Meta Platforms: Phase Change

From “Moving The Goal Posts” (November 2022):

“If that conclusion proves accurate, FOA [Family Of Apps] revenue growth rates should reaccelerate as the macro environment improves. If FOA is capable of double digit annualized revenue growth over the next few years - which, again, assumes that the significant incremental CapEx investments will deliver a reasonable ROI through a combination of improved ad targeting / measurement and better recommendations / higher user engagement (and which would widen Meta’s moat) - that would make the expense growth currently anticipated much more manageable… On that point, there’s significant room to operate this business much more efficiently; that may not have been the highest priority for Meta management two or three years ago, but the realities of the business have since changed – and that demands a response.”

The good news for Meta investors? We’re seeing a real response.

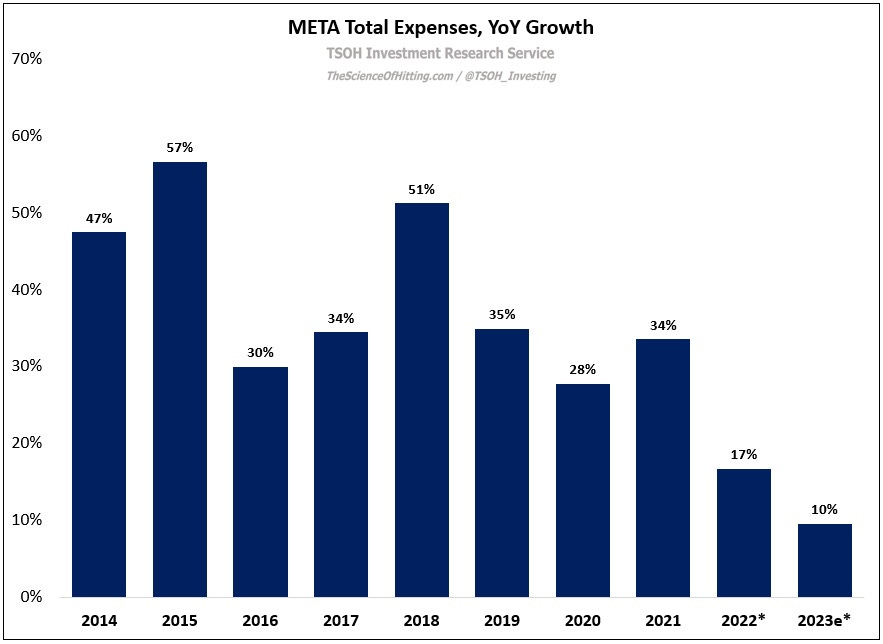

This is most evident when looking at Meta’s 2023 total expense guidance: the midpoint implies a ~10% YoY increase, by far the slowest growth rate in the company’s history – and as I’ve noted in previous posts, the company tends to reduce expense guidance as the year progresses.

(In the chart, 2022 and 2023e have some adjustments for one-time charges.)

