Netflix: The Cost Of Success

From “We’re Off To A Good Start”:

“I think Netflix’s 2022 performance was revealing. In the midst of the most competitive environment that they’ve ever faced, Netflix maintained a substantial lead over their streaming peers on key metrics like revenues and engagement. As others in the industry are forced to address the realities that have surfaced over the past year, Netflix stands alone in its ability to remain 100% committed to the long-term opportunity in streaming… I continue to believe that opportunity will be substantially larger than it appears today (in terms of revenues and profitability / FCF). Further bumps along the road are inevitable – but the long-term destination should prove well worth the ride.”

On Tuesday, Netflix reported its Q1 FY23 results. In a relatively quiet quarter (particularly compared to what we’ve seen over the past ~18 months), Netflix continued to make progress on its primary revenue drivers: subscriber growth and FX-adjusted average revenue per membership, or ARM. In addition, while it remains early days, management is figuring out the path forward on notable initiatives like the password sharing crackdown and the ad-supported tier. Finally, after 15 years of focusing on growth above all else, the company is starting to optimize its business further down the income statement. All-in, Netflix’s ship is moving in the right direction; with effective execution, I think they will further distance themselves from competitors in the years ahead.

Competition and Cash Flows

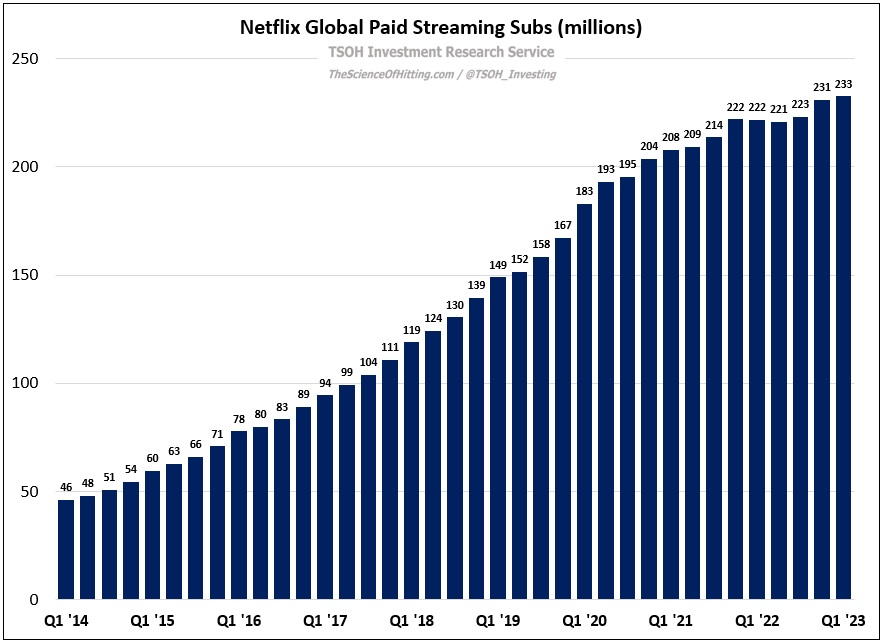

At the end of Q1 FY23, Netflix had ~233 million global paid subscribers. As you can see in the below chart, this total is ~40% larger than it was in Q4 FY19 (pre-pandemic). Given the competitive dynamics at play during the intervening years, which included aggressive pricing by legacy media companies looking to establish a DTC subscriber base (the precursor to building a DTC business), I think double-digit annualized subscriber growth for the incumbent after 10+ years in the business is an impressive outcome. (That said, this reflects a major slowdown from the growth rates achieved in pre-pandemic years.) The fact that Netflix achieved that result while driving consolidated ARM growth makes that outcome even more noteworthy.

