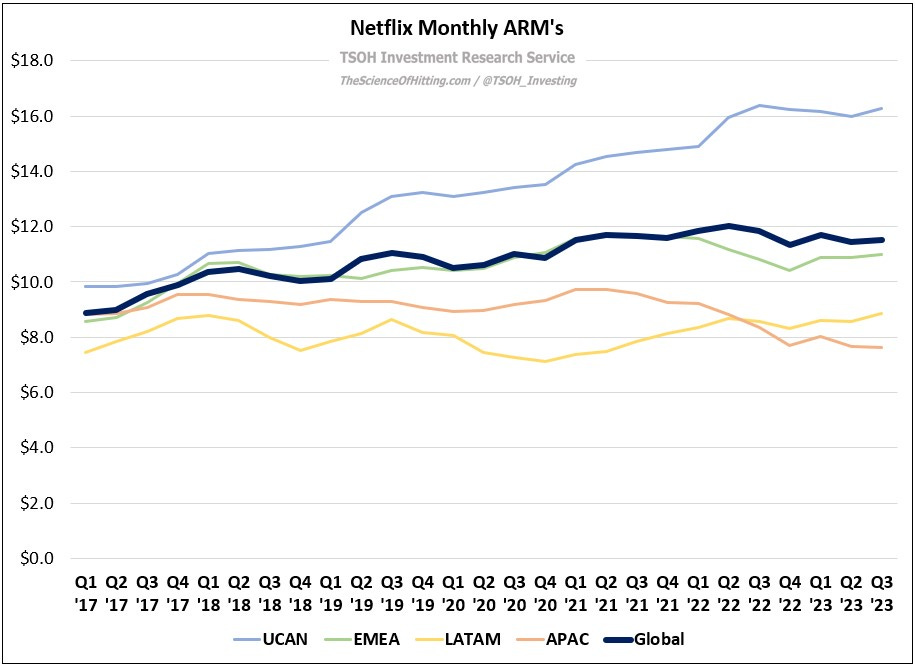

As it relates to the evolution of Netflix’s business in recent years, the following two charts provide some important context: despite significantly outsized sub growth in non-UCAN markets (mix shift headwind), Netflix has still managed to increase global (average) ARM’s by more than 30% since yearend 2016.

That outcome is attributable to continued UCAN ARM growth, as well as healthy ARM’s in markets like LATAM and APAC that are meaningfully higher than competitors. (At less than $4 per month, WBD’s International DTC ARPU is >50% lower than Netflix’s ARM for blended APAC / LATAM).

Last quarter, I wrote in detail about the UCAN growth algorithm. That discussion built upon the analysis from “Regional Economics and Global Scale”, which quantified Netflix’s regional P&L’s and explained why it’s useful to think about UCAN and non-UCAN as distinct businesses (if you have not read “Regional Economics”, I’d recommend doing so; it’s helpful for framing the evolution of the financials, particularly on gross margins / EBIT margins).

As it relates to the long-term revenue growth trajectory for Netflix, the key takeaway from the past two quarters is that the future opportunity will come from a cleaner balance of subscriber growth and ARM growth. Critically, they are at a place on each metric that is (hugely) advantaged relative to peers; in addition, they have a well-worn playbook to foster continued improvement.