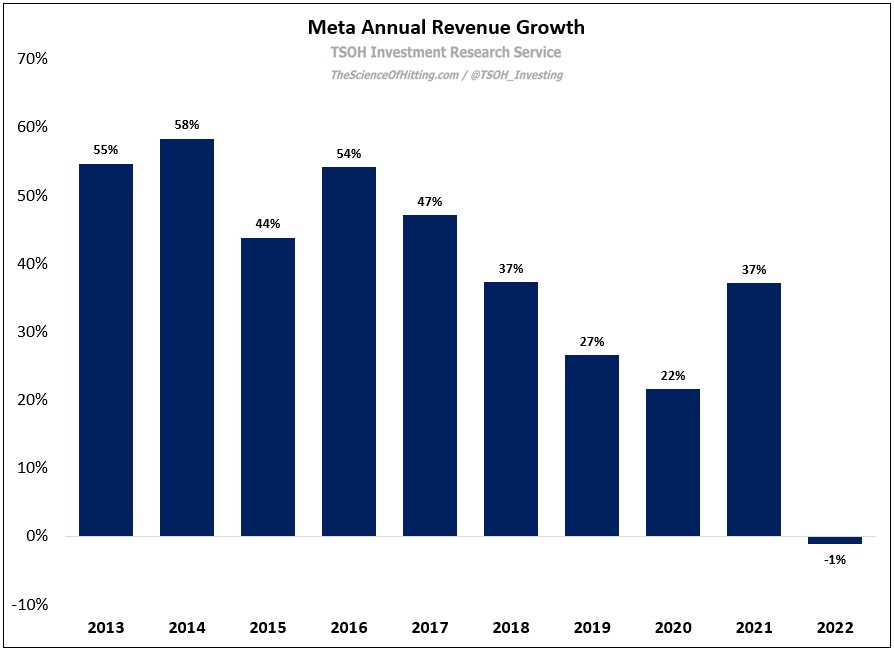

As CEO Mark Zuckerberg discussed on the Q4 FY22 conference call, management recognizes that the cost structure must be built with consideration for the economic realities of the business: “On the efficiency point, we come to it from a few places. One is the journey of the company; for the first 18 years, we grew 20% - 30% compounded, or a lot more, every year. That changed very dramatically in 2022, where our revenue was negative for the first time in the company's history… We don't anticipate that's going to continue, but I also don't think [those growth rates] necessarily go back to the way it was before. So, this is a pretty rapid phase change that has forced us to basically take a step back and say we can't just treat everything like it's hyper growth… We have [services] with a lot of people using them that support large amounts of business that we think we should operate somewhat differently… It just makes sense to really focus on efficiency a lot more than we had… we can do that work more effectively.”