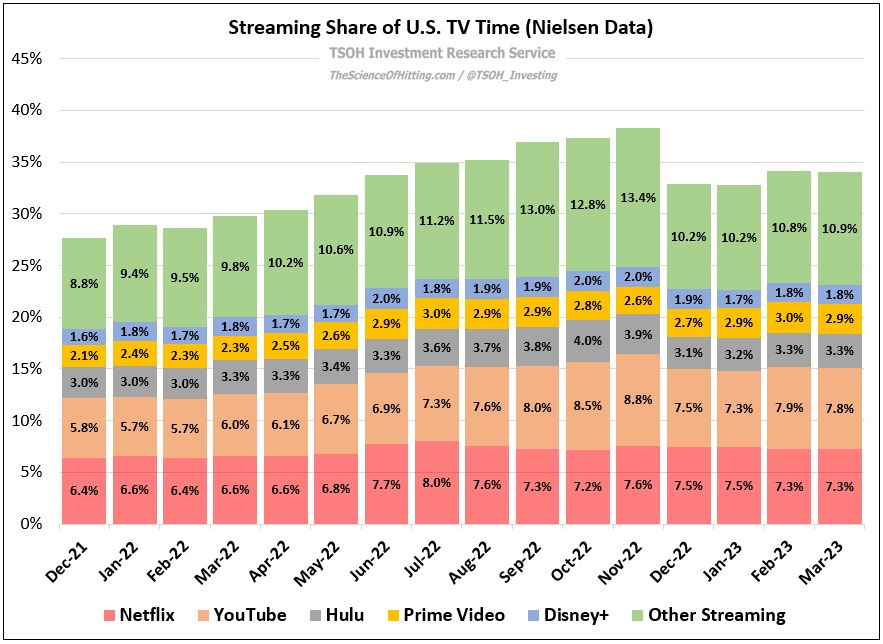

On those competitive dynamics, Nielsen’s U.S. engagement data tells an interesting story. As you can see below, Netflix accounted for ~7.3% of TV time in March 2023, up from ~6.6% in March 2022 (helped by share shift to streaming generally). Today, Netflix and YouTube are in a league of their own: each service (individually) accounts for a larger share of U.S. TV time than Prime Video, Disney+, HBO Max, and Peacock collectively. I don’t want to overstate the conclusion from that data, but I think it gives you some sense for how Netflix’s position in the industry has held strong despite an onslaught of competition (and at a time when many of those competitors are signaling they do not have the ability or willingness to keep investing aggressively).

That said, Netflix’s own ability / willingness to keep investing aggressively is also worth looking into. For context, consider what Reed Hastings said on the Q3 FY21 call (when he was asked if Netflix could increase its content budget another 2x – 3x): “We're really entertaining the world. Even ex-China, if we're able to pull that off, to be the place where the whole world goes to for most of their entertainment, then you're definitely thinking too small. Now, it will take a couple of decades to get there, it's not overnight. But in the long term, we've got to be able to monetize it. So we got to be able to have the revenue growth and profit margins, but it would be incredibly satisfying if we could build up to much bigger content budgets than we have today.”