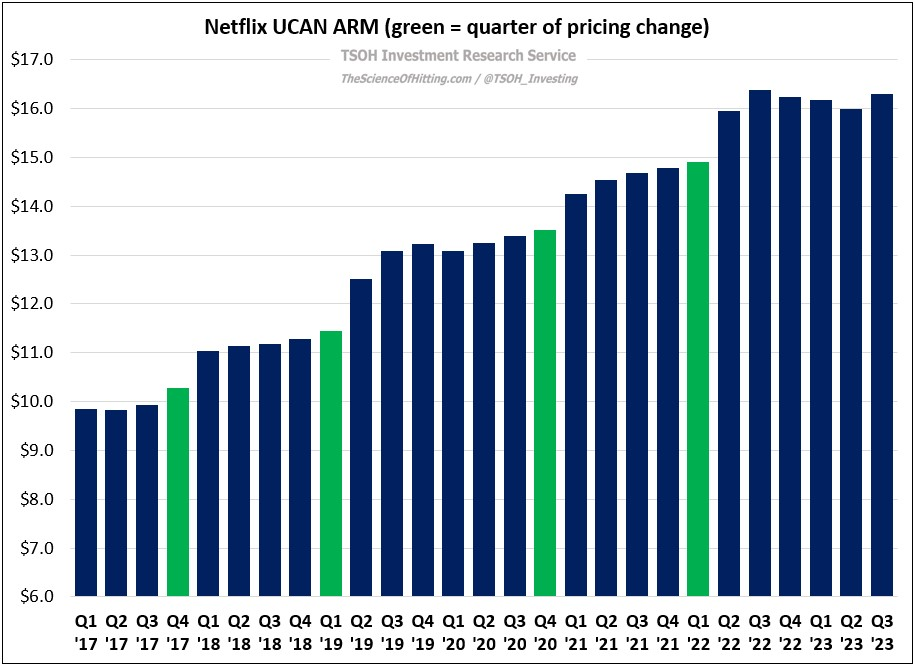

While we’ve seen a lull on pricing adjustments (increases) with the ad-tier rollout and the crackdown on password sharing, we’re now returning to a more regular cadence. Netflix announced a number of price increases alongside the Q3 results, the most notable of which was (to me) the 20% hike on the Basic tier to $11.99 per month (as discussed last quarter, it’s clear that they are comfortable pushing the cheapest UCAN ad-free tier up to >$15).

In addition, the Q3 call commentary indicates further price hikes are coming in the years ahead: “Expect a more balanced mix of membership and ARM growth in 2024 and beyond… We've got a long runway for growth from membership and higher ARM, in a more balanced way than [2023].”

I’m of the belief that Netflix continues to build an offering that will command much higher prices over time (and that’s before considering any success with initiatives like gaming). In the U.S., the ad-supported tier and the ad-free tier start at $6.99 per month and $15.49 per month, respectively (by comparison, U.S. linear TV now costs >$70 per month and rising). Their ability to grow the UCAN sub base over the past 5+ years despite significant price / ARM increases reflected previously untapped pricing power. Time will tell on what lies ahead, but I personally believe Netflix remains well positioned to continue that trend over the next five years, while driving ARM’s to >$20 per month (at ~$20 per month, that would result in ~4% annualized UCAN ARM growth).

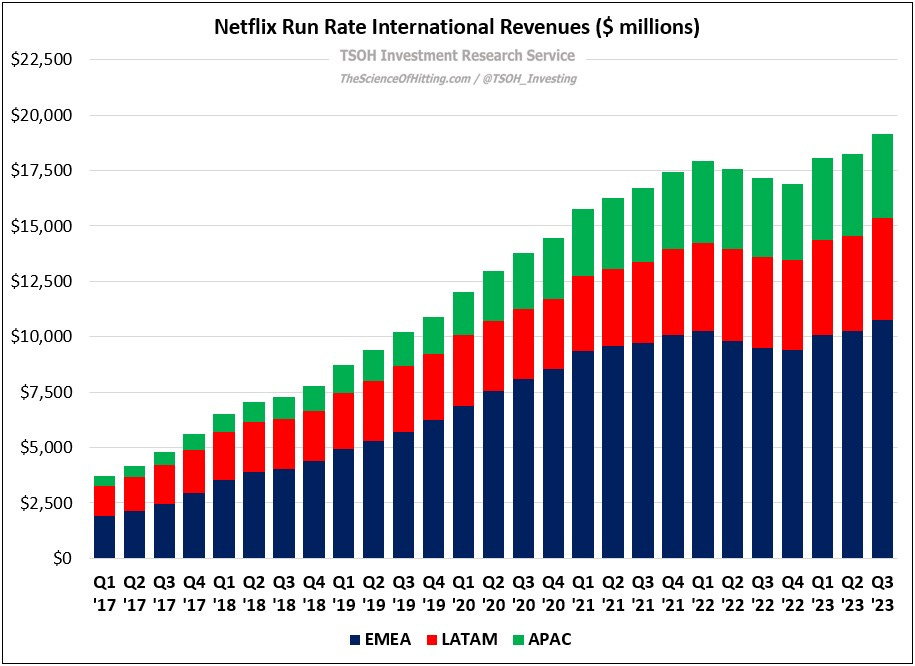

International is a trickier equation; the company is earlier in its lifecycle and is still balancing its revenue growth drivers (which led to some notable price cuts earlier this year). With that said, one shouldn’t overlook what they’ve already accomplished: this is a business (non-UCAN) with ~$19 billion in run rate revenues, a number that has quadrupled over the past six years. It will take time, but I’m confident Netflix will find an effective approach in dozens of countries around the world that will cumulatively support a large and growing non-UCAN business over the long run (while driving overall profits / FCF).

