Meta: “Appropriately Calibrated”

In “Meta: A Precarious Position”, I concluded with the following:

“A thoughtful discussion on Meta must now address concerns around FoA user growth and engagement (most notably for the blue app), a competitive threat from TikTok, the impact of IDFA and regulatory headwinds on revenue growth, the massive expense ramp (which will continue into FY22), and the ~$10 billion of annual losses at FRL (with very little that we can tangibly point to as the output from that investment). That’s a lot to work through. And when you finish that exercise, I think you inevitably conclude that this bet requires a lot of trust in Zuck and the team (that’s always the case, but this is at another level). Given their impressive track record, I think they’ve clearly earned that trust; however, their actions of late are quickly putting that to the test (to paraphrase Buffett, it took 17 years for Zuck to build a reputation and six months to ruin it).”

That change in perception and lack of trust, most notably as it related to the belief / concern that Zuck was willing to spend an ever-growing sum at FRL, led to a market cap decline following Meta’s Q4 FY21 earnings of ~$250 billion, the largest one-day drop for a company in stock market history.

But right out of the gates on the Q1 FY22 call, it was apparent that management - and specifically Zuck - had come to appreciate the importance of addressing this issue more directly and transparently for shareholders (sorry for the long excerpt, but this is an important topic):

“I think it's useful to level-set on our business trajectory over the last few years. After the start of Covid, the acceleration of e-commerce led to outsized revenue growth, but we're now seeing that trend back off. However, based on the strong revenue growth we saw in 2021, we kicked off a number of multi-year projects to accelerate some longer term investments, especially in our AI infrastructure, business platform, and FRL… But with our current business growth levels, we're now planning to slow the pace of some of our investments… On FoA, I’m confident we can return to better revenue growth rates over time and sustain high operating margins. In FRL, we're making large investments to deliver the next platform that I believe will be incredibly important both for our mission and business - comparable in value to the leading mobile platforms today. I recognize it's expensive to build this - it's something that's never been built before and it's a new paradigm for computing and social connection. Over the next several years our goal from a financial perspective is to generate sufficient operating income growth from FoA to fund the growth of investments in FRL while still growing our overall profitability. That's not going to happen in 2022 given the revenue headwinds, but longer term that is our goal and expectation.”

This commentary has put some much needed guardrails around FRL (which, by the way, still generated an operating loss of ~$3 billion in the quarter). In addition, it was encouraging to see management express some optimism on the long-term trajectory for FoA, which is facing its own headwinds.

As I noted recently in a post about Disney, the interplay between Mr. Market’s views on a company’s long-term prospects / strategic vision and how management chooses to react to that signal can be an interesting dynamic. There are times when management should rightly disregard the short-term worries of the stock market and plow forward. On the other hand, there are also circumstances where I believe Mr. Market’s skepticism should be viewed as a sign to management that an alternative approach should be considered.

With Meta, the market (rightly) expressed concerns about FRL, most notably the scale of investment given management’s own admission that the segment was unlikely to be a material driver of the business at any point in the current decade. With the Q1 commentary, we now have a clearer understanding of how these investments are likely to evolve over the coming years (“the goal is to continue growing operating profits and to fund FRL through that growth of the FoA business”). Management took Mr. Market’s skepticism as a valid reason to consider an alternative approach, primarily in terms of how they communicate their long-term vision with shareholders; in my opinion, it was a much needed change and an important step in the right direction.

FoA Segment

Undoubtedly, part of management’s evolution on the FRL commentary is reflective of underlying challenges in the core business. In Q1, FoA revenues increased 6% to $27.2 billion, the slowest quarterly top-line growth rate reported in the company’s history (on a constant currency basis, FoA revenues were +10% YoY). As I’ve discussed previously, this outcome reflects a number of headwinds, including the impact of Apple iOS changes / ATT, a shift in platform engagement to use cases that currently monetize at lower rates (Reels accounts for >20% of time spent by users on IG), and macro headwinds (“the war introduced further volatility into an already uncertain landscape for advertisers… we saw a pretty significant slowdown in Central & Eastern Europe that impacted Q1 ad demand in Europe broadly”).