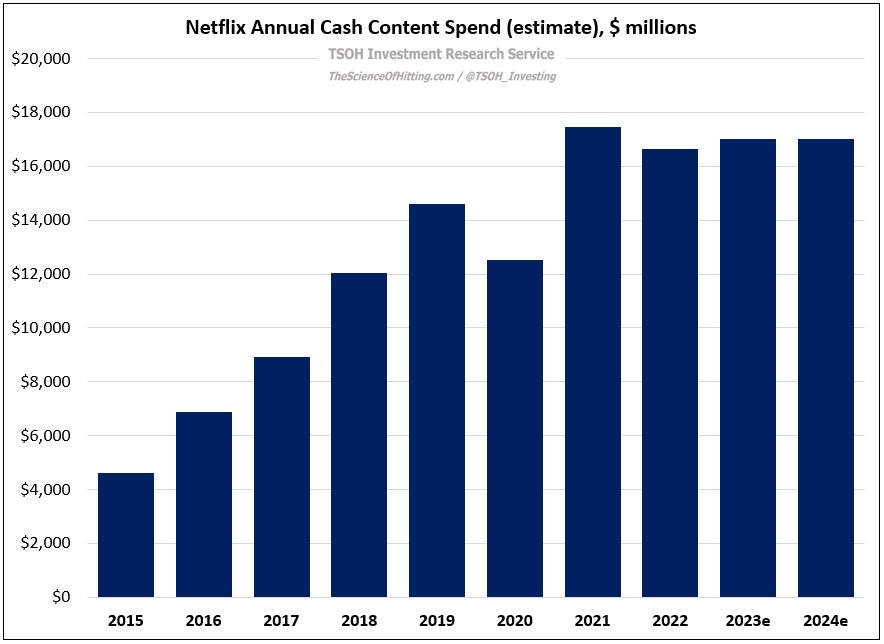

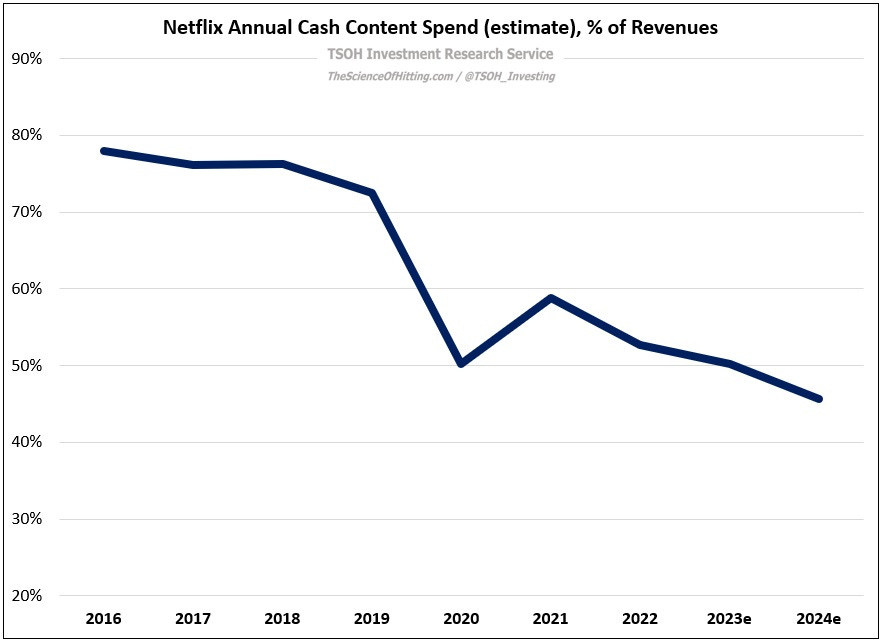

Contrast that with this comment from the Q1 FY23 letter: “Assuming no material swings in F/X, we now expect at least $3.5 billion of FCF for 2023, up from our prior expectation of at least $3.0 billion. This reflects lower cash spend on content than we originally forecasted, resulting in a YoY decrease in cash content spend (bringing our 2023 cash content to content amortization ratio closer to 1.0x). For 2024, we expect cash content spend to be ~$17 billion, consistent with our prior expectations for 2022 – 2024.”

There’s another section of the letter that’s relevant to this discussion:

“We want to be more sophisticated around pricing so that we offer a range of price points and feature sets to suit consumers’ differing needs. For example, when we launched globally in 2016, we took a fairly uniform approach to pricing across most countries given our focus on early adopters. Over time we’ve adapted our prices to meet local needs and to further deepen our penetration, including lowering prices in India by 20% - 60% in December 2021. These reductions – combined with an improved slate – helped grow engagement in India by nearly 30% year on year while F/X neutral revenue growth in 2022 accelerated to 24% (versus 19% in 2021). Learning from this success, we reduced prices in an additional 116 countries in Q1.”