Profitability

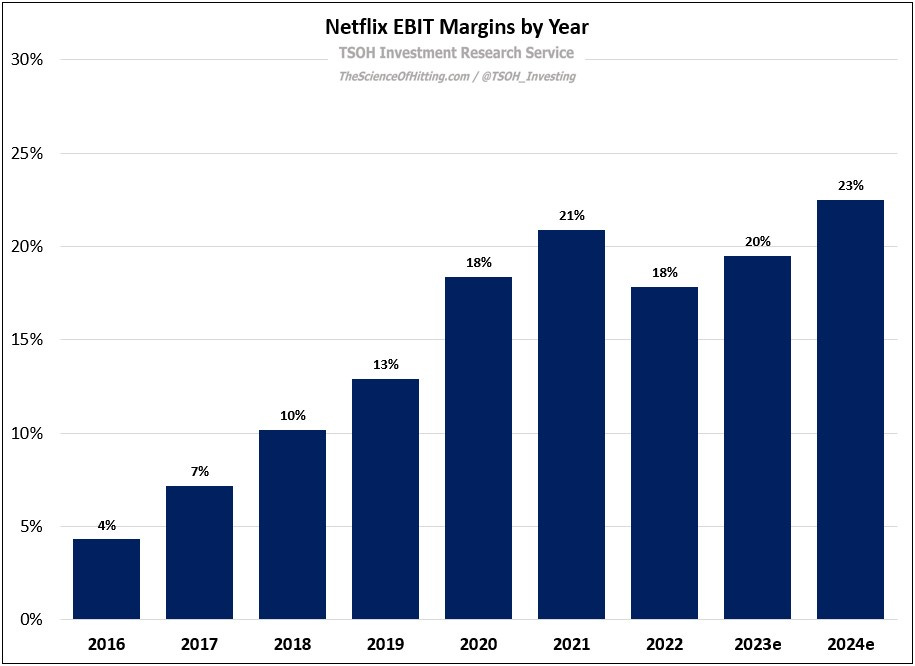

In the weeks leading up to the Q3 FY23 earnings release, Netflix’s stock price declined by ~20%. As best as I can tell, some of that change (in terms of any company specific developments) was likely attributable to this comment from Neumann at the Bank of America Conference on September 13th: “I don't think it's really prudent for us to keep growing [our EBIT margins] at three percentage points per year. That would probably constrain the business too much on the growth opportunity. So, we'll grow margins more gradually.”

Given that statement, the market was likely a bit surprised that Netflix’s FY24 guidance calls for 200 – 300 basis points of margin expansion to 22% - 23%. As shown below, this reflects the continuation of a decade of meaningful profit margin expansion for Netflix (and, as Neumann noted on the company’s Q3 FY23 call, “we don't think we're anywhere near a margin ceiling”).

Honestly, I think the focus on the short-term margin trajectory misses the forest for the trees. Think about the short-term P&L impact from content investments: my contention has been, and continues to be, that the best scenario for the company would be if that number continues to grow meaningfully for many years into the future. If that happened overnight - for example, if they were offered a compelling long-term, global licensing deal with a major content producer for all of their output that dented near term EBIT margins - that would still be an intelligent decision in the right situation.

In addition to the level of spend, another consideration is effectiveness of spend. On that topic, I continue to view Netflix’s global scale as a critical advantage: for actors, directors, writers, comedians, sports leagues, and even competing content / DTC VOD companies, Netflix stands alone.

”Suits” is the latest example that speaks to the unparalleled strength of Netflix’s position; as we think about what that means in terms of their value add for content creators, it doesn’t seem outlandish to believe Netflix could justify paying less (in absolute terms) for certain content than competitors.

Another notable example is “Drive To Survive”; for Formula 1, what are the non-economic considerations that they would think about with competing offers from Netflix and Paramount+? For example, how much value has been created from the exposure that (only) Netflix offers? If I ran the league and was focused on its long-term success, I would unquestionably accept an inferior bid from Netflix versus most other streamers. With that said, I view this as more of a latent opportunity (which may remain untapped) than a requirement for long-term success; it’s just something to be mindful of, especially if we see meaningful changes in the industry capital cycle (which could impact what Netflix licenses, how much it pays, etc.). In my mind, it’s another clear example why Netflix is in a hugely advantaged position. It’s one reason, among many, why they will report (further) massive profit growth over time - with operating margins well above current levels.

Conclusion

After Q2, I wrote the following in the conclusion of the Netflix update:

“I have a high degree of confidence in Netflix’s sustainable competitive advantages, and I also believe that attractive inorganic opportunities will appear over the coming years (that said, management clearly has specific requirements for an acquisition target; I don’t think they’re willing to be saddled with linear TV assets to get great IP). At the same time, I’ll readily admit that there’s a fair amount of good news priced in at [$427 per share] - and while I believe that optimism is very likely to prove justified over the long run, it must come with the recognition that periodic short-term stumbles will come with reactions like the one we saw last week (down ~10% after earnings). That’s a reality of life for us long-term investors, with the caveat that there needs to be a reasoned belief that we’re being properly compensated for accepting that cost (I get nervous when reasonable IRR’s demand looking 5+ years out). For now, I believe that’s still the case.”

My conclusion is unchanged. Similarly to Microsoft, there’s a point where I would consider reducing the Netflix position (particularly if outperformance and higher prices coincided with pressure elsewhere in the portfolio / on the watchlist). The stars would need to align for that to happen, and I don’t think that’s the case at the moment. Unless I’m given a very good reason to do otherwise, I’m comfortable holding a large NFLX position for a long time.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.