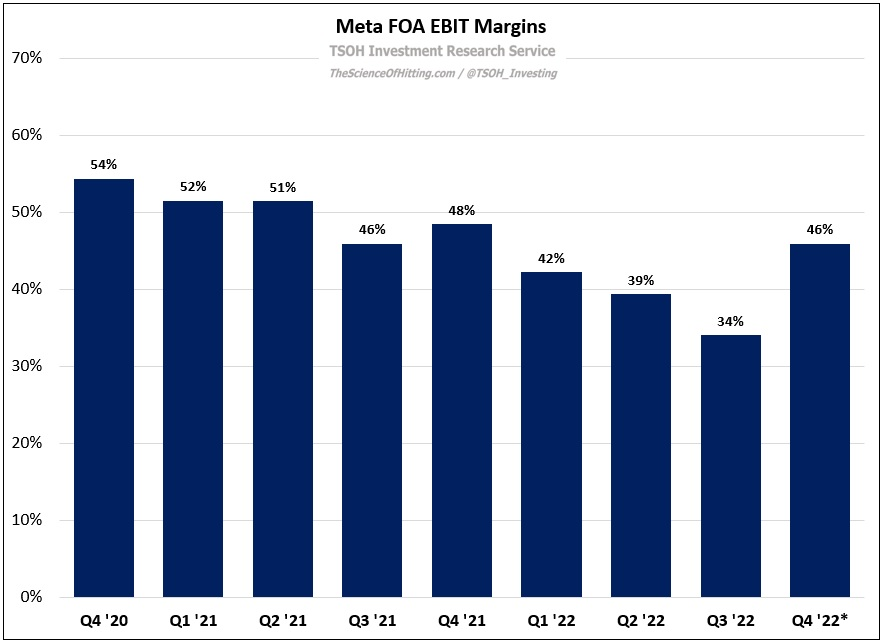

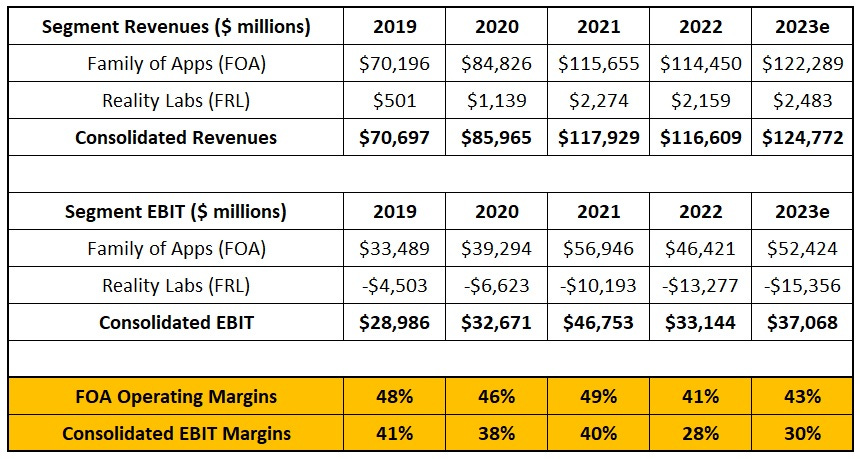

This is clearly more applicable (from management’s perspective) to FOA than Facebook Reality Labs (FRL). At FOA, total expenses nearly doubled over the past three years, from ~$36.7 billion in FY19 to ~$71.8 billion in FY22. Despite the significant revenue growth reported over the same period (from ~$70.2 billion in FY19 to ~$114.5 billion in FY22), this led to ~700 basis points of cumulative FOA EBIT margin compression.

What the 2022 (annual) results fail to capture is the change in trend in Q4 FY22; specifically, if we exclude the $3.76 billion in restructuring charges, the FOA segment generated Q4 FY22 EBIT of $14.4 billion, with margins of 46% - down ~200 basis points from Q4 FY21 (for context, YoY FOA EBIT margins declined by 1,000 basis points or more in Q1, Q2, and Q3). This is a clear indication that the actions being taken will meaningfully impact profitability; given that the FOA business generated >$45 billion of FY22 operating income (also adjusted for the Q4 restructuring charges), or ~3x higher than the run rate FRL losses, you can appreciate why this is a very big deal for Meta.

As noted earlier, the updated 2023 guidance implies a meaningful reduction in YoY expense growth, particularly at FOA (we can infer that based on some of the FRL commentary, which I’ll discuss in more detail in the next section).