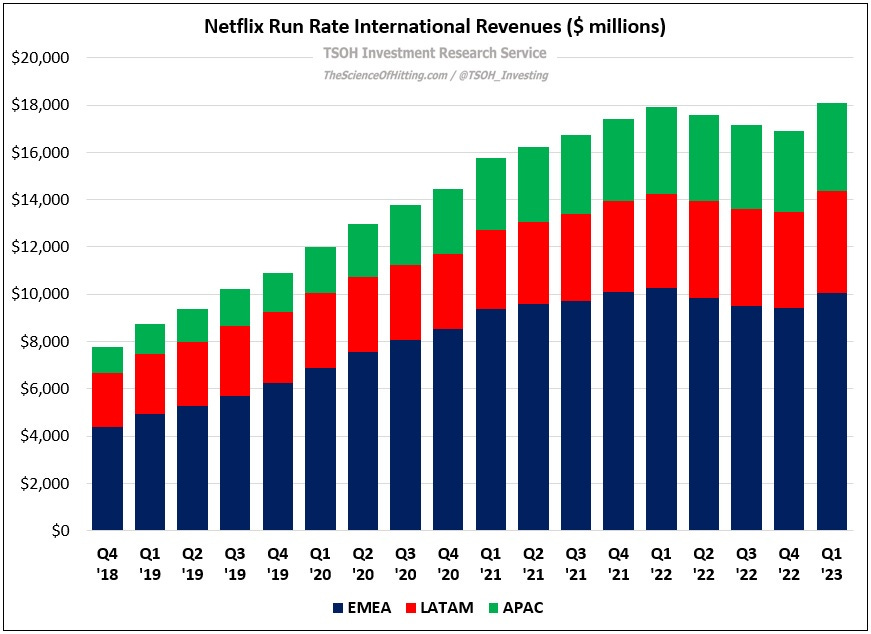

At a high level, the long-term goal remains unchanged – “to be the place where the whole world goes to for most of their entertainment”. The hard part, as we’ve seen with Disney, is how to do so in a way that makes financial sense given much lower ARPU’s in many of these markets (no matter how good the content is, ARM’s in India will not come anywhere close to parity with the U.S. or Western Europe; that said, the “right” metric is revenues, i.e. quantity and pricing). The combination of a flattening overall content budget and aggressive pricing actions in smaller markets (on a revenue basis) “to meet local needs” suggests they’re trying to thread that needle. In my opinion, the best long-term outcome for Netflix is a scenario where they can intelligently take the content budget to 2x – 3x current levels over the coming decades (Reed’s vision). That would hinder short-term FCF generation to some extent, but it would also suggest the global business opportunity (measured in revenues) still has a long runway ahead. The alternative outcome – a cap on content spend as a direct result of insufficient revenues to justify that spend – could be a result of structural challenges outside of Netflix’s control (not just the willingness of consumer to spend some percentage of their income on DTC entertainment, but the ability). I remain optimistic the world will get there over time, but it won’t happen overnight. (This answer, from CFO Spencer Neumann, suggests content spend will likely grow again beyond 2024: “We said we'd stay at ~$17 billion on average over a few year period… but there's a big entertainment market to go after beyond that. As we reaccelerate revenue, we see a lot of room to grow into that viewing, engagement, and business opportunity ahead.”)

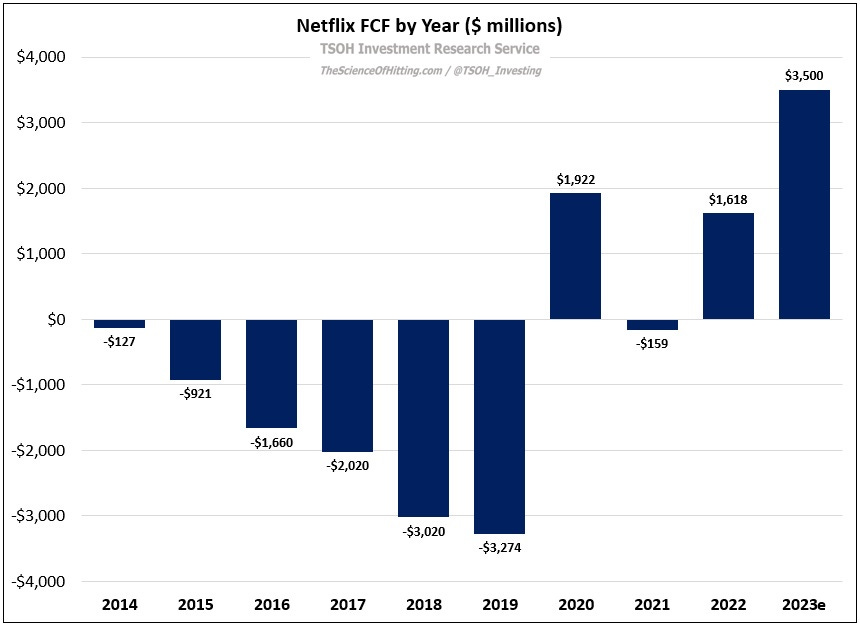

On the topic of FCF, we’ve hit an inflection point. As shown below, the company’s updated guidance calls for 2023e FCF of +$3.5 billion, an improvement of ~$6.5 billion from five years ago (over the same period, Netflix’s FCF margins have improved by roughly 3,000 basis points).

The primary driver is the interplay between revenue growth and content spend: if Netflix can drive ~10% top-line growth while holding its largest expense line flat, that will work wonders. On my (rough) estimates, FY24e cash content costs will be equal to <50% of revenues – down significantly from the mid-70’s (% of revenues) spent on content from FY16 – FY19.

In summary, I think the FY23 / FY24 results effectively serve as (early) validation of the strategy that Netflix pursued over the past 10 - 15 years. They’ve established a dominant global leadership position in this industry, and it is now showing up in a big way on the income statement and the cash flow statement. As shown in the FCF chart above, the investment to get there was substantial; that was the cost of success. My view for some time has been that legacy media companies are unlikely to replicate that outcome, which will present additional opportunities for Netflix to tweak its approach (a major licensing deal with Paramount, NBCU, etc., or potentially M&A). This course of events has taken longer to play out than I once believed it would, but I think the end game is unchanged. The position Netflix finds itself in today is the culmination of 15+ years of investment and hard work; the company deserves immense credit for what it has accomplished.

Password Sharing and Ad-Supported