The Q2 guidance indicates that this pressure will (unsurprisingly) continue in the near term; but while the growth rate has slowed meaningfully, it’s worth noting that the business is generating ~$120 billion in annual revenues, with the Q2 guide implying mid-teens YoY growth. In addition, Meta is investing aggressively behind its AI / ML efforts, “the crucial components of these privacy-enhancing technologies”, to find workarounds for the ad infrastructure changes (“with the right investments, we'll navigate [the signal loss] okay over time”). While short-term challenges clearly remain, Meta also holds an enviable hand (significant financial resources, technical capabilities, etc.). Personally, I remain convinced that the company can find effective solutions / workarounds to many of these issues in the coming years (“Over the longer term, I think these large technology investments can provide a sustainable competitive advantage over others in the industry.”)

Financials

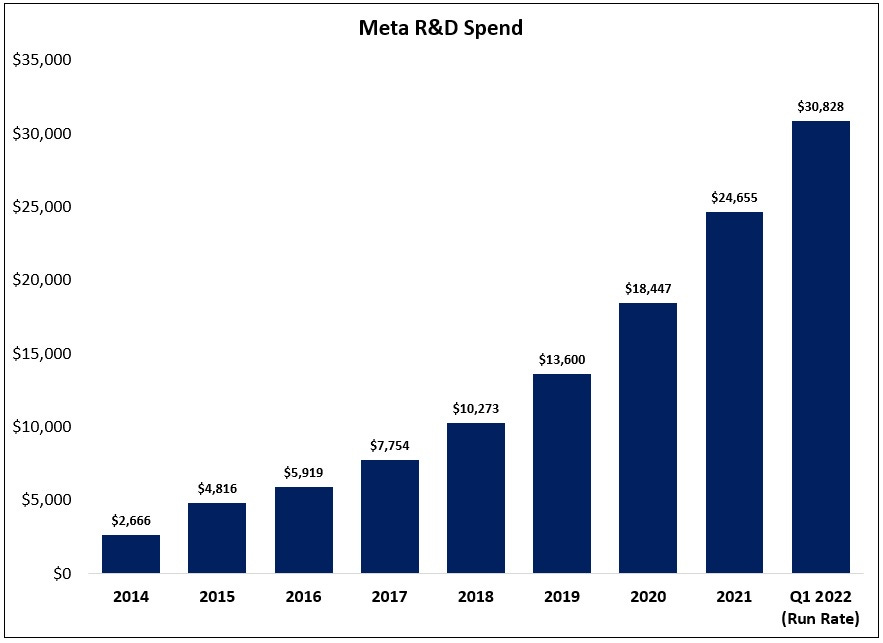

In the first quarter, as a result of outsized expense growth (+31% YoY), Meta’s operating income declined by ~25% to ~$8.5 billion, with EBIT margins contracting ~1,200 basis points. One line item that stood out to me from the P&L was R&D: at ~$7.7 billion in Q1, run rate expenses now exceed $30 billion, or larger than Meta’s total revenue base five years ago ($27.6 billion in FY16). As that suggests, Meta has exhibited a pace of expense growth over the past few years that is proving unsustainable given the realities that they’re currently facing. (As I noted earlier, Zuck effectively admitted that point in his opening remarks on the Q1 conference call.)

It’s early days, but that conclusion is starting to have an impact on the financials: management now expects FY22 total expenses of $87-$92 billion, or roughly $5 billion less than initial expectations (first guide in Q3 FY21).

As CFO Dave Wehner noted on the call, management is focused on “ensuring our investment plans are appropriately calibrated to the operating environment”. While the updated guidance still implies 26% YoY growth in FY22, that would be the lowest pace of incremental expenses (%) in its history (and if previous years are any indication, we’re likely to see further downward revisions on the expense guide in the coming quarters).