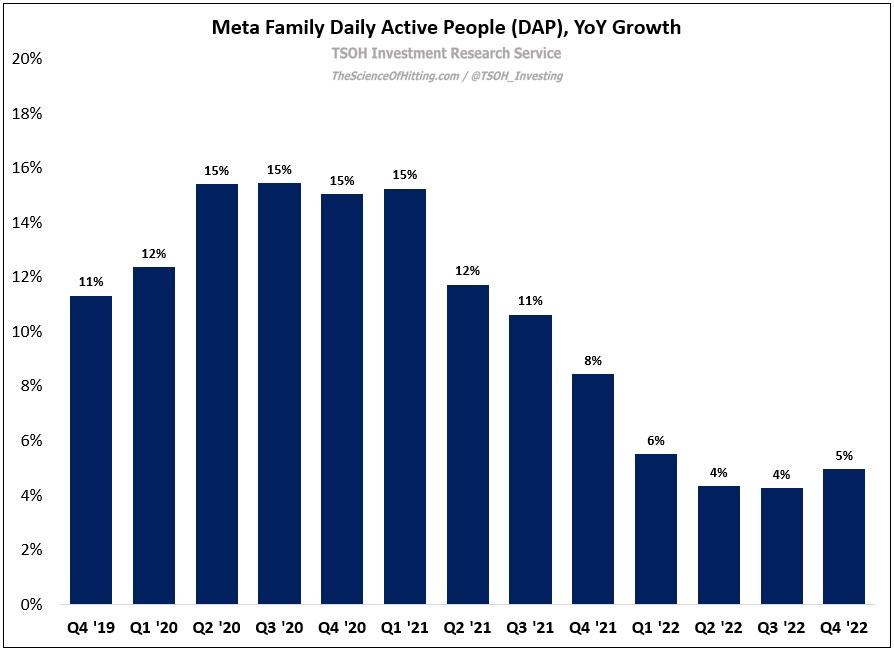

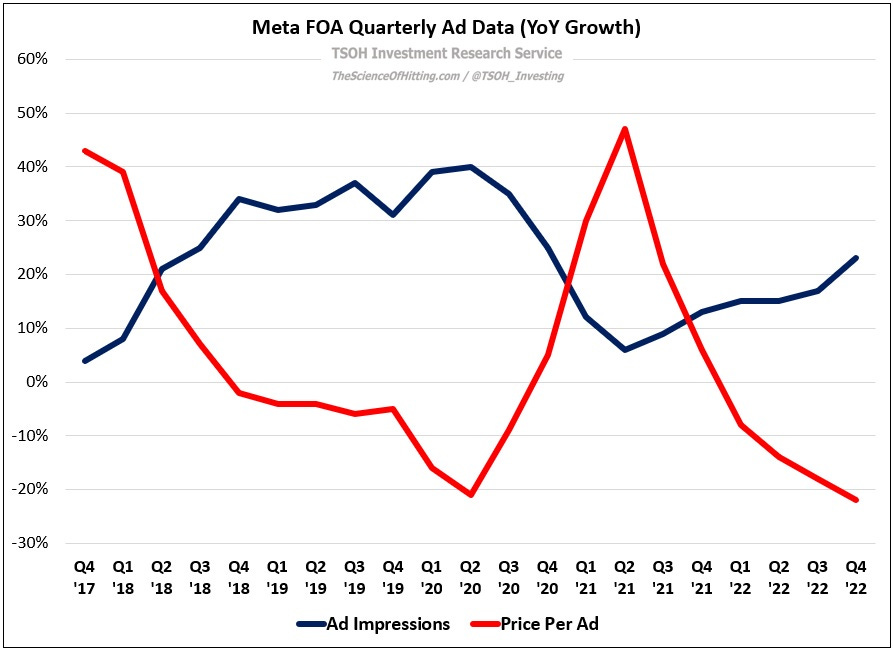

As Meta starts to operate its mature businesses “somewhat differently”, we are approaching an important turning point for the FOA results. (And while this particular discussion focused on expenses, FOA continues to report user / DAP growth and rising engagement / time spent, which has driven accelerated gains in ad impressions - and should lead to reaccelerated revenue growth over time.)

Facebook Reality Labs (FRL)

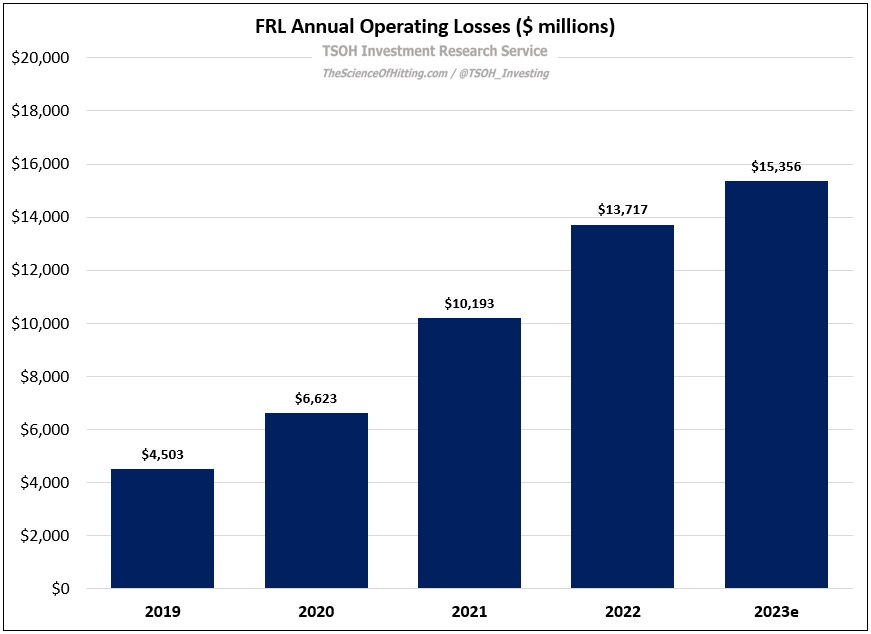

That brings us to the more difficult part of the equation: FRL. In 2022, the segment generated an operating loss of $13.7 billion on $2.1 billion in revenues. As CFO Susan Li noted on the Q4 call, management expects FY23 losses to increase versus FY22. If we run rate the Q4 losses (excluding the $440 million restructuring charge in the segment), that puts FY23 losses north of $15 billion – with five-year (FY19 – FY23e) cumulative losses of ~$50 billion.

As a reminder, here’s what Zuckerberg said about Meta’s long-term financial goals on the Q1 FY22 call: “Over the next several years, our goal is to generate sufficient operating income growth from FOA to fund the investments in FRL while still growing our overall profitability.”