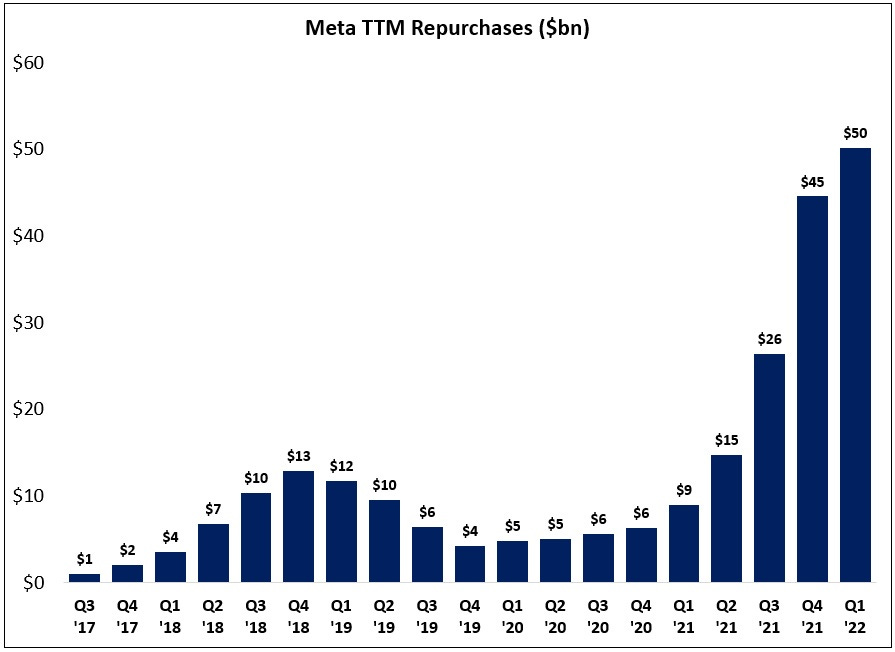

Another notable change at Meta has been a much larger focus on share repurchases; as shown below, the company repurchased ~$50 billion of stock over the past year, which is roughly 5x – 10x higher than the level of spend that shareholders had come to expect in the years preceding FY21 (and a as a result, the diluted share count declined ~5% YoY in Q1).

The company’s financial position remains incredibly conservative / strong, with ~$50 billion in net cash & investments on the balance sheet, alongside a business that continues to generate tens of billions of dollars in annual free cash flow even in the face of a massive CapEx ramp (in Q1, FCF was +9% to ~$8.5 billion). While the company remains unlikely to pursue large inorganic opportunities (I’m doubtful regulators in the U.S. and Europe would allow it), they have significant financial flexibility to pursue other avenues, like share repurchases, that can be additive to long-term per share intrinsic value.

Conclusion

In light of the weak FoA results, at least relative to historic expectations, the market’s positive reaction to the print is revealing. The results in the core business managed to hold up fairly well in the face of significant short-term headwinds, with reason to believe that some of these pressures will start to abate in the back half of FY22. In addition, the commentary around FRL provided investors with incremental confidence that Meta will be thoughtful about the short-term financial implications of its decisions as they pursue additional long-term growth opportunities (I’d also note that the release of a web version of Horizon later this year will be a useful near term test for FRL).

While challenges remain, I’m encouraged by the continued FoA user base growth (Family DAP’s up 6% YoY to 2.87 billion), as well as the positive commentary on user activity (“engagement for both Facebook and Instagram remain above pre-pandemic levels; that's true globally and in the U.S.”).

The disclosures on Reels and other product evolutions, like AI-driven recommendations in the feed alongside social content, also indicate that the company remains focused on key objectives in FoA. Finally, in light of the well published issues / concerns around engagement, measurement / attribution, and mix shift to less effective formats (Reels), it’s worth noting that ARPU in the U.S. and Canada increased YoY in Q1 FY22 (albeit marginally).

I don’t want to suggest this is all roses; the ~50% YTD decline for the stock at its April lows is indicative of real short-term headwinds, and work remains on key strategic initiatives (for example, while Meta has seen traction with its Click-to-Messaging ads, on platform commerce / Shops has struggled). That said, I remain confident in management’s ability to navigate these issues over the long run. For that reason, I will leave my FB position unchanged for now.

NOTE - This is not investment advice. Do your own due diligence. I make no representation, warranty or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report. Any assumptions, opinions and estimates expressed in this report constitute my judgment as of the date thereof and is subject to change without notice. Any projections contained in the report are based on a number of assumptions as to market conditions. There is no guarantee that projected outcomes will be achieved. The TSOH Investment Research Service is not acting as your financial advisor or in any fiduciary capacity.