Even if you agree with my optimism on FOA, rapidly rising FRL losses are an impediment to those financial goals. The fact that FRL is on pace to lose ~$15 billion in 2023, in combination with Zuckerberg’s own prediction that the metaverse bet is unlikely to pay off in the current decade, undoubtedly leaves all but the diehard believers uncomfortable (to put it kindly). As I’ve written previously, I can appreciate why they aggressively pursued this opportunity - but I also think the prize is highly uncertain and a long way off. At some point, further investments must be tied to demonstrated outcomes – and based on the recent FRL results, I don’t think you can reasonably argue that higher spend has been earned: “Horizon’s weekly retention rate sat at 11% in January, meaning one in nine users play again the following month.”)

As I wrote in November 2022, Meta’s valuation at that time made this a somewhat acceptable condition: “If you believe the core business can grow revenues and profitability over time, as I do, you’d have to do some real gymnastics to argue that FOA, as a standalone company, isn’t worth significantly more than its implied value.” The “problem” is that the stock price has roughly doubled since November; as opposed to a mid-single digit multiple on FOA TTM EBIT, that metric is now in the double digits (assuming FRL’s value is unchanged). That last assumption is a (very) important one: with Zuck calling 2023 the “Year of Efficiency”, is there any willingness to tap the brakes at FRL?

For now, I’ll take management at their word (full steam ahead, with growing FRL losses); that said, it remains clear that the company has a major out if they’re willing to rethink FRL. As I’ve said before, I don’t think this requires an extreme decision (all-in or all-out); if they capped annual FRL losses at ~$10 billion – some would say that’s still a lot of money! - it would be applauded by owners.

Conclusion

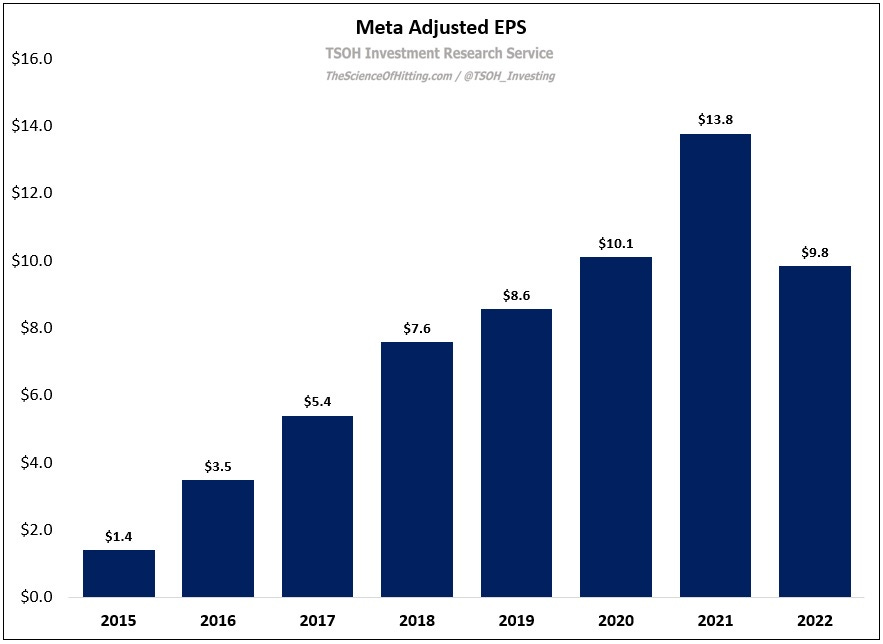

2022 was a challenging year for Meta, and that was apparent in the financial results (as shown below, adjusted EPS fell by ~30%, to ~$9.8 per share). At the same time, I think Meta management deserves credit for its response to notable industry developments, including Apple’s iOS policy changes (ATT) and the rise of TikTok (it is now clear that Reels / short-form video is a big opportunity for Meta); while work remains, management has done a good job mitigating the threats to the long-term earnings power of the core business (“we have continued to make improvements to our ads targeting and measurement that, we believe, are driving more conversions and better returns for advertisers”).

In addition to their effective responses to these challenges, I’d also argue that this period has highlighted the underlying value proposition of the FOA business for advertisers and users alike. (Meta has faced questions about its sustainability for as long as I can remember; in the face of many dire predictions, the company’s revenue CAGR over the past five years was +23%.) As we look ahead, the actions taken in recent months and the Q4 commentary suggests management will act aggressively as they adjust to this “phase change”. This, in my mind, was the big takeaway from Q4: it provided some sorely needed tangible evidence that Zuckerberg isn’t indifferent to the (valid) concerns expressed by shareholders.

If we witness a reacceleration in revenue growth rates (as I expect in the back half of 2023), in combination with real focus on operating efficiency in the segment, I continue to believe FOA can deliver double digit annualized EBIT growth. If this coincides with continued capital returns to shareholders (the share count fell ~5.5% in 2022), I believe that’s a path to double digit EPS growth. To return to the question from “Peak Profitability” – will Meta exceed its FY21 EPS at any point in the next few years? – I think there’s reason to believe that this is an attainable goal for Meta within the next three years.

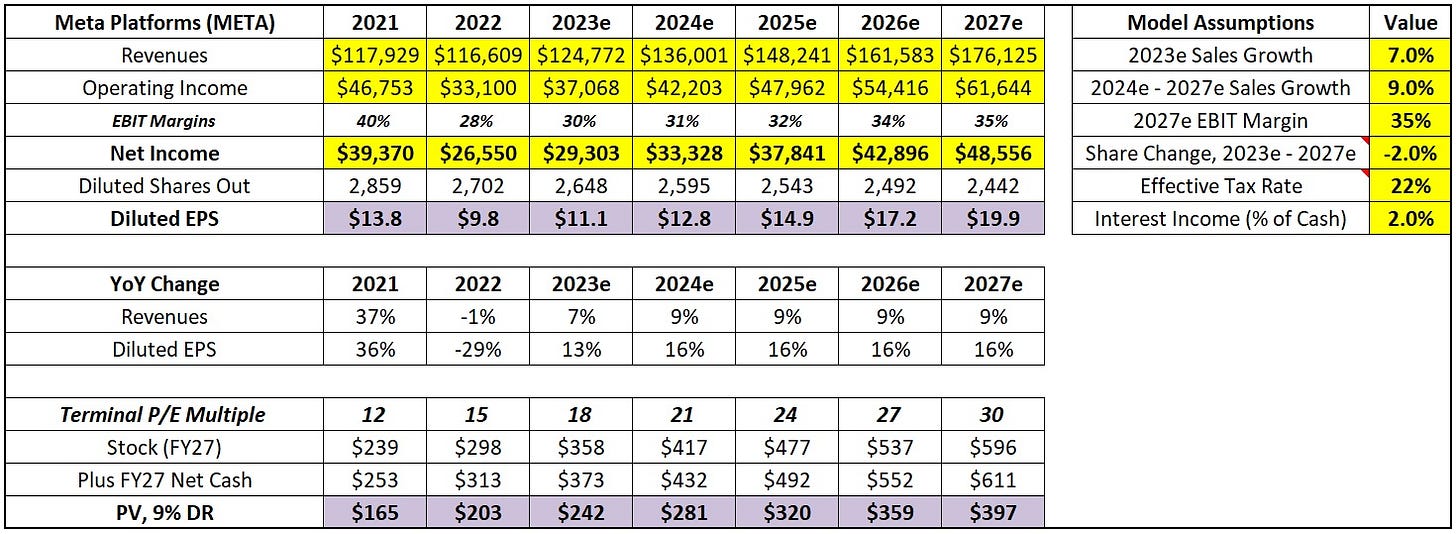

At ~$183 per share, Meta trades at ~19x trailing earnings. As shown below, I believe there’s a path ahead for EPS to roughly double over the next five years (this assumes that FRL continues to be a large money pit). At <10x 2027e EPS, I believe Meta remains attractively valued. For that reason, I will maintain my current position; if I had reason to believe FRL was being curtailed or showing signs of meaningful progress, I’d be open to adding more META.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.

Great work, as always.

Part of the most pervasive narrative prior to the past Q was that Zuckerberg was obsessed with the Metaverse and would throw everything away while chasing it. In my own writing, I stated how I thought that was a bit silly since, historically, Zuckerberg (and Meta as a whole) are exceptional capital allocators. I can not say exactly what the market reacted to after the print, but I know that what surprised me most was not the extent of the cuts that have already occurred, but the speed at which they came. Even in my own thinking, I assumed there would be a deceleration in spend post-2023 and then several years before big cuts (if needed). All of the language around efficiency and urgency from the last call only reinforces that that line of thinking couldn't be further from the truth.

10/10 work Alex